How to Size Positions Without Blowing Up Your Trading Account

Position Sizing Framework for Profitable Swing Trading | Edition 42

Dear traders,

If I could erase a single mistake from the minds of all beginner traders, it would be this:

They think market direction matters the most. But in reality, position sizing is what kills them.

You can be right on direction in 70% of your trades…

and still lose money.

You can have only a 40% win rate…

and still become profitable.

The difference? Position sizing.

This concept is so ignored that almost all traders end up repeating the same cycle:

they enter too big,

the market slaps them,

the account inflates-and-deflates like a balloon,

your mental capital gets destroyed,

you blew your trading account.

Today we stop that here.

The Lesson That Changed My Results Forever

When I first started trading high-beta swings, I thought the outcome of a trade was determined by:

how good my analysis is,

how strong the momentum is,

how fast the move is,

how much money I put in so it “feels” meaningful.

The truth? My success rate increased only when I reduced my position size.

It’s counterintuitive and annoying.

You want money, you size big, you lose even bigger.

And then I asked myself the question:

What is that one single thing which, if you understand it, changes everything?

Position sizing dictates your psychology.

If you master it, everything becomes simple:

fewer emotions,

clearer decisions,

controlled losses,

more time to experiment,

consistent account growth.

FALSE BELIEFS in Trading

Traders panic and increase sizing for three reasons:

“If I enter small, it’s not worth it.”

False. Big profits come from repetition and consistency, not from going all-in.

“Position sizing is for beginners.”

No. It’s exactly what separates professionals from people who gamble.

“I will never grow my account like this.”

False. If you can’t grow a $1k account, you will not succeed when you have $100k either.

What I’m offering today is not to trade something else.

It’s not to change the strategy.

It’s to change the way you enter the market.

A position sizing model adapted for high-momentum swing trading, one that reduces drawdown and increases your chances of survival.

MY POSITION SIZING FRAMEWORK for swing trading (Freedom Trades)

1. Use percentage, not emotion

My standard: 0.5%–1% risked per trade.

It doesn’t matter how much you “feel” the position.

It doesn’t matter how sure it seems.

It doesn’t matter how viral the ticker is on Reddit / X.

In the beginning use a fixed percentage between 0.5% and 1% (you decide, but never change it).

Get used to consistency for at least 6 months.

Then you can move to adaptive position sizing depending on setup / situational awareness.

But that’s for the next level. (the kind of thing we talk about in the PRO community)

2. Adapt your sizing to volatility (ADR/ATR)

Stocks with ADR 8–12% are our beast.

But if you enter with the same dollar size as on a stock with ADR 3%, you will blow your account.

My rule:

High ADR, smaller position size

Low ADR, slightly larger position size

But this does not mean you will risk more than 1%.

You still keep the risk limited.

3. Small initial sizing + add only when you have confirmation (pyramid)

In some cases, like high ADR and breakout plays, never enter full size from the start. Never.

Try:

50% entry

25% add on confirmation

25% add on breakout

This way you avoid the classic situation: “it went against me instantly.”

4. Limit your total exposure in the market

For high-beta swing trading:

Max 6–8 active positions at the same time

If you have more positions, all you do is disperse your focus.

You need conviction to grow your account.

5. Adapt your sizing with market conditions

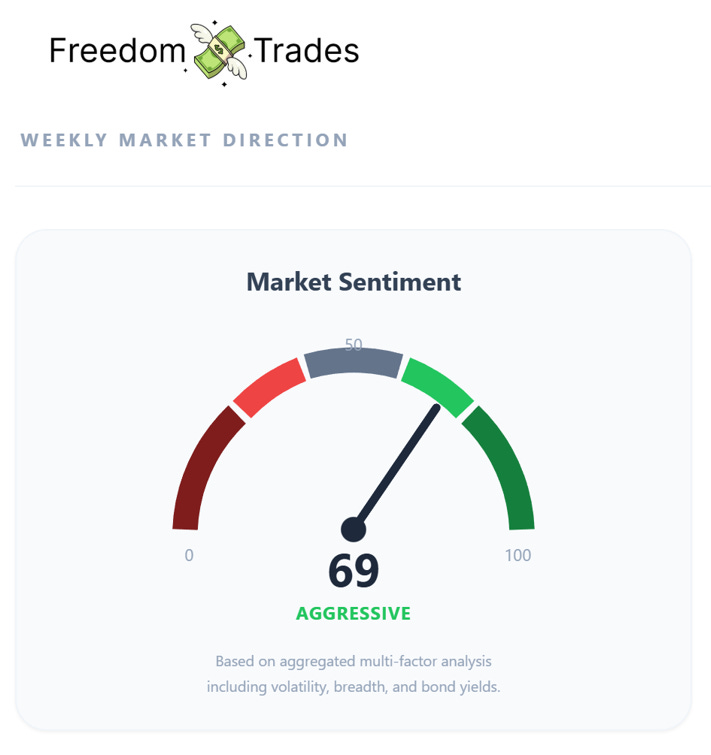

Those in the PRO community use a tool called Weekly Market Direction.

We look at it every Saturday to see what it tells us so we are prepared for the upcoming week.

When WMD (Weekly Market Direction) shows high risk:

reduce everything by 30–50%

take profits faster

avoid adding on choppy breakouts

When the market is hot:

gradually increase up to full sizing

Why Position Sizing works

Because it:

reduces drawdown,

protects your psychology,

allows you to survive the difficult periods,

maximizes your gains in good periods,

eliminates the need to “be right.”

In trading, survival is everything.

When you survive, you give your edge time to work.

And if you want to master position sizing at the level where it becomes second nature, not theory, that’s what we work on every week inside Freedom Trades PRO.

If you’re serious about becoming consistent, step into the room where we actually do the work.

Trade Setups of The Week

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my entire watchlist for free here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

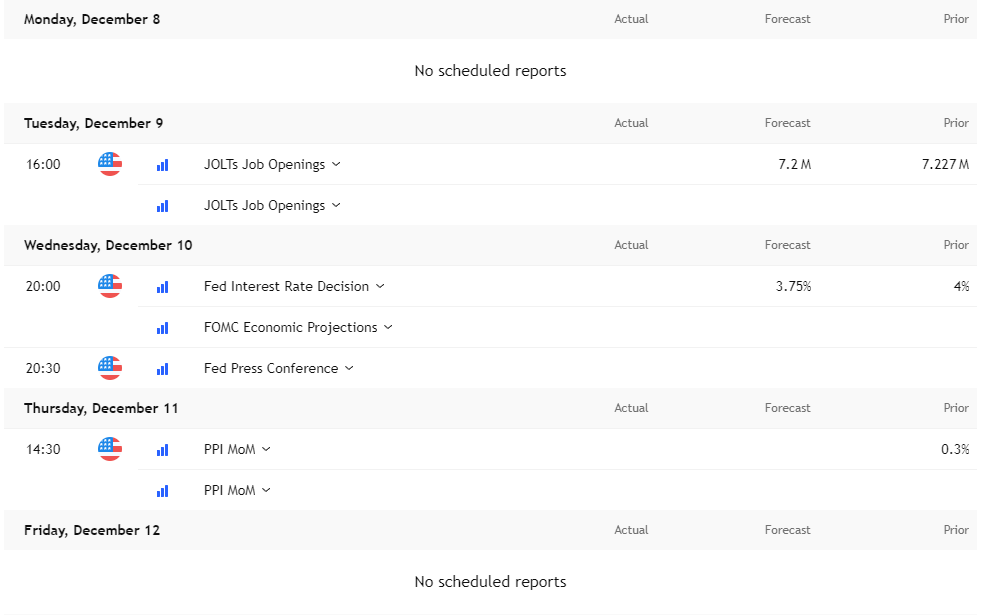

Economic events to watch next week

Stocks finished the week strong, but the Santa Claus rally isn’t guaranteed.

A Fed cut sounds nice, but a too dovish Powell could flip the market fast.

Wednesday is the whole story. Keep your eyes on the projections.

Earnings to Swing Trade Next Week

Chewy, Oracle, Adobe, Broadcom, Lululemon, and Costco will steal the spotlight because they each answer a different market fear: spending, software demand, and consumer strength.

Weekly Market Direction

If you want the full picture with all the signals and context that sits behind this number, consider upgrading so you can see the complete breakdown.

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav

This is one of those pieces every trader thinks they understand… until they blow up an account and realize position sizing was the real problem all along.

You nailed the most overlooked truth: position sizing isn’t about returns — it’s about psychology and survival.

I’ve seen great analysis fail simply because the size was wrong, and mediocre setups succeed because risk was controlled. Once you internalize that outcomes don’t matter nearly as much as process, trading becomes calmer, repeatable, and scalable.

The point about being able to grow a $1k account before ever touching $100k is especially important. If sizing discipline isn’t there early, more capital just amplifies mistakes.

Strong framework, clearly explained, and immediately actionable. This is the kind of post that actually keeps traders in the game long enough for their edge to show up.

Well done.

Why is risk not the difference between entry price and the stop loss? Just bc I put 1% to work doesn’t mean the total is at risk.