I Told You META Was a Monster. Next High-Conviction Trades

High Probability Trades for 8-12 December 2025 | Edition 20

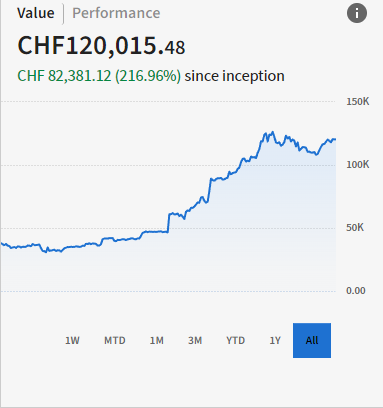

This is the current value of my swing trading account.

Attention: since I live in Switzerland, the currency is set in CHF (which means if you convert it to USD, the amount is higher).

To better understand the strategy we are following and not to buy blindly without any context, please read and analyze my strategy carefully:

All the positions I take during the week can be found on the Discord server or in the Freedom Trades private chat.

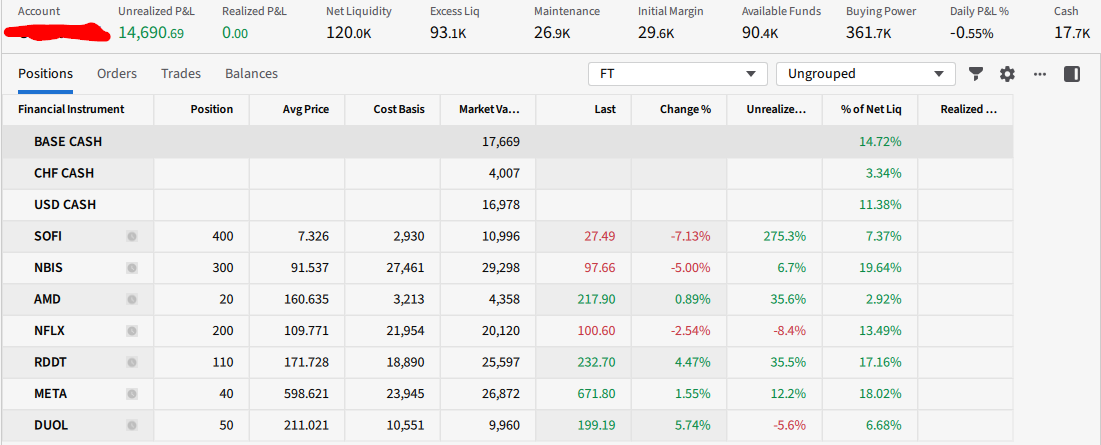

Right now, these are my positions:

Hello traders,

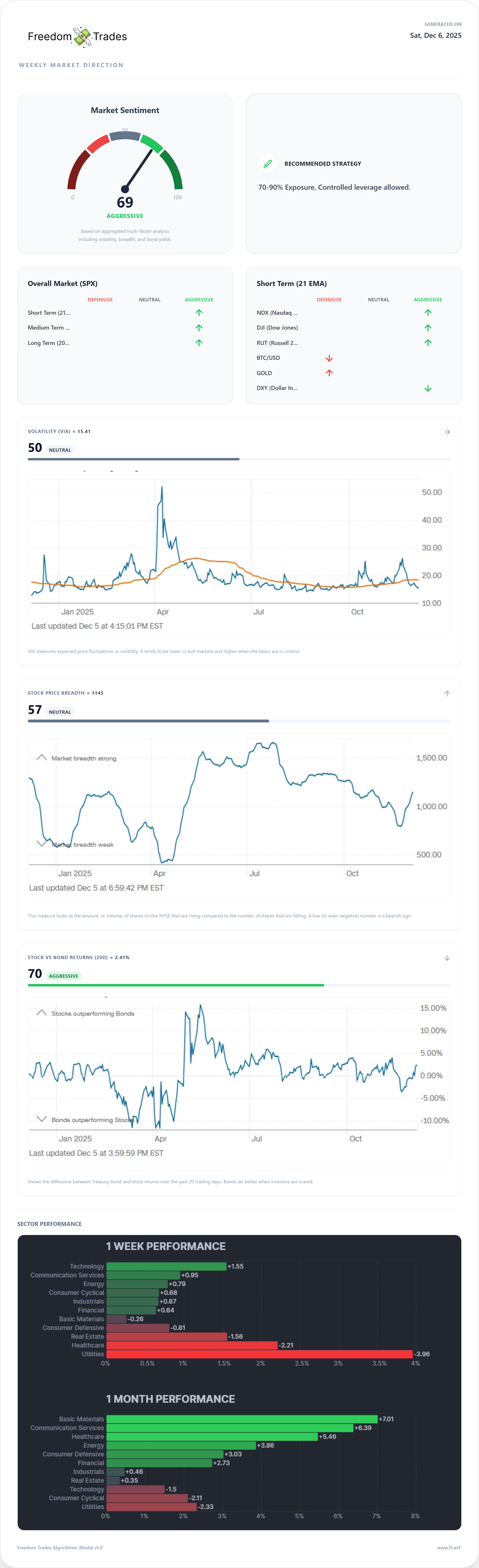

It’s now been three weeks since I introduced the Weekly Market Direction, and in both of those weeks the algorithm helped us read the market direction and adjust our positioning accordingly.

So as always, we start with the Weekly Market Direction to understand what kind of environment we’re in. This is our in-house model, built on 13 indicators.

If we analyze the model, we can see that market sentiment came in at 69, firmly risk-on, and honestly, it shows. All SPX timeframes are green, which means the trend is aligned and buyers are still in control. This is the kind of environment where 70–90% exposure makes sense, as long as you stay disciplined with risk.

Volatility is low, breadth is improving but not perfect. That’s the only yellow flag right now, participation isn’t as broad as I’d like, but it’s moving in the right direction.

The strongest signal this week is stocks crushing bonds. Whenever this reading hits the 70s, we usually see continuous follow-through on breakouts and stronger risk appetite across the board.

Sector-wise, in the last week tech and comm services keep leading, while defensives like healthcare and utilities got hammered.

You can copy my full watchlist for next week here.

High Probability Trades

Ticker: SNDK

A lot of momentum is flowing into this ticker, along with significant institutional activity. SNDK has retested the $180–$190 level once on November 21st and again on December 4th. In both cases, the bulls defended that zone and pushed the price higher.

I believe it will make another attempt at the all-time high, and there is a potential breakout setup toward the $300–$320 area. The risk-to-reward is about 1:2, which makes it an attractive trade.

If it opens strong on Monday, you can take a starter position and then add on a retest of Friday’s low or Thursday’s mid-range.

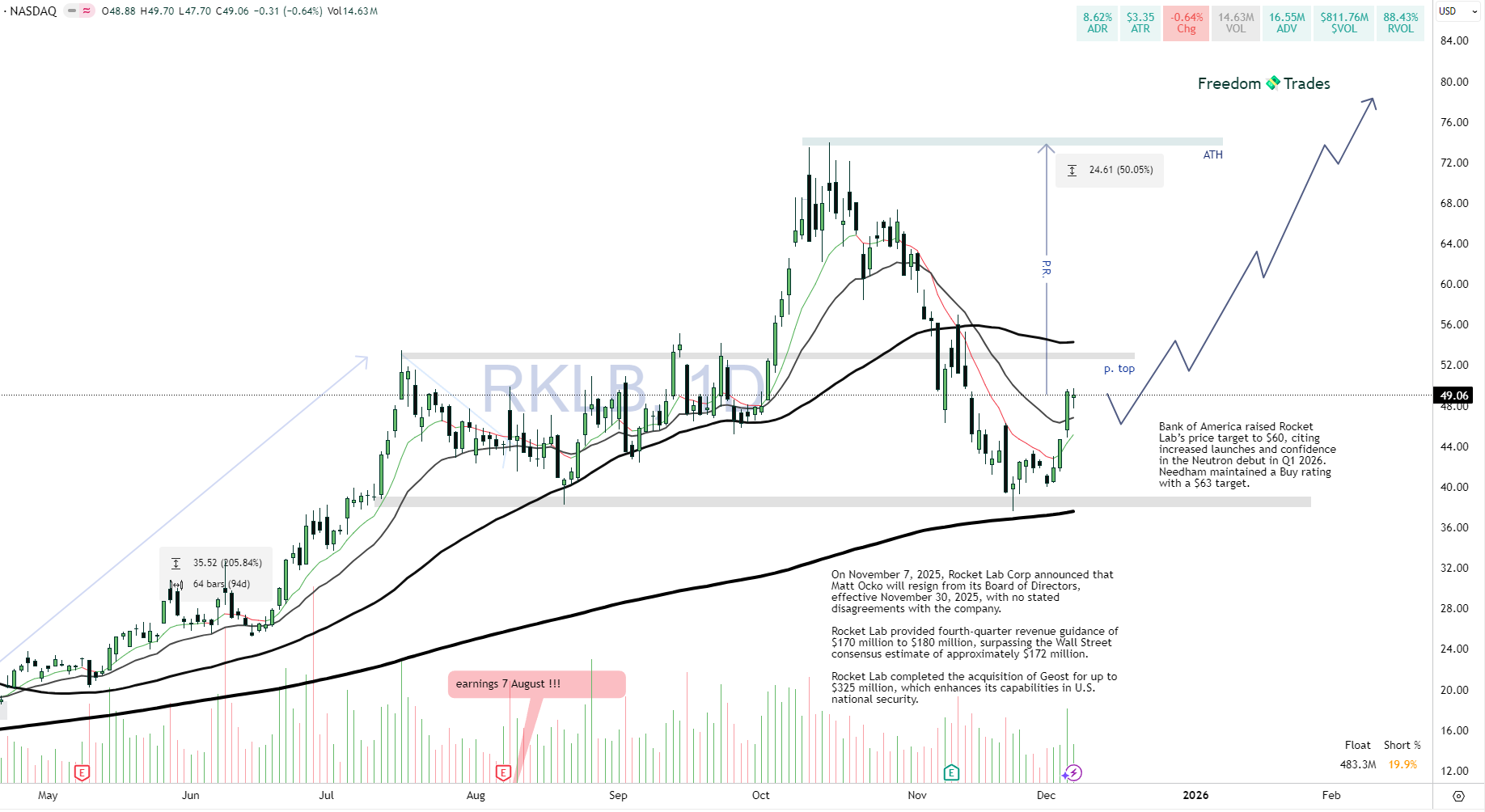

Ticker: RKLB

Since July, Rocket Lab has been stuck in this range, with six consecutive red weeks. Over the last two weeks, it’s finally starting to show strength.

I believe RKLB is getting ready to take another shot at its all-time high, and if Neutron has a successful debut in Q1, we could see a lot of momentum. I think the market is already trying to price in this potential future catalyst.

How I would play this ticker is either by waiting for a breakout above the $52 range, or by taking a starter position now and adding if it retests the $40 area.

Ticker : ASTS

Personally, the price action on ASTS looks very clean to me.

I think that even if it doesn’t manage to break the previous ATH, this range-play setup still makes sense. It would be roughly a 1:1 risk-to-reward ratio, which simply means you shouldn’t size in with a large position.

In my opinion, RKLB has a higher probability than ASTS of breaking that ATH, but both trades make sense.

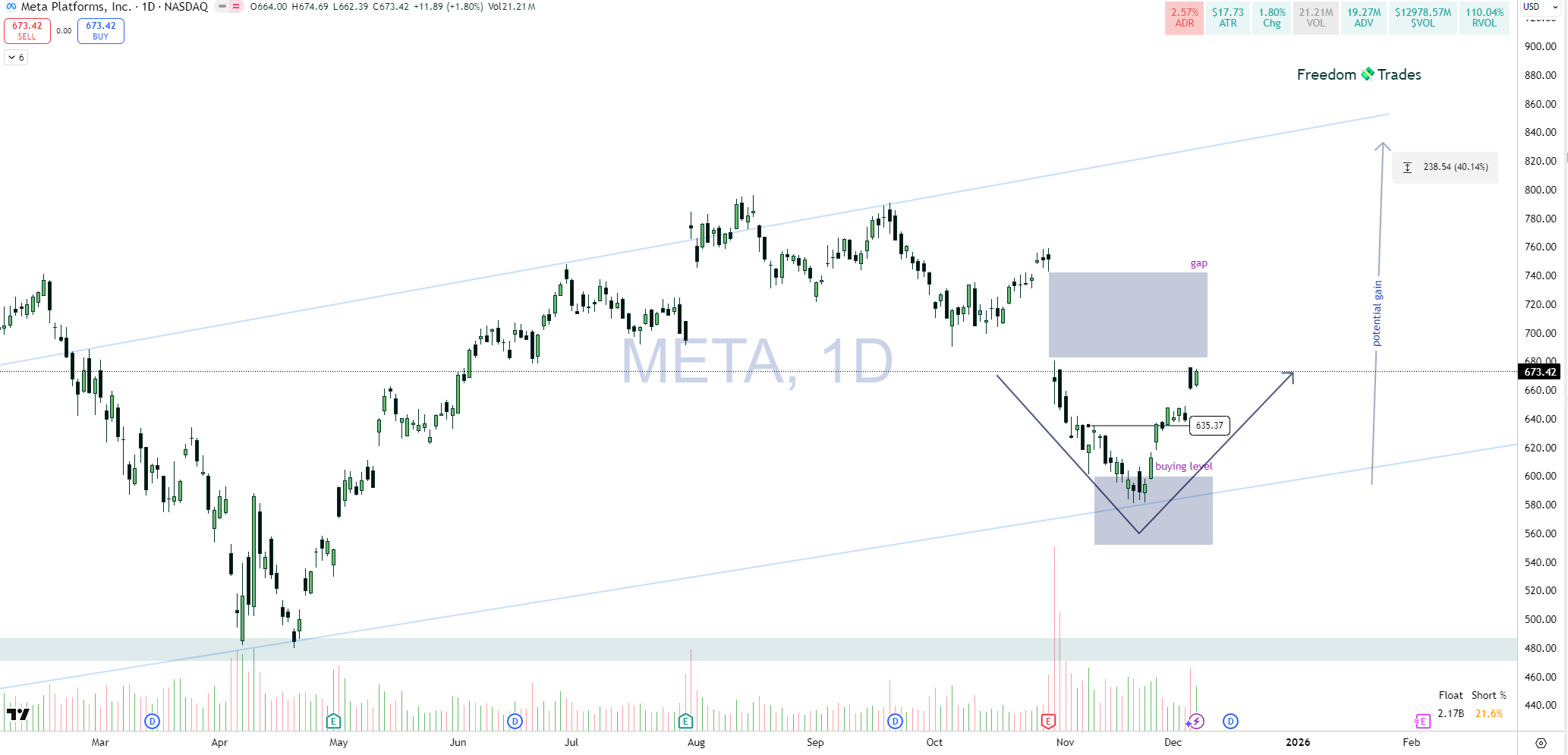

Ticker: META

Even though I announced this as one of the highest-probability trades of the year, I’ll be honest, I did not expect it to make this V-shape move and attempt to fill the gap this quickly.

We bought right at the bottom, and I’ve seen that some of you have already locked in some nice gains. (discord server)

The reason I kept listing it is because I still believe that next year META will be trading above $700. Of course, this is not a fast mover, so you’ll probably want to accelerate those gains with leverage or options.

If that’s the case, I would wait for a potential pullback into the $650 area.

Ticker: IONQ

Out of all the Quantum Space tickers, I believe this one will be the winner, as it has the strongest financials, marketing, and overall prospects.

Of course, I don’t know whether they’ll still be around in 5–10 years, but in the short term I expect another attempt toward the $75–$82 level, offering roughly 60% upside potential.

I like how the price has reacted every time it touched the 200 SMA. As you can see, in all three cases there was a period of accumulation followed by an expansion toward the next zone.

Since this is a fast mover, I would either set a tight stop or a wider stop paired with smaller position sizing. For example, you could take a starter position with a wider stop below $44, or a tight stop below $50.

Ticker: OKLO

I think this company is extremely overvalued, considering its market cap is $16 billion while it currently generates zero revenue. Oklo is still waiting for the Federal Nuclear Regulatory Commission to approve its advanced fast reactors. Until then, the company can’t sell any electricity or generate revenue.

On Friday, they announced a $1.5 billion public offering, which potentially implies 8–10% dilution.

However, you don’t fight momentum stocks. There is a lot of interest and many institutions rotating into this hyped sector, so I believe there is money to be made on this name.

Other important tickers you should keep an eye on:

PL , RDDT, NBIS (I am super bullish on this one), VRT, DUOL, BBAI.

Important links to read and understand:

🟢How to define whether a setup is A+, A, or B. (Click here)

Soon I will add more to this category..

Context

Check the chart watermark to identify the analysis timeframe.

The gray/blue zone marks support and resistance.

The slim blue lines are trend lines

The moving averages used are 200 EMA, 50 EMA, 20 EMA, and 10 EMA.

The 200 EMA is the most important for trend direction.

The 10 EMA is used for exits, if you are in profit and the price closes below the 10 EMA on a daily close, exit the position. (wait for EOD before closing)

You are free to choose/decide when to take profits, but the most important is to place your stop loss at -10% (from entry price / avg price if you dont enter with full size).

For an A+ setup, you can extend it to -15%, but never let a position go beyond that.

Important: That 15% refers to your position size, not your total capital. You should never risk more than 3% of your total capital on any single trade.

I encourage you, if you’re already a PRO member, you can upgrade your membership on the Discord server (at no extra cost) and get access to a fully private server dedicated to PRO members, for networking, trade ideas, insights, and alerts.

Connect PRO account with discord server

P.S.: The email you use on Discord must be the same as the one on Substack.

If you get an error or can’t make it work, message me privately, I might be able to help you out. 🙂

“One trade closer to freedom”

Vladislav