Investment Thesis: Polestar (PSNY)

High Risk - High Reward EV Play

Before we begin, I want to warn you that this investment is for the medium term (between 1 and 3 years), it is not a momentum stock, and it carries significant risks compared to everything we have analyzed so far. So please, do not allocate major capital. This play is high risk / high reward.

I had my eye on this company since 2023 when I first saw a Polestar passing by. I had never seen or heard of this brand before, and I was very impressed by how good the car looked.

However, I only invested in this company in 2024.

Now, I am ready to make my investment thesis public.

One last thing before, I want to say that I pour countless hours into researching, writing and formatting this investment thesis—all for free. If you find value in what I write, please consider subscribing to support my work and stay updated on the path to financial freedom.

Let's start with a brief introduction to who Polestar is.

Who is Polestar?

Polestar Automotive Holding UK PLC (NASDAQ: PSNY) is a Swedish electric vehicle (EV) manufacturer specializing in premium performance and sustainability. Originating as a performance sub-brand of Volvo Cars, Polestar became an independent EV company in 2017. Supported by Volvo and its parent company, Geely, Polestar leverages established automotive expertise while operating as a distinct brand.

Polestar Financials - Revenue Growth and Delivery Performance

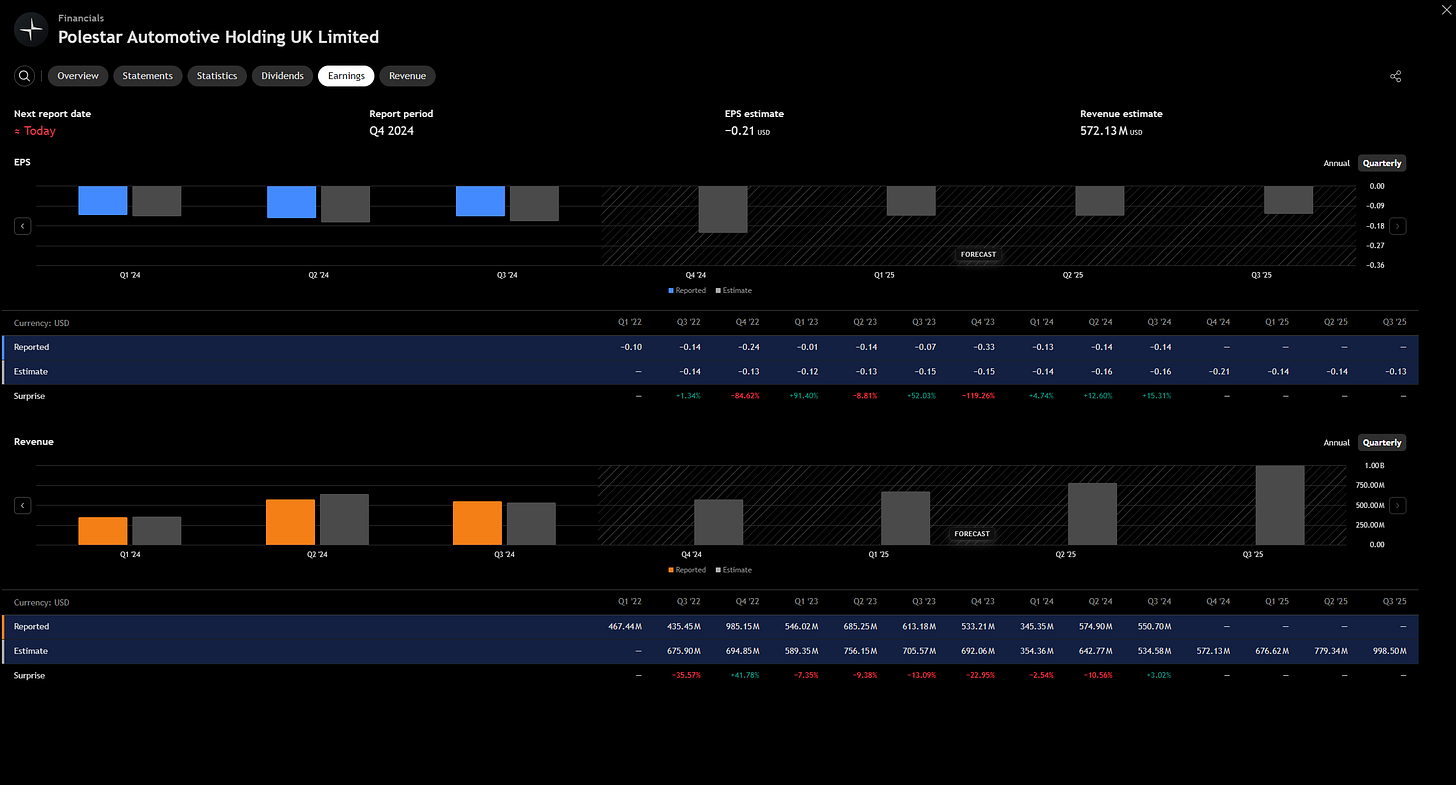

Polestar’s 2024 financial dashboard reflects a company still in the red but making adjustments under the hood. The latest earnings data from 2024 show declining sales and ongoing losses, highlighting why this investment requires a hearty risk appetite. Yet, management has outlined a path to turn things around by 2027. Here’s a snapshot of Polestar’s recent financial performance:

Revenues: Polestar generated $551 million in Q3 2024, down ~10% year-on-year. For the first 9 months of 2024, revenue totaled $1.456 billion, a 21% drop vs. the same period in 2023 .

This dip was driven by lower vehicle sales and higher discounting in a fiercely competitive market (Tesla’s price war has everyone slashing prices).

Deliveries: Polestar delivered 12,548 cars in Q3 2024, down 8% year-on-year. Total 2024 deliveries were ~44,851 vehicles, about 15% fewer than 2023 . This decline is a setback (especially since 2023 saw ~52,000 deliveries), but it’s largely due to delayed launches of new models (Polestar 3 and 4) and a soft patch in EV demand mid-year. The good news? Orders surged 37% in late 2024 , suggesting pent-up demand as new models roll out.

Profitability: Polestar is not profitable yet – not by a long shot. In Q3 2024 it posted a net loss of $323 million. Gross margin was negative (~-1.4%, effectively selling cars at a slight loss) . The company’s operating expenses have been heavy, but there’s a silver lining: adjusted EBITDA losses improved by 28% year-on-year in Q3 thanks to cost-cutting. Polestar’s management targets profitability by 2027, with a goal of achieving positive adjusted EBITDA in 2027.

In other words, they’re aiming to stop the bleeding and turn the corner within the next year. It’s an ambitious goal (perhaps bordering on “we’ll believe it when we see it”), but it signals a serious focus on cost discipline.

Cash Flow & Balance Sheet: As of Q3 2024, Polestar had about $501 million in cash , which is down ~47% from a year prior after funding its operations and growth. To bolster liquidity, Polestar secured over $800 million in new credit facilities in December , showing it has access to funding when needed. Its parent companies (Volvo and Geely) remain supportive – in fact, Polestar is working with Geely to secure additional equity/debt financing to fund its growth plans . This backing is a key strength; it’s like having wealthy relatives to call if you run low on cash during your road trip. Still, investors should expect further fundraising in 2025, which could mean dilution or debt: the company openly acknowledges it will need more capital to execute its strategy .

Free cash flow is projected to remain negative for a couple more years, with Polestar aiming for positive free cash flow only by 2027

In short, the balance sheet is adequate but not abundant, and Polestar’s financial runway, while extended by recent loans, will rely on successful fundraising and eventually turning profits.

One-Time Items: Polestar had a few accounting bumps in the road. It announced plans to restate its 2022 and 2023 financial statements due to some balance sheet errors . These restatements do not change key performance metrics, but it’s a reminder that the company is still firming up its financial controls (not unusual for a young public company, but something to watch). Additionally, in late 2024 Polestar took a write-down on inventory values (likely due to the aforementioned discounting) , which hurt gross margins. Management changes (a new CEO and CFO as of Q4 2024) indicate a push for more financial rigor going forward.

Bottom Line (Financials): Polestar’s current financials won’t win any value awards today – revenue has dipped, losses are sizable, and cash burn is ongoing. However, the company is actively course-correcting: cutting costs, raising funds, and striving to hit an inflection point in 2025. For a value-oriented investor, there is an angle here: Polestar’s market cap is roughly $3 billion , which is just about 1x its annual revenue – comparatively modest next to more hyped EV peers. If Polestar can execute its turnaround (growing sales and nearing break-even), the current depressed valuation could re-rate significantly. Just remember, this is a classic “show me” story – the financial improvements are a forecast for now, not a reality. Investors will need the patience of a monk and the stomach for volatility.

Every Tesla investor remembers the years of red ink before the big payoff – Polestar is in that gritty stage now. If you believe in the team’s ability to steer into the black, the next few years could be an exciting (and bumpy) ride.

So, as we can both see, financially, Polestar does not look good at all, but...

Growth Potential: Expanding the Lineup and Scaling Up

If 2024 was about pumping the brakes, 2025–2026 will be about hitting the accelerator for Polestar. The company’s growth potential rests on new models, market expansion, and increasing production scale. Polestar is no longer a one-trick pony (the Polestar 2 sedan) – a fleet of new EV models is coming to showrooms, aiming to broaden its appeal and boost volumes. Here’s how Polestar plans to supercharge its growth:

New Models (Product Pipeline): Polestar is launching a trio of new EVs that should significantly expand its addressable market:

Polestar 3: A premium electric SUV (two-row) that entered production in late 2024. This is Polestar’s first SUV, catering to the red-hot luxury SUV segment dominated by the likes of the Tesla Model X and high-end Audi/BMW EV SUVs. Production of Polestar 3 is kicking off in both China and the United States (South Carolina) , which not only helps volume but could qualify the vehicle for U.S. EV tax credits (since it’s built in USA). The Polestar 3 boasts a 700+ km range (WLTP) in its long-range version , and early reviews praise its design. Importantly, Polestar 3 and the smaller coupe-SUV Polestar 4 made up 56% of Polestar’s new orders in Q4 2024 , indicating strong customer interest. In other words, more than half of late 2024 buyers are eyeing the new SUVs – a very positive sign for 2025 sales.

Polestar 4: A compact “coupé” SUV, a bit smaller and more affordable than Polestar 3. Launched in China in late 2023 and rolling out internationally in 2024–25, Polestar 4 targets the popular crossover segment (think Tesla Model Y competitor, though Polestar 4 emphasizes style and luxury). With a sleek design (no rear window – a quirky design choice using cameras instead) and a mid-range price point, Polestar 4 could become the volume leader for the brand in Asia and Europe. Production is ramping up in China, and initial reception has been positive. This model opens Polestar to a broader audience and should drive significant unit growth in 2024–2025 as availability expands.

Polestar 5 (and beyond): In late 2025, Polestar plans to launch the Polestar 5, a luxury electric GT sedan inspired by the Polestar Precept concept. This is aimed at the Porsche Taycan/Audi e-tron GT segment – halo cars that enhance brand prestige. Following that, Polestar is working on a Polestar 6 roadster (an electric convertible expected around 2026) and has even previewed a Polestar 7 (a future compact SUV planned to be built in Europe) .

The takeaway is that by 2027, Polestar will have a full lineup: from a sporty roadster to SUVs and sedans. This multi-segment presence is crucial to ramp volumes and stabilize revenue. It’s as if Polestar is growing from a single-model startup into a full-fledged automaker over the next 2–3 years.

Production & Scalability: Unlike some EV startups that struggle to scale manufacturing, Polestar has an ace up its sleeve: it leverages Volvo/Geely’s manufacturing footprint. Polestar cars are built in established factories (for example, Polestar 2 in a Geely plant in China; Polestar 3 in Volvo’s U.S. and China plants . This “asset-light” production model (essentially contract manufacturing via its parent companies) helped Polestar reach tens of thousands of deliveries faster than many peers. In fact, observers have noted that Polestar’s no-fuss approach to production might be a key advantage: “80k deliveries expected for Polestar. Perhaps contract production is the way to go.” . While they didn’t actually hit 80k, Polestar’s strategy of using existing factories means it can scale without spending billions on new gigafactories. As new models come online, Polestar can ramp production by tapping into parent-company plants on multiple continents. This global manufacturing presence (U.S., China, Europe) provides flexibility and could shorten delivery times and costs in key markets.

Sales & Market Expansion: Polestar is aggressively expanding its market presence. The company plans a 75% increase in retail “Polestar Spaces” (showrooms) by 2026 , bringing its cars to more cities and customers. It entered new markets in 2024 (for example, launching sales in France ) and is now present in 27 markets worldwide . More retail locations and service centers mean better brand visibility and customer support – critical for converting EV-curious shoppers into Polestar owners. Polestar is also modernizing its sales approach with an “active selling model” across major markets – likely a more direct, concierge-style sales process to engage customers (similar to Tesla’s direct sales). All these efforts aim to boost Polestar’s market share in the premium EV category.

Volume Targets: While Polestar had stumbled on earlier lofty targets, it has reset and clarified its growth trajectory. The company now projects a compound annual growth rate of ~30–35% in retail sales from 2025 through 2027 . If 2024 saw ~45k deliveries, this implies ~60k+ in 2025, ~80k in 2026, and ~100k+ by 2027. For context, that scale would put Polestar in the ballpark of where Rivian is aiming in a similar timeframe, and about 1/10th of Tesla’s current volume – ambitious but not unimaginable. Management is optimistic that “2025 will be the strongest year in Polestar’s history”, fueled by the new SUV launches and wider market reach . Additionally, Polestar is targeting positive EBITDA in 2025, which suggests not just growing for growth’s sake, but doing so more efficiently.

Recent Momentum: Despite a tough 2024, late-year indicators point upward. Polestar reported that order intake in Q4 2024 jumped ~37% vs Q4 2023 , and orders for the full year 2024 were also ~38% higher than 2023 . This surge in orders (even as deliveries lagged) implies a backlog forming for new models. It’s a bit like a restaurant that had a slow night, but suddenly a line is forming outside because a new chef (or in Polestar’s case, new car) has gotten rave previews. If Polestar can convert those orders to deliveries in 2025, we should see a return to solid year-over-year growth. The company did adjust its 2024 guidance downward due to the delays, but importantly did not signal any demand problem – in fact, they cited “a solid order intake for new models in late Q4” as giving “an encouraging start to 2025.”

Polestar’s growth potential is real and tangible: new vehicles in popular segments, a growing geographic footprint, and a scalable manufacturing model. If execution goes well, Polestar could evolve from selling ~50k cars a year to several times that within a few years. That growth, combined with improving margins, is what could drive significant value for shareholders. As a long-term investor, you’re essentially betting that Polestar’s upcoming launches and strategy will reignite its growth curve – moving past the 2024 slump into an era of rapid expansion. There’s no guarantee (execution is everything here), but the pieces are in place for Polestar to accelerate.

Competitive Positioning: Navigating a Crowded EV Highway

The EV market isn’t just booming; it’s overflowing with players new and old. So where does Polestar fit in this crowded landscape? In short, Polestar is carving out a niche as a premium, design-focused EV brand with green credibility, but it faces intense competition from the likes of Tesla, emerging rivals (Rivian, Lucid), and the EV efforts of legacy automakers. Let’s compare:

Tesla – is the undeniable leader in EVs, and every newcomer must reckon with Tesla’s shadow. Tesla’s annual volume (nearly 1.8–2 million vehicles globally) dwarfs Polestar’s (~45k), and Tesla’s scale gives it cost advantages. Moreover, Tesla sparked a price war in 2023–24 by aggressively cutting prices to boost volume, forcing competitors to either follow suit or lose market share. Polestar has felt this pressure: it had to offer higher discounts on the Polestar 2 to stay competitive, which hurt 2024 revenues. That said, Tesla’s dominance is starting to erode at the margins as more options enter the market – for instance, Tesla’s share of U.S. EV sales fell to ~49% in 2024 (down from 62% in 2022). This indicates room for competitors. Polestar’s approach to Tesla is not to out-Tesla them on technology or charging networks (that would be tough), but to offer an alternative choice: Polestar’s cars emphasize Scandinavian design elegance, high build quality (leveraging Volvo’s safety DNA), and a brand ethos of sustainability and performance. Some consumers who don’t vibe with Tesla’s minimalist interior or simply want something different might opt for Polestar – akin to choosing a chic boutique hotel over the big famous resort. Also, Polestar has joined the Tesla Supercharger network for North America, meaning Polestar drivers will have access to Tesla’s charging stations, effectively neutralizing one of Tesla’s infrastructure advantages. All told, Tesla remains a formidable competitor (and will continue to set market pricing), but Polestar doesn’t need to beat Tesla outright to succeed; it just needs to capture a slice of the rapidly growing EV pie.

Rivian – is an American EV startup focused on luxury electric trucks and SUVs (R1T pickup and R1S SUV). While Rivian targets a different primary segment (outdoor/off-road lifestyle EVs), there is some overlap in the premium EV space. In terms of production, Rivian delivered about 50,000 vehicles in 2023, comparable to Polestar’s output, and ~51,000 in 2024– so they’re in a similar volume class. Rivian’s market cap and hype, however, have been much larger (Rivian’s valuation has hovered around $15–20B, a reminder of how undervalued Polestar may be by comparison). Polestar actually has a broader product lineup (sedans and SUVs vs. Rivian’s two models) and an international footprint, whereas Rivian has mainly U.S. sales so far. One key competitive advantage for Polestar is manufacturing efficiency – Polestar didn’t have to spend billions building a factory from scratch, while Rivian did. Polestar’s contract manufacturing via Volvo allowed it to scale faster early on. However, Rivian has a strong brand in its niche and deep pocket backers (Amazon, etc.). In the near term, these two aren’t directly zero-sum competitors (a buyer looking for a rugged electric pickup likely isn’t cross-shopping a Polestar 2), but as both expand (Rivian planning a smaller R2 SUV, Polestar expanding into SUVs), the rivalry could increase. From an investor standpoint, Polestar and Rivian offer a useful comparison: similar current sales, but Polestar trades at a fraction of Rivian’s valuation – a sign that if Polestar executes, there could be significant upside in closing that perception gap.

Lucid – Motors is another EV startup, focused on ultra-luxury electric sedans (Lucid Air) and upcoming SUVs. Lucid’s production has been far lower – only 6,000 cars delivered in 2023 and around 10,000 in 2024 – yet Lucid’s market value has often been 3–5 times that of Polestar. Polestar has already achieved what Lucid is still trying to: mass production at (moderate) scale. For example, Polestar delivered roughly 7x more cars than Lucid in 2023. This indicates Polestar’s execution and manufacturing partnerships have given it a leg up in the industrial learning curve. On the flip side, Lucid’s backing by Saudi Arabia means it’s extremely well-funded (cash isn’t a worry for Lucid in the near term), whereas Polestar must be more cautious with its capital. When it comes to product, Polestar and Lucid both compete in the premium segment, but Polestar’s pricing is generally more accessible (Polestar 2 starts around $50k, whereas Lucid’s Air sedan often runs $80k+). In some ways, Polestar’s closest analog from a product standpoint might be Audi or BMW’s EV offerings – stylish, high-quality electric cars that are premium but not ultra-expensive. Lucid aims higher (trying to outdo Mercedes in luxury). Therefore, Polestar’s competitive set is broad: It’s vying to win customers who might otherwise consider a Tesla Model 3/Model Y, a BMW i4/iX, an Audi e-tron, or maybe a Lucid Air Pure. That’s a tough fight with many strong contenders. Polestar’s differentiators are its minimalist Scandinavian design (for those who appreciate the aesthetic), the Volvo reputation for safety and build (which can reassure buyers coming from legacy brands), and its explicit emphasis on sustainability (which younger or ESG-minded buyers might value).

Legacy Automakers (Volkswagen, GM, Ford, etc.): Virtually every major automaker is racing into EVs. Legacy brands bring scale, manufacturing expertise, and established dealer networks – but they also carry the baggage of transitioning from gas to electric (which is proving slower and costlier than many expected). Polestar, being a pure-play EV maker with Volvo’s heritage, is somewhat straddling these worlds: it’s new and nimble, but also has an old soul in its corner. Against European luxury brands, Polestar stacks up well on performance and style. Reviews often compare the Polestar 2 favorably to the Tesla Model 3 or BMW i4 in driving dynamics and interior quality (though Polestar’s software and brand cachet are still growing). Legacy competitors like Audi, BMW, and Mercedes are releasing multiple EV models (e.g., Audi Q4 e-tron, BMW iX, Mercedes EQ series) that will compete with Polestar’s SUVs and sedans. Polestar’s advantage is focus: it only sells EVs and can concentrate all R&D and marketing on that mission, whereas legacy OEMs are juggling ICE businesses and sometimes send mixed signals (e.g., dealers not pushing EVs aggressively). Polestar also benefits from Volvo’s dealer service network – even though Polestar sells direct, many Volvo service centers can service Polestars, giving some comfort on the after-sales front. Against U.S. legacy automakers, Polestar is less directly competing (Ford’s Mustang Mach-E, for instance, is lower-priced than Polestar’s offerings; GM is focused on mid-market EVs for now). But all legacy players increase the competitive noise and are driving EV prices down.

Polestar’s competitive positioning can be seen as David among Goliaths – but this David has some friends in high places (Volvo/Geely) and a clear niche to target. Polestar is already ahead of many EV startups in key metrics like production volume and global reach. It has proven it can design and deliver a desirable EV (Polestar 2) and is now extending that into a family of vehicles. The brand sits in a unique space: premium and design-centric, but not ultra-luxury, sustainable yet performance-oriented.

The key competitive risks are evident: price pressure (the need to match rivals’ discounts – as seen in 2024), innovation pace (Tesla and others continually improve tech, and Polestar must keep up in range, software, autonomous features), and brand recognition (Polestar is still new to many consumers – it must invest in marketing to stand out in a field where Tesla gets all the free headlines). However, the competitive opportunity is that the EV market is not a zero-sum game right now; it’s growing so fast that multiple winners will emerge. Polestar doesn’t need to conquer Tesla to succeed; it needs to execute its own strategy and capture loyal customers in its target segment. If it can do that, the competitive landscape will shift in Polestar’s favor simply due to the rising EV tide lifting all boats.

Sustainability: ESG Leadership and Green Innovation

Polestar doesn’t just make electric cars; it has woven sustainability into its corporate DNA. For investors who value ESG factors or just the long-term viability of a company in a decarbonizing world, Polestar’s commitment to the environment is a noteworthy part of the thesis. After all, the core premise of EV makers is riding the wave of environmental transition – and Polestar is determined to be an EV leader in carbon footprint reduction, not just EV sales.

Climate-Neutral Car “Moonshot”: Polestar has one of the most ambitious climate goals in the auto industry: the Polestar 0 Project. This project aims to develop a truly climate-neutral car by 2030, meaning a vehicle that, from raw material extraction through production to end-of-life, adds zero net carbon emissions to the atmosphere. No offsets, no funny accounting – just outright elimination of emissions. It’s a moonshot goal (Polestar itself calls it that), requiring rethinking everything from materials (zero-carbon aluminum and steel) to manufacturing processes. Polestar has recruited numerous partner companies to collaborate on this “cradle-to-gate” decarbonization effort. While 2030 is beyond our investment horizon, the significance today is that Polestar is positioning itself as an ESG innovation leader. If successful, Polestar will not only appeal to eco-conscious consumers but might also license or share these technologies industry-wide, potentially creating new value streams. Even if you’re a hard-nosed investor who only cares about dollars, there’s a strategic angle: in an era of carbon regulations, Polestar’s early move could future-proof it against carbon taxes or supply chain mandates that competitors will eventually face.

Transparency and Accountability: Polestar is notably transparent about its environmental impact. It was one of the first automakers to publish detailed Life Cycle Assessment (LCA) reports for its cars, disclosing the total carbon footprint per vehicle. For example, Polestar reported that its new Polestar 3 SUV has a cradle-to-gate footprint of 24.7 tons CO₂e, which is actually lower than that of the smaller Polestar 2 at its 2020 launch (26.2 tCO₂e). In three years, Polestar managed to reduce the Polestar 2’s manufacturing emissions by around 3 tons through improvements in materials and energy use. This kind of progress shows that Polestar isn’t just making promises; it’s engineering tangible reductions in emissions. The company also issues annual sustainability reports and tracks metrics like GHG emissions per car. In 2023, greenhouse gas emissions per vehicle sold fell by 9% compared to 2022– a remarkable achievement given that many companies see emissions per unit rise as they scale up. This indicates Polestar is managing to decouple growth from emissions, aligning with the idea of sustainable growth.

Supply Chain & Manufacturing Initiatives: Polestar is attacking carbon emissions on multiple fronts:

It uses 100% renewable energy in its factories (the Polestar 2 is built in a climate-neutral powered facility, and the new U.S. plant for Polestar 3 in South Carolina also runs on 100% renewable electricity

Polestar has integrated renewable fuels in its logistics – for instance, it started running its ocean freight ships on biofuel (B30 blend) for routes from its Asian factories to Europe, cutting shipping emissions by ~20-25% It also converted intercontinental freight for materials to run on 100% biofuel, yielding an ~84% reduction in those transportation emissions.

The company is working with suppliers to source green materials: e.g., aluminum made with hydroelectric power, exploring novel low-carbon steel, and even looking into sustainable tire and plastic alternatives

Polestar is moving its vehicle processing and charging operations to renewables (its European hub in Belgium charges new cars on 100% renewable electricity before delivery).

ESG Recognition and Alignment: Polestar’s efforts align well with global ESG trends. Regulators and investors are increasingly scrutinizing automakers’ environmental impact beyond tailpipe emissions – battery sourcing, mining impacts, manufacturing energy, etc. Polestar is proactively addressing these issues. They’ve set a goal to halve per-car CO₂ emissions by 2030 (vs. 2019 baseline) and reach climate neutrality by 2040 across the board. In ESG rankings, Polestar (being a young company) might not yet top the charts, but its clear targets and disclosures put it ahead of most legacy automakers on sustainability. For institutional investors with ESG mandates, Polestar could become a favored name in the auto sector, potentially improving its access to capital and shareholder base.

Social and Governance: While the focus is on environmental sustainability, it’s worth noting Polestar benefits on governance by having established parents (Volvo/Geely) ensuring experienced oversight. The company’s leadership refresh in late 2024 (new CEO, CFO, COO) also brought in industry veterans, suggesting a commitment to robust corporate governance and execution discipline. On the social side, Polestar has championed diversity and inclusion in its marketing (and presumably internally, given its Scandinavian roots, it likely inherits Volvo’s progressive culture). Additionally, EVs themselves are part of a social trend towards cleaner air and innovation. All told, Polestar’s ESG profile is a net positive, especially compared to legacy peers transitioning from fossil fuels.

Sustainability isn’t just a buzzword for Polestar – it’s a core part of its brand identity and strategy. For an investor, this serves two purposes: (1) It enhances the brand’s appeal to a growing segment of consumers who care about buying from responsible companies, and (2) it positions Polestar to navigate and potentially benefit from the evolving regulatory landscape that favors low-carbon leaders. There’s also a feel-good aspect: investing in Polestar means backing a company that’s trying to make the world a cleaner place (it’s okay to admit that we like investments that aim to do good!). Just keep in mind that these initiatives, while laudable, are also part of the cost structure – being green isn’t free. Polestar’s challenge is to achieve its ESG goals while also achieving financial goals (profitability). If it can do both, it sets itself apart as a truly “sustainable” business in every sense.

EV Market Trends: A rising tide

Investing in an EV manufacturer like Polestar isn’t just about the company itself; it’s also a bet on the broader electric vehicle market continuing to grow. Fortunately, most indicators suggest that the EV revolution is only in its early-middle innings, with significant growth ahead globally. However, the road forward has both tailwinds and headwinds. Let’s examine the key EV market trends that form the backdrop for Polestar’s journey:

Surging EV Demand (Global Growth): EV adoption is accelerating globally. In 2024, global EV sales hit record highs – an estimated 10+ million fully electric cars sold (over 14% of new cars worldwide, when including plug-in hybrids this figure was even higher) and growing fast. Projections for 2025 show over 20 million EVs (EV + PHEV) sales, which would be ~17% growth year-over-year. By 2030, forecasts commonly predict EVs could be 30-40% of new car sales worldwide. For Polestar, a company exclusively selling EVs, this is the proverbial rising tide that can lift all boats. More EV demand means a bigger addressable market; even if competition is fierce, a big enough pie allows room for multiple winners. Polestar, targeting the premium segment, should particularly benefit in markets where that segment’s EV adoption grows. For instance, Europe and China – Polestar’s key markets – are witnessing rapid EV uptake. In China, EV sales jumped 40% in 2024 to reach 11 million units (including plug-in hybrids), and the government there remains very pro-EV with continued subsidies and incentives. In Europe, EVs comprised roughly 20%+ of new sales in many countries in 2024, and EU-wide sales topped 3 million in 2024. Europe is forecast to see another ~15% EV sales growth in 2025, spurred by tightening CO₂ regulations. North America is a bit behind (around 7-8% of new cars in the US were EVs in 2023), but even the U.S. is expected to see EV sales growth of ~16% in 2025. These trends indicate a robust demand environment for any automaker selling EVs – Polestar included. The company’s decision to expand into new markets (like recent entry into more European countries and eventually, one assumes, deeper into Asia) aligns well with where the demand is growing.

Regulatory Tailwinds (and Uncertainties): Government policies around the world are largely pro-EV, providing an underpinning for the market:

Europe: The EU has stringent emissions targets (and automakers face heavy fines if they don’t reduce fleet emissions), effectively forcing legacy automakers to sell more EVs or buy credits. Additionally, many European countries have ICE (internal combustion engine) phase-out plans around 2030-2035. This guarantees a receptive market for EV-only brands like Polestar. In fact, Polestar might indirectly benefit as competitors like VW or BMW push EVs (training consumers to accept EVs as the new normal), which broadens the customer base that Polestar can capture.

United States: The U.S. introduced substantial EV incentives through the IRA (Inflation Reduction Act) of 2022 – tax credits for EV purchases, especially if vehicles and batteries are made in North America. Polestar’s Polestar 3 (being built in the USA starting 2024) could qualify for some of these credits, improving its price competitiveness in the U.S. market. However, U.S. policy can swing: a change in administration or priorities could slow the EV push (as hinted by potential rollbacks under certain political scenarios. That said, many states (like California) and the auto industry itself are moving toward EVs regardless of federal politics. Charging infrastructure funding and standardization (e.g., Tesla’s NACS plug becoming a North American standard) also help alleviate consumer concerns.

China: China’s government has been heavily supportive of EVs (subsidies, license plate advantages, etc.), and while some subsidies were set to phase out, they have extended key incentives to sustain EV momentum. Polestar, partly Chinese-owned and manufacturing in China, is well-positioned to tap the Chinese market if it can stand out among fierce local competition.

Other Markets: Countries like Canada, Australia, and across Asia are also tilting toward EV adoption, often following Europe’s lead on emissions standards. In summary, the regulatory environment globally is a tailwind for EV makers – essentially shaping a future where EVs are not just encouraged, but mandated. Polestar’s pure-EV status means it doesn’t have to worry about transitioning from gasoline models (unlike legacy rivals); it can focus on capitalizing on these pro-EV policies.

Technology and Cost Trends: The technology underpinning EVs – especially batteries – continues to improve. Battery energy density is rising gradually, charging speeds are improving, and crucially, battery costs over the long term have trended down (despite some hiccups from commodity spikes). Over the past decade, battery prices fell ~89%. There was a blip in 2022-2023 where raw material inflation paused this decline, but analysts expect the cost/kWh to resume falling as new chemistries (LFP, sodium-ion, etc.) and scale efficiencies kick in. Cheaper batteries mean lower EV prices or better margins (or both). This is an important trend for Polestar: as a smaller company, it doesn’t yet have the scale of Tesla to command ultra-low prices, but it can benefit from industry-wide cost reductions driven by scale and innovation in the supply chain. Additionally, infrastructure improvements (more charging stations, faster chargers) are reducing consumer range anxiety, making it easier to sell EVs. Polestar owners now have access to Tesla’s Supercharger network in the US, and generally charging is becoming more convenient. All these tech trends support the uptake of EVs, which in turn supports companies like Polestar.

Market Competition and Dynamics: On the flip side, the rapid growth of the EV market has attracted many competitors and created some turbulence:

2023–2024 saw what one might call an “EV bubble hangover” – a period where many EV startups (and even established players) realized how hard it is to profit in this space. High interest rates increased the cost of car loans, dampening auto demand a bit, and commodity prices (lithium, etc.) spiked, squeezing margins. Tesla’s response was to cut prices drastically, prioritizing growth over short-term profit . This decision by the market leader created a deflationary ripple: almost every EV maker had to consider cutting prices or offering incentives to keep up. Polestar was no exception – they explicitly cited “continuing market pressure from discounting” in late 2024. So, while demand is growing, pricing power is not guaranteed in the near term. We can expect continued volatility in EV pricing. Automakers that achieve better cost control (through scale or efficient production) will have the advantage. Polestar’s strategy to cut costs and improve margins will be vital for it to navigate this environment where the consumer expects more for less.

There’s also a question of EV market saturation in certain segments. In China, for example, there are dozens of EV brands, and not everyone will survive the consolidation that’s likely coming. Globally, not all startups will make it to the finish line. Polestar’s competitive edge here is that it’s not starting from zero – it has an established production base and global distribution. But it still needs to be cautious and nimble. The next 1-3 years could see some weaker players exit or merge. Polestar’s backing by Geely/Volvo could position it as either a survivor or even a consolidator. If a shakeout occurs, ideally Polestar comes out as one of the recognized, credible brands in the premium EV space, which could increase its market share.

Consumer Behavior: Consumers are warming up to EVs, but they are also becoming choosier as more models are available. Early adopters might have bought any EV that looked cool; now mainstream buyers want the whole package – style, range, performance, reliability, and price. Polestar’s strong product design addresses many of these factors, but brand loyalty in auto takes time to build. Market trends show that EV buyers often stick with EVs for future purchases (once you go electric, you don’t go back, generally), so capturing new customers now can lead to repeat business later. Polestar’s focus on customer experience (they mention new retail strategies, etc.) will be important to convert curious shoppers into Polestar owners amidst a sea of other choices.

Macro Factors: We can’t ignore macroeconomic trends. High inflation and interest rates in 2023 made car financing more expensive, which is a headwind for all automakers. If interest rates remain high, the auto market may stay under pressure, and higher-priced EVs (like Polestar’s lineup) could see slower adoption among cost-sensitive consumers. However, if rates stabilize or fall over the next 1-3 years (as some forecasts suggest by 2025–2026), it could release some pent-up demand for big-ticket items like cars. Additionally, fluctuating oil prices can influence EV demand – a spike in gas prices often boosts EV interest, whereas cheap gas can slow the urgency for some buyers. Given the global push for decarbonization, it’s likely that policies (like carbon taxes or fuel economy standards) will ensure fossil fuel costs trend upward in the long run, indirectly favoring EV adoption.

In essence, the EV market outlook is broadly positive for a long-term investor: more consumers want EVs each year, and governments want you to drive one too. Polestar is aligned with these mega-trends. The company’s job is to make sure it grabs its share of the expanding pie and navigates the choppy waters of competition and pricing. For an investor, betting on Polestar is partly a bet that the EV boom will continue, and specifically that the premium EV segment will flourish. All signs point to “yes” on EV growth, with the caveat that it may not be a smooth, straight line (there will be cycles and shakeouts).

Polestar’s management seems to understand these dynamics – hence their urgency in cutting costs (to survive price wars) and expanding product range (to capture more customers). If global EV sales keep rising at double-digit rates annually (as forecasted), even a small market share for Polestar translates into substantial unit growth.

Risks and Challenges

No investment thesis is complete without addressing the risks. Polestar, as a young EV automaker, has plenty of them. This is not a stock for the risk-averse or those who can’t tolerate some high drama. While we’ve painted a promising picture based on data and trends, it’s equally important to acknowledge what could go wrong (and in a high-risk scenario, many things could). Here are the key risks to keep in mind:

Continued Losses and Cash Burn: Polestar is still losing money on each car it sells (negative gross margin as of 2024). If the company fails to improve this – say, due to higher-than-expected costs or inability to scale production efficiently – it might not achieve its 2027 profitability goal. That would likely spook investors and could necessitate additional capital raises beyond what’s planned. More equity raises could dilute current shareholders, while more debt raises could strain the balance sheet (especially in a high interest rate environment). Essentially, if Polestar’s turnaround plan hits a snag, the company could find itself in a cash crunch by 2025/26. The reliance on external funding (Geely/Volvo or banks) is a vulnerability; if those backers ever wavered, Polestar would be in a tight spot. As an investor, you must be comfortable with the fact that Polestar might be burning cash for a couple more years before generating self-sustaining cash flow. Monitor gross margin and EBITDA progress in upcoming earnings – they are critical signals of whether the risk is abating or growing.

Execution Risk (Production & Launches): Polestar has an ambitious launch schedule (Polestar 3, 4, 5 in rapid succession). Launching new models on time and ramping their production is a complex task – one that even seasoned automakers can fumble. In 2024, Polestar already had delays (Polestar 3 and 4 sales ramp was slower than expected, impacting Q4 results). Any further delays or hiccups (e.g., supply chain issues, quality problems requiring recalls, etc.) could hamper growth and damage Polestar’s brand reputation. Unlike a software company that can push out fixes quickly, an automaker dealing with manufacturing issues can face weeks of halted production or costly reworks. Polestar must execute almost flawlessly to meet its growth and cost targets. This is a high bar, especially as a relatively new company working with new technologies. Additionally, scaling up manufacturing in multiple locations (China and U.S.) and ensuring consistent quality worldwide is a challenge. Investors should watch delivery numbers and any commentary on production challenges in 2025 closely – any significant miss might indicate an execution misstep.

Competitive and Pricing Pressure: As discussed, the EV market is hyper-competitive and Polestar is up against giants. Price wars are particularly worrisome. Tesla has shown it’s willing to sacrifice margins to spur volume, and legacy automakers can afford thin margins on EVs because they have other profit centers (e.g., trucks/SUVs) – both scenarios create a tough pricing environment. If Polestar has to keep cutting prices or offering incentives to stay in the game, its road to profitability could stretch further out. There’s also the risk that competitors out-innovate Polestar. For instance, if in two years a competitor offers a similar car with 30% more range or a much lower price thanks to a new battery breakthrough, Polestar could be left with an outdated or overpriced product in comparison. While Polestar’s association with Volvo suggests solid engineering, they don’t have the R&D budget of a Toyota or Tesla. So, betting on Polestar is betting that it can punch above its weight in innovation or at least adopt new tech quickly via partners. Any sign that Polestar’s products are falling behind (in tech, range, features) could undermine the thesis.

Market Sentiment and Stock Volatility: PSNY, like many de-SPACed EV stocks, has seen wild swings. In fact, Polestar’s stock has traded well below its SPAC IPO price, reflecting investor skepticism. The stock is likely to remain highly volatile. On any given news (good or bad), the percentage swings could be large. For a long-term investor, volatility is not necessarily a problem – if you’re not selling, the roller coaster ride is just paper gains/losses. But it tests your conviction. Negative news (e.g., an earnings miss, a recall, a broader market EV selloff) could hammer Polestar’s stock disproportionately. And if there’s a broader market downturn or risk-off sentiment, small-cap growth stocks like Polestar often get hit hardest. In short, be prepared for a bumpy ride. It’s easy to say you have high risk tolerance; it’s harder to watch a stock drop 30% in a month and not feel queasy. Having a long horizon and a clear thesis (and sizing the position appropriately for your risk tolerance) is key to weathering this.

Dilution Risk: We touched on fundraising, but to emphasize: Polestar will likely issue more shares or bring in new strategic investors to finance its growth (they’re actively seeking new equity funding with Geely’s help). The share count may go up, potentially diluting existing shareholders’ ownership percentage. Ideally, this capital infusion would be used to accelerate growth and thus be a net positive, but it’s a risk if done at a low share price or in large amounts. It’s something to keep an eye on in news/filings.

Macroeconomic Risk: A significant economic downturn or recession could hurt Polestar’s sales. Premium electric cars are a discretionary purchase; if consumers tighten their belts, big-ticket items like luxury EVs might see demand drop. We’ve already seen tech sector slowdowns and higher financing costs impacting auto sales. If 2025 were to bring a recession, Polestar might have to navigate selling expensive cars in a tough environment (possibly forcing more discounts or leading to unsold inventory). This is somewhat out of the company’s control, but it’s a scenario to consider. A mitigating factor is that EV adoption has a regulatory push – even in a downturn, some consumers will still switch to EVs due to external factors (fuel savings, mandates), and fleet buyers (government or corporate) might continue EV purchasing. But generally, a rough economy is a risk.

Regulatory/Policy Changes: While mostly positive, there’s always a risk that some incentive is cut or a policy changes in a way that’s unfavorable. For example, if the U.S. decided to impose higher tariffs on imported EVs (Polestar imports some models to the U.S.), or if a subsidy in a key market expired abruptly, it could momentarily hurt Polestar’s competitiveness or demand. Also, as a Sweden-based company with Chinese ownership, Polestar operates across different jurisdictions – geopolitical tensions (like US-China trade issues) could create supply chain or market access risks. These are low-probability but non-zero risks to keep in mind.

Key Person/Operational Risk: Polestar’s new CEO, Michael Lohscheller, took the helm in October 2024. Leadership execution will matter a lot. Lohscheller has automotive experience (ex-Opel, briefly at Nikola Motors) – his ability to steer Polestar effectively will be crucial. Any instability in the management team or strategic missteps could derail progress. Additionally, Polestar’s reliance on Volvo for tech and Geely for backing means it has less independence; if priorities at the parent companies shift, Polestar’s strategy might be affected. However, given they own large stakes, they have every incentive for Polestar to succeed.

After listing all these risks, one might wonder: why invest at all? The answer circles back to risk-reward. These risks are the very reason Polestar is potentially undervalued relative to its long-term opportunity. In a scenario where Polestar executes well – hits its growth targets, achieves profitability by 2025, and continues scaling – the reward could be a significantly higher stock price in a few years, as the market gains confidence and perhaps values Polestar more in line with peers. But the path to that scenario is narrow and demands solid execution.

Investors should only consider Polestar if they:

Believe in the EV megatrend and Polestar’s ability to claim a decent stake in it.

Are comfortable with volatility and potential setbacks – understanding that quarterly results may wobble and sentiment will swing.

Have a long-term horizon to allow the thesis to play out (this is not a quick flip; it’s more like a 1-3 year minimum story).

Maintain a balanced perspective – be ready to adjust if the thesis breaks (e.g., if EV growth stalls unexpectedly or Polestar’s new models flop, that would be a signal to reconsider).

It’s also wise to size the investment such that if Polestar doesn’t pan out, it doesn’t ruin your portfolio. High risk should ideally be a portion of a portfolio, not the whole thing – that way you can sleep at night even if PSNY has a bad day on the ticker.

We remain cautiously optimistic. That means acknowledging Polestar is far from a sure thing. There will likely be twists and turns. The EV space is notorious for not following a smooth trajectory (just ask any early Tesla investor). Polestar has a plan, and we have evidence (cited throughout) that the plan is grounded in reality, but executing it is the hard part. Investors should keep an eye on quarterly delivery numbers, gross margin trends, and cash burn. These will be the tell-tales of whether Polestar is on track or hitting road bumps.

PS: Thank you for all the messages and followers in the last 2 weeks, you motivate me to keep posting exclusively on Substack!

Thanks!. I’ll take a look at how they’ve rebounded post-pandemic—could be some interesting setups.

Nice write-up. This company is outside of my investment world but I used to invest in Polaris and Malibu boats. Both are profitable with solid balance sheets. Their problem is lots of demand was pulled forward during the pandemic. Haven't followed their recovery in a while, might be interesting for you.