11 Trading Lessons From The $1.5 Billion Trader

Trading Lessons From Reminiscences of a Stock Operator | Edition 43

Dear traders,

I just finished Reminiscences of a Stock Operator by Edwin LeFevre.

One of the most famous books that every trader should read.

I didn’t just read it. I studied it.

What impressed me the most is that this man was trading 100 years ago, yet the rules he talks about are more relevant today than ever.

Today, I want to give you the treasure I gained from reading this book.

Please pay attention and read everything.

I’m convinced this can either make you millions or save you from losing millions.

I’ll start with one of my favorite topics.

1. Livermore on the psychology of trading

fear and greed

“It is inseparable from human nature to hope and to fear. In speculation when the market goes against you hope that every day will be the last day, and you lose more than you should had you not listened to hope, to the same ally that is so potent a success-bringer to empire builders and pioneers, big and little. And when the market goes your way you become fearful that the next day will take away your profit, and you get out, too soon.

Fear keeps you from making as much money as you ought to. The successful trader has to fight these two deep-seated instincts. He has to reverse what you might call his natural impulses. Instead of hoping he must fear; instead of fearing he must hope”

Cut losses when hope appears

Hold winners when fear appears

Hope

”The belief in miracles that all men cherish is born of immoderate indulgence in hope. There are people who go on hope sprees periodically and we all know the chronic hope drunkard that is held up before us as an exemplary optimist. Tip-takers are all they really are.”

More on hope

“What does a man do when he sets out to make the stock market pay for a sudden need? Why, he merely hopes. He gambles. He therefore runs much greater risks than he would if he were speculating intelligently, in accordance with opinions or beliefs logically arrived at after a dispassionate study of underlying conditions. To begin with, he is after an immediate profit. He cannot afford to wait. The market must be nice to him at once if at all. He flatters himself that he is not asking more than to place an even-money bet. Because he is prepared to run quick— say, stop his loss at two points when all he hopes to make is two points— he hugs the fallacy that he is merely taking a fifty-fifty chance.”

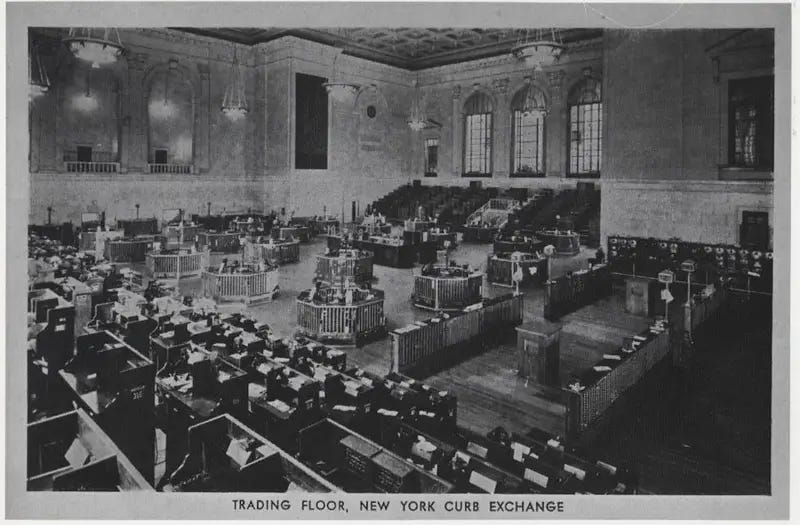

“Fear and hope remain the same; therefore the study of the psychology of speculators is as valuable as it ever was. Weapons change, but strategy remains strategy, on the New York Stock Exchange as on the battlefield.”

”Carefully laid plans will miscarry because the unexpected and even the unexpectable will happen. Disaster may come from a convulsion of nature or from the weather, from your own greed or from some man’s vanity; from fear or from uncontrolled hope.”

”The speculator’s deadly enemies are: Ignorance, greed, fear and hope. All the statute books in the world and all the rules of all the Exchanges on earth cannot eliminate these from the human animal.”

2. Livermore on overtrading

“There is the plain fool, who does the wrong thing at all times everywhere, but there is the Wall Street fool, who thinks he must trade all the time. No man can always have adequate reasons for buying or selling stocks daily, or sufficient knowledge to make his play an intelligent play.”

The mistake is not being wrong once , it is feeling the need to always be in a trade. Markets do not offer good opportunities every day, and forcing trades leads to poor decisions.

The lesson for traders:

You do not need to trade every day

Good trades are rare

Waiting is part of the job

The best traders act only when they have a clear reason.

Doing nothing is often the smartest position.

“The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages.”

This quote explains why overtrading happens.

Many traders feel pressure to make money every day, as if trading were a salaried job. That mindset forces action even when market conditions are poor.

3. Independence in Trading

“A man must believe in himself and his judgment if he expects to make a living at this game. That is why I don’t believe in tips. If I buy stocks on Smith’s tip I must sell those same stocks on Smith’s tip. I am depending on him.”

To succeed, a trader must trust their own judgment.

Tips(alerts, buy and sell) make you dependent on someone else, not only to enter, but also to exit.

If you don’t own the decision, you don’t own the trade

Alerts remove responsibility and control

Real confidence comes from your own process

A trader who relies on tips can never be consistent !!!

That is why, in this community, we are obsessed with process, not buy and sell alerts.

I have said this many times.

You must stop being dependent on “gurus”.

I do not want you to be my students forever.

I want you to become my trading partners.

4. Pain teaches faster than theory in trading

“There is nothing like losing all you have in the world for teaching you what not to do. And when you know what not to do in order not to lose money, you begin to learn what to do in order to win. Did you get that ? You begin to learn!”

Big losses force you to understand what not to do.

Once you stop losing, you can finally start learning how to win.

5. Livermore on clarity and context

“If a stock doesn’t act right don’t touch it; because, being unable to tell precisely what is wrong, you cannot tell which way it is going. No diagnosis, no prognosis. No prognosis, no profit.”

If a stock does not behave as expected, stay away. If you cannot explain what is happening, you cannot predict what comes next.

No clear setup means no trade.

“all a man needs to know to make money is to appraise conditions.”

This sentence is so important to the way I am trading!

I always say, situational awareness matters more than setups.

It is about understanding the conditions you’re trading in.

6. The importance of discipline and routine in trading performance

“The game of beating the market exclusively interested me from ten to three every day, and after three, the game of living my life.

I never allowed pleasure to interfere with business. When I lost it was because I was wrong and not because I was suffering from dissipation or excesses. There

I couldn’t afford anything that kept me from feeling physically and mentally fit. Even now I am usually in bed by ten.

As a young man I never kept late hours, because I could not do business properly on insufficient sleep.”

Treat trading as a focused job, not a 24/7 obsession.

Show up rested, sharp, and disciplined.

Protect your sleep, your health, and your routines, they are part of your edge.

Do not blame losses on bad luck if you showed up tired or unfocused.

Trade when you are at your best.

Step away when you are not.

Poor habits lead to poor decisions.

7. Letting your winners run in a trade

“They say you never grow poor taking profits. No, you don’t. But neither do you grow rich taking a four-point profit in a bull market.

Where I should have made twenty thousand dollars I made two thousand. That was what my conservatism did for me. About the time I discovered what a small percentage of what I should have made I was getting I discovered something else, and that is that suckers differ among themselves according to the degree of experience.”

Do not cut winners short in a strong market.

Taking small, quick profits feels safe, but it limits your upside. In a bull market, your job is not to protect pennies , it is to let winners run.

Small profits do not build wealth

Market conditions dictate how long you hold

When the market is strong, think bigger.

Play small only when conditions demand it.

8. Importance of Patience in Trading

“the big money was not in the individual fluctuations but in the main movements, that is, not in reading the tape but in sizing up the entire market and its trend.

It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market.

Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money.”

Stop chasing small moves. Focus on the main trend.

You do not make real money by constant action or perfect timing.

You make it by positioning correctly and staying in the trade.

Being right is not enough.

You must sit tight.

Patience pays more than activity.

9. Livermore on trading in ranges

This experience has been the experience of so many traders so many times that I can give this rule: In a narrow market, when prices are not getting anywhere to speak of but move within a narrow range, there is no sense in trying to anticipate what the next big movement is going to be— up or down. The thing to do is to watch the market, read the tape to determine the limits of the get-nowhere prices, and make up your mind that you will not take an interest until the price breaks through the limit in either direction. A speculator must concern himself with making money out of the market and not with insisting that the tape must agree with him. Never argue with it or ask it for reasons or explanations.

When the market is in a range, do not guess the next big move.

Define the range. Respect the boundaries. Stay neutral until price breaks out with conviction.

Ranges are for observation, not prediction

Trade the expansion, not the chop.

10. The difference between a professional trader and an amateur

The difference distinguishes the professional from the amateur. It is the way a man looks at things that makes or loses money for him in the speculative markets. The public has the dilettante’s point of view toward his own effort. The ego obtrudes itself unduly and the thinking therefore is not deep, or exhaustive. The professional concerns himself with doing the right thing rather than with making money, knowing that the profit takes care of itself if the other things are attended to. A trader gets to play the game as the professional billiard player does— that is, he looks far ahead instead of considering the particular shot before him. It gets to be an instinct to play for position.

11.Your trading strategy starts with knowing yourself.

A man must know himself thoroughly if he is going to make a good job out of trading in the speculative markets.

This speaks to me deeply because from the very beginning of my trading journey, my goal was to find my trading style.

And to find my style, I had to study myself.

I had to understand who I am.

This is the only way to succeed in this game.

Unfortunately, I’m limited by how many words I can share here, and I still have three times more notes left.

If you want this and you like this approach, I can split it into three volumes or share everything as notes on Substack.

Until then, I invite you to join the community, read along, and grow with us.

And if you decide to join on the yearly plan, you get 2 months free.

Trade Setups of The Week

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my entire watchlist for free here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

Don’t look down on the trader who has blown up an account. Look at them as a fierce competitor. Their knowledge is in the form of scars. Their experience of what not to do is invaluable. I think that made Livermore a true speculator. Fortunes won and lost but he is always in the game learning to be his best.

Great book!