Money Can’t Buy Happiness, But This Can Buy Your Freedom

WMT Setup, Tariff Impact, Watchlist & More in This Week’s EDGE (Mar 31 – Apr 6, 2025) | Episode 7

Last week, I caught up with an old friend I grew up with. We hadn’t spoken in years. We laughed about the dumb stuff we used to do, the chaos we came from… and then he said something that stuck with me:

“Yeah man, but money can’t buy happiness.”

And I get where he’s coming from. We both know people with cash who are still miserable.

Money might not buy happiness, but it sure as hell buys options.

The option to leave a toxic job.

To take care of your family.

To sleep at night without a knot in your chest.

Financial peace isn’t about flexing. It’s about freedom.

With that being said let’s start with our Weekly EDGE.

Freedom Trade of the week

WMT Trade Setup – Long

If WMT holds this key support zone (~$84–$85), where price is sitting just above the 200-day moving average, then we could see a bounce back toward the mid $90s. Momentum is oversold but stabilizing, and volume’s been drying up—classic base behavior.

Entry: $86.00 (on confirmation of a green daily close with volume pickup)

Stop loss: $82.90 (a clean break below the 200MA invalidates the setup)

Target 1: $91.50 (gap fill and declining 50MA)

Target 2: $95+ (if momentum really kicks in and macro cooperates)

If it breaks below and fails to reclaim, then step aside—support becomes resistance and the trend stays bearish.

Confidence Level (1-5): 💸💸💸

If you want more setups and trades like this, upgrade your subscription for full access!

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely:

Get exclusive market insights—access my free watchlist now!

🔗 Check it out here: TradingView Watchlist

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

This Week in the Economy: What You Need to Know

1. Tariffs are back and this time, they’re not bluffing.

The U.S. just slapped a permanent 25% tariff on imported cars. Fully assembled vehicles get hit starting April 3rd, and by May 3rd, auto parts, engines, transmissions, electronics are getting taxed too. No exceptions, no negotiating table.

The pitch? $100B in revenue and a patriotic push to bring manufacturing back home. The reality? Global supply chains just took another gut punch, and car prices are about to climb while inflation’s already kicking people in the teeth.

Markets didn’t like it. Ford, GM, Toyota, BMW, all dumped. Tesla? Sitting pretty. They build in the U.S., so they’re (mostly) safe.

The bigger story? This isn’t just about cars. The U.S. is rolling out “reciprocal tariffs” to even the score with countries playing games through subsidies and taxes.

The message is clear: If you want to sell to America, start building in America.

2. Jobless claims dipped, but the slowdown’s still real.

224K filed last week, slightly below expectations. Layoffs aren’t surging, but job openings and worker movement are slowing fast.

No mass cuts yet, but under the surface, the market’s cooling.

3. Q4 GDP revised up

Growth hit 2.4% in Q4 2024, slightly better than expected. But don’t get excited—Q1 is tracking way lower, with some models flirting with flat.

Next big check-in: April 30.

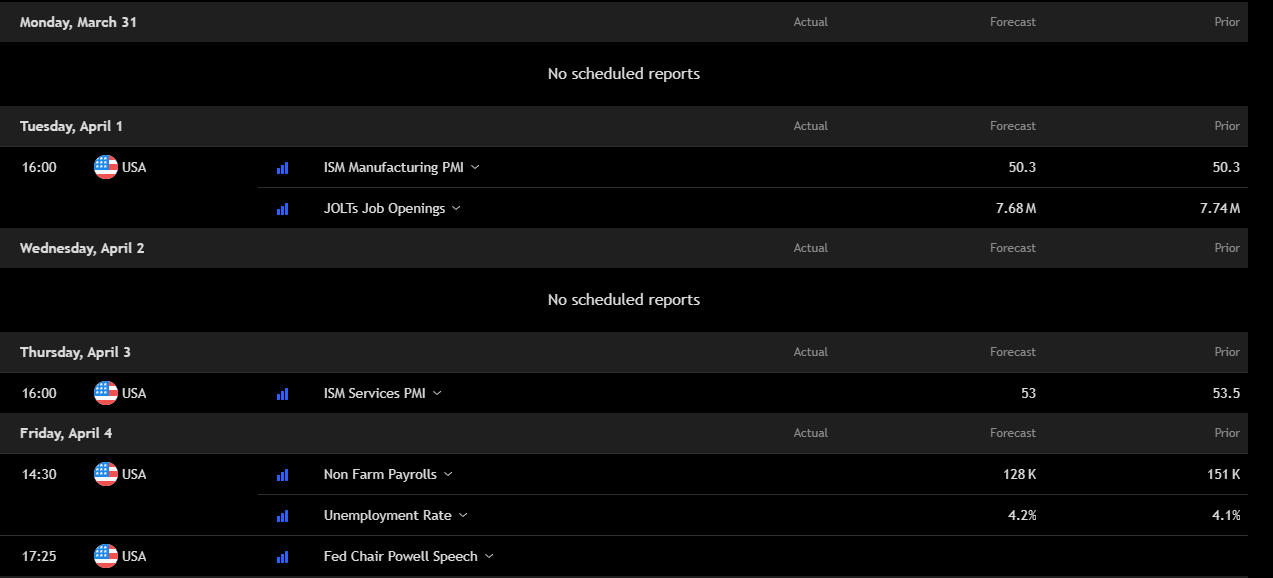

Key economic events to watch next week

Big week ahead for U.S. markets—data drops and Powell on deck.

ISM Manufacturing & Services will hint at recession or resilience, while Friday’s NFP and unemployment rate could be the real market mover. Eyes on Powell’s speech, after he’ll either soothe or spook Wall Street.

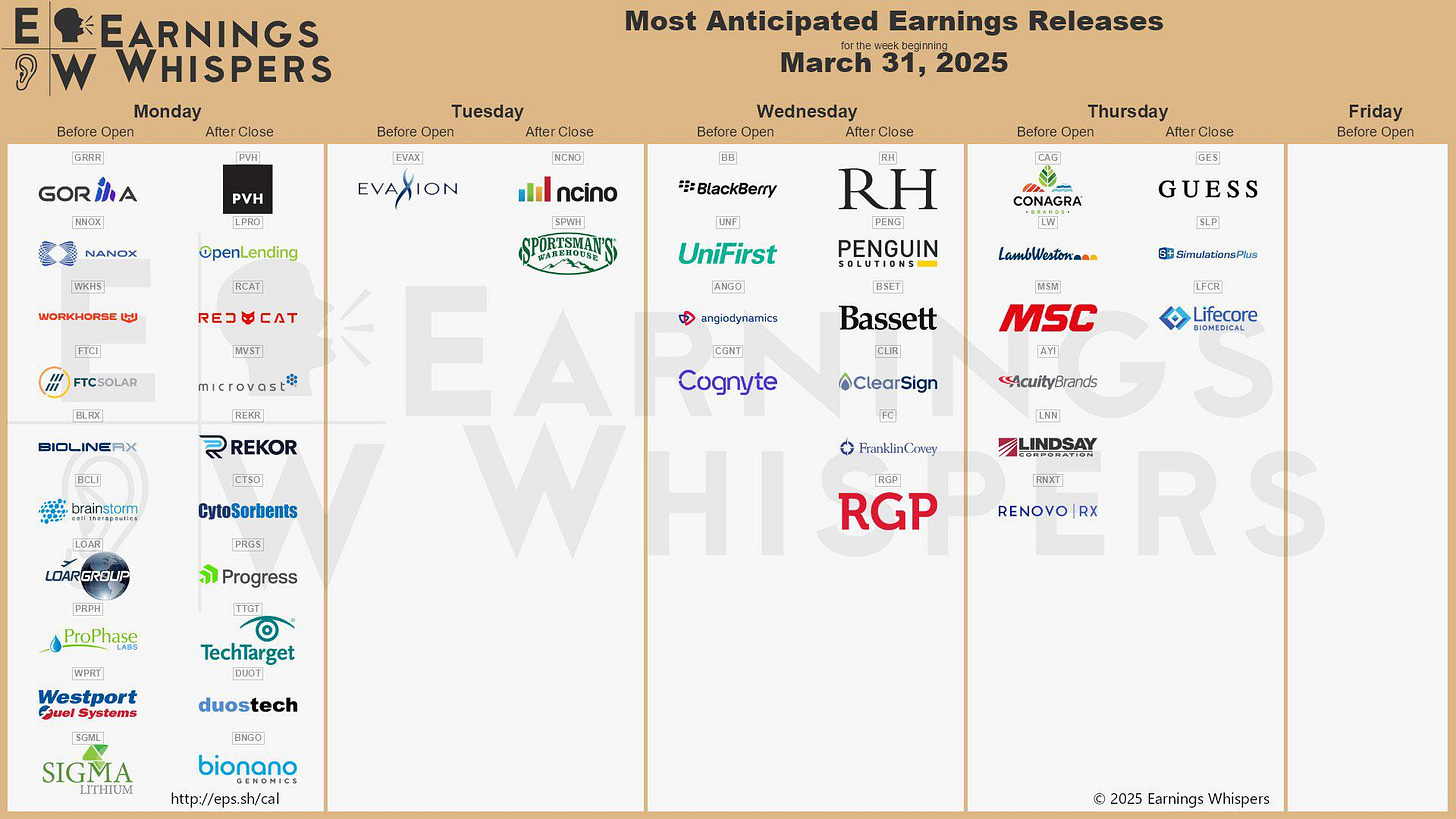

Earnings to watch - Who’s making money?

Here are some interesting earnings reports coming up:

Earnings season is still hot—and this week, a few key names could stir up the markets.

Wednesday with BlackBerry (BB) reporting before the bell—watch for AI and cybersecurity updates that could revive interest. RH (Restoration Hardware) drops after close, always a wildcard in the luxury home space, especially with consumer spending in flux.

Thursday, we’ve got Conagra Brands (CAG) and Lamb Weston (LW) before open—both important for inflation watchers tracking food margins.

No mega-caps, but enough mid-sized movers.

Fear & Greed Index

Meme of the week

Closing Bell

P.S. If you haven’t read my latest piece on why most FIRE plans are BS, go check it out.

See you next Sunday,

Vladislav