How to become a profitable trader in 2026

A Simple Blueprint to Become a Profitable Trader | Edition 45

Dear Traders,

I want to tell you exactly what I would do if I had to start over, and how I would become a profitable trader in 2026.

First of all, profitability starts with you.

My philosophy is simple: we can all be profitable, but only if two conditions are met:

Our trading strategy is adapted to our personality.

We give ourselves enough time.

Now let me explain what I mean by this, and why these two are the most important things.

1. How to build your trading strategy

First, be brutally honest about who you are, not who you want to be.

If you hate screens, fast decisions, and adrenaline, day trading will drain you.

If you love action and get impatient waiting days, swing trading ultra-slow setups will make you break rules.

Your personality decides:

– how often you trade

– how long you hold

– how much noise you can tolerate

– how much stress you can handle

Ignore this and no system will save you.

THAT’S WHY you keep saying “I SUCK AT TRADING PSYCHOLOGY”, it’s because your trading strategy is not a good fit for your character.

That’s why you break your rules, it’s all connected!

Ask yourself:

When do I feel sharp? Morning? Evening?

How many decisions can I make before I get sloppy?

Do I prefer clear yes/no rules or discretionary judgment?

I personally design strategies that:

– require few decisions

– have clear invalidation

– don’t need constant babysitting

Not because it’s “optimal”, but because it’s sustainable for me.

Pick a timeframe that matches your patience.

Impatient personalities force trades on higher timeframes.

Overthinkers overmanage lower timeframes.

If you:

overtrade then move up a timeframe

hesitate too much, then simplify rules

Your flaws tell you exactly how to adjust your system.

Most traders try to “fix themselves”.

It’s wayyyyy better and FASTER to build around your weaknesses.

Listen to how you feel when you risk your money

If your PnL swings change your mood, risk is too high.

If you feel nothing, you won’t respect the trade. (increase position)

Risk is not only math, It’s also mental capital.

Now I want to talk about the second point I mentioned:

2. Give yourself enough time to test the trading strategy

This is the point where a lot of traders sabotage themselves.

You finally manage to build a strategy.

You test it for one week. Two weeks.

You take five trades.

You hit one bad streak.

And then you say, “It doesn’t work.”

That’s not testing.

You don’t have enough data to draw a conclusion.

One week isn’t enough.

One month isn’t enough.

Not even one year is enough, because you haven’t gone through a full market cycle to see how the strategy performs in a bear market versus a bull market.

And from what I’ve seen, most strategies look broken at the beginning.

Because variance shows up before edge does.

You can do everything right and still lose for weeks.

That doesn’t mean the system is bad.

Most of the time, the market environment plays a huge role.

You also need time to master the strategy.

To start getting creative with it.

To see what works and what doesn’t.

To understand where its weak points are.

The main objective of testing a strategy is to learn how the strategy behaves.

Don’t focus on making money. That’s why many people recommend reducing your position size when you’re testing a new strategy.

Think about it like testing a new car.

Do you immediately go full speed the moment you take it out of the parking lot?

Of course not.

First, you drive it slowly.

You test the brakes.

You see how it responds.

And only after you build confidence do you take it to the track.

Acum urmeaza poate cea mai importanta parte.

3. Track all your trades

You can’t understand where you’re making mistakes and where you’re doing things right if you don’t record every single trade.

I have a saying: “You can’t improve what you don’t measure.”

When you journal properly, patterns jump out:

– where you break rules

– which setups actually pay

– which trades are just boredom trades

– how emotions affect execution

Without data, every mistake feels random.

You don’t need anything fancy.

Log:

– entry and exit

– reason for the trade (setup)

– risk taken

– outcome

– other important measures for you, like how you felt before and after

That’s it.

After 30–50 trades, you’ll learn more about yourself than any YouTube video could teach you.

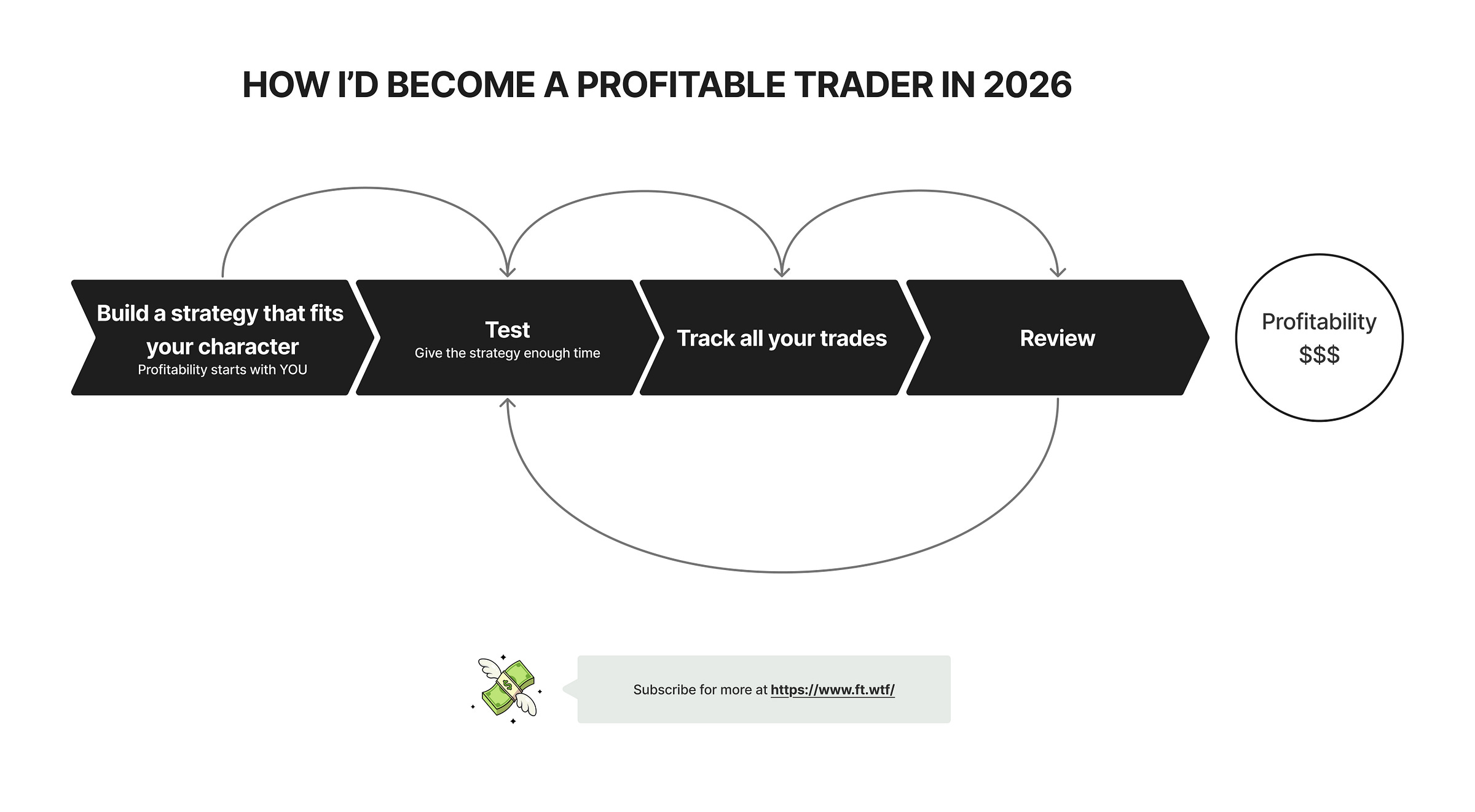

The recipe to become a profitable trader

I put together a simple framework that brings together everything we talked about above.

I promise you that if you do all of this, you’ll become at least a break-even trader.

And that already puts you ahead of 90% of traders who lose money.

I hope this guide helped and gave you clarity.

If you want to take the next step and build this alongside other traders who are truly serious, I invite you to join our community.

If you join now, you’ll get 2 free months on the annual plan.

See you inside the community.

Trade Setups of The Week

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my entire watchlist for free here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

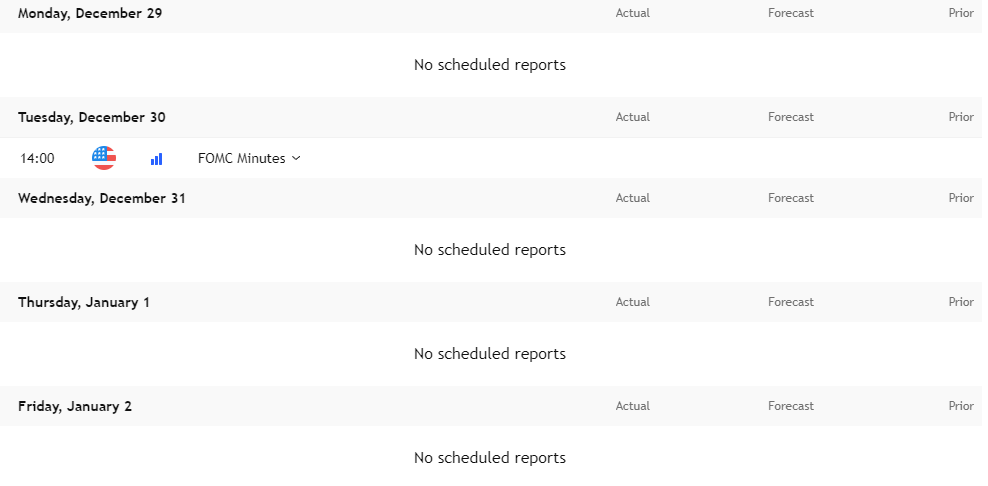

Economic events to watch next week

Quiet calendar, only real thing to watch is FOMC Minutes.

Earnings to Swing Trade Next Week

No earnings!

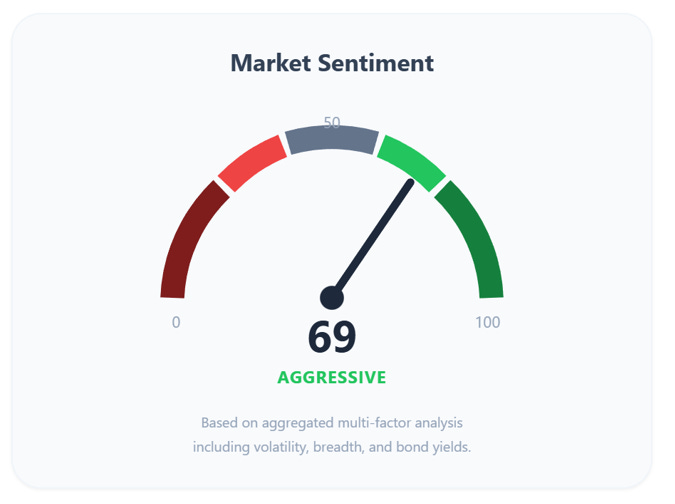

Weekly Market Direction

If you want the full picture with all the signals and context that sits behind this number, consider upgrading so you can see the complete breakdown.

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav