How to Pick the Right Stocks to Trade (and Actually Make Money)

In less than 1 minute | Edition 18

Most traders get lost in the details. They chase perfect strategies, secret entries, magical signals.

But they ignore something essential: how to pick the right stocks to trade.

This is the number one thing that made me money.

Being in the right stock.

In the beginning, I made the same mistake. I spent hours staring at random charts. I felt busy, but I wasn’t making progress. Until I realized I needed a filter. A screener. And not just any screener, but one that fits my system perfectly.

As a swing trader, a screener isn’t optional, it’s the extension of your eyes. It helps you see what matters, cut through the noise, and save your energy for what’s important: decision-making.

Today, I’m going to show you exactly how I found dozens of swing trade ideas using one simple, free trick that brought me results like these:

or:

All of these swing trade ideas could’ve been found by anyone easily.

Don’t believe me?

Let me prove it.

Let’s break things down so you can understand where we actually need to start.

Most people think price moves because “the market decided.” But the market isn’t some invisible god pushing buttons. The market is a battlefield between institutions, real money, beliefs, fear, and greed.

If you want to truly understand why something moves, you have to look beyond candles and patterns. You have to see what powers them.

And that power is VOLUME.

Think of price like a boat on water. Volume is the wind in the sails. Without it, the boat (price) barely moves. With strong volume, it picks up speed and the direction becomes obvious.

In the markets, price only moves up or down when enough participants (volume) put real money behind that move. Volume confirms intent. Without it, price action is just noise.

Now, if you look again at the first chart I posted in this newsletter, you’ll see my exact entry point came right at that big volume spike.

And no, it wasn’t on their earnings day. It happened four days after.

How to actually find these Profitable Swing Trades

It’s impossible to check thousands of stocks every day to see which one had a volume spike.

That’s why you need a screener.

And the best part?

You don’t even need to build one from scratch.

If you’re using TradingView, it’s built right into the app.

I recorded my screen so you can see exactly how to access and use it.

Simple, right?

Now let me explain what this list actually is. Basically, you're seeing the hottest stocks of that day, the ones with the highest trading activity.

These stocks usually have either an earnings report or a catalyst, a piece of news that’s pushing them. v

Your job now? Figure out why these stocks are getting that volume, and start filtering through them.

I have trading ideas, but which stock should I actually buy?

Having this list isn’t enough. You can’t just start buying blindly.

The secret is applying filters. (based on your sistem)

For example, if you watch the video again, you’ll see I looked at the top 3 stocks of the day: BBAI 0.00%↑ , NVDA 0.00%↑ si APVO 0.00%↑.

Can you tell which of the three stocks you should’ve avoided?

If you said APVO, you were right. Why? Because it’s a penny stock that’s done multiple reverse splits just to milk investors, and it’s lost 99% of its value. At that point, that volume spike was nothing but a classic pump and dump.

Next, filter out the stocks that had earnings on that exact day. (Sometimes, an earnings beat or miss can be a strong catalyst for a multi-day move, so don’t ignore them entirely, but be selective.)

That alone will leave you with around 10–15 stocks to choose from.

Now it’s time to filter even further, and this is where your system comes into play. A system you can trust because you've backtested it or forward-tested it over months or years.

That’s why I said: your screener must match your system, not the other way around.

Now, let’s go back to that first screenshot as an example.

It wasn’t just the volume that made me buy, it was also the fact that between May 13 and September 16, the price held that new high beautifully and formed a clear accumulation zone.

Seeing that, I knew the stock was setting up for a new breakout.

All I had to do was be patient.

It doesn’t matter how good your swing trade idea generator is.

Yep, that’s the truth. The key is consistency. It doesn’t matter how good your screener is if you don’t open it every single day.

That doesn’t mean you have to take trades daily. But by showing up daily, you’ll start spotting patterns as they form.

You’ll build a mental filter , and it’ll take you less and less time to spot a real opportunity.

You’ll also see trades you missed. You’ll learn what worked and what didn’t.

Understand this: in trading, there’s no such thing as that one trade that changed your life. (Unless it wiped out your entire account, in that case, sure.)

Build your swing trade idea generator based on your system

Right now, I have 4 different screeners, each tailored to the setups and plays I run.

Since I’ve hit the maximum length for this newsletter (yep, that’s a thing, and honestly, I don’t even know if anyone actually reads all the way to the end… if you do, I’d love to chat with you haha), I can’t go into more detail here.

But I want you to tell me, if you’re struggling in any way to build a swing trade idea screener, just reach out.

Freedom Trade of the week

Ticker is BBAI.

Current price: $3.96

Volume is picking up significantly, and price is holding key levels, strong signs of accumulation.

If price breaks and holds above the $4.10–$4.20 zone on volume, I'll enter with first target at ~$5.30 (34%+), second target ~$9.5

If it rejects and retests support near $3.50. I may build a position slowly with wider stop ($3.20) and adjusted size.

Invalid if it closes below $3.45 with volume, trade idea canceled. If this happens then I can wait to retest the support and see if I can retry the same idea at 2.50 $

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Get exclusive market insights, access my free watchlist now!

🔗 Check it out here:

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

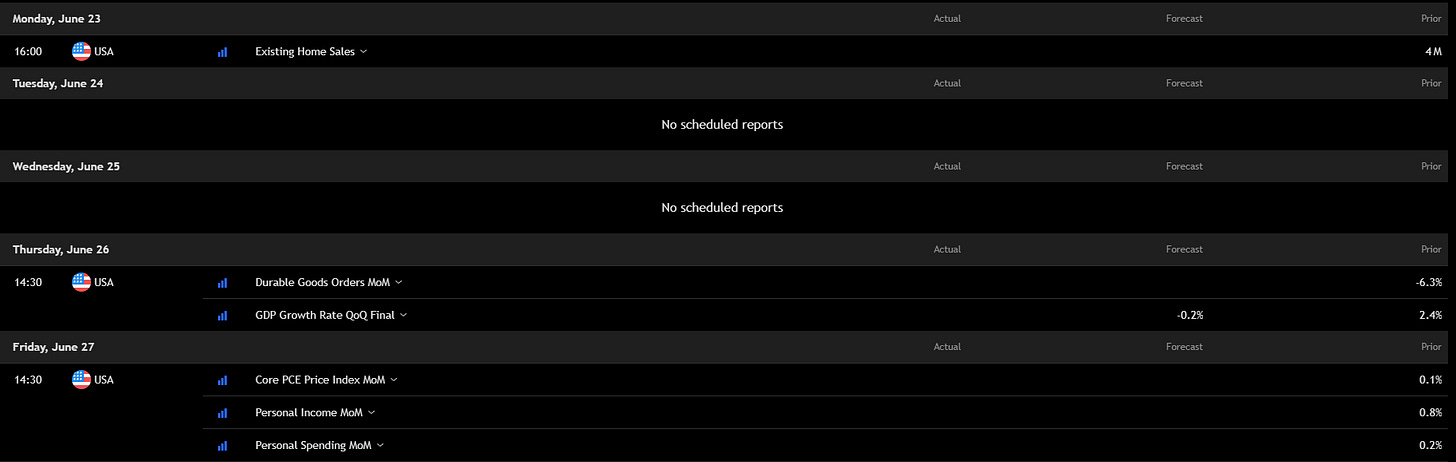

Key economic events to watch next week

Next week brings key macro data that could shake the market.

Durable Goods and Final GDP on Thursday, Core PCE on Friday, Fed's favorite inflation metric.

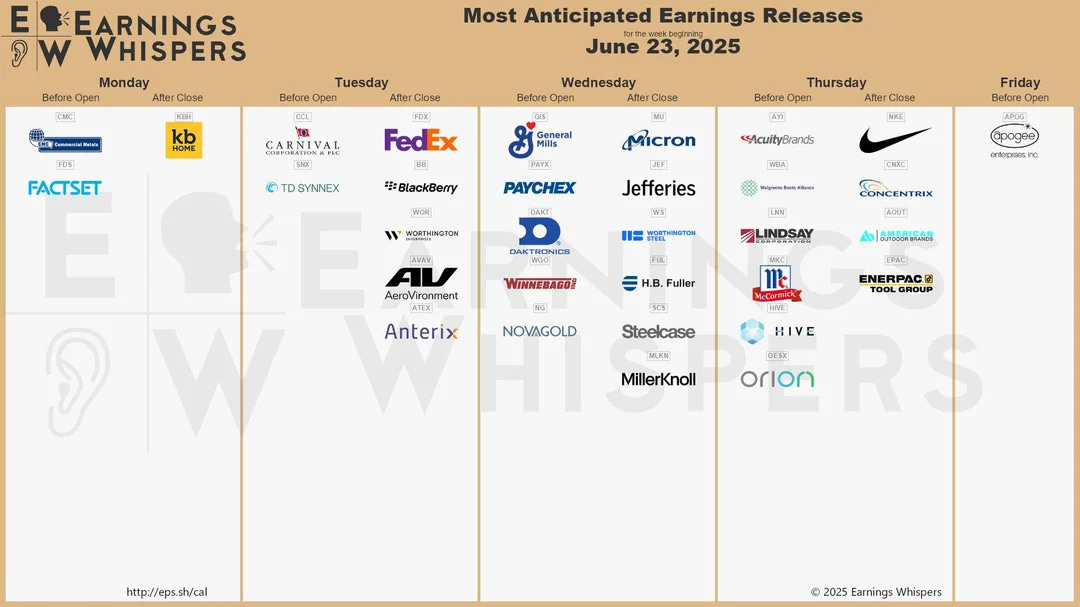

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

Tuesday: FedEx – Global economy thermometer. Watch guidance.

Thursday: Nike – Consumer strength test. Big retail mover.

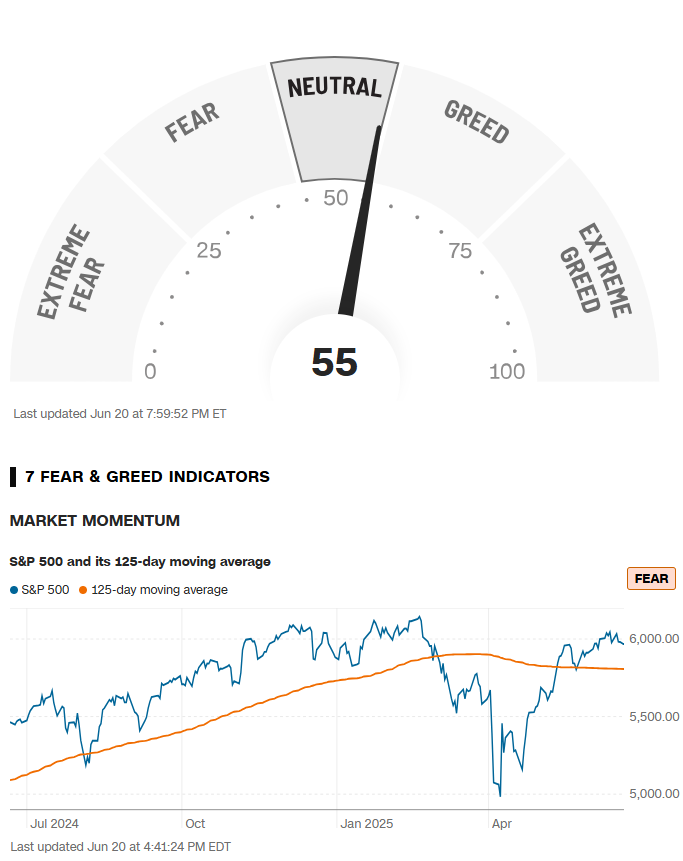

Fear & Greed Index of the week

Financial Meme of the week

Thank you for being with me in this edition, and if you think this newsletter could be helpful for your friends, share it with them so it can reach as many traders as possible.

“One trade closer to freedom.”

Vladislav