How to Build a System That Trades While You’re on the Beach

Missiles in the Middle East, Bitcoin Hits $1.3B and GameStop's Buying Bitcoin | Edition 17

I'm still on my vacation in Bali, and I’ve been thinking about how easy it feels to trade, monitor my positions, and write this newsletter.

All of that, because I have a solid system in place. For literally everything.

Seriously, everything. Even this newsletter. Otherwise, how could I be consistent for 17 weeks straight?

If you’re on vacation and forced to stop trading, forced, not out of choice, I’m sorry to say, but you’re not a swing trader and you don’t have a system.

That might fly for a day trader or scalper. But as a swing trader?

A good system doesn’t depend on your schedule. It’s built to free you from it.

When you’re working 9 to 5, your system should give you clarity.

When you’re on vacation, your system should give you peace of mind.

Your goal as a swing trader is to create a process that works within any type of schedule.

And no, there’s no perfect swing trader schedule that works for everyone, because we’re different people, living different lives.

But here’s how you can define yours, step by step:

Define exactly how much time you can realistically dedicate to trading.

Let’s take my case, I work 9 to 5 in the healthcare industry (but I’m in a different timezone than New York, which allows me to be in front of my screen from 10:00–10:30 AM CDT).

That gives me up to 2 hours of trading time before lunch. Just enough to do my analysis and enter any positions if needed.

Choose the right timeframe.

Your timeframe should come from three things: your backtesting, your risk profile, and how much time you can allocate to trading.

Always test.

Keep a daily journal. Track everything: your setup, how you felt, what you could’ve done better, what went wrong.

That’s the only way to really know yourself and improve.

One of the books that helped me build systems is Atomic Habits. A quote I still remember:

“You do not rise to the level of your goals. You fall to the level of your systems.”

So define clearly what your analysis hour is, when you’ll review your positions, what timeframe you analyze, the frequency of your analysis, your entry, and your exit.

Of course, these are just the first steps you need to take to start building a system that trades while you're on the beach. There's so much more to talk about on this topic, and if I were to go into detail, it would easily turn into a full 2,000-word article.

Hmmm, maybe I should actually write one specifically on this.

If you think that would be interesting, or want help with this, drop me a message below:

Freedom Trade of the week

Markets don’t like surprises. Especially the kind that involve missiles.

Last night, Israel launched strikes on Iranian nuclear sites and assassinated top military commanders. Iran retaliated immediately. Decades of tension finally erupted, and Wall Street did what Wall Street does.

Stocks dropped hard at the open.

Oil surged past $74 a barrel before cooling off.

Gold spiked as traders scrambled for safety.

Travel stocks? Obliterated. Hilton, Marriott, cruise lines, no one’s booking dream vacations while missiles fly.

Airlines like Delta and United got clipped too, caught between rising fuel prices and closed airspace.

History doesn’t repeat, but markets rhyme.

In 2022, Russia stormed Ukraine. Oil soared. Growth slowed. Inflation ignited. Central banks slammed the brakes.

Now? Same pattern. Different actors.

Unless this blows into full-scale war, the market shock might fade fast.

And Boeing lost another 1.62% as the fallout from a 787 Dreamliner crash in India continues…

ohh and what is also interesting to mention is that:

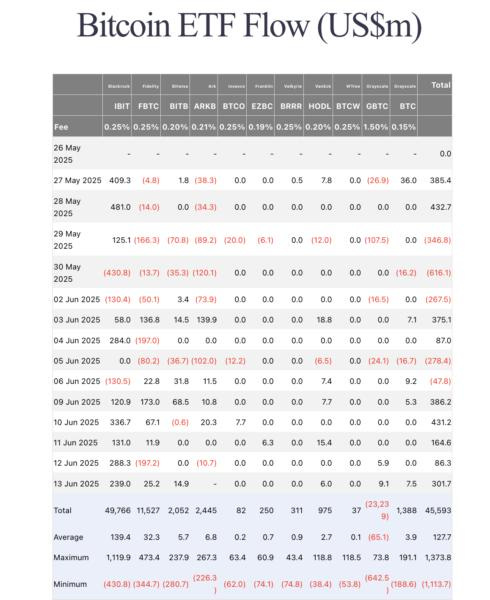

Bitcoin ETFs see $1.3B inflows RECORD in 5 days, war or no war

While missiles flew over the Middle East, money kept flowing into Bitcoin.

For five straight days, from June 9 to June 13, Bitcoin ETFs recorded over $1.3 billion in inflows, according to Farside Investors.

And GameStop GME 0.00%↑ plummeted 22.45% after the video game retailer announced that it will sell $1.75 billion in convertible bonds to buy more bitcoin. (lol 😂) - it's unbelievable what's going on, if you didn't knew that this is a meme stock yet, I guess this is the confirmation, what more do you want?

But hey, maybe a good swing trading opportunity arises.

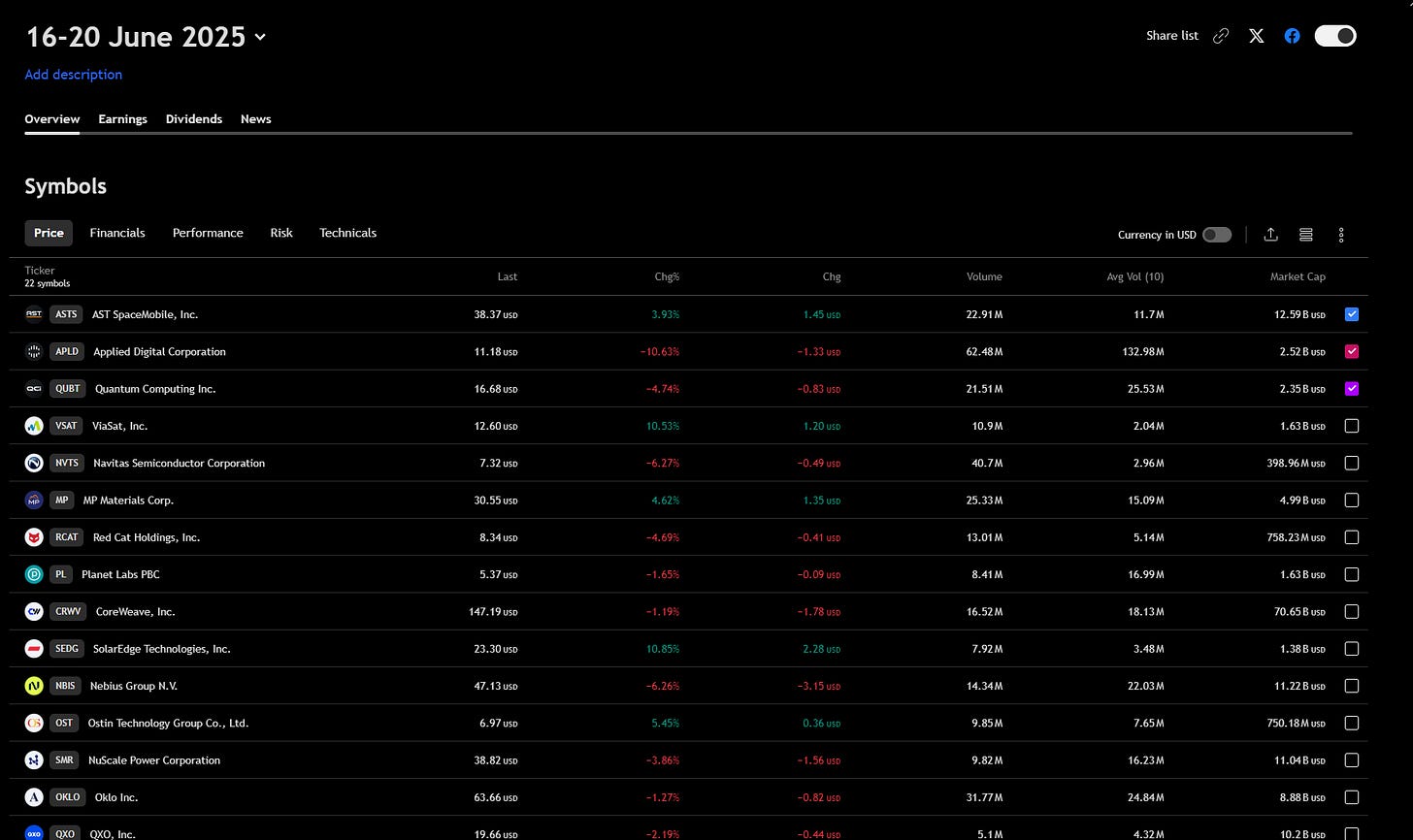

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Get exclusive market insights, access my free watchlist now!

🔗 Check it out here:

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

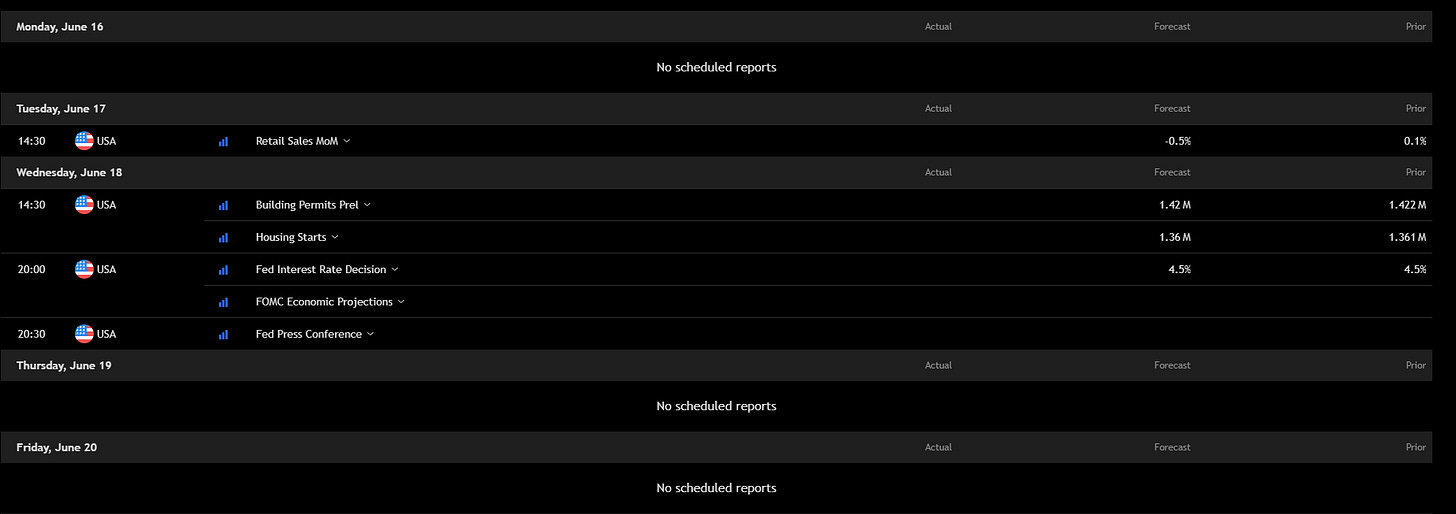

Key economic events to watch next week

Wednesday is the big one.

Housing data drops at 14:30 (Building Permits + Housing Starts).

But all eyes are on the Fed at 20:00, rate decision and economic projections.

At 20:30, Powell takes the mic for the press conference.

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

Not a heavy hitter week. Overall a quiet earnings week, expect macro (FOMC) to dominate the headlines instead.

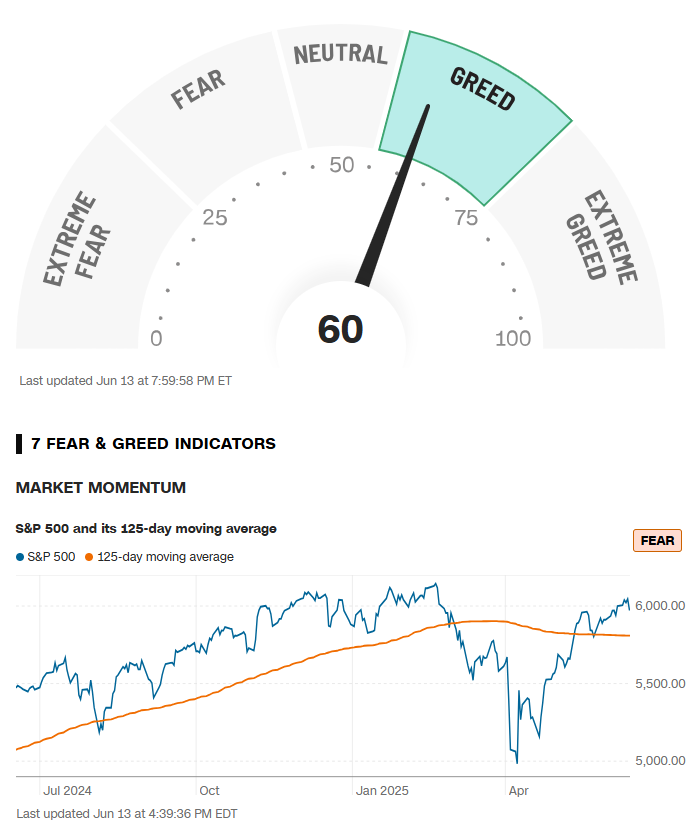

Fear & Greed Index of the week

Financial Meme of the week

Happy Father’s day, traders!

Thank you for being with me in this edition, and if you think this newsletter could be helpful for your friends, share it with them so it can reach as many traders as possible.

“One trade closer to freedom.”

Vladislav

Ah yes that's the lessor spotted Jelly fish tree......only kidding I haven't got a clue, I had to click on it because I thought it was floating!

It will be a volatile week in the markets, volumes will be high and I suspect there will be a rotation into the more defensive stocks, dollar and gold by any means necessary.