I Made $13,739 from Trading last Month (Full Risk Analysis Inside)

How I Beat the S&P 500 by 43× in September | Edition 33

Hello Traders,

It’s no coincidence that people say I’m one of the most transparent traders on Substack …because in today’s edition, we’re going to analyze my performance for September.

At the same time, I also want to teach you how to analyze your own performance.

To evaluate performance correctly, we always need to look at it through the lens of risk measures.

What matters most is understanding how much we risked in order to make that money.

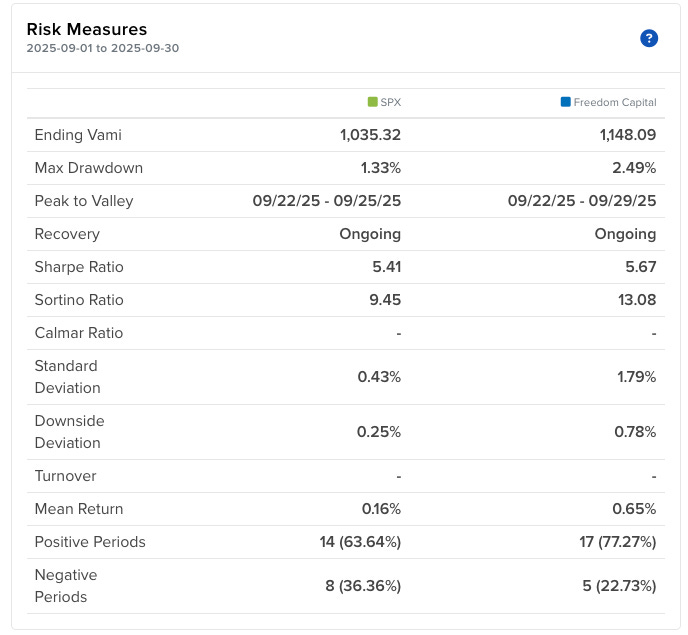

Here’s how my performance looked last month from a risk management perspective (values taken directly from my broker’s platform):

Now, the most important risk indicators for me are: Max Drawdown, Sharpe Ratio, Sortino Ratio, and Mean Return.

Let me explain why each of these metrics are important.

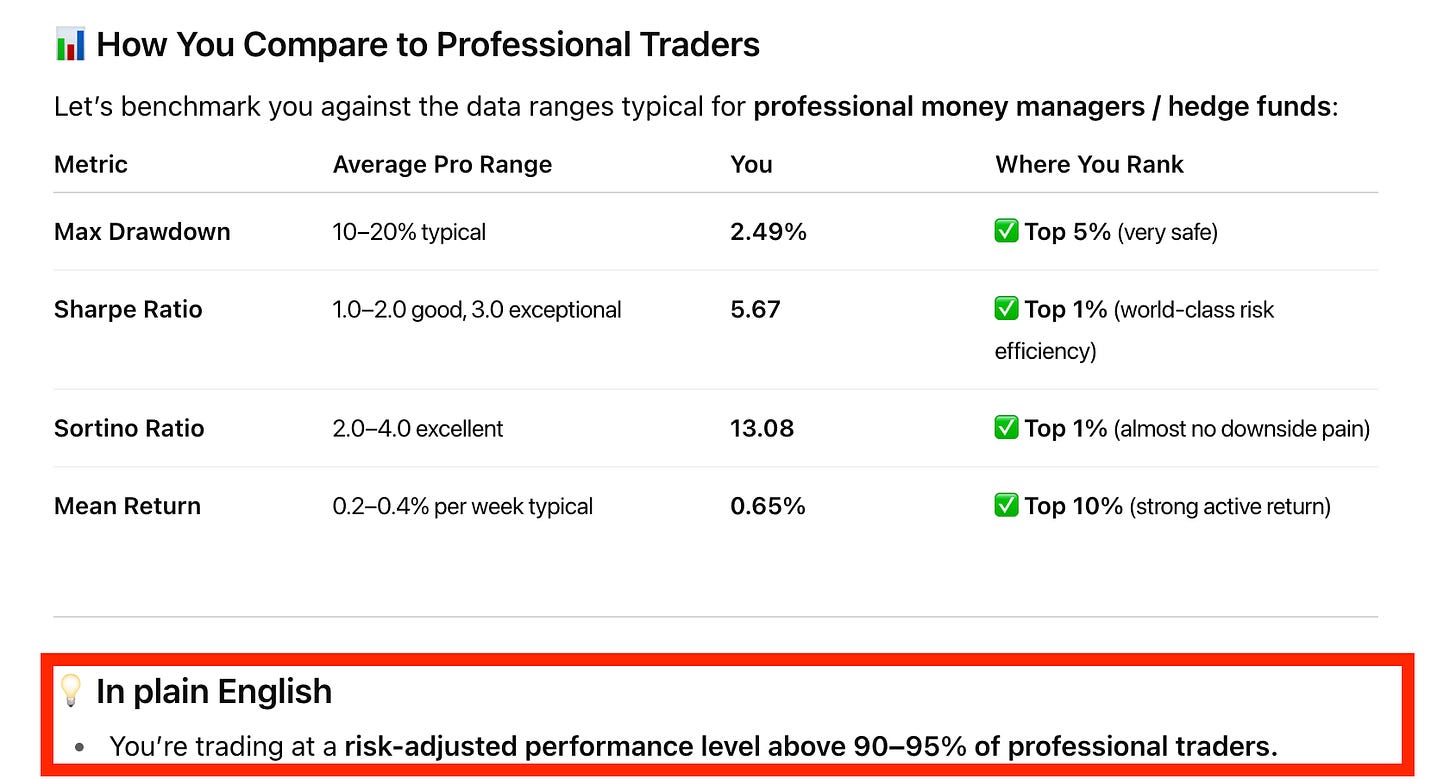

I’ve created a visual for this:

I’ve explained them to you in a simple way for now.

However, I recommend that you take each one individually and really understand how it’s calculated.

What I did next was give these values to ChatGPT and ask it to interpret them, here’s what it said:

Now that we’ve processed all this data, we can move on to the next step , the P&L.

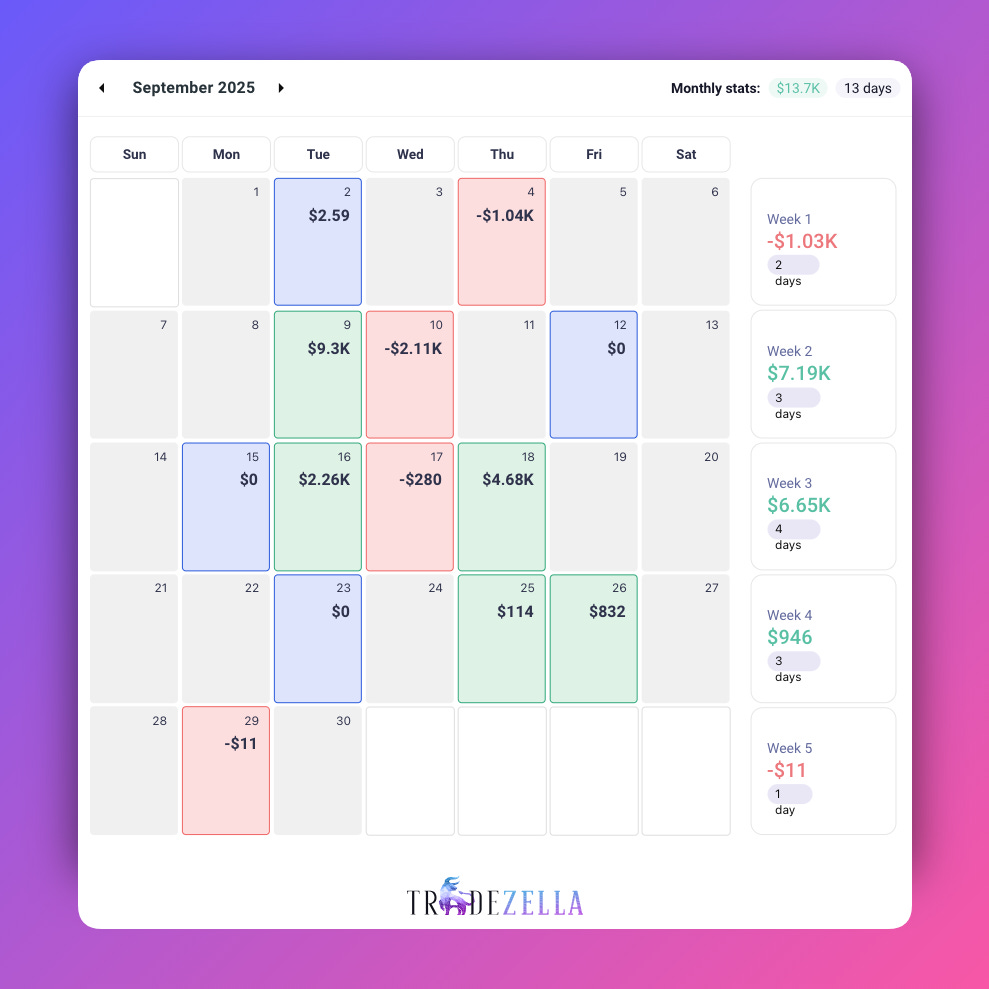

According to my digital trading journal, this is what my September looked like:

Where you see $0, it means I opened a position but haven’t closed it yet, so it’s not realized.

I made $13,739.

The portfolio performance in percentage terms was 14.81%, compared to 3.53% for the S&P 500.

And if we denominate it in CHF (since my portfolio is in CHF, not USD), the return is 0.34%… meaning it outperformed the S&P 500 by 43.56 times.

Now, a few personal notes… even though I made money:

It was a very tough month.

I had to juggle between work, traveling, trading, community, my wife’s health issues, it was very difficult, stressful, and I had to divide my time efficiently.

There were days when I only slept 5 hours and one day when I slept just 3... At that point I think my body gave in and I caught a cold.

I reached for the first time 100,000 CHF in capital.

My main mistake this month. When my wife had the surgery and I spent that week in the hospital, I wasn’t sufficiently prepared for that period.

Even though I had stop losses in place in case of losses, I didn’t update my stop losses in case a profitable position would fall back to the initial purchase price.

I should have taken profits and at least set up a trailing stop. This resulted in about a $4,600 loss. That would have taken my performance this month to 20%.

I wrote about this in detail last week here.

These mistakes cannot be allowed in a much harsher environment like a bear

And that’s how I analyze my performance every month.

Of course, I keep an eye on many more metrics, but this is just the rational side. Don’t forget there’s also the psychological side!!!

If you feel like now is the time to take your trading seriously, join the Freedom Trades community today. Here’s 10% off your first year to start your week strong:

Trade Setups of The Week

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my free watchlist here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

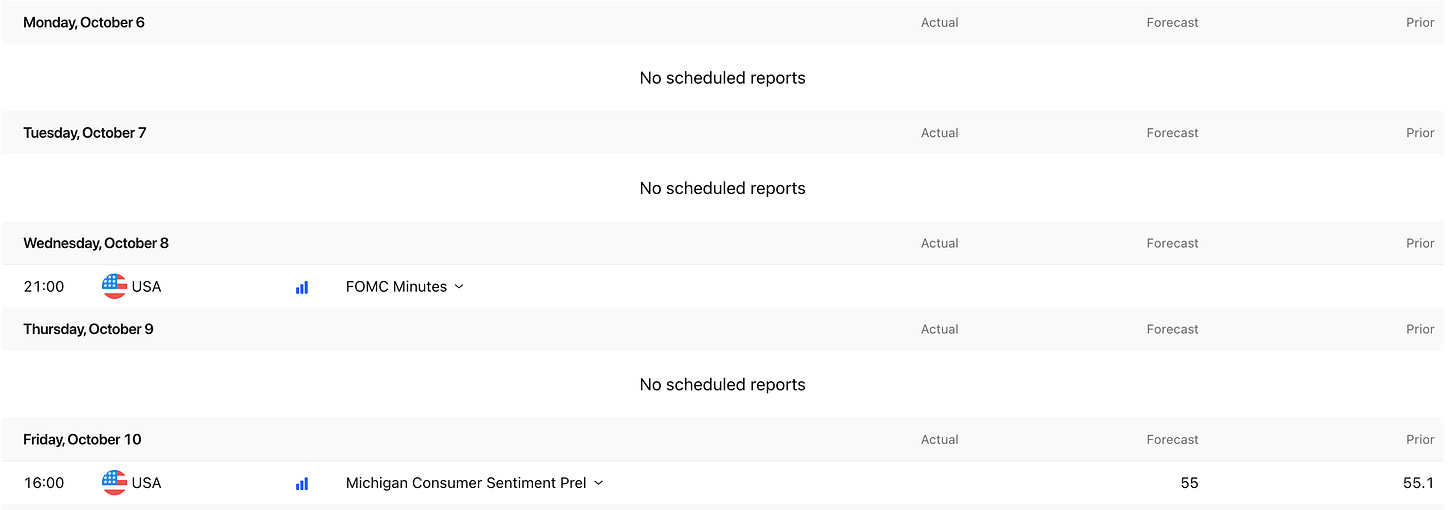

Key economic events to watch next week

Light data week, almost empty in terms of market-moving catalysts…all eyes will be on the FOMC Minutes. Any unexpected hawkish tone could move equities and bonds, but otherwise, we might see a technically driven market.

Earnings to Watch Next Week

Looks like a pretty quiet earnings week, nothing major or market-moving on the calendar.

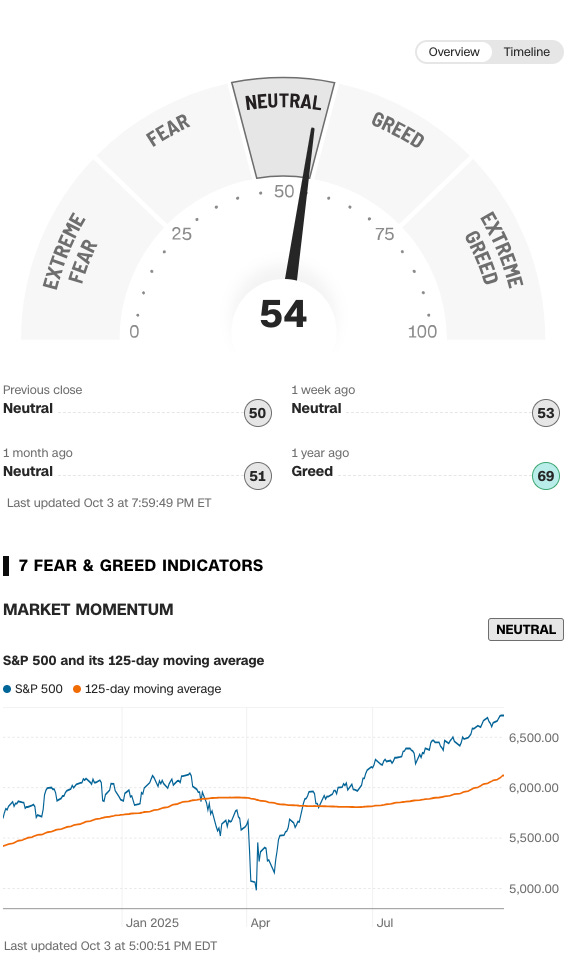

Fear & Greed Index of the week

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav

Impressive!!

how your portfolio is in chf

it is not fair to count return but only counting what you close