3000$ in one day! Here's how you could have done it too

The Trade Everyone Ignored (And Why It Paid Me $3000) | Episode 9

Wow, what a messy week.

How was that quote again.

"There are decades where nothing happens; and there are weeks where decades happen." — Vladimir Ilyich Lenin

That's how it felt lately.

Well, in case you’ve been living under a rock this past week, I put together a bit of context so you can understand what happened:

If you haven’t realized it by now, that was the perfect moment to open a long position at the open on April 7th, when all the news was exploding with bearish headlines.

The chart looked something like this

And that’s exactly what I did, me and the people in my community.

Now I’ll be honest with you. Do you really think I knew an upside explosion was coming?

Of course not. Nobody can predict these things. But there’s a small, subtle detail you only learn after years of experience.

The fact that the risk/reward ratio was skewed. After such a massive drop of trillions and over 10% in less than 2 days, what do you think were the odds of another 10% drop?

Yeah, sure, it was possible, it could’ve happened… But this trade was favorable.

And as long as you’re not risking your entire capital, it was so worth it.

It was 3000 for me and for the others who took the trade with me.

Hah, my subscription to my newsletter would’ve been paid just like that, from one trade :).

Doesn’t sound that expensive now, does it? Hmm, speaking of which, I actually have a discount right now on the yearly subscription — it’s basically $0.6 per day or $4 per week.

Freedom Trade of the week

AAPL Trade Setup – Long

AAPL just printed one of the cleanest long setups we've seen in a while.

We're talking about a textbook high-volume reversal from a key weekly demand zone , an area where historically, big money steps in.

This move didn’t just happen out of nowhere.

Of course, this spike in AAPL came right after Trump announced a pause on new tariffs and specifically excluded key sectors like semiconductors and phones, basically removing the biggest short-term threat for Apple’s margins.

Market loves clarity.

But be careful… this is politics. Situations like this can flip overnight. Headlines drive volatility.

Technically though? This weekly demand zone was already a high-probability area for a bounce. The news just acted as the perfect catalyst.

Now it’s all about execution and risk management. This is the kind of spot long-term investors dream of.

Strong RR. Clean invalidation below $165-$170 zone.

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely:

Get exclusive market insights—access my free watchlist now!

🔗 Check it out here: TradingView Watchlist

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

This Week in the Economy: What You Need to Know

Rising yields + falling dollar = not exactly what you expect from the world’s biggest economy.

For years, the US dollar has been the safe place for global money. Strong economy, tech dominance, energy independence, it made sense.

But this past week? Things changed fast.

The dollar dropped over 3%… its worst week since 2022. Meanwhile, the euro had its best week in three years.

And the Swiss franc? Highest level in a decade. (feels nice to be paid in Swiss francs hehe :)

A big part of this move came after Trump hit pause on those new tariffs and even excluded key sectors like semiconductors and phones. But the market still didn’t fully buy it. The uncertainty around trade is enough to make investors look elsewhere.

Even the Fed admitted it’s unusual, normally, tariffs strengthen the dollar. This time, money is leaving the US.

And it’s not just the dollar. Yields on US bonds jumped like crazy. The 10-year Treasury had its biggest weekly move in decades. Investors are clearly dumping bonds, too.

Why? Simple. In a world full of political noise, trade tensions, and rising rates…investors want safety. And right now, that means getting out of USD and Treasuries.

Where’s that money going?

Gold.

Despite a quick dip earlier this week, gold came back strong, hitting another all-time high. And with everything happening in markets right now, it’s hard to argue against gold continuing to shine.

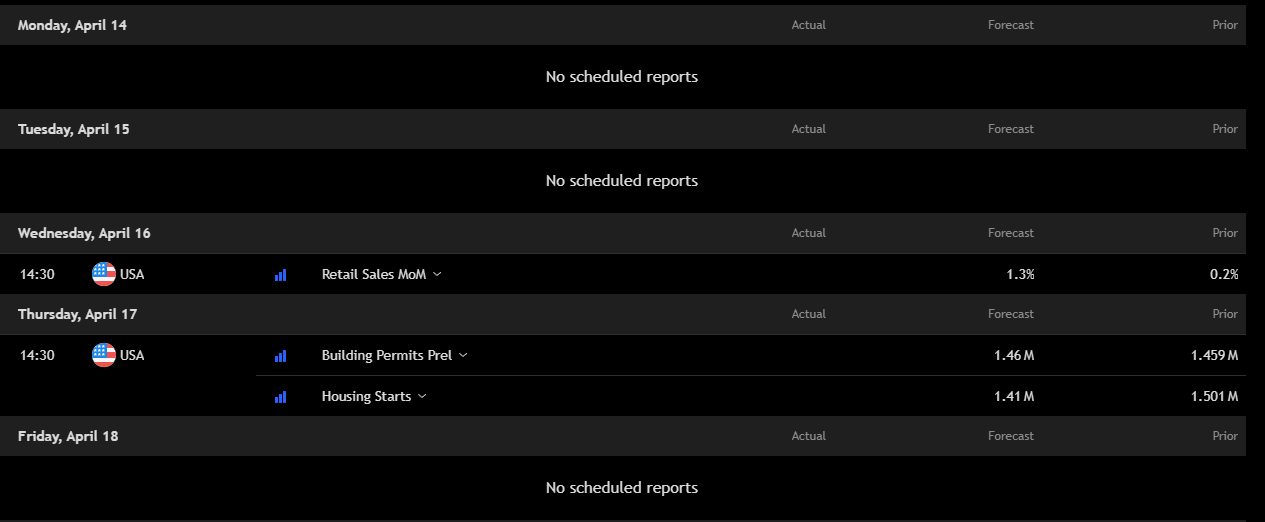

Key economic events to watch next week

Quiet start to the week, but eyes on Wednesday & Thursday.

Retail Sales (Wed) : Forecast 1.3% vs 0.2% prior. Strong print = bad news for rate cut hopes.

Housing Data (Thu) : Building Permits & Housing Starts slightly slowing.

Low event week.

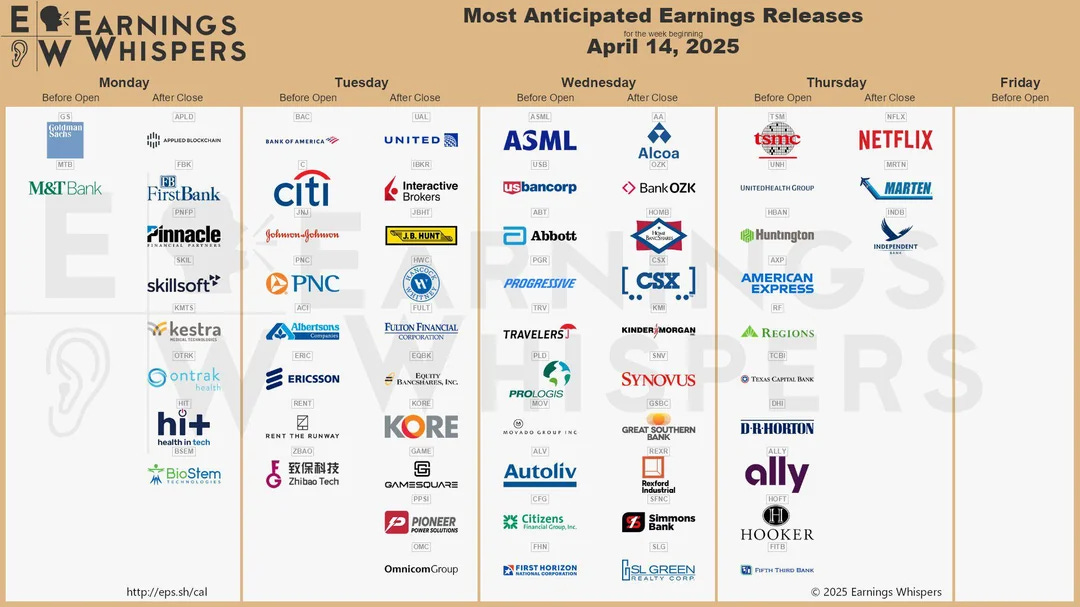

Earnings to watch - Who’s making money?

Here are some interesting earnings reports coming up:

Big earnings week ahead.

Tuesday: Eyes on Bank of America, Citi, Johnson & Johnson, key for market sentiment.

Wednesday: ASML & Abbot, huge for tech & healthcare outlook.

Thursday: TSMC & American Express, big read on chips & consumer spending.

Thursday After Close: Netflix, always a market mover.

Fear & Greed Index

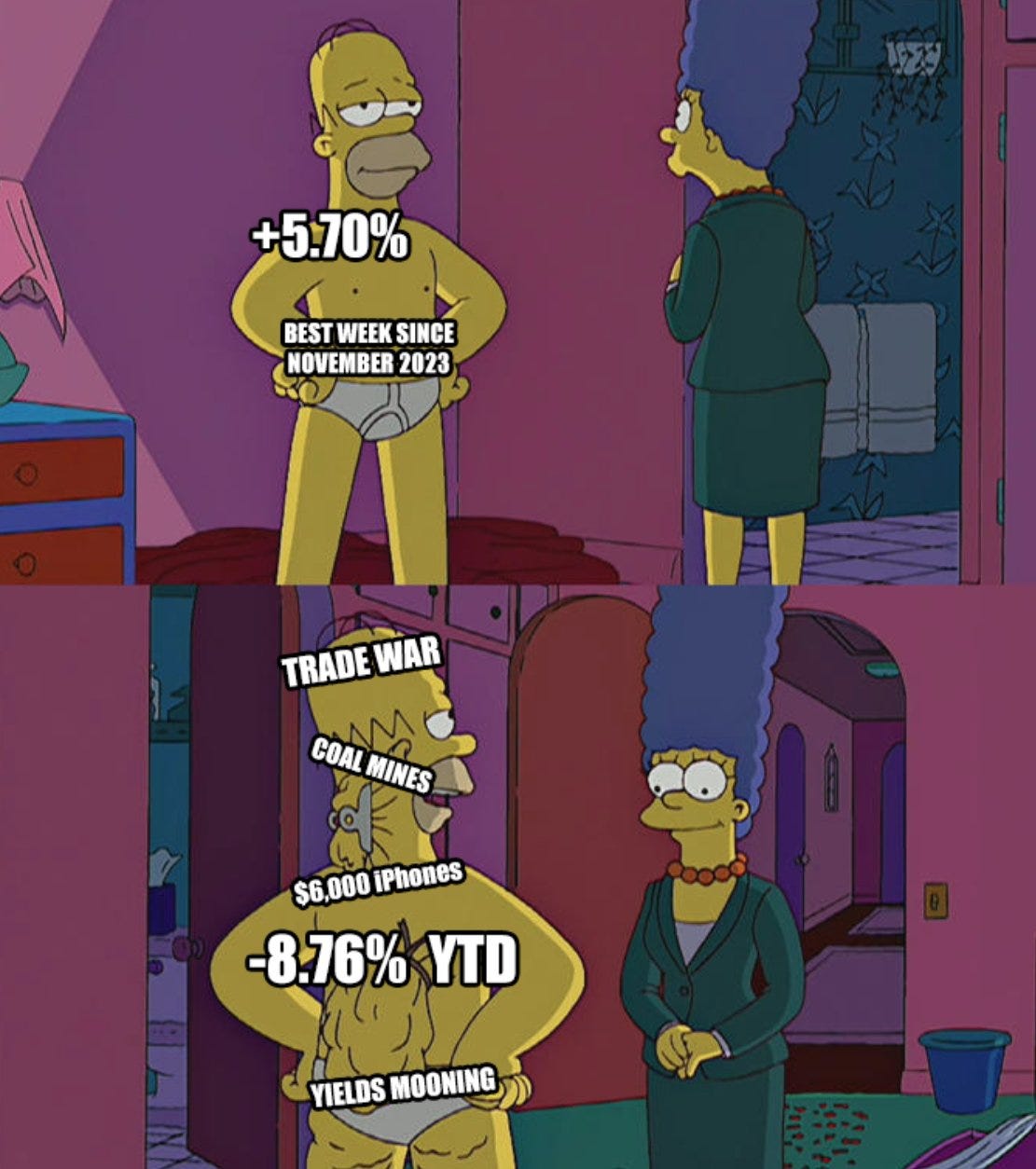

Meme of the week

The Only Newsletter I Want You To Actually Read

I feel like I’m starting to become more and more authentic. Like I’m finally using my real voice.

And my goal is simple, I want this publication to give you maximum value for exactly $0.

At least this weekly edition will remain free, where we do a full recap of what happened and I share everything you need to prepare for the next week.

But I need your help.

Tell me how I can make this even better. I want you to make money with this newsletter. I don’t want this to be just another email lost in your inbox.

For that, I need you. Let me know how I can improve it even more.

Thank you for reading this far.

Until next Sunday,

Vladislav

Basically normal support & resistance what you did there.

But you did it so well, nice one 🤟🏻🤝

any plans to bring back the discount you had in April...say for Black Friday :). thanks