This Setup Has a 1:5 Risk/Reward Ratio—And It’s Hiding in Plain Sight

VIX Hit 60. Here’s How I See It | Potential entry Long Buy for BTC | Episode 10

Happy Easter, dear investors, friends, partners.

Here we are, issue #10 of this newsletter, which means I’ve been showing up for 10 weeks straight alongside you :)

Unfortunately, this milestone doesn’t come with good news. Markets are bleeding, prices are climbing thanks to tariffs, and it’s starting to feel like the end of the world out there.

So many bad headlines this week, I had to sneak in at least one good one… but we’ll get to that in a bit.

First up: UnitedHealthcare stock dropped 22.38%, its worst trading day in 25 years, after a rough earnings report.

They slashed their 2025 earnings forecast to $26–$26.50 per share, way below the $29.50–$30 they predicted back in December and far under Wall Street’s $29.73 estimate.

Healthcare as a whole has been under pressure, tight government payouts, rising costs, and frustrated patients. Still, many saw it as a relatively safe haven.

But Medicare Advantage costs are eating into margins, and now the whole sector’s feeling it.

As you know, international money is pulling back from U.S. assets, and who can blame them? What used to be seen as the safest game in town now looks like chaos, thanks to policy whiplash and tariff roulette.

If Trump ends up with control over the Fed, the last real independent institution left, that’s not going to calm nerves. It’s going to pour gasoline on already shaky sentiment.

Powell made it clear: No rate cuts, no safety net. Markets are on their own.

And just to twist the knife, the ECB cut rates again, seventh time in a row, while the Fed stays frozen.

What is VIX doing?

The VIX hit 60 last Monday, then dropped to 33 by Thursday after the president paused tariffs. Fear’s still high, it’s stayed above 30 for 10 straight days, something we haven’t seen since the 2022 bear market.

But fear doesn’t always mean doom. The good news is that historically, when the VIX spiked above 45, the S&P 500 was up 10 out of 11 times four months later. (Prepare for that :)

Freedom Trade of the week

JPM Long

We’ve got a descending trendline break setup, and JPM is consolidating right below that trendline. Price is also sitting in a buy zone, just above key support near $229. RSI is neutral, around 52, so momentum isn’t overstretched yet. Here's how I'm looking at it:

IF JPM holds above the $229 support zone, THEN I’m looking for a move toward the 1st target at $255 (approx. +10%).

IF price breaks and closes below $224, THEN trade idea is invalidated.

Levels:

Buy Zone: $229–$231

1st Target: $255

Stop Loss: Below $224 (gives a ~2.0% risk, very tight setup)

Risk/Reward: ~1:5 — clean asymmetric setup

Confidence: 💸💸💸

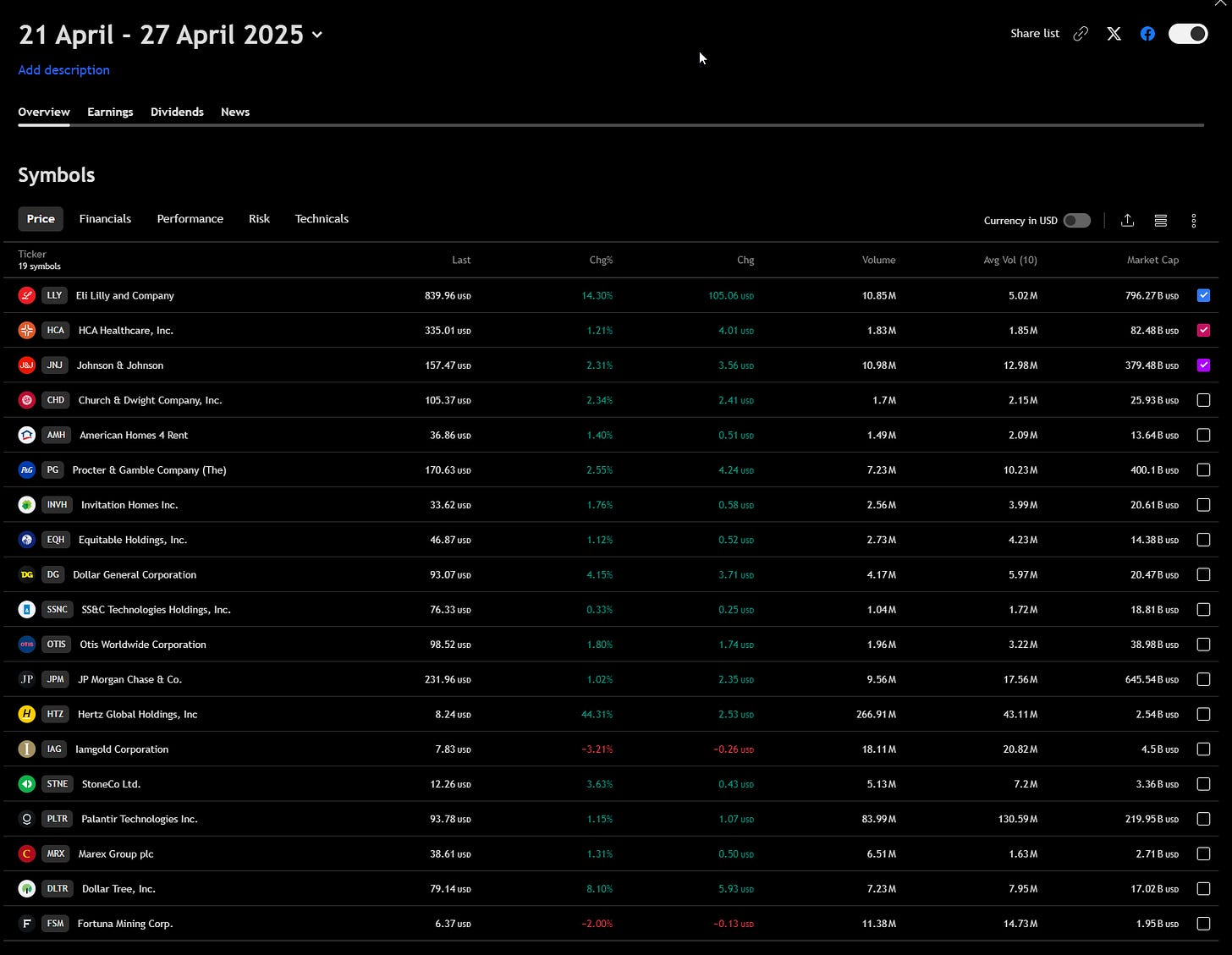

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely:

Get exclusive market insights—access my free watchlist now!

🔗 Check it out here: TradingView Watchlist

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

This Week in the Economy: What You Need to Know

Jobless claims just dropped again, 215,000 new filings last week vs. 224,000 the week before.

Despite all the tariff drama and economic noise, companies aren’t laying people off en masse… yet.

Unemployment is still steady, though continuing claims did tick up a bit to 1.89 million.

The job market’s holding up, for now. But if costs and uncertainty keep rising, that resilience could crack.

On the other hand, China’s feeling the pressure…

Premier Li Qiang is calling for bold, fast action to stabilize markets and boost confidence as the U.S. trade war drags on. He’s telling officials to “break norms” and roll out serious policy support, because things are getting shaky.

Yes, Q1 GDP came in stronger than expected, but with U.S. tariffs at 145%, that number doesn’t mean much. UBS just cut China’s 2025 growth forecast to 3.4%, far below their 5% target.

Now, Beijing’s prepping stimulus, likely more fiscal firepower than monetary easing, to keep the economy afloat. They’re also opening up more sectors to foreign investors, trying to lure in capital while the U.S. tightens the screws.

A deal might be coming, but the damage is already showing…

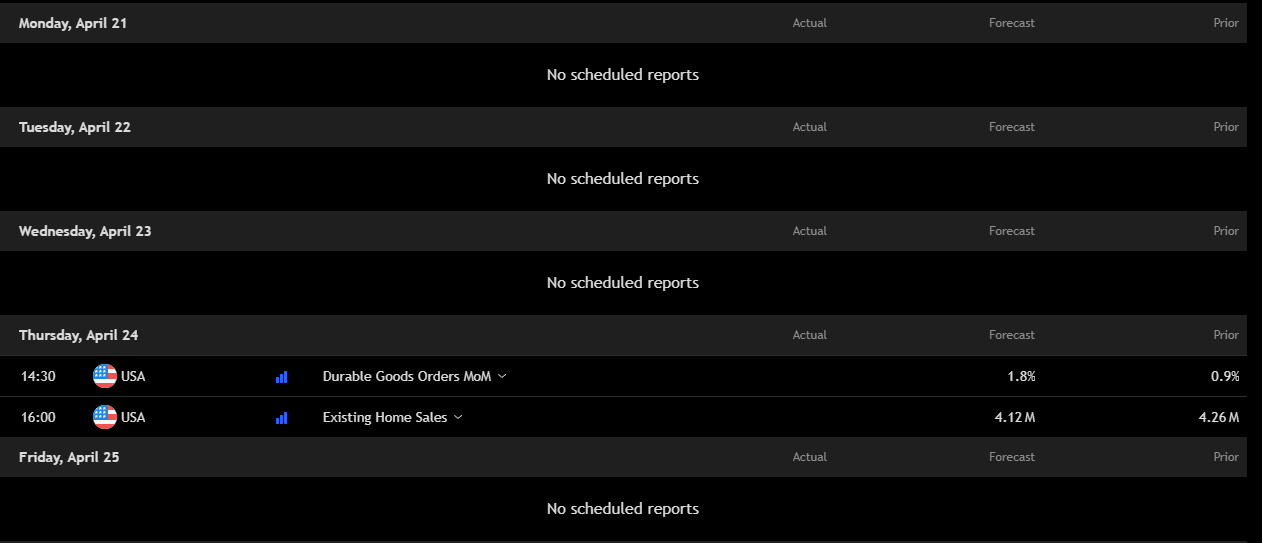

Key economic events to watch next week

Next week’s key action lands on Thursday with Durable Goods Orders and Existing Home Sales, both closely watched for signs of economic strength.

If durable goods beat and housing misses, we could see a split narrative: businesses still spending, but consumers pulling back.

Earnings to watch - Who’s making money?

Here are some interesting earnings reports coming up:

Big week ahead for earnings, Tesla, Microsoft, Alphabet, and Intel are the heavy hitters to watch.

These names alone could move the entire market, expect fireworks.

Fear & Greed Index

Meme of the week

Another opportunity - BTC

BTC looks like it's breaking out of the downtrend channel, finally showing signs of strength.

Holding above $85K could confirm the move.

If it retests and holds, this might be a clean buy setup with upside momentum.

Eyes on volume and follow-through, this could be the shift bulls have been waiting for.

If you found all this useful, please share this article, you might help your friend with some cool information, and for you too (as I plan to reward the most active members :)

Until next Sunday,

Vladislav