I lost $3,937 from Swing Trading in November

Full Risk Analysis Inside Trading Performance | Edition 41

Dear traders,

November wasn’t a green month for me, and I want to be upfront about that.

Losing months are part of trading, and I promised full transparency from day one.

In this review, I will walk you through the mistakes, the decisions I would take differently, and the strategic adjustments I’ve already implemented moving forward.

Mindset Going Into November

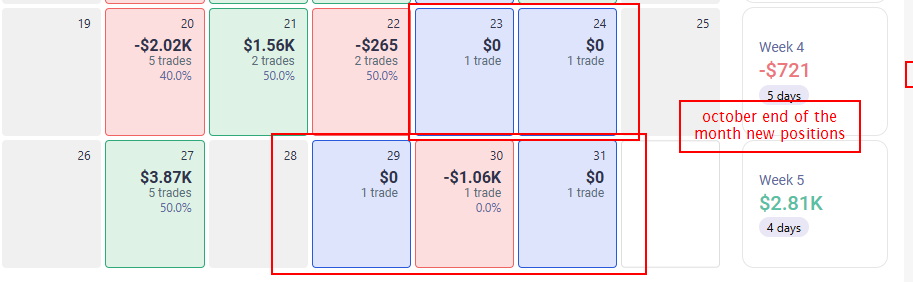

In October, I was anticipating a pullback, given that we had just seen six consecutive green months on the SPX.

Naturally, I shifted into a defensive mindset, which held me back from sizing up on some of the opportunities that appeared. I wasn’t performing at my full potential.

At the same time, toward the end of the month (in the final week), when I saw the market continuing to climb, I “forgot” my own plan (no new position - manage current position) and started opening new positions.

Right Setups, Wrong Environment

Even though the setups were valid and not random, the market environment wasn’t.

Despite the clear signs, failed breakouts, low volume on up-days, and other warning signals, I ignored them.

My situational awareness was affected, and that pushed me into a drawdown.

Naturally, I started implementing measures to control the damage.

I talked more here about how I recover from a loss.

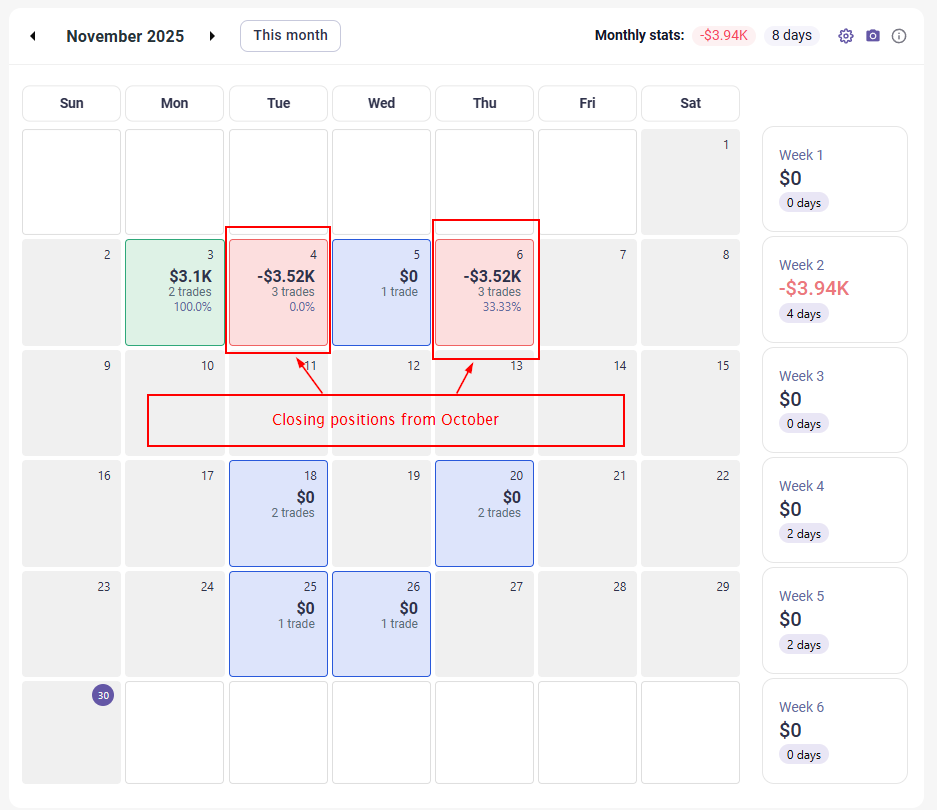

My largest drawdown occurred on November 20th.

As you can see in the image below, while the Nasdaq had dropped -6.89%, my portfolio was down -10.20%.

Strategic Positioning During the Drawdown

On November 17, I was about 80% in cash and only 20% in equities. I had reduced my positions massively and positioned myself well for the next opportunity.

By November 20, I was down approximately $18,000 from the account’s high.

Even though the trader instinct is to recover losses as quickly as possible, this is the worst thing you can do during a drawdown.

Downsizing your positions and staying patient is what actually gets you out of a drawdown.

If you look at my November calendar again, you’ll notice that I waited 12 days before opening a new position , and even then, that position was small relative to the total account size.

So I wasn’t trying to “win it back.” I was slowly positioning myself for the next real opportunity.

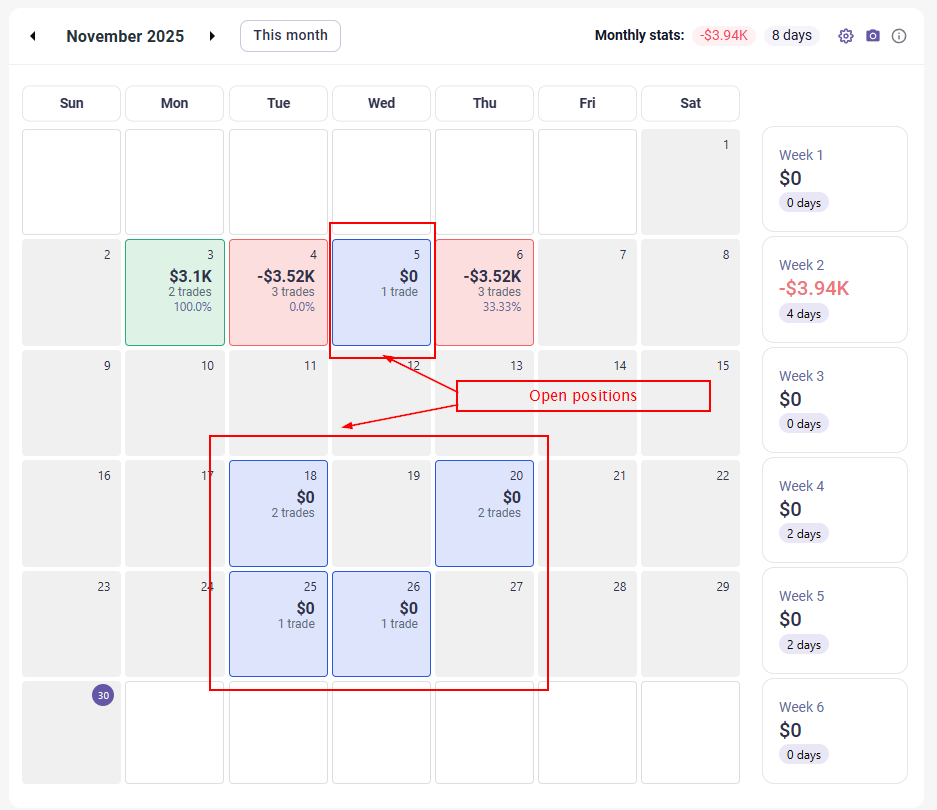

By November 15, when I released the High Probability Trades, I was already watching a few setups that were simply too good to ignore.

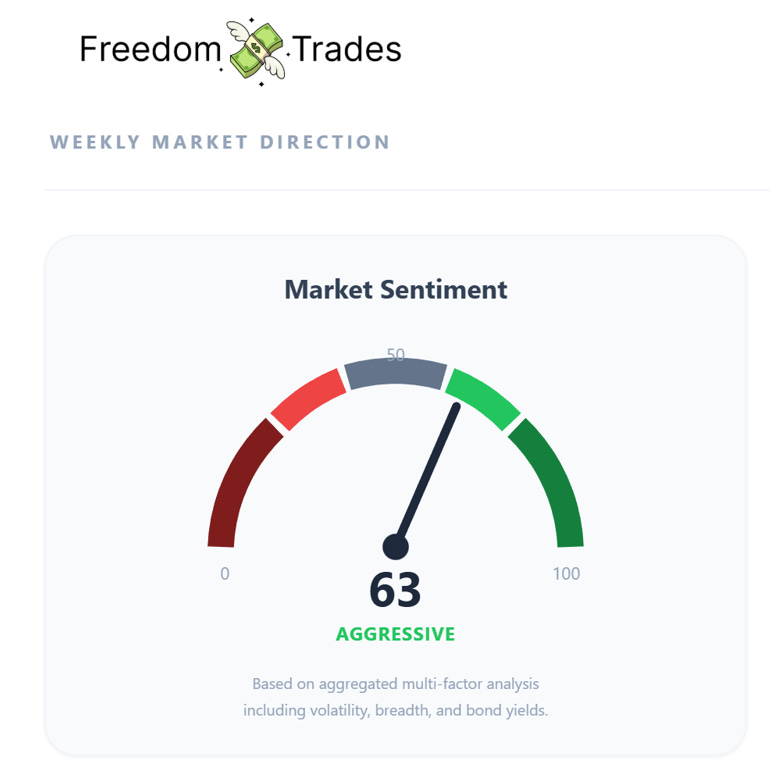

Using my situational awareness, my strategy, and a new tool that both I and the community now have access to: the Weekly Market Direction , I gained the confidence to push forward and open new positions.

These new positions have generated $12,175 so far in unrealized gains.

As you know, I don’t count unrealized profits, because they’re not truly your money until you lock them in.

However, they did help me recover most of my drawdown.

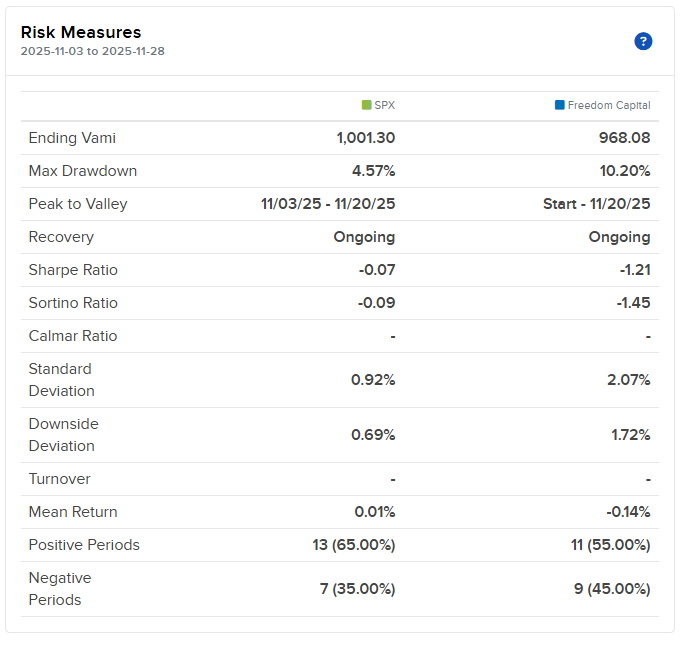

Risk to Performance Measures

To evaluate performance correctly, we always need to look at it through the lens of risk measures.

Here is a screenshot of the Risk measures of my account from my broker:

When you look at these numbers, you get a really good picture of how the account behaved throughout the month.

Sharpe & Sortino

Both ratios are negative this month, which simply means the volatility we absorbed didn’t translate into gains.

In a choppy environment, momentum systems tend to look ugly on paper, and November was exactly that kind of environment.

The account experienced bigger swings than the index, which is expected for this style. We’re still in the recovery phase, and the numbers simply reflect a difficult trading environment where many of the high-beta names rolled over at the same time.

Key Mistakes & Lessons

Stayed defensive too long because I anticipated a pullback early.

Sized too small on quality setups due to the defensive bias.

Ignored the warning signs (failed breakouts, low-volume up days).

Entered positions in a weak environment instead of waiting for alignment.

Risk control must be mechanical, not emotional.

Heading into December, the focus is:

Rotating towards high-beta names showing early relative strength.

Increasing position size if Market Direction aligns with my setups.

If you’re serious about leveling up your trading, join Freedom Trades today.

It’s the last day to get this offer.

Trade Setups of The Week

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my entire watchlist for free here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

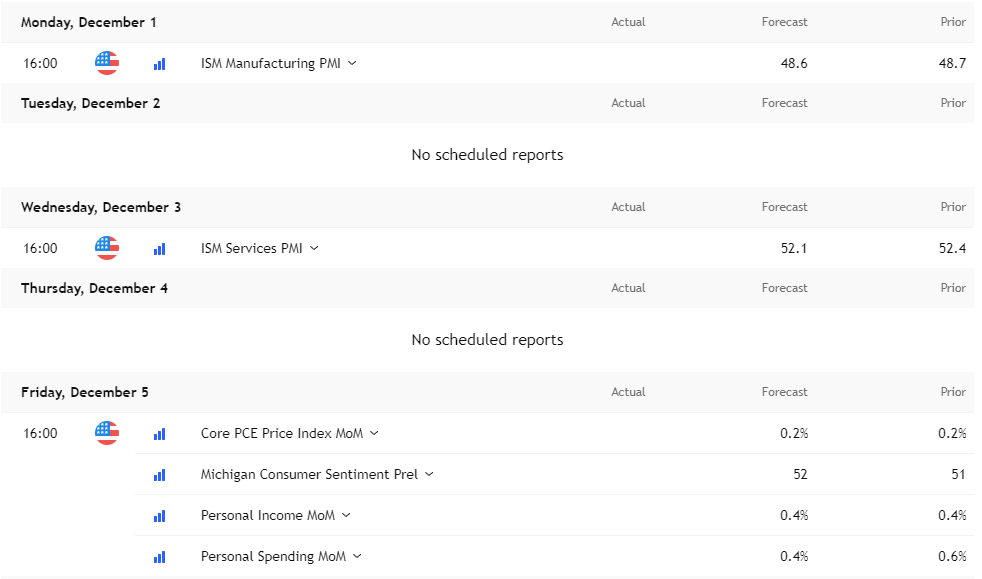

Economic events to watch next week

PCE on Friday is the only thing that actually matters for market direction.

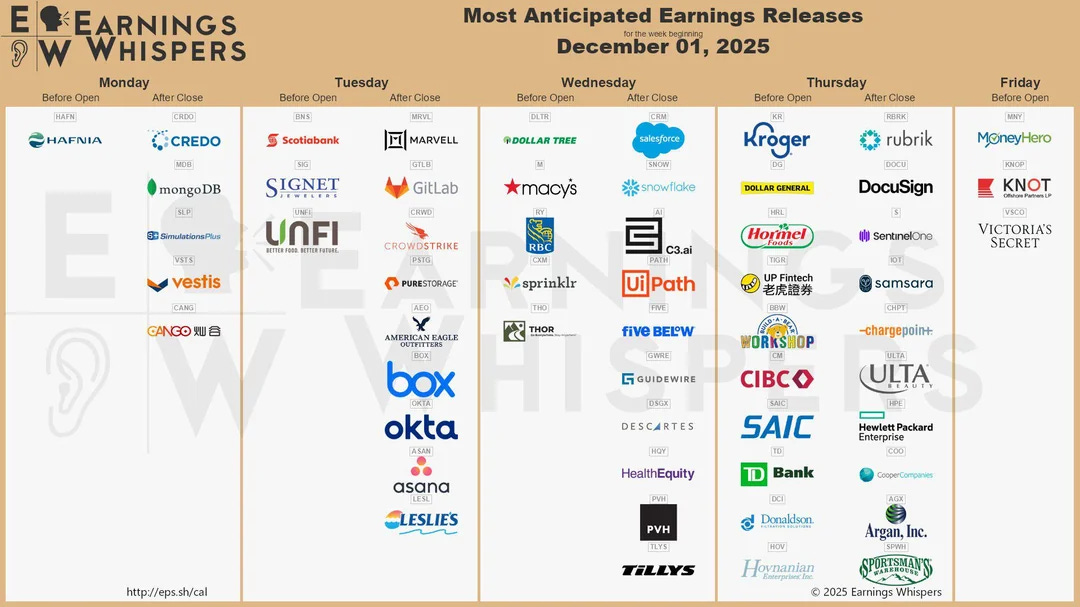

Earnings to Swing Trade Next Week

CrowdStrike, Salesforce, and Snowflake are the real fireworks here.

Weekly Market Direction

If you want the full picture with all the signals and context that sits behind this number, consider upgrading so you can see the complete breakdown.

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav

Thanks for the honesty. In one account, I lost about 15% starting with the oct gold dip. Fortunately i was more cautious in my main account.

What I learned was that my screeners were inadequate. They only worked in high momentum.

Since then I’ve developed a 3 regime approach based on various market measurements, and then the screeners emphasize different tech indicators for each regime. I was finally able to turn it around on Nov 20.

Love the transparency.

November was brutal for me. But enjoyed last week’s recovery.

The most important is to take the lesson and move on!