QBTS Skyrockets on NVIDIA hype - potential SHORT opportunity

Update 21.03.2025 : Trade closed

🟢 + 24.68 % Return

D-Wave Quantum Inc. (QBTS) just went vertical, surging nearly 80% in a few days. The catalyst? NVIDIA’s upcoming Quantum Day event, fueling speculation and FOMO-driven buying. But parabolic moves don’t last forever, and this setup is screaming for a fade. Let’s break it down.

IF momentum stalls and we see exhaustion signals, weak closes, wicks on the daily, or a drop in volume, THEN the party is over. Buyers who chased the move will start panicking, and that’s where the cracks begin.

IF price fails to hold above $11.50 and starts closing under intraday support levels—then we’re looking at a potential rug pull, with a fast move back toward $8.50 (first target).

Why? Because liquidity pockets work both ways. Just like price ripped up on low supply, it can free-fall when demand dries up. And when algo-driven FOMO fades, bag holders start unloading.

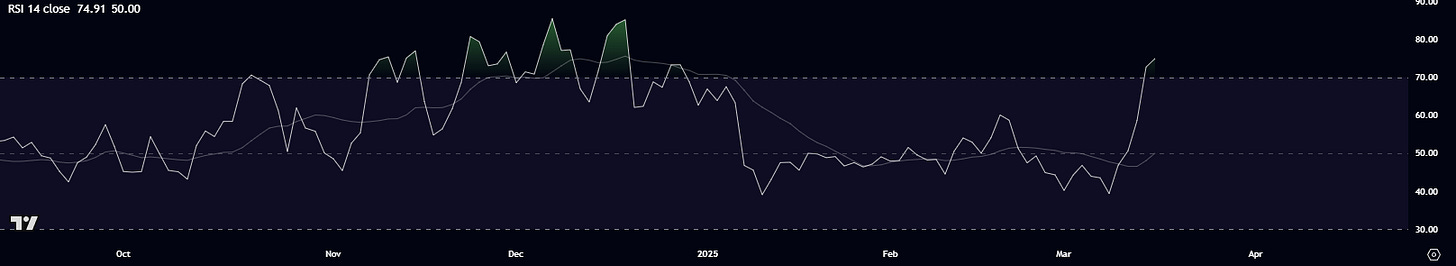

RSI is above 74, deep in overbought territory. Doesn’t mean it HAS to drop, but it does mean the easy long money has been made. Historically, this stock struggles to hold extreme RSI levels.

Look at past price action. Late December 2023? Massive run-up, then a full retrace. Pattern looks similar. Retail piles in late, smart money exits, and gravity does its job.

IF we get a lower high and rejection at resistance, then I’m taking a short position with tight risk management. Stop placement depends on intraday action, but a clean stop above recent highs keeps it manageable.

Targets: $8.50 first, then $6.50. If selling accelerates, we could see a full retrace toward $5.50.

IF price somehow holds above $11.50 and grinds higher, THEN shorts get squeezed, and the play is invalidated. No bias, just reacting to price.

Trade the setup, not the emotion. The market doesn’t care what you think—it moves where liquidity demands. Let’s see how this unfolds.

Disclaimer: Shorting is risky. It requires discipline, patience, and strict risk management. Never risk more than you can afford to lose, and don’t go all in on a single trade. If you’re new to shorting, practice on a paper account first. Be careful, manage your capital wisely, and always have a stop-loss in place.

If you want more breakdowns like this, subscribe for real-time trade insights and market analysis.