I Made 6 Figures Trading with This One Skill

The $8,000 Loss That Saved My Trading Career | Edition 31

Welcome back home, trader!

Take a seat and let me tell you about my greatest ally on the road to Financial Freedom!

It can become yours too, but only if you first understand it and respect it.

When I first started chasing profitability as a trader, I had one dream:

To finally quit my job, control my own time, and support my family.

In short: Financial Freedom.

I had some money, a strategy, and a bit of brainpower (or so I thought, hehe).

So I went to battle.

And I want to show you exactly what happened.

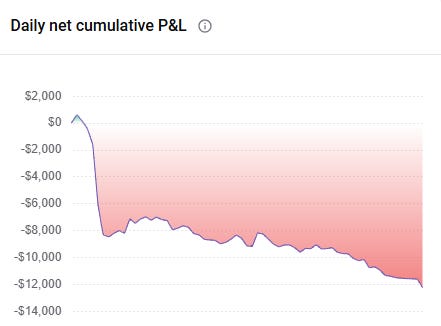

Oof… this is going to hurt, but… here you go.

Here’s a screenshot of my daily net cumulative P&L.

Basically… that was my savings.

All the work from my job…gone down the drain.

I didn’t even get to enjoy it.

But take another look at what happened after that massive -$8,000 swing. Do you notice how I was still losing money, but over a much longer period of time?

What changed?

Well, I took my first step into risk management…

And that was,

Position sizing.

That’s how I discovered my most important ally:

Risk Management

Through a defeat, it lifted me from the ground and said:

“I will protect you! Use me as your shield!”

And that’s exactly what I did.

I started reading about risk management. I applied multiple safety measures like stop loss, position sizing, risk-to-reward, cost averaging.

Guess what happened a few months later?

I became a break-even trader!!!

Many traders get stuck here, thinking they’re failures when they reach the break-even stage.

But what they don’t realize is that this is massive progress, from being a losing trader to becoming a break-even one.

You know what break-even really means? It means you’ve bought yourself time.

You’re no longer burning capital, you’re giving yourself the chance to learn, to test, and to refine your system without the market kicking you out of the game.

Break-even isn’t failure…it’s the first proof that you’re starting to think like a professional.

This is where the real path to profitability begins.

And you can’t get here without your best friend: Risk Management!!

What no one tells you is that every trader goes through multiple phases.

The phases a trader goes through

Here’s a chart I created to explain better what I mean:

I think you’ve already figured out where the majority give up!

You know the secret to getting out of this stage?

TIME!! TIME! TIMEEEE!

Like I said above, you need to buy yourself time!

And to buy time, you need to “live to trade another day.”

Risk management, man! How many times do I have to say it!

Because that’s exactly what it is:

My Risk Management Philosophy

My philosophy of risk management is that any strategy can be profitable!

Okay, not all strategies have the same alpha, and some edges decay. But I bet you, if you apply risk management, you’ll at least become a break-even trader!

And if you stay long enough in this game, what will happen is you’ll eventually discover the secret.

And the secret is…

THE MOST PROFITABLE STRATEGY WILL BE THE ONE ADAPTED TO YOUR STYLE!

Sorry for the caps, but I’d seriously want you to frame that sentence and hang it on your wall, haha!

I mean it.

I’ve shared my full strategy right here on Substack, check it out:

Copy it! You’ll make money.

But the real money comes when the strategy fits you like a glove.

When you’ve adapted it to your style, to your character.

And that’s where the real value of this community lies…

To form a complete trader. A worthy opponent for me… not a copy of me.

When you truly get this…you’ll join the community, and you’ll start writing to me more often.

21 smart traders already understood it. When will you?

Join Freedom Trades!

Trade Setup of The Week

I’m not offering any setups this week, as everything we’re looking at is either at an All-Time High or in breakout/price discovery.

As a result, I’d only be giving you a very risky setup, and I don’t want to take responsibility for that.

Here we focus on quality, not quantity.

For those in the PRO community, check out the latest post here and the private chat:

High Probability Trades for Week 38, 2025

This post is available exclusively to PRO members and contains my interpretation of the watchlist along with the trading opportunities I see for the next week.

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my free watchlist here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

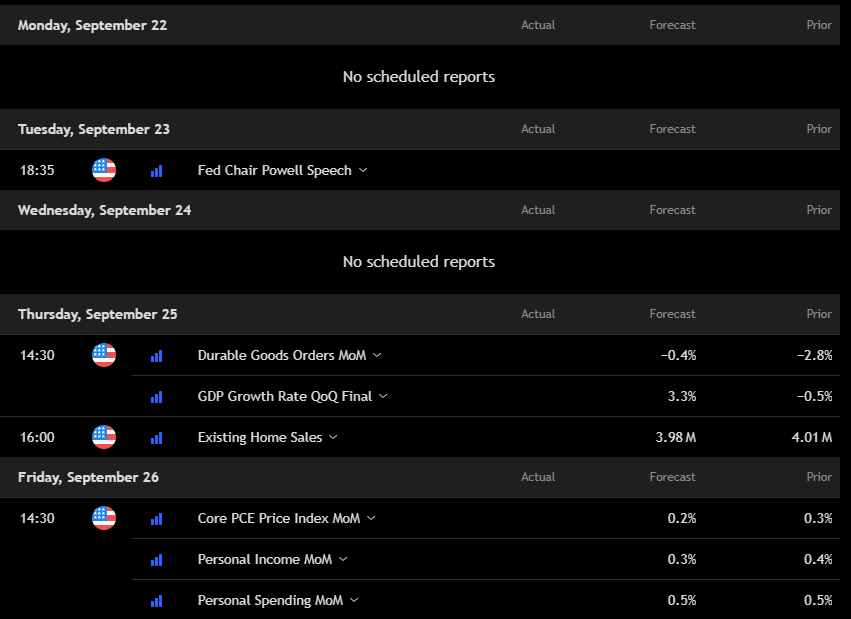

Key economic events to watch next week

A pretty busy week, Powell’s speech on Tuesday can shake markets, and Thursday/Friday are packed with heavy data (GDP, durable goods, PCE).

Earnings to Watch Next Week

For this week, the heavy hitters to watch are Micron (Tuesday), Costco (Thursday after close), and Accenture (Thursday before open).

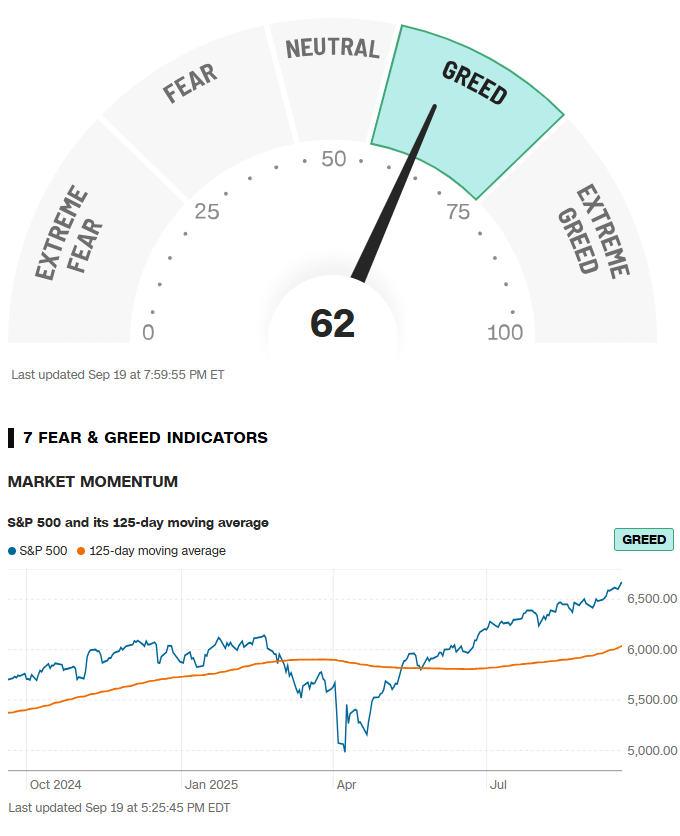

Fear & Greed Index of the week

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav

Sure can relate to this. It’s one of the things I’m going to be writing about in my own reflections on where I am on that chart!

Well, as of today I’m still bobbling along that break even line. Big red day today but closed nothing, so we’ll see what tomorrow brings. I published my first trading journal post this morning. Sets the scene for the road ahead.