Recession Risk 60% After Trump Tariffs

$3.1 Trillion Gone. One Chart I’m Betting On. | Episode 8

I don’t have good news, Nasdaq dropped nearly 6%, its worst day since 2020. As of April 4, 2025, the market slide has deepened, wiping out around $3.1 trillion.

Why?

Simple.

Trump’s tariffs = biggest tax hike since 1968.

All three major indexes are now in correction territory, and the Russell 2000? It's officially in a bear market.

JPMorgan just raised the odds of a U.S. & global recession to 60%.

Retaliation, broken supply chains, collapsing sentiment—JPM calls it a macro shock big enough to break the economy.

We’re not in soft landing territory anymore.

Freedom Trade of the week

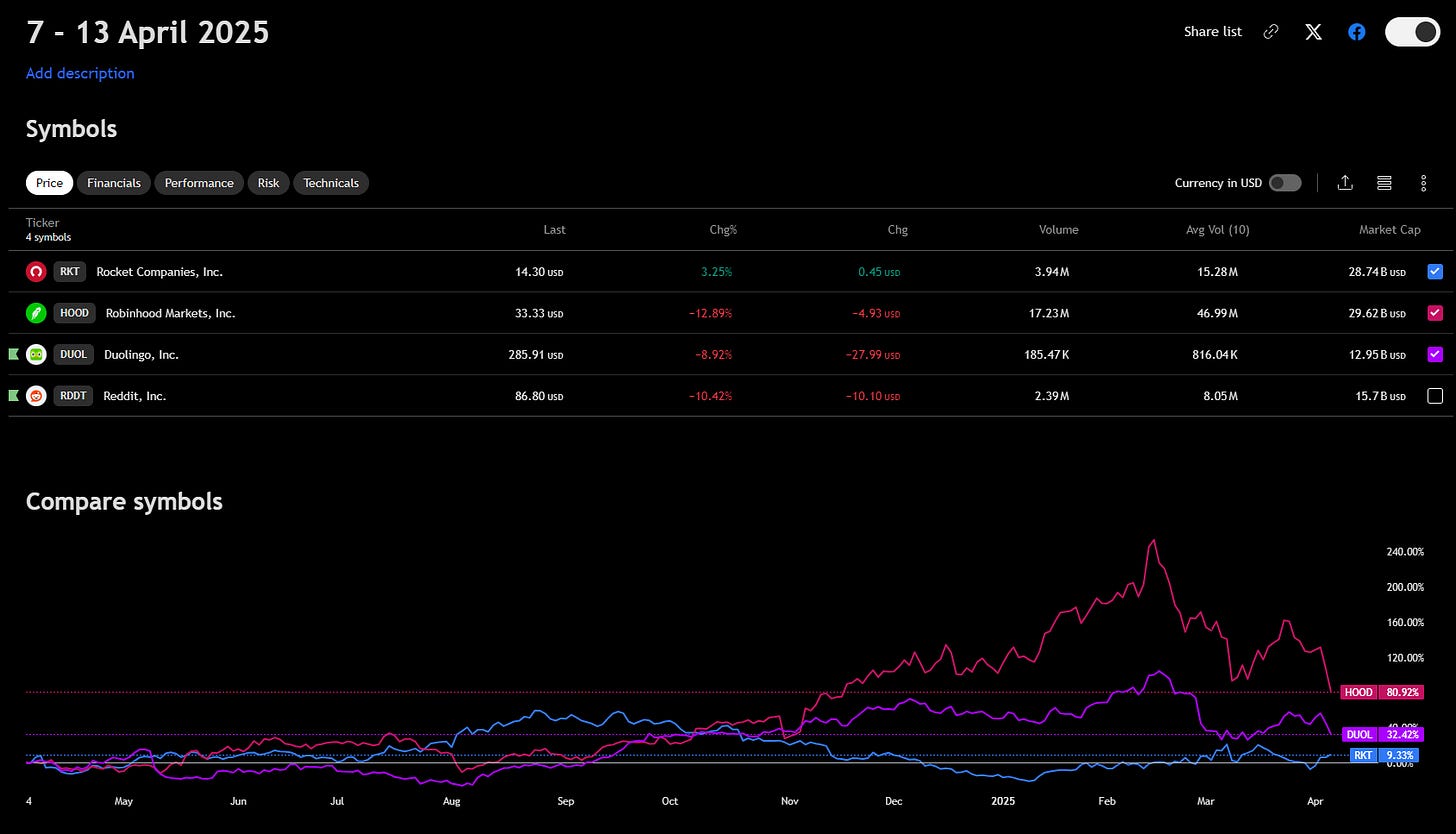

RKT Trade Setup – Long

If price holds above the 200 SMA and confirms this breakout with volume, then we’ve got the start of a trend reversal. That push through the 50 and 100 EMAs is no joke, it’s reclaiming ground fast after the March flush.

Entry: anywhere between $14.30–14.50 on a slight pullback or consolidation above the 200 SMA.

Stop: just below $13.10, under that last higher low and below all key EMAs—if it fails there, thesis is invalid.

Target: short-term swing to $17.50, with an eye on $19.00 if momentum carries.

If RSI clears 60 and price breaks above the recent high at ~$15.50, we’re looking at serious follow-through.

If not? No hero trades, cut fast, move on.

You’re not marrying it. Just dating it for a quick move.

Confidence Level (1-5): 💸💸

Be careful! The market is not favorable for long positions right now.

If you want more setups and trades like this, upgrade your subscription for full access!

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely:

Get exclusive market insights—access my free watchlist now!

🔗 Check it out here: TradingView Watchlist

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

This Week in the Economy: What You Need to Know

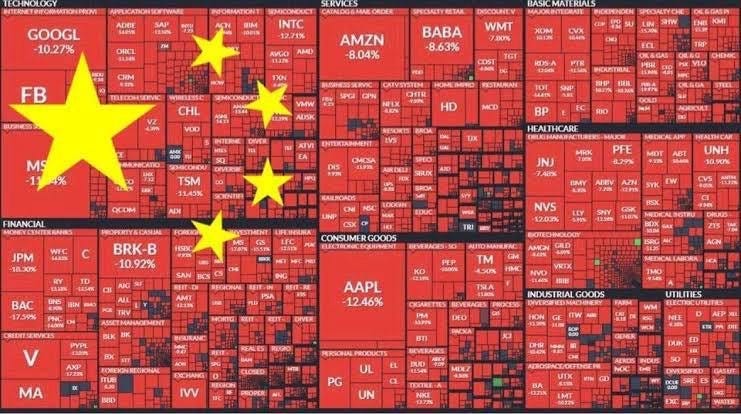

Turns out, Trump’s idea of “Liberation Day” was less about freedom, and more about freeing the S&P 500 from its hopes of a Q1 rebound.

The chaos started with a now-viral poster board announcement unveiling sweeping tariffs, sending the markets into a full-blown meltdown. By the opening bell, nearly $2 trillion in value had evaporated.

Here’s the gist: Trump slapped a blanket 10% tariff on all exports to the U.S., with even steeper rates for countries running big trade deficits with America, think China, Japan, and the EU.

Wall Street was hoping for tough talk, not an economic gut punch. While Trump framed it as a win for U.S. manufacturing, the market saw it as a self-inflicted wound.

By mid-morning, over 80% of S&P 500 companies were bleeding. Apple, Nike, and Amazon got hammered. Retailers like Target and Dollar Tree tanked. Big Tech? Wrecked.

Only a few held strong, consumer staples, utilities, and healthcare weathered the storm best. American-made companies and ETFs tied to Mexico and Canada actually saw a bump, simply because they dodged the worst of the damage.

Edit:

China just fired back. Starting April 10, it will impose a 34% tariff on all U.S. imports, in direct retaliation to President Trump’s newly announced 34% tariff on Chinese goods. The trade war just got real.

Key economic events to watch next week

Big week ahead.

The market’s already on edge post-tariffs, and now we’re heading into a data storm:

– Wednesday: FOMC Minutes drop. If the Fed sounds even a bit hawkish, brace for more selling.

– Thursday: Inflation data hits hard—CPI, Core CPI… all eyes on whether inflation is cooling or re-igniting.

– Friday: PPI and Consumer Sentiment. If producers feel the squeeze and consumers lose confidence, recession fears might hit full volume.

In short: volatility isn’t done with us yet.

Earnings to watch - Who’s making money?

Here are some interesting earnings reports coming up:

Wednesday

Delta Airlines (DAL) – Before Open

The market wants to see if travel demand is holding up under rising costs. A strong beat here could lift the entire airline sector. A miss? Confirmation that consumers are pulling back hard.Constellation Brands (STZ) – After Close

Alcohol demand is a stealthy economic signal—if they’re raising prices and still selling, that’s consumer strength. Weak margins = inflation pressure still biting.

Thursday

CarMax (KMX) – Before Open

Used car sales are a credit market thermometer. If financing demand is down or margins shrink, it's a red flag for the average consumer’s wallet.

Friday

JPMorgan Chase (JPM) – Before Open

The most important print of the week. If JPM warns on credit or deposits, the whole financial sector will feel it. If they’re strong, it brings some calm back.Wells Fargo (WFC) – Before Open

A read on U.S. consumer banking. Watch for loan growth, credit quality, and commentary on rate sensitivity.BlackRock (BLK) – Before Open

Massive AUM player. If flows are dropping or clients are going defensive, expect risk-off sentiment to grow.Morgan Stanley (MS) – Before Open

Leans on capital markets—if MS reports trading revenue weakness or M&A slowdown, it could weigh on sentiment for tech and growth stocks.BNY Mellon (BK) – Before Open

Not flashy, but important for back-end market operations. A solid print signals institutional confidence is intact. A weak one could hint at deeper liquidity issues.

Friday is the main event. The rest is the buildup.

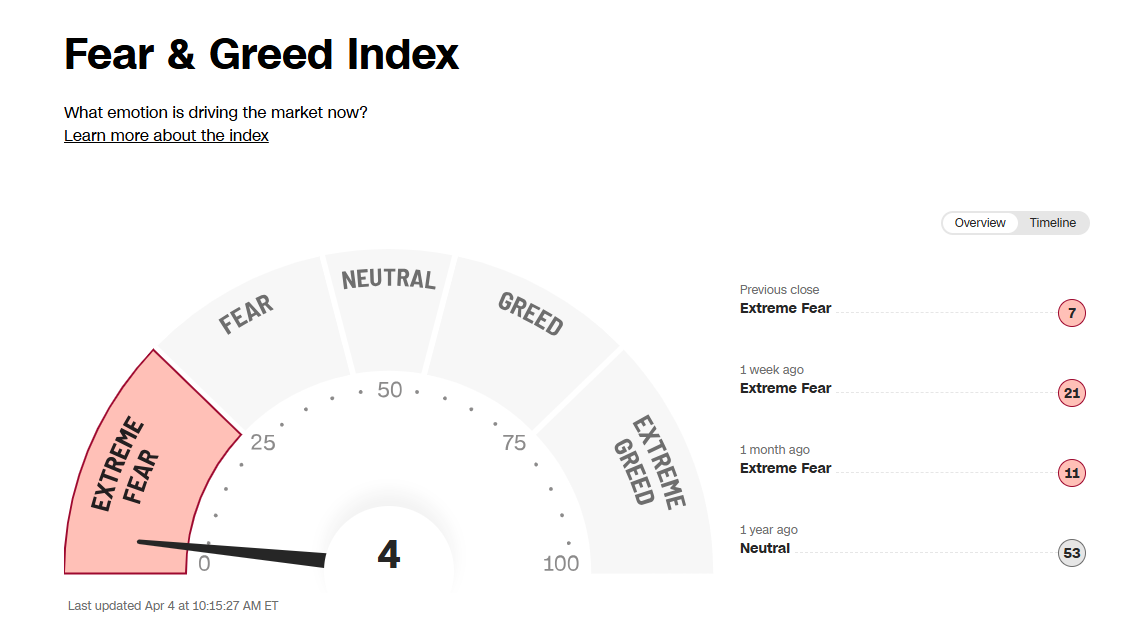

Fear & Greed Index

Can we get a 1 ?

Meme of the week

Closing Bell

That’s the wrap. Volatility’s back, uncertainty is the default, and most people are either frozen or panicking.

But not you.

You’re here to learn, prepare, and act. Keep sharpening your edge, keep showing up, and never forget, financial freedom isn’t a game, it’s your future. So be relentless.

Until next Sunday,

Vladislav