How to Never Blow Up Your Trading Account

The Cheat Code to Scaling Faster Without Blowing Up | Edition 48

Dear Traders,

A lot of you have lived through the worst moment in trading.

Blowing up an account.

I did too.

I lost an $18,000 account at the start.

At the time, that was all my savings. Every dollar.

Gone.

I can honestly call this “a trauma.”

Because it does not only hit your wallet.

It hits your identity.

After that, your brain changes.

You start doubting your system. Then you start doubting yourself.

Next time you see a clean setup, you hesitate.

You cut winners early.

You hold losers longer.

You revenge trade.

Not because you are stupid.

Because your brain is trying to protect you from feeling that pain again.

Here is the key part most traders miss.

A blown account is not a strategy problem first.

It is a sizing problem.

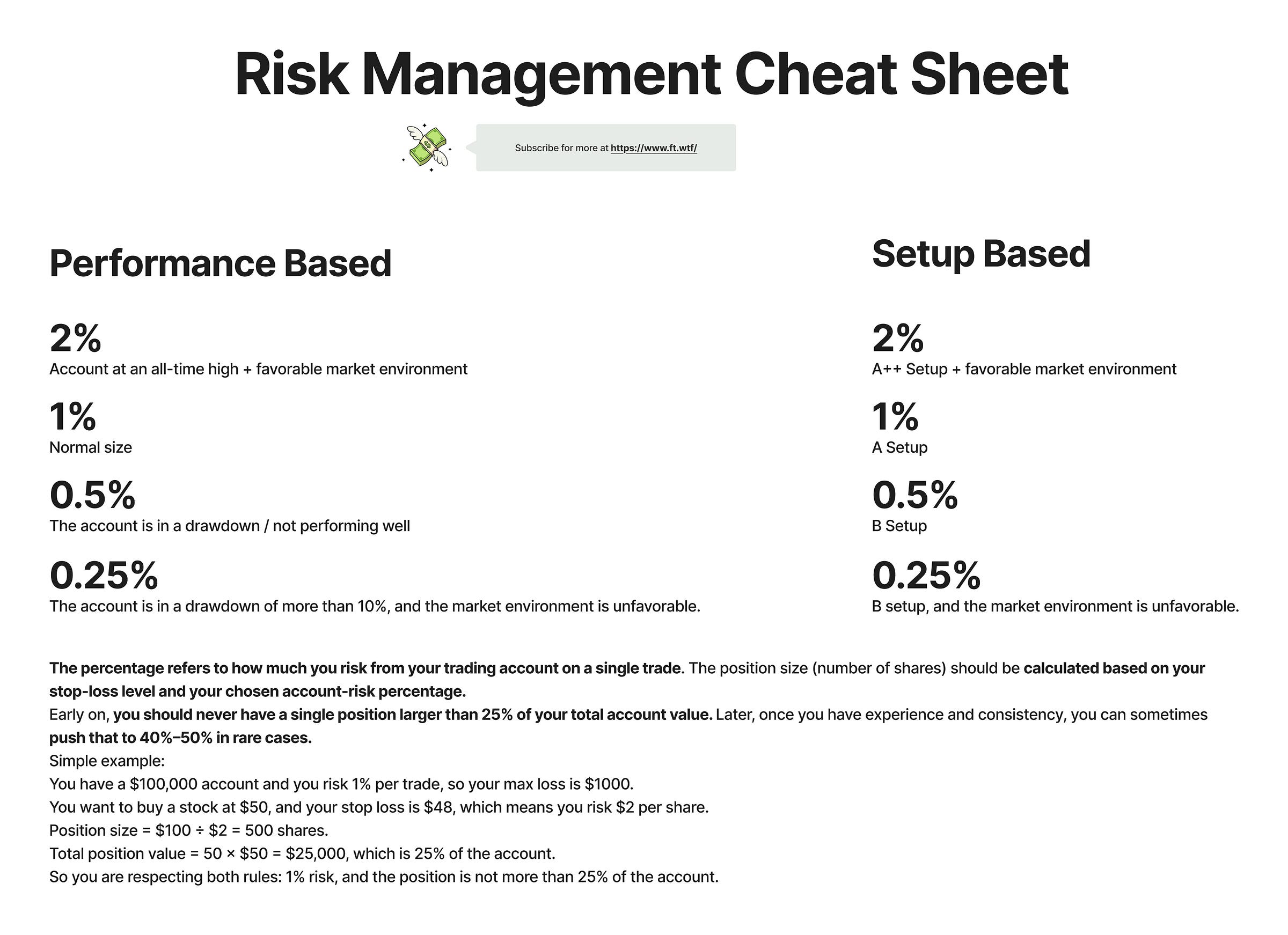

Risk Management Cheat Sheet

Here’s how I do it.

Risk should always be in percentages, not a fixed dollar amount.

It’s way easier to scale an account when you think in % instead of dollars.

I’ve said it a thousand times: don’t think in dollar amounts, think in percentages.

I recently went through a drawdown and worked my way out of it, and this is exactly what I did.

Now, the easiest way to control your position size is based on performance.

But there’s a next level, and I’ll show it to you right after this.

Performance-Based Risk Management

Basically, you risk a percentage of your account based on your current performance.

Here’s my formula:

2% = Account at an all-time high + favorable market environment

1% = Normal size

0.5% = The account is in a drawdown / not performing well

0.25% = The account is in a drawdown of more than 10%, and the market environment is unfavorable.

Now, like I said, there’s a next level, and it’s this:

Setup Based Risk Management

Here’s the formula:

2% = A++ Setup or favorable market environment

1% = A Setup

0.5% = B Setup

0.25% = B setup, and/or the market environment is unfavorable.

The reason this is the next level is because you obviously need stats and experience to know what counts as an A++, an A, or a B setup, and you need to know the expected value for each one.

That’s why I always recommend you keep a trading journal. I use Tradezella Tradezella (I included a referral link for a discount).

In one year this will become your most valuable data. trust me.

How to identify the exact position size you should be using

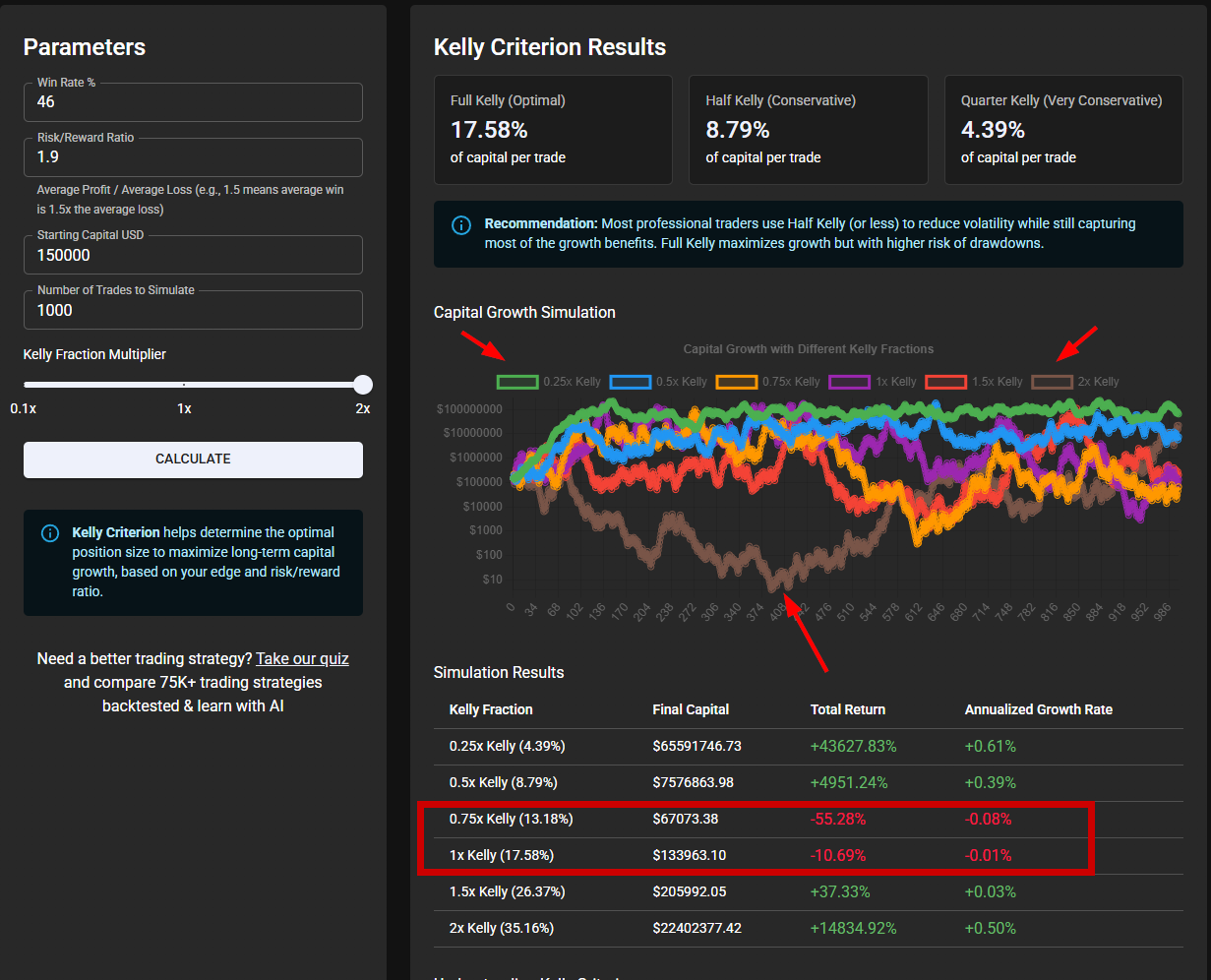

It’s very simple: you find the optimal position size using the Kelly Criterion.

Again, you need inputs like your win rate (%) and your risk-to-reward ratio.

How do you know those?

By keeping a trading journal. See how important it is.

You can calculate the Kelly Criterion using ChatGPT (or any AI), Python, or this website: https://tradesearcher.ai/tools/kelly-criterion-simulator

Let’s run a simulation for my account so you can see a real example.

As you can see, out of 1,000 simulated trades, 2 of the kelly’s are unprofitable, and in one of them (the riskiest one), the 2x Kelly, I blow the account completely.

Even though it shows a massive recovery by the end, that’s just not realistic.

Because it doesn’t include mental factors, slippage, and human error.

What you want as a trader is the smoothest equity curve possible, not a boom-and-bust roller coaster full of volatility.

If you play with the tool, you’ll notice that in most simulations, 0.25x Kelly and 0.5x Kelly come out as the best balance: strong returns, and you still sleep at night.

Note: ignore the “annualized growth rate” column. It looks miscalculated. I think the author meant “growth per trade.”

Now let’s move to the next step.

How to Never Blow Up a Trading Account

Now let’s combine all of this with the ultimate tool, and I’ll show you how to never blow up an account.

Risk of ruin

It is math.

And the name of that math is Risk of Ruin.

My “aha” moment was simple.

I stopped asking: “How do I make more?”

I started asking: “How do I make it impossible to lose?”

Because if you survive long enough, you can not lose the game.

You can have a bad month and still be here next year.

You can be wrong and still stay calm.

You can learn without paying the stupid tax over and over.

So let’s make this practical.

Risk of ruin is what happens when your bet size is big enough that a normal losing streak can end your career.

Not a rare event.

A normal event.

Because losing streaks are not a bug in trading.

They are part of trading.

Even a solid system will have streaks.

The question is not “Will I have losses?”

The question is “Can losses kill me?”

Here is the math that changed everything for me.

If you risk 5% of your account per trade, it takes about 14 losses in a row to cut your account in half.

At 2% risk, it takes about 35 losses.

At 1% risk, it takes about 69 losses.

Read that again.

The market can hurt you.

But it cannot erase you unless you give it the knife.

I stopped trying to be right, and started trying to stay alive.

That is the whole game.

So how do you make “blowing up” almost impossible?

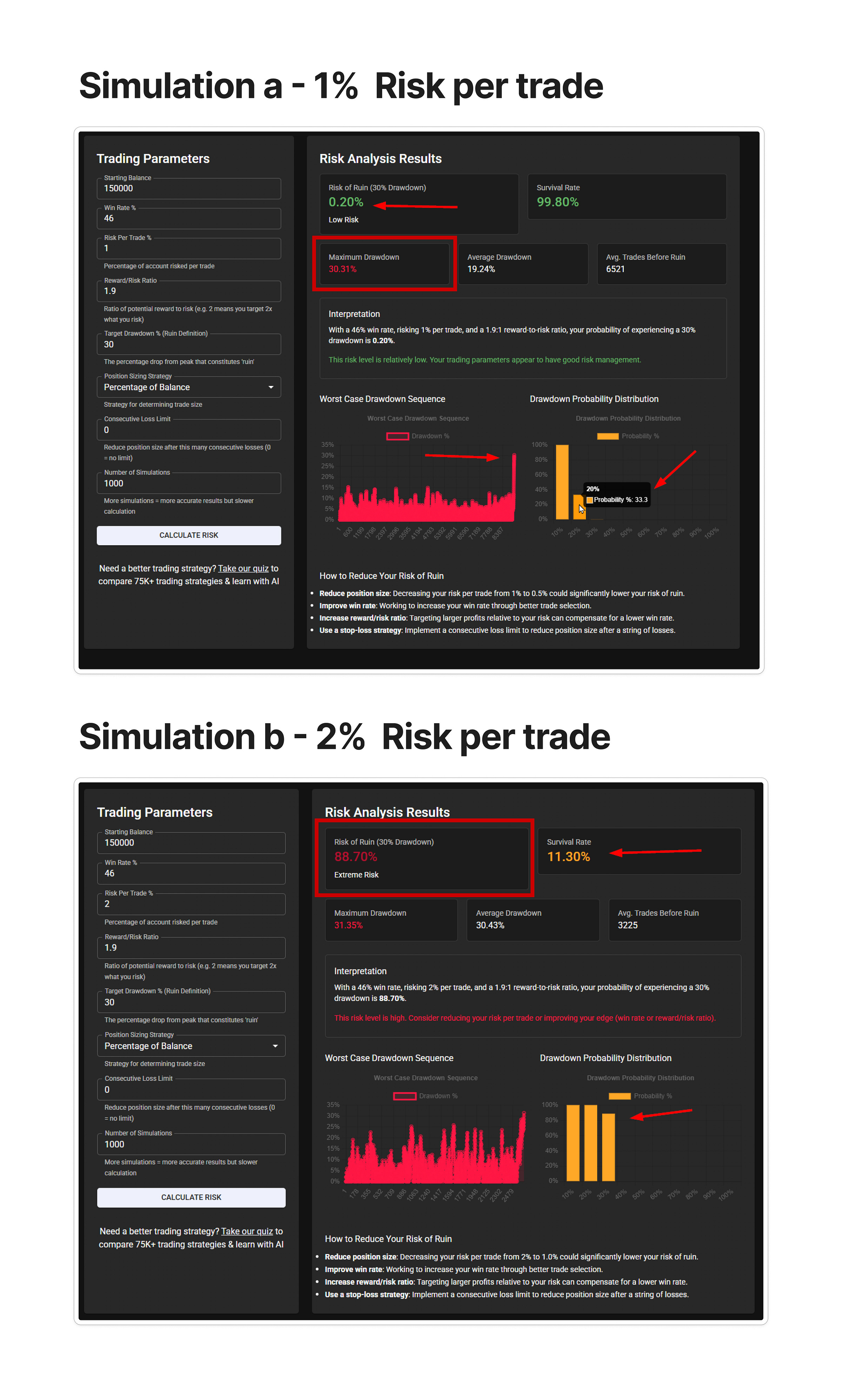

Let’s use again the same website for Risk of Ruin Calculator.

And now let’s use my trading stats. (as an example)

I’m going to set the goal of never having a drawdown larger than 30%, and let’s compare two scenarios: one where I risk 2% per trade, and one where I risk 1% of capital per trade.

As you can see, in Scenario 1 where you risk 1%, you have a 33% probability of exceeding a 20% drawdown across 1,000 simulations.

Think about that: even risking just 1% per trade, at some point you’re likely to experience a 20% drop in equity.

But the probability of a 30% drawdown is extremely low, only 0.20%.

I consider that safe.

Now look at Scenario 2.

If you risk 2% per trade, you have an 88% chance of experiencing a drawdown greater than 30%.

And trust me, when you see your account down 40%–50%, it hits you psychologically so hard that you start doing dumb things.

You make the biggest mistake: you increase position size.

And guess what that does?

It increases your risk of ruin even more, which means the odds of blowing up the account go way up.

SAVE YOUR TRADING ACCOUNT!

Read this again, slowly. Don’t skim it.

Then run your own simulations with these tools. Test 1% vs 2%, test 0.25x–0.5x Kelly, and focus on drawdown, not just return.

Pick rules you can actually follow, and trade them for 30 days.

If you want more content like this, high probability trades and support to implement this properly, join the Freedom Trades community.

Trade Setups of The Week

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my entire watchlist for free here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

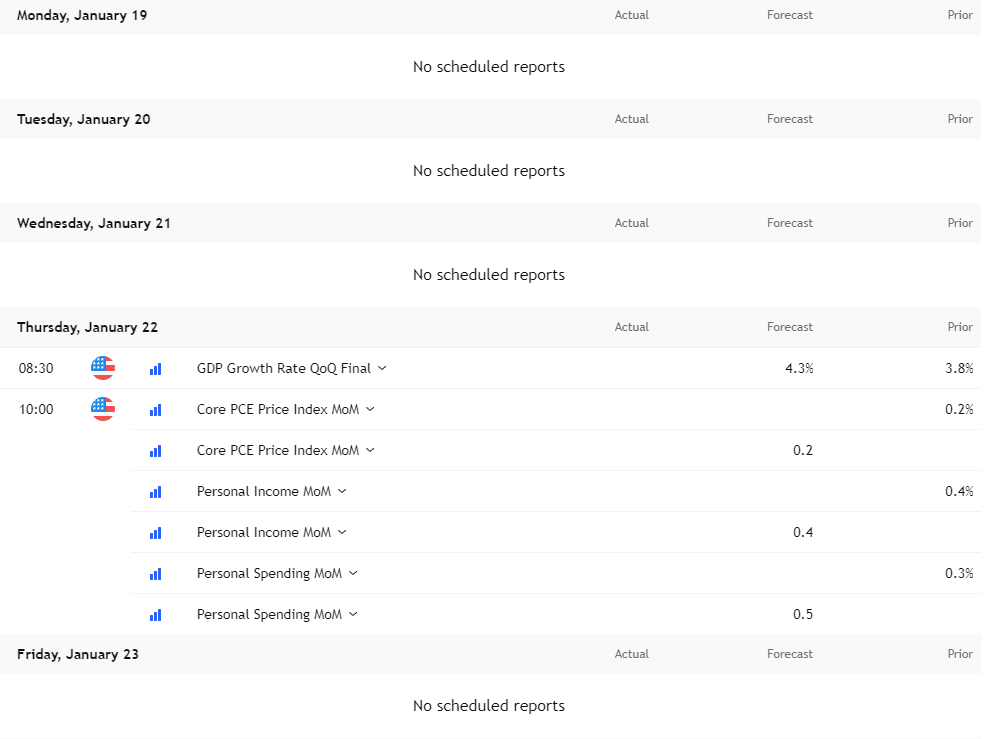

Economic events to watch next week

Pretty quiet week until Thursday, then you get a full macro dump with GDP and Core PCE, which can move the market fast.

Earnings to Watch Next Week

Big names this week: NFLX, INTC, PG, JNJ, MMM. Expect volatility around those reports, so don’t get caught holding size into earnings unless that’s your plan.

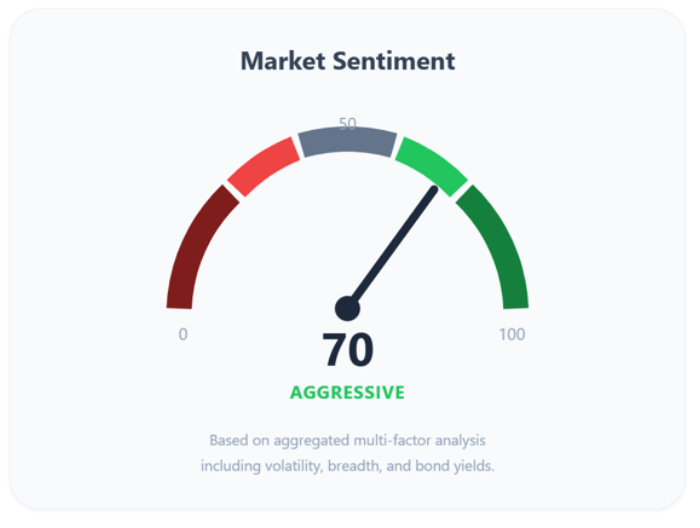

Fear & Greed Index of the week

If you want the full picture with all the signals and context that sits behind this number, consider upgrading so you can see the complete breakdown.

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav

Can’t begin to tell you how eye opening & valuable your portfolio risk management strategies have been to me! Truly a game changer!

The part that really stands out is the link between drawdowns and identity.

Once an account is damaged, traders don’t just manage risk differently — they perceive risk differently. That’s often why sizing errors repeat even after the math is understood.

Framing risk in terms of survival and recoverability, not returns, is what most traders only learn the hard way.

How do you personally distinguish between reducing size to protect capital and reducing size because confidence hasn’t fully recovered yet?