Freedom Trades Just Got Better - See What’s New

My Best Trade Ideas for the Week Ahead | Edition 24

Hello traders,

I’m back from vacation, and a lot has happened in the meantime. Our community has grown by about 100 new traders in just one week, and 7 of them decided to join the PRO community.

They recognized the value of this community, and even more, 3 of them chose to contact me privately (completely optional) for a mentorship session.

I’ve made this completely optional, and I don’t charge anything for it because I want to connect with as many profitable traders, or traders on their way to becoming profitable, as possible.

And YES! They have the highest chance of becoming profitable because:

They are the most active

They communicate and always seek help when they don’t understand something

They review their mistakes and aren’t afraid to ask for feedback

They put into practice what they learn

I can feel your chances of success based on how much you want it and how much time you dedicate to it.

Today is Sunday, are you on the charts? Are you preparing for tomorrow?

I guarantee you that profitable traders don’t just blindly enter the market at Monday’s open. We are athletes, and like any athlete, we must prepare before a match.

Those in the PRO community do exactly that! They prepare.

From now on, they will receive new opportunities every week before the market opens on Monday!!!

They have access to the exact opportunities I’m watching, buying, and trading.

Here’s the proof if you don’t believe me:

More than that, last week I decided to share my entire swing trading strategy with you.

You’ll learn exactly how to replicate the strategy, how to spot your own opportunities, how to execute trades, all with concrete examples.

My goal is for you to become independent traders and eventually take off on your own, not to depend on me forever, even if that means I lose money because of it.

In the end, I want you as colleagues, not as unprofitable students.

If you want to access it, you can do so here:

Moreover, in the future I will combine the “High Probability Trades for This Week” series with the Weekly Portfolio Report, where I want to show, with proof, exactly when I enter, when I exit, and the total value of my portfolio.

This will take a bit of time because I’m currently in the process of consolidating my portfolios. Right now, I trade from three different accounts, two stock accounts and one crypto account. As you know, if you’ve been following me, I recently sold a large portion of my BTC at $122K. Well, transferring assets/positions and setting up takes time.

For those of you who are paid members, I’ll keep you updated.

Thank you for your trust, and without further delay, let’s dive into this week’s edition.

Freedom Trade of the week

Ticker is RKLB

If the price can hold this $44 level, it could retest the previous high of $53.

Caution: My position will be small since the price has already risen 76% this year, meaning bulls may be looking to sell. The stock is in price discovery, so no one knows how high it can go. My stop‑loss will also be very tight, less than 5%.Price could be fueled by the next earnings report!

You can find all of this week’s setups/opportunities in detail here.

Copy my Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my free watchlist here:

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch. Gain access to my trading strategy, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

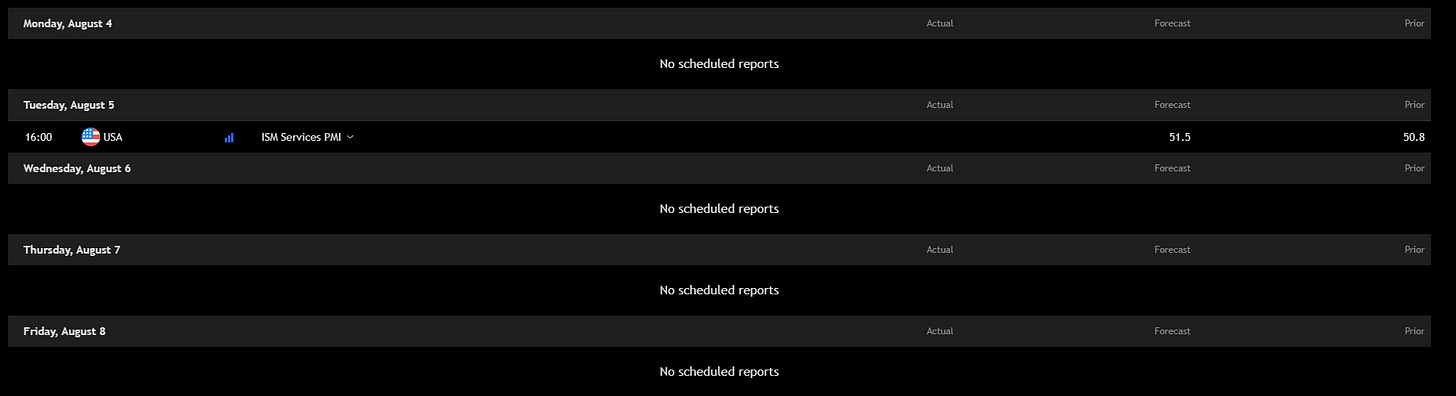

Key economic events to watch next week

Quiet week for economic data, the only notable release is Tuesday’s US ISM Services PMI (forecast 51.5 vs. prior 50.8). Markets will mostly trade on earnings, technicals, and headlines.

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

Big earnings week ahead, watch for volatility in AMD, Palantir, Shopify, Disney, Eli Lilly, Block, Pinterest, and Twilio. Plenty of sector‑moving reports that could set the tone for August trading.

Fear & Greed Index of the week

The market sentiment dropped sharply, moving from 74 (Greed) last week to 50 (Neutral).

This shift signals fading bullish momentum, with traders turning more cautious after recent volatility.

Financial Meme of the week

Thank you for being with me in this edition, and if you think this newsletter could be helpful for your friends, share it with them so it can reach as many traders as possible.

“One trade closer to freedom.”

Vladislav