Foreign Money Is Ditching the US, Here’s Who’s Profiting From It

36% of the S&P 500 report earnings next week | Episode 11

Another volatile week, but this time, all three indexes closed green.

It was also a crazy month for my swing trading account, which had 103% return.

The S&P 500 punched back above 5,500 for the first time since the tariff mess started. Risk appetite came back swinging: gold took a hit, bitcoin took a win.

Stocks fought to keep the rally alive after China teased a possible tariff cut on US imports. Trump said trade talks are happening, but don’t get your hopes up for another 90-day pause like last time.

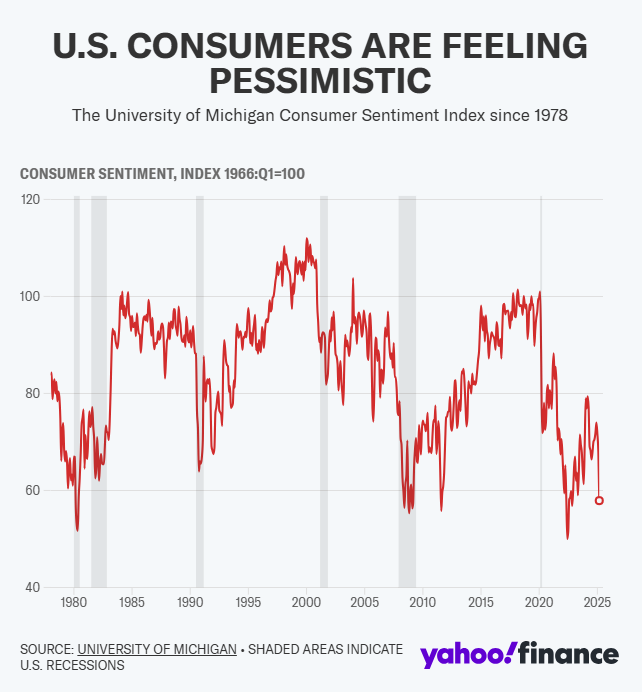

Meanwhile, consumer sentiment keeps sinking, lowest since July 2022.

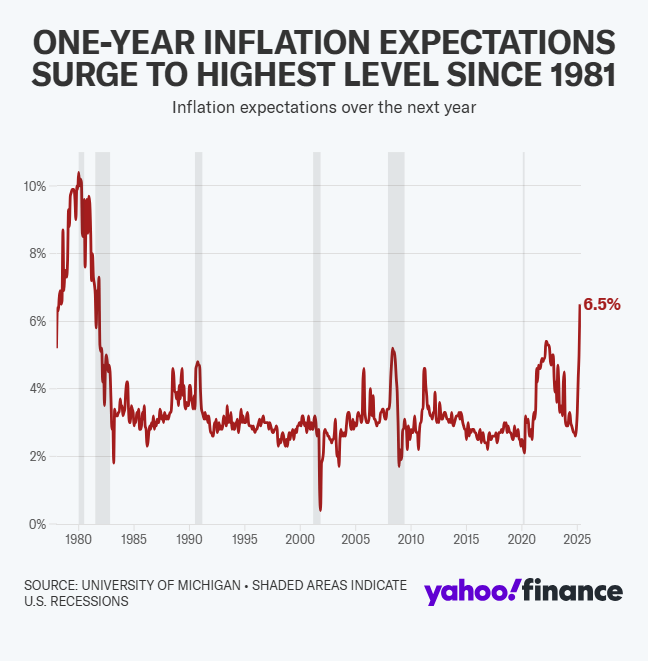

Inflation expectations? Worst spike since 1981. The storm’s not over.

As last week, foreign investors are trying to get rid of the US markets. (sold $63 billion of US equities since the start of March)

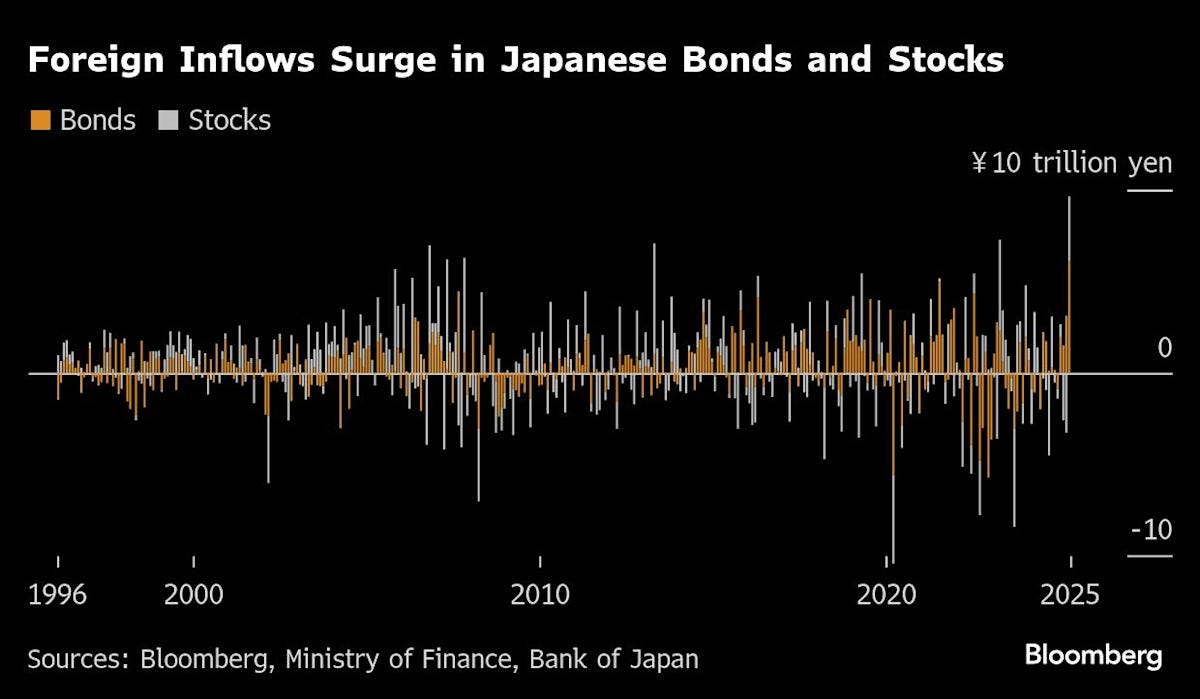

And who has benefited from this in recent weeks? Japan.

This month alone, international traders have pumped a record $67.5 billion into Japanese stocks and bonds - most of it in bonds, according to Bloomberg.

But I still believe that this year will end on a positive note. Here, I said it ^__^!

Let's see if I'll be right.

Freedom Trade of the week

At the moment I don't plan to take any trades this week, as I will be traveling. For more details, read at the end.

If I take any trades, I will let the community know in chat.

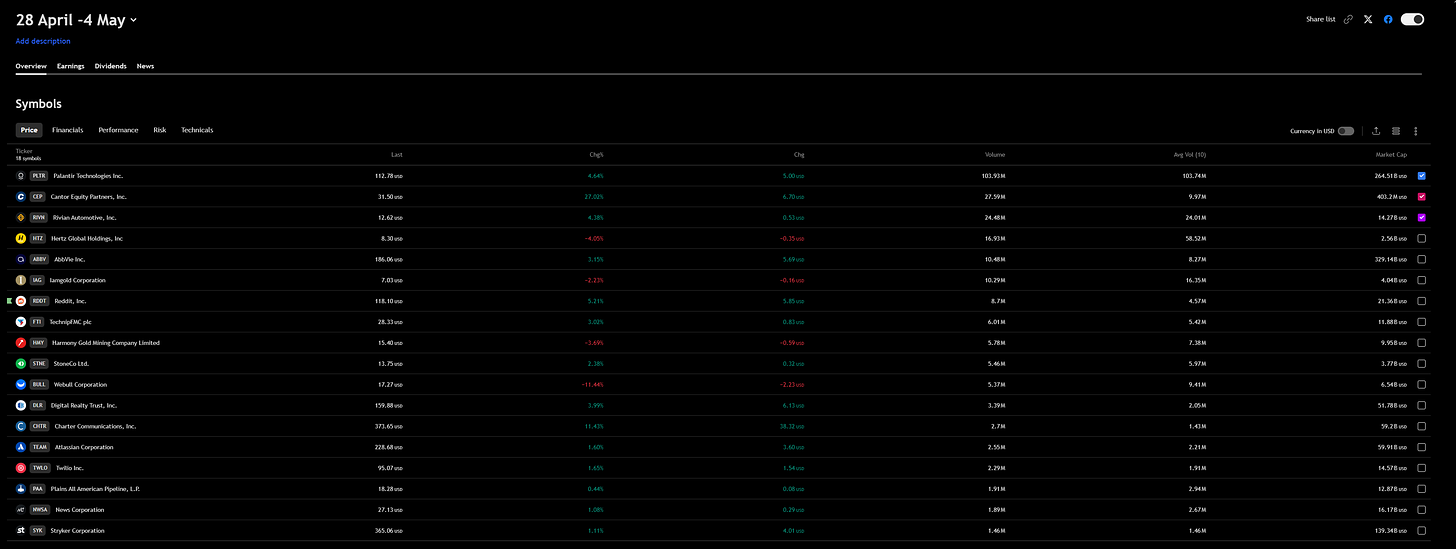

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely:

Get exclusive market insights—access my free watchlist now!

🔗 Check it out here: TradingView Watchlist

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

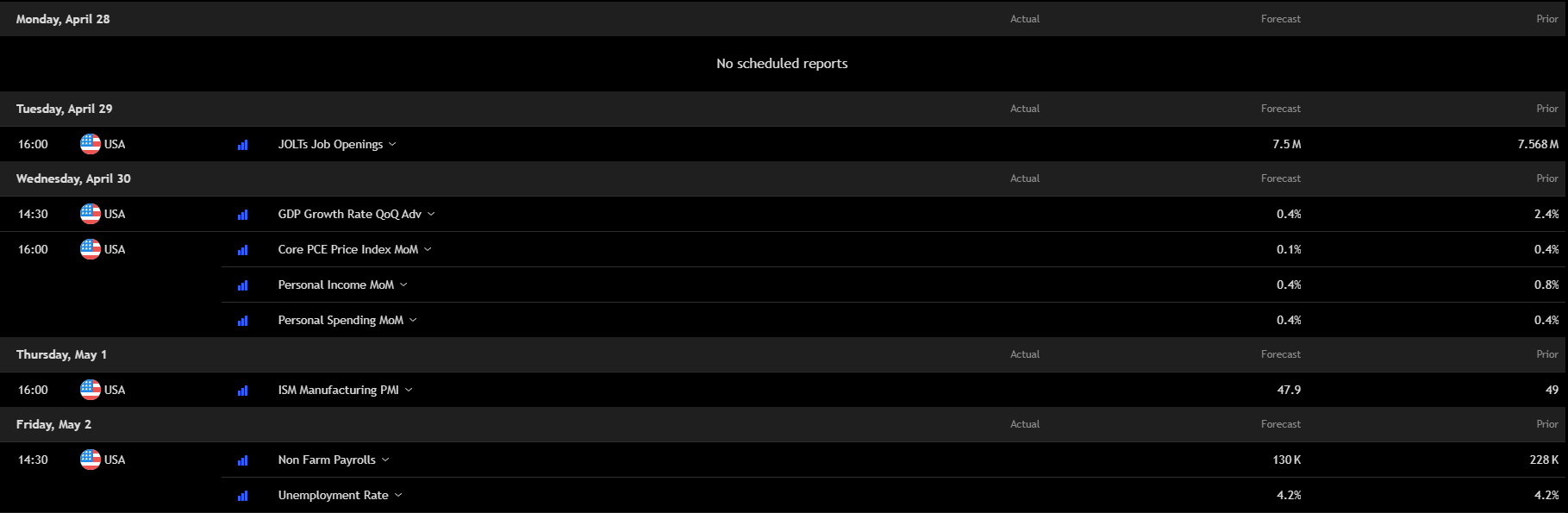

Key economic events to watch next week

Next week’s loaded.

All eyes on Wednesday: GDP growth, Core PCE, income, and spending, all dropping back-to-back. That’s the real market mover.

Thursday’s ISM Manufacturing PMI will show if the economy’s still breathing. Friday is NFP and unemployment data.

Volatility’s coming.

Earnings to watch - Who’s making money?

Here are some interesting earnings reports coming up:

36% of the S&P 500 report earnings next week. It is 40% if you go by market cap, but half of that is in just four names:MSFT, META, AMZN, and AAPL

Tuesday and Wednesday are tech-heavy with Visa, PayPal, Microsoft, and Meta reporting, big potential movers.

Thursday is packed with major consumer and tech names like Amazon, Mastercard, and McDonald's, expect high volatility.

Friday shifts the focus to energy and healthcare, with ExxonMobil, Chevron, and Cigna leading.

Fear & Greed Index

Meme of the week

Why May 1st is an important date for me

No, it's not because AAPL or AMZN are reporting earnings, it's because it's my birthday and I plan to spend it on a sunny island. 😅

After about 7 months of hard work, I plan to take a well deserved (I say) vacation

But that shouldn't worry you because I've already scheduled another newsletter for next Sunday.

But it won't be in this format obviously because I'm on vacation and I don't plan to stare at the screens day after day, but rather at the beach.

But I will write about "18 Money Rules You Need to Know Before You Turn 30", an article that will surely help you, especially those who are just starting out.

Until next Sunday,

Vladislav

Interesting to see the capital fleeing to Japan, they've their own problems with the money.