How to Recover From a Loss (without losing your mind)

My 4-Pillar Risk System Explained | Edition 38

Hey traders,

I think this is the perfect moment to talk about how to recover from a losing streak (drawdown) and reach new heights in your account.

As you know, this week the market wiped out hundreds of millions, and the emotional damage probably doubled that number.

It affected us too, and right now we’re in a drawdown of almost 10% from the all-time high.

This is the point where I start taking serious measures to prevent the drawdown from going beyond 20% from the ATH.

It’s a worrying level for me, it can happen, especially in times of massive volatility. It’s not the end of the world, but once you go below 20%, recovery becomes harder and takes much longer.

That’s the biggest challenge when trading high-beta stocks.

For example, a 50% drawdown requires a 100% gain just to break even.

Here’s what I mean:

It’s important to keep this in mind because, you see, percentages , unlike money, don’t lie. They’re a constant that helps you scale your account more easily.

So always think in percentages. Forget about dollars , percentages are what truly matter.

How to get out of a drawdown

As always, I want to simplify things so you can walk away with one clear takeaway. (Still, this field is very complex , that’s why I strongly recommend diving deeper into it; more on that below.)

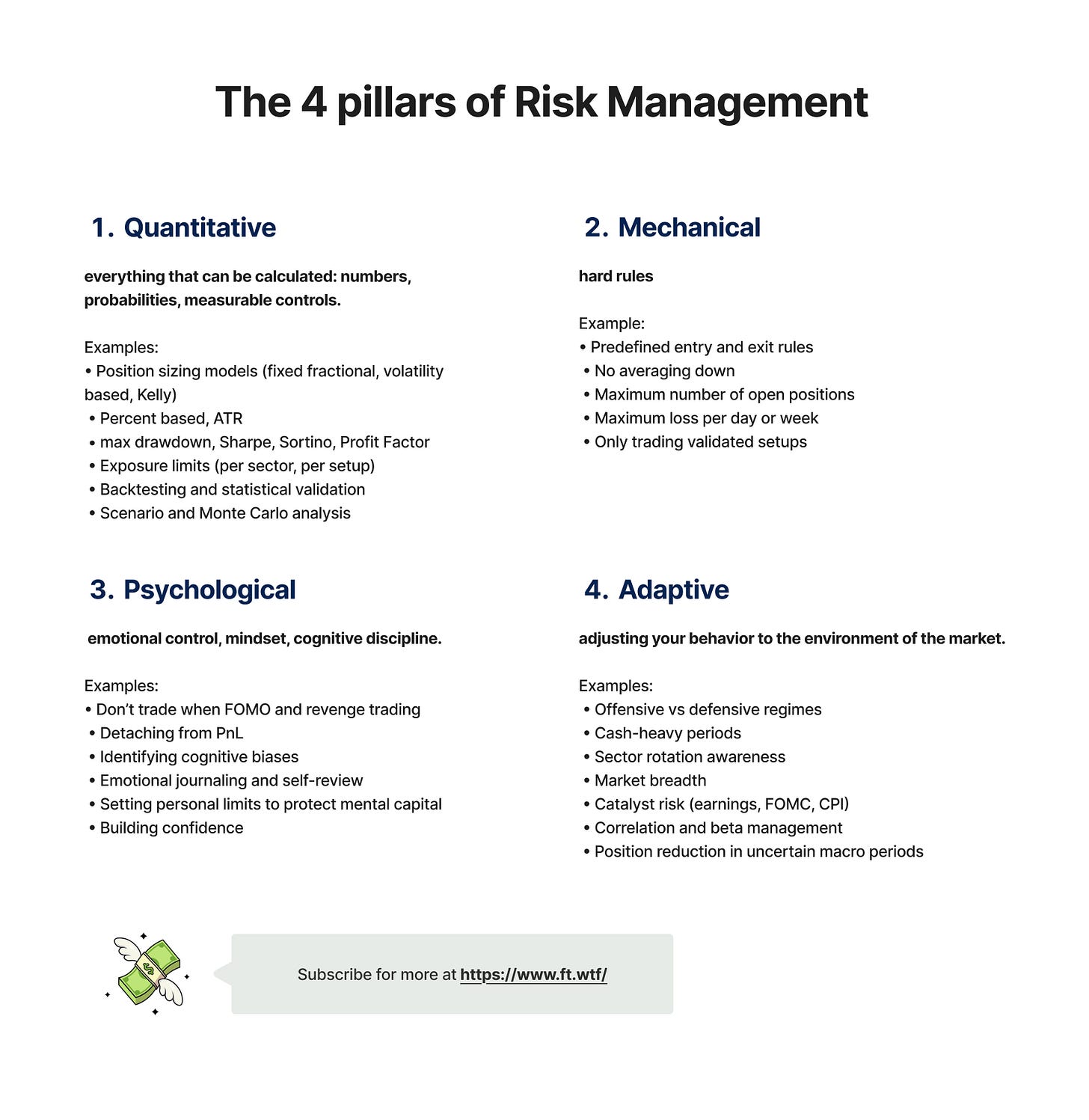

If I were to simplify everything I’ve learned, I’d categorize risk measures into four main pillars:

Quantitative (numbers), Mechanical (strict rules), Psychological, and Adaptive (adjusting trading to the environment of the market).

Like most traders, I started with the mechanical approach , the simplest one.

It’s also the one I recommend to every beginner trader to build consistency.

A classic example of a mechanical risk measure is the godly, most popular one: the STOP LOSS.

You simply set your stop loss at a certain level ,and you respect it.

You respect it! (That’s the most important part, haha.)

But over the years, I kept experimenting.

The truth is, I now use a bit from all four categories.

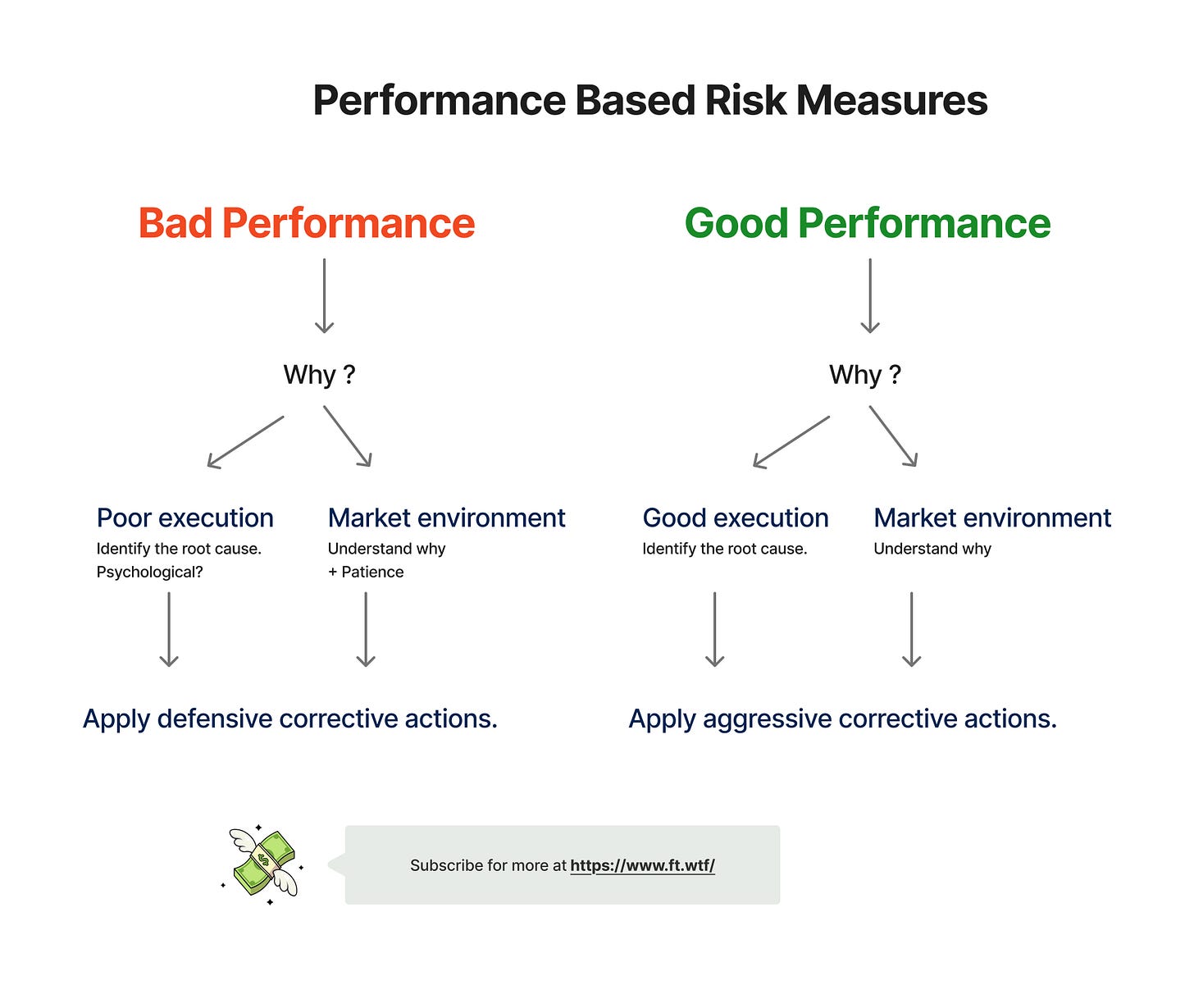

I call it Performance-Based Risk Measures, meaning I adapt my risk rules based on how I’m performing.

My simple process

Identify the reason why you’re in a drawdown.

Is it poor execution, or is it an unfavorable environment for a momentum strategy?

Depending on the cause, I know what I need to work on next. If it’s poor execution, that means it’s something within my control, something I caused , and I need to take full responsibility and ownership for it.

What caused that poor execution? Most of the time, it’s a psychological issue.

If it’s the second reason, then I know it’s not under my control. I can’t control what the market does , all I can control is how much I’m willing to lose.

In that case, I know I need patience on my side.

Taking the necessary measures

Most of the time, this means I will:

Sell all positions that are at a -10% unrealized loss

Cut my position size in half (I don’t risk more than 1% on any new trade)

Tighten my stop losses

The first step is always identification.

And if I’m performing well, then I can start being more aggressive.

Here is a simple scheme I made for you to understand it better:

Most of the time, it’s one or the other, for example, either poor execution or an unfavorable market environment.

But when both combine, those are the moments when you blow up your account or find yourself in a 50% drawdown.

The opposite is also true, when you combine good execution with a favorable market environment, that’s when you start seeing massive returns.

What to do next

As I said, there are hundreds of risk measures a trader can apply, quantitative, mechanical, process-based, psychological, and adaptive.

I recommend studying all of them.

Become obsessed with risk management.

It’s the best thing you can do for your trading career.

Once you master them, you’ll know when and how much to apply each. This field is so vast that some people have dedicated their entire lives to it, among them, Jim Simons, Harry Markowitz, and Ralph Vince.

Even though I’ve been in this game for several years, I still consider myself a beginner in this industry. I keep reading at least one book every four-five months that covers risk management. Recently, I read Thinking in Bets by Annie Duke.

“Thinking in Bets” is essentially a book about risk management because it teaches you how to make decisions under uncertainty , the same way a professional trader does. Annie Duke shows that every choice, in both markets and life, is a bet made with incomplete information, shifting odds, and outcomes you can’t fully control.

The biggest takeaway I got from this book is this: a good decision can still lead to a bad outcome, and a bad decision can lead to a good outcome. So never judge the quality of a decision by its result.

With that being said, I invite you to subscribe to this community and join the Discord server, where hundreds of pro traders are already having daily discussions about topics like this.

It’s simply much easier, and far more enjoyable to achieve financial freedom together.

Trade Setups of The Week

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my entire watchlist for free here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

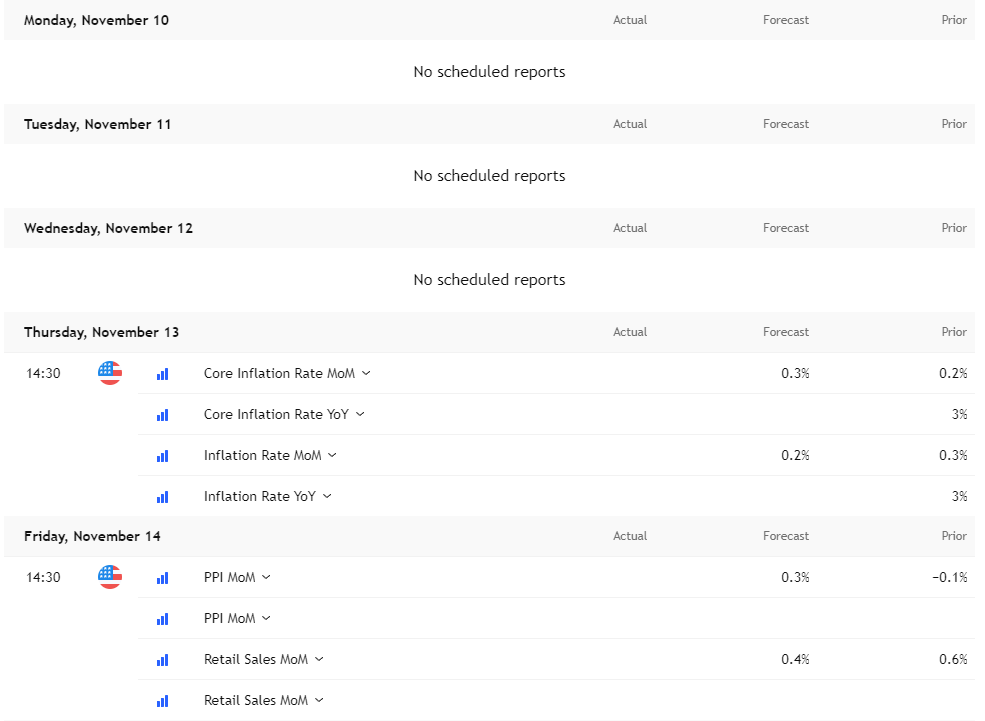

Economic events to watch next week

This week’s calendar is quiet until Thursday, then all eyes are on U.S. inflation data.

Friday’s PPI and Retail Sales will confirm whether inflation is cooling or not.

Earnings to Watch Next Week

There are a few interesting names, including Quantum Space = RGTI, CRWV, BBAI, and ASTS on Monday after market close.

Then there’s BYND… I’m curious to see if retail traders will finally catch a break :)) I feel bad for them; the stock dropped over 70% from its all-time high, and so many are still stuck up there :(

Also watching NBIS on Tuesday, and DIS and NU on Thursday.

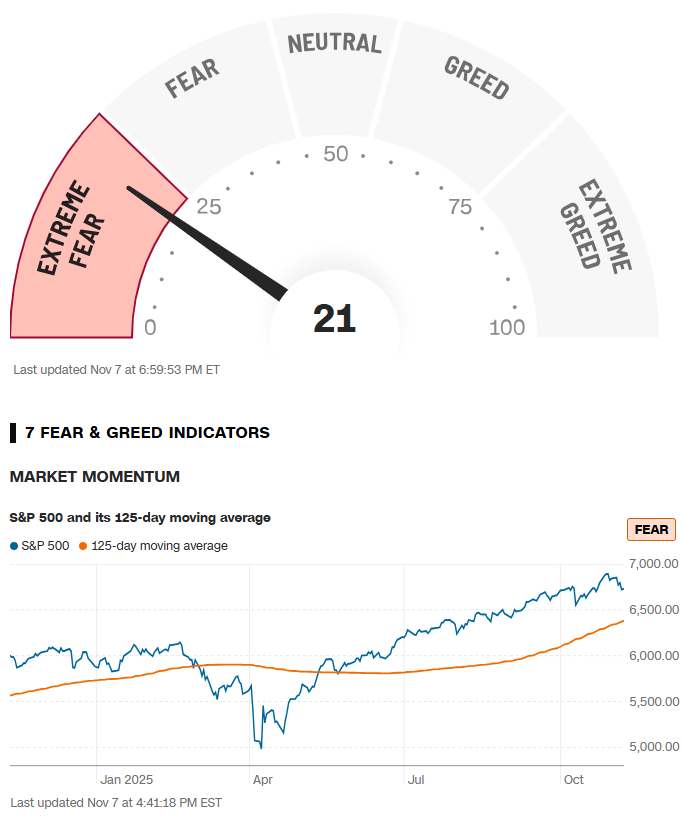

Fear & Greed Index of the week

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav

Great post! Losses teach you many things in this game. Bet small, protect your capital, stay in the game, and learn from your mistakes. That’s what it takes.