40% Potential Upside on This Trading Setup You Can’t Ignore

$HTZ Trade Breakdown | Episode 12

I want to tell you that back in February, when this community was created, the main idea was to build content for investors. But in these four months with you, I’ve met so many investors, equity analysts, and financial consultants who bring incredible value through their experience.

I’ve spent hours reading their analyses and realized I’m the one learning from them. At the same time, I’ve discovered I’m much more excited to write about trading, a topic you never really figure out completely. By nature, you’re bound to make mistakes, and that’s exactly what drives growth.

As I wrote on 28th April:

I want to share this journey of swing trading (and sometimes intraday trading) with you. I want to show you ideas, trading setups, backtesting, and most importantly, live testing. I want to show you that it is possible, it is possible to make a living from this and reach financial independence..

Freedom Trade of the week

Hertz ($HTZ) just printed one of the wildest moves this year. Ackman’s Pershing Square took a nearly 20% stake, sending the stock flying over 100% in two days.

Price filled the gap and is now setting up for a potential second leg targeting the previous resistance around $9.

I’m watching closely into May 12 earnings (after market). I won’t touch size here, post-earnings dump risk is real. Safer play is to wait for confirmation after the call.

This trade could be driven by a “green week” fueled by optimism around the US-China talks and a possible cooling of the tariff war.

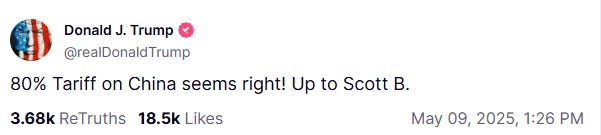

The US and China finally sat at the table in Switzerland to cool down the tariff war that’s been shaking global markets since January.

Ahead of the US and Chinese negotiators meeting in Switzerland this weekend, Donald Trump posted this on his platform, Truth Social:

Confidence level (1-5): 💸💸💸

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely:

Get exclusive market insights, access my free watchlist now!

🔗 Check it out here: TradingView Watchlist

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

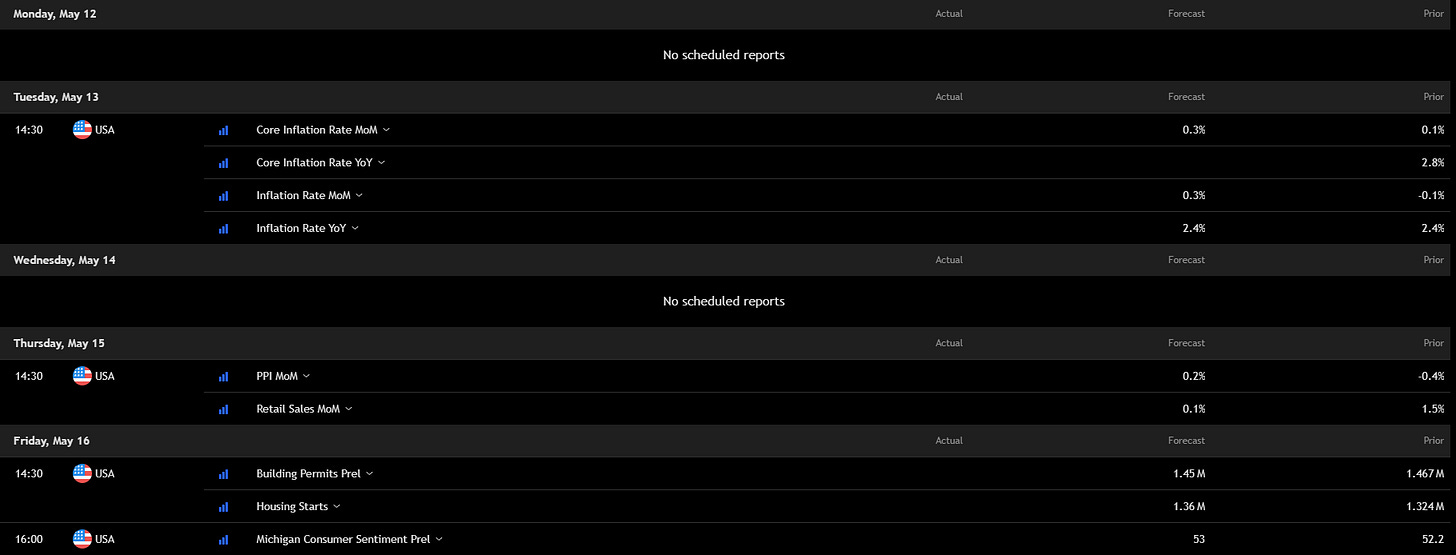

Key economic events to watch next week

Big week ahead for US markets. Tuesday’s CPI data (core + headline) will set the tone, 0.3% MoM expected, any surprise will shake equities and bonds hard. Thursday brings PPI and Retail Sales, both critical for the inflation narrative. Friday wraps with Housing and Michigan Sentiment.

Earnings to watch

Here are some interesting earnings reports coming up:

Monday: All eyes on Hertz (HTZ), especially after Ackman’s stake and wild price action.

Tuesday: JD.com (JD), Sea Ltd (SE), Honda (HMC), big names across e-commerce and autos.

Wednesday: Sony (SONY) and Tencent (TCEHY) headline a tech-focused day.

Thursday: Massive lineup with Alibaba (BABA), Walmart (WMT), John Deere (DE), and Applied Materials (AMAT), expect fireworks.

Friday: nothing interesting to me.

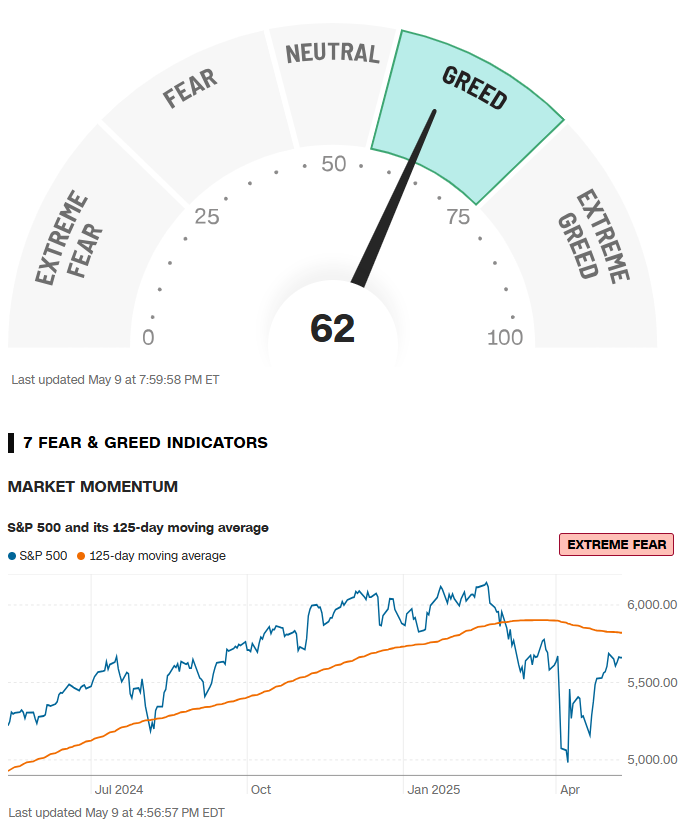

Fear & Greed Index

Meme of the week

Until next Sunday,

Vladislav