HIMS Stock Analysis

With soaring revenue and expansion plans, HIMS looks promising—but can it overcome rising competition and profitability challenges?

This morning, HIMS hit my scanner with one of the highest traded volumes on the market, and that immediately caught my attention.

When a stock moves like that, there’s usually a reason—so I decided to dig in and see what’s really going on under the hood. What I found? A fast-growing telehealth powerhouse that might be one of the most undervalued growth plays out there.

Hims & Hers Health (NYSE: HIMS) operates in the competitive telehealth space, offering direct-to-consumer healthcare solutions. While its expansion efforts are impressive, the company still faces challenges that could impact its long-term trajectory.

HIMS Numbers

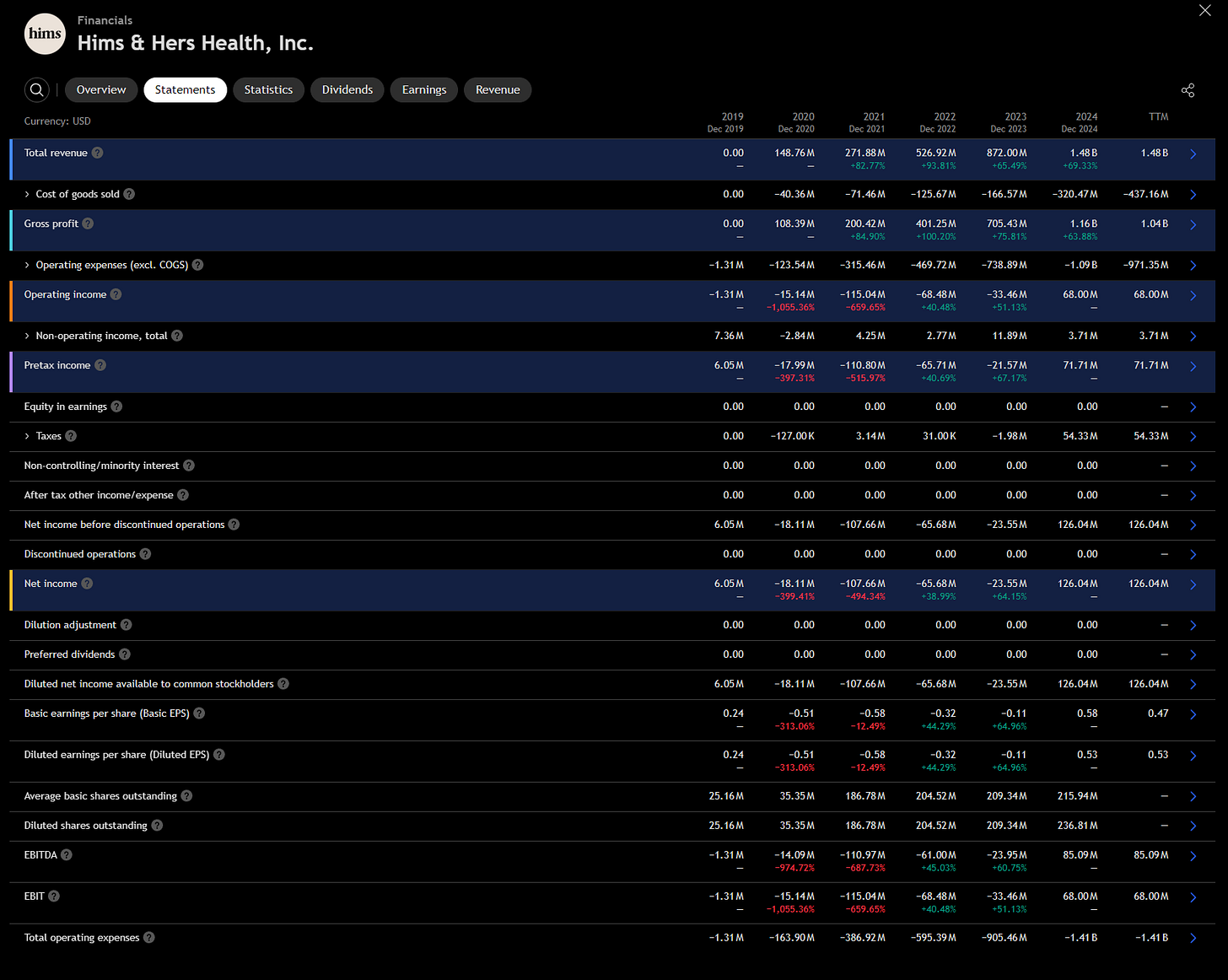

Looking at the data, HIMS is showing strong revenue growth, but valuation concerns and industry risks should not be ignored. Here’s what stands out:

—Revenue Growth: HIMS has been compounding revenue at a solid rate, with double-digit YoY growth. However, maintaining this growth in an increasingly competitive market remains to be seen.

—Gross Margins: With margins above 75%, HIMS has a scalable model, but sustaining these margins long-term will depend on customer acquisition costs and retention rates.

—Subscription Model Strength: A recurring revenue model provides stability, but customer churn rates and long-term brand loyalty remain key factors to monitor.

—Customer Base Expansion: The company is broadening its offerings beyond hair loss and ED treatments, moving into mental health, skincare, and weight loss, but execution risks exist.

Why Wall Street is Sleeping on HIMS

Despite its strong financials, HIMS remains undervalued compared to the sector, trading at a lower price-to-sales ratio than legacy healthcare providers and newer telehealth players.

Potential Underrated Catalysts:

Market Expansion – HIMS is moving into new verticals, tapping into broader demographics beyond its initial audience.

Direct-to-Consumer Dominance – No insurance headaches, no middlemen—just a smooth, digital-first experience.

Operational Efficiency – The company is driving lower CAC (customer acquisition costs) while increasing lifetime value (LTV), a recipe for long-term profitability.

Potential Profitability Milestone – Analysts project HIMS could hit profitability ahead of schedule, making it a turnaround story that the market isn’t fully pricing in yet.

Risks to Watch

HIMS isn’t without challenges. Rising competition in the telehealth space and potential regulatory hurdles could slow growth. However, its brand strength and first-mover advantage in direct-to-consumer healthcare make it a formidable player.

For investors looking for a high-growth, undervalued stock with strong fundamentals, HIMS is worth serious consideration. The company’s ability to scale its subscription model and expand into new healthcare segments makes it a potential multi-bagger over the next few years.

If you can handle some volatility and believe in the future of digital health, HIMS might just be your next big winner.

Gotta watch the valuation for this one.