How I Made $58,962 | With Proof

Complete Breakdown - Step by Step | Edition 22

Hi,

Today I’m going to show you exactly how I made $58,962.

This week’s edition is going to be a special one.

I want to be fully transparent with you and show the entire process I went through to reach this amount.

Breakdown of the Trade

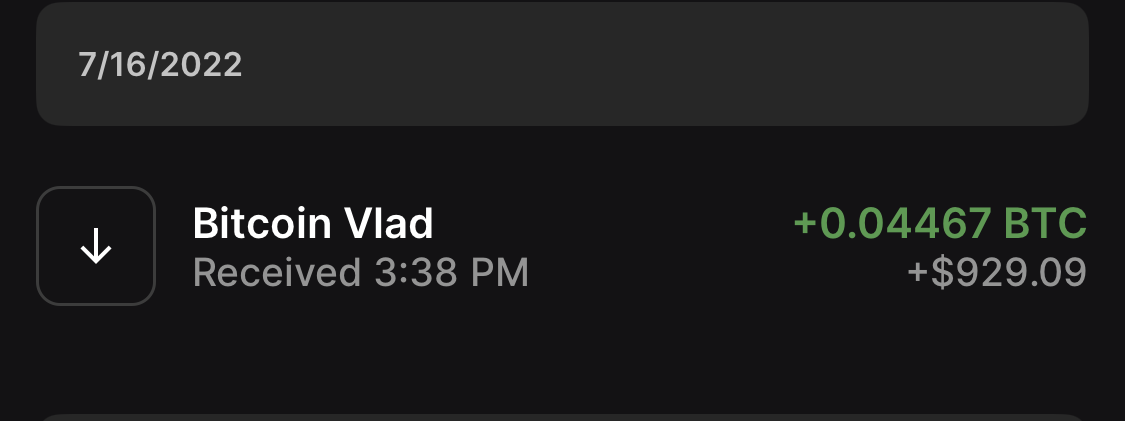

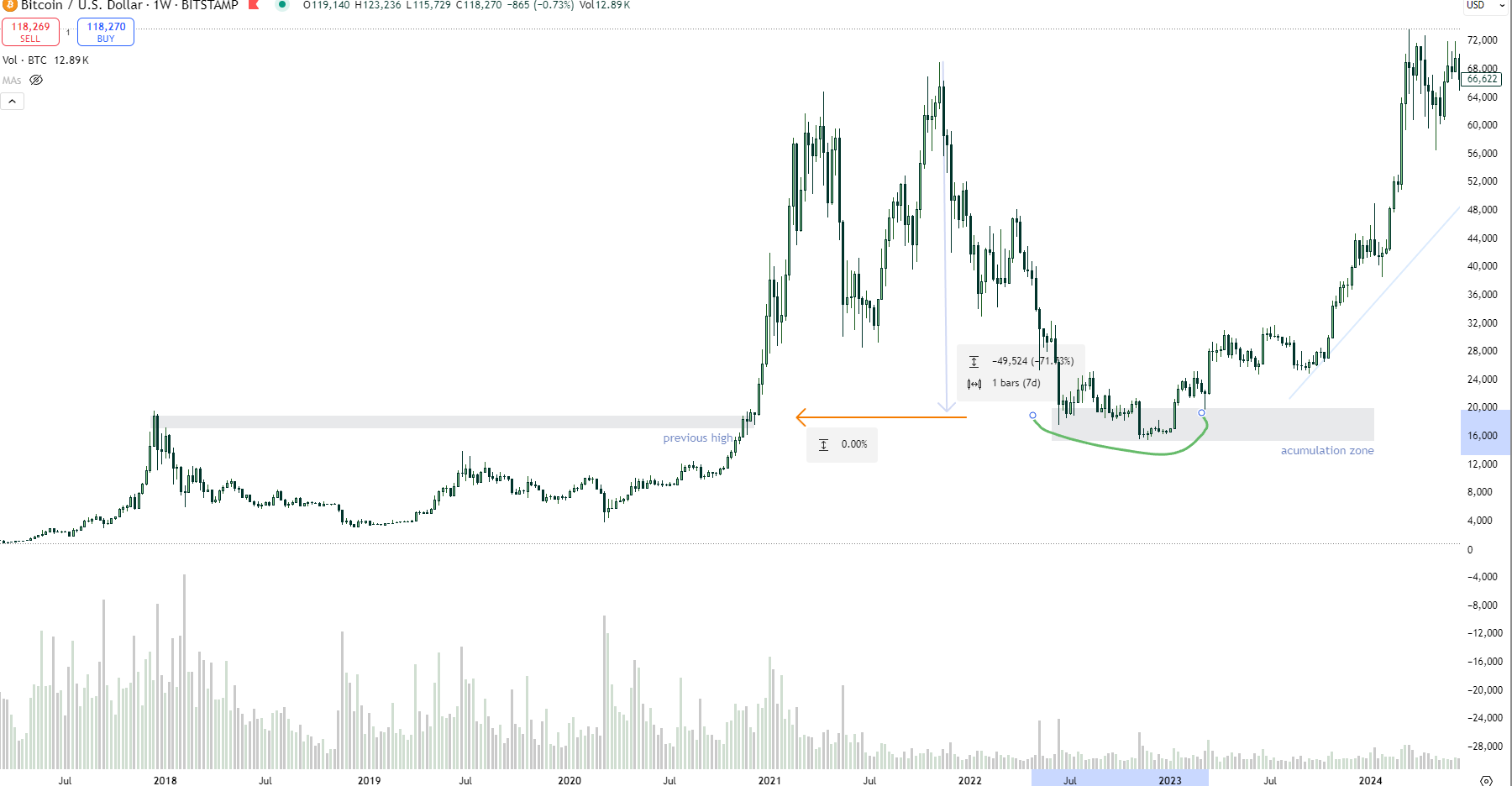

Let’s start from the beginning. It was July 2022, and the price of $BTC looked like this:

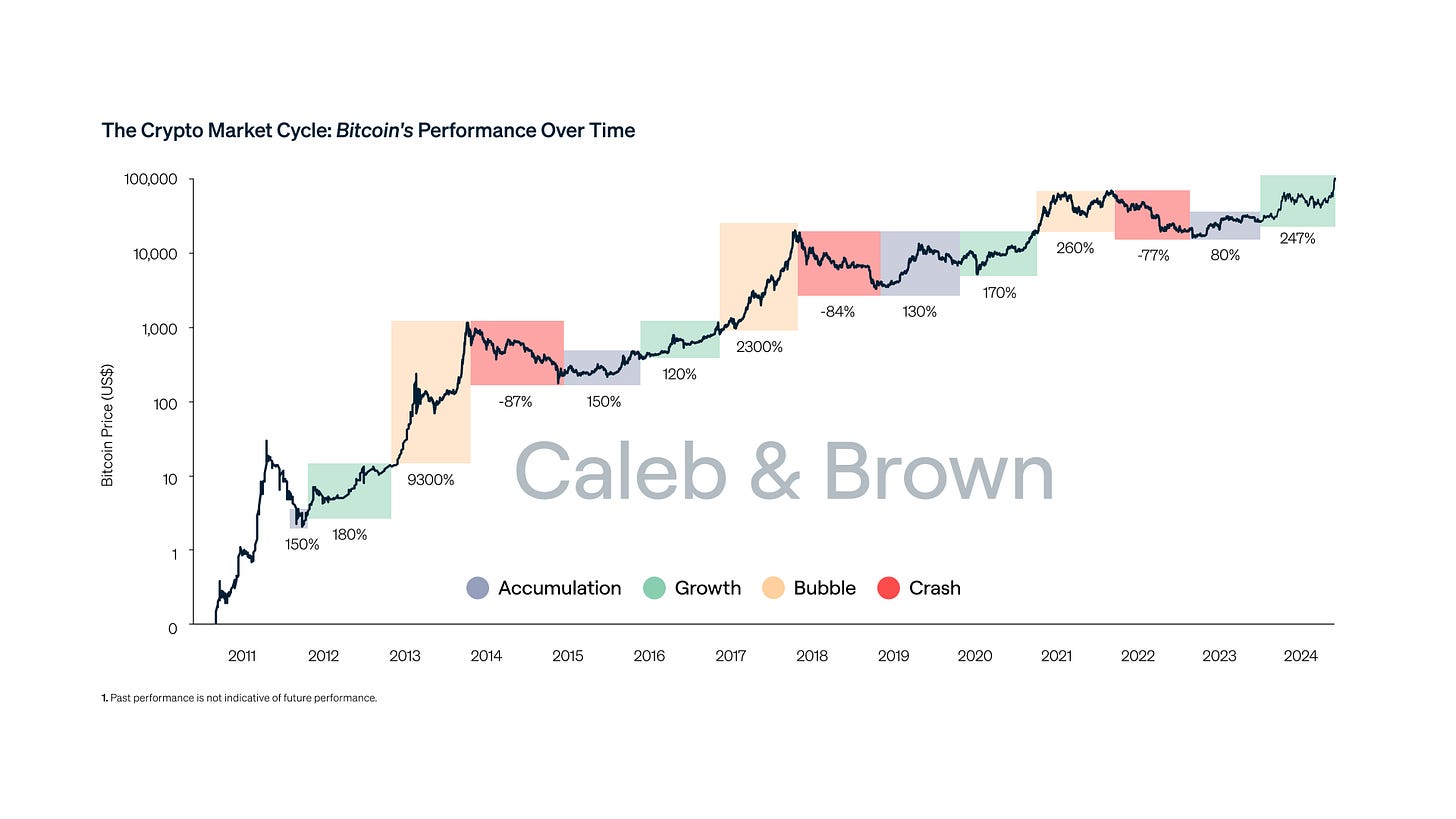

BTC had dropped 71% and was retesting the support at its previous high. That’s when I started to believe it was nearing the bottom of the bear cycle.

This was the first moment I began buying, small portions, in $1,000 chunks. (At the end, I’ll tell you the total amount and the return. You won’t believe it :)

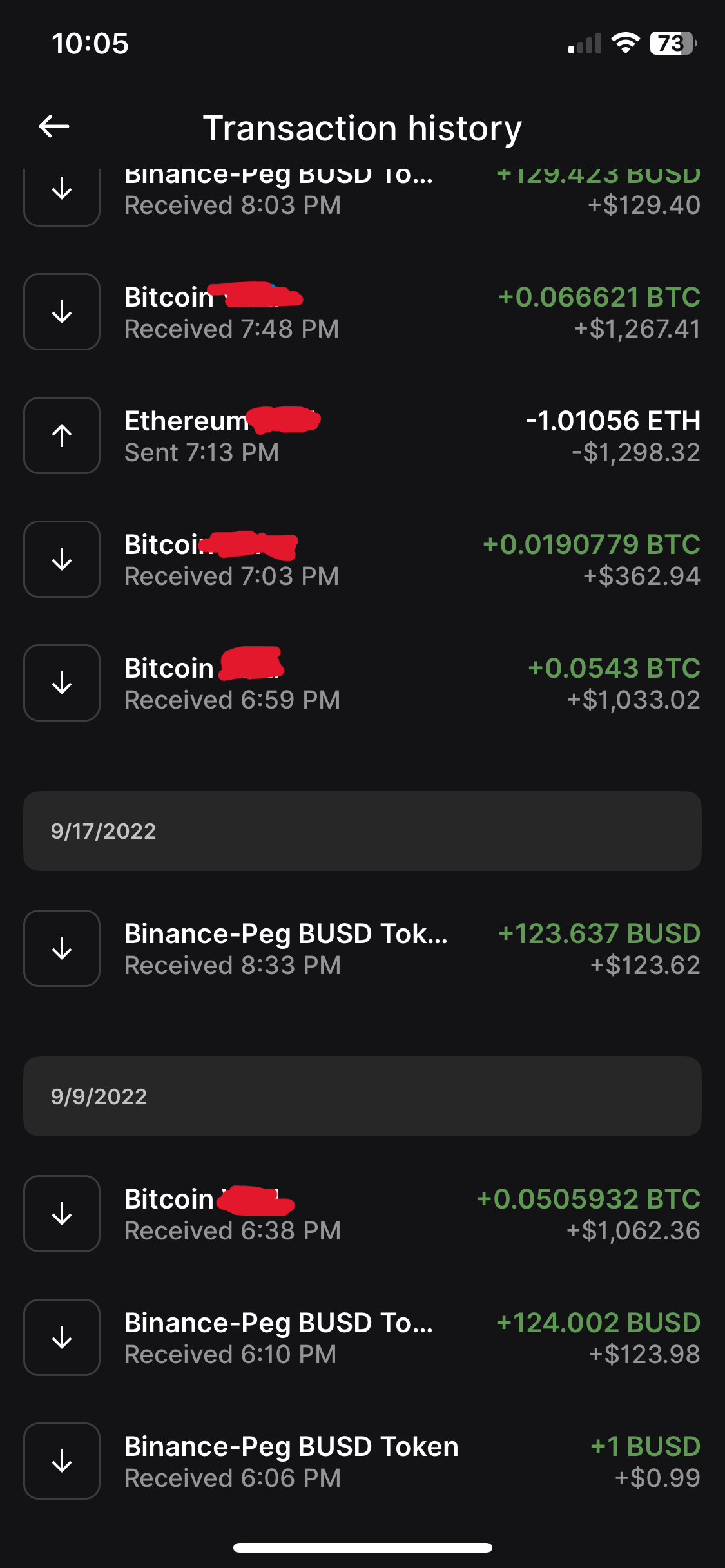

Here’s proof of the purchases, in my Ledger cold storage wallet.

I start doing DCA, believing this is the bottom, because it’s entering an upward trend, and the RSI was consistently in oversold, both on the weekly and the daily.

But I was wrong. The second-largest exchange, FTX, collapsed and from the $25,000 high, BTC dropped further to $15,483, another 38% drop from the previous high.

That’s when I started buying even more aggressively.

Unfortunately, one mistake I made here was talking to other people, including traders who had no clue about the crypto community or what BTC really means.

When I shared my theory and convictions, they laughed in my face, telling me it was going to zero…

Obviously, I didn’t listen to them, but I think subconsciously, it still held me back from being more aggressive and buying more.

My plan was simple: buy everything I could under $20,000, because I saw BTC as undervalued below that zone, that was my accumulation range.

What followed right after was nothing short of magical.

BTC had just gone through the halving and entered the next bull market cycle, hitting $100,000 for the first time in December 2024.

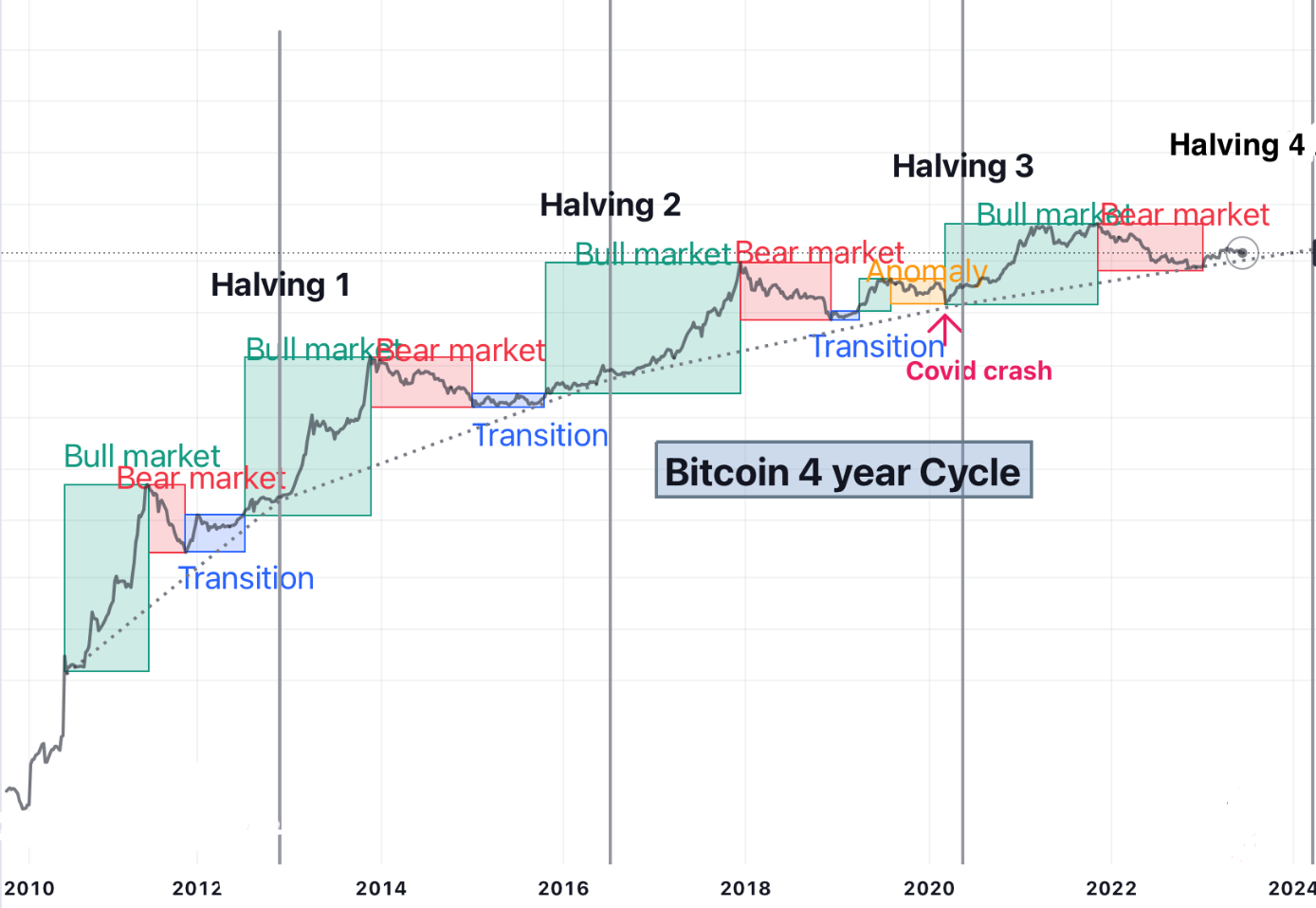

My conviction came from the 4-year cycle that BTC keeps following, entering a bear market, then a transition phase (accumulation) that lines up with the Halving.

That’s exactly what I did in the 2016–2018 cycle, when I was 20 years old and made my first 5 figures from just $700 :)

Like any pattern, this won’t last forever. It will work until it doesn’t, that’s why risk management is key. I wrote in this post more about risk management:

As much as I love BTC and am grateful for what it’s done for my life, please don’t throw your life savings into it.

There’s a real possibility that in the next cycle we’ll see some anomaly, especially now with so much institutional involvement.

Are you an idiot? Why did you sell, why now?

The selling moment came on July 14, 2025, when BTC hit $120,000. But I managed to sell at $122,470, a bit higher than I had planned. (That’s when I happened to wake up, hehe.)

But this level was on my radar from the moment I started this trade.

How? How could you possibly know it would reach that level?

To be honest, I had no idea it would hit that exact number!

No one should blindly believe 100% in their convictions when it comes to trading. You know why? Because sometimes it just doesn’t happen. And when that’s the case, you need to be ready to part ways with your idea. Don’t marry your idea/trade!

I’ve always said it: Risk management! Manage your position! The goal is to stay in the game!

The way I arrived at the 120k level was through some math I did based on the growth of each cycle, plus a few supporting charts, and they all pointed to a zone between 120k and 140k.

One of those supporting charts was USDT.D (USDT dominance in the market).

Even though I sold, this chart makes me think there’s still at least 11% room for growth.

And if this cycle turns out to be massive, BTC could still climb another 50% from here.

Why is it important to look at the USDT.D chart?

Because USDT.D (USDT dominance) shows how much capital is sitting on the sidelines in stablecoins vs. how much is flowing into crypto.

When USDT.D drops, money is flooding into BTC & alts → bullish sentiment.

When USDT.D rises, people are running to safety → risk-off, possible top or correction.

Basically, it helps you see how much “fuel” the market has left and whether people are in risk-on or defensive mode. If you see BTC high but USDT.D starting to climb, pay attention, it’s a sign the cycle might cool off.

Will BTC go higher this cycle?

The short answer is YES!

The long answer is: it depends :)

Yes, I believe there’s still room for growth, as I said above, but I also want to explain myself to the crypto community and to you: my return on this trade is 637%. (initial investment was close to 8000$)

For me, at this point, it was more about sticking to my plan. If I hadn’t sold at this level, I probably wouldn’t have sold at all (and maybe that’s the whole point, never sell your BTC haha).

This is what I recommend to you traders: remember that besides physical capital, you also have mental capital. If I had lost this money, it would’ve hit me much harder, to the point where I’d have questioned my ability as a trader.

What are my plans with this money?

This money will be redirected into my trading/investment account. I’ll continue my plan to become a millionaire and retire this family.

And yes, I’ll jump back into crypto in the next cycle :)