The #1 Reason Traders Fail

(Hint: It’s Not Their Strategy) | Edition 20

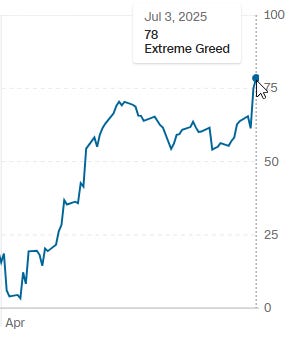

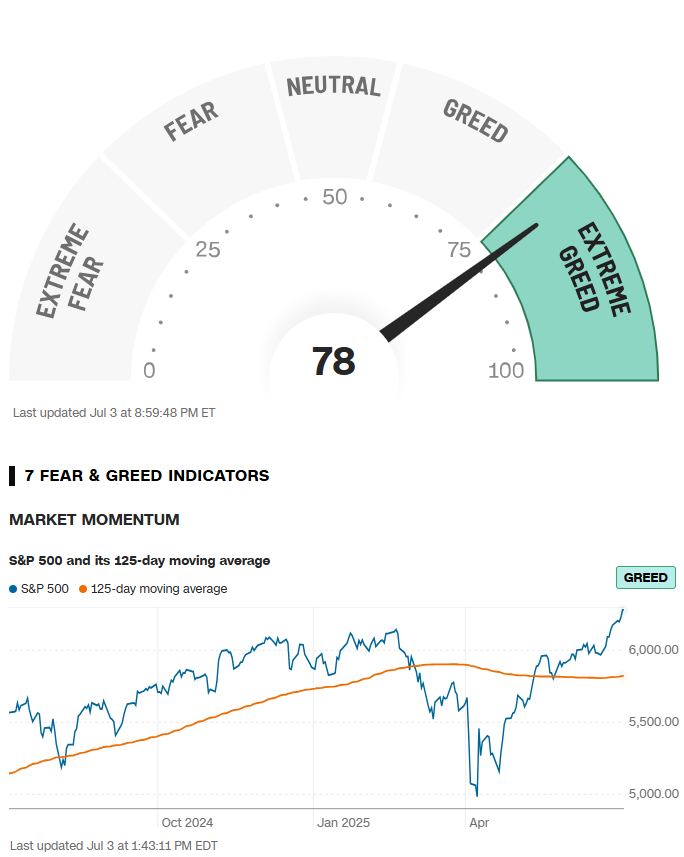

Does anyone remember April? 4 months ago everyone was screaming recession, well since then the market has gone from extreme fear to extreme greed.

Is next week setting us up for a surprise with Trump’s “Big beautiful bill”?

Ouuu and one more thing, the 90-day tariff pause expires on July 9 :)

I personally am in a small short position to hedge some of my exposure. Of course, I’m ready to close it anytime the market proves me wrong.

And so should you, because in the end, the only thing we control is how much we lose. Risk management is a retail trader’s most powerful weapon.

and that's exactly the topic today “The #1 Reason Traders Fail” …

Stop Trying to Be a Hero. Your First Job is Not to Go Broke.

Let’s get something straight.

Most traders are obsessed with finding the one trade that will make them rich. The 10-bagger. The life-changer. They hunt for moonshots, praying for a win that will erase all their mistakes.

That’s not trading. That’s playing the lottery with extra steps.

I’ve been broke. I’ve seen my business, my contracts, and my hard work evaporate into thin air. That kind of failure teaches you something you can't learn from a textbook: the most important part of winning is learning how to survive the losses.

If you’re serious about this, your mindset has to shift. You’re not a hero. You’re not a gambler. You are the manager of a business, and your capital is your inventory. Your only job is to protect it at all costs.

Forget the Lambo dreams for a minute. Let’s talk about how to actually stay in the game long enough to win.

Your Stop-Loss Is a Business Expense.

People hate stop-losses. Why? Because it means admitting you were wrong. It feels like a failure.

Let me reframe that for you.

A stop-loss isn't an admission of failure. It's firing an employee that isn't doing its job. The trade isn't working. It’s costing you money. Why would you keep it on the payroll? You wouldn't. You’d cut it loose and find a better candidate.

Treat every loss as a calculated business expense. It’s the cost of finding out which trades are the real winners. Pay the fee, take the lesson, and move on.

The 1% Rule is your Armor.

Here’s the most practical tip I can give you. Never risk more than 5% of your entire trading account on a single trade. (especially at the beginning!!!)

Don't just nod your head. Actually do the math. If you have a small account, say $10,000 account, you cannot lose more than $500 on any one position. Period. (in fact 5% is already a lot, the standar is 1% , but as a swing trader, sometimes this does not apply)

Why? Because with this rule, you could be wrong 10 times in a row and you’d only be down 10%. You can recover from that. But if you risk 20% or 30% on a trade, a few bad decisions can wipe you out completely.

It forces you to detach from the money. It stops you from making emotional, all-or-nothing bets.

Stop Averaging Down on Losers.

You are not an investor catching a falling knife. You are a swing trader. The stock is falling because your initial thesis was wrong. Buying more is like throwing good money after bad. You are reinforcing a losing position.

Cut the damn trade. Let it go. There are thousands of other stocks. Find one that's actually going in the right direction. Don’t marry your trades. They will not love you back.

Know When to Walk Away.

Sometimes the best risk management is closing your laptop.

As I've written before, when life gets stressful, when you’re burnt out or juggling a million other things, you are your own worst enemy in the market. Your judgment is clouded. You’ll force trades. You’ll miss your exits.

Staying in cash is a position. It's a strategic decision to protect your capital, both financial and mental, when you are not at your best. Trading will be here tomorrow. Make sure you are too.

Making money is the result. Managing risk is the job.

Start acting like a professional.

Freedom Trade of the week

The ticker is SMR 0.00%↑ . I wouldn’t buy it right now, but I have it on my radar for a potential second leg – double test of the high at 44.

The stock is still not cheap enough for me. I also want to see volume increasing, which is not the case yet. On top of that, we have to consider that the stock is already up 93% YTD, so the upside potential is limited given that this company isn’t even profitable. Very speculative.

As I said, I’ll keep this ticker on my watchlist for now, and if I get the signal, I’ll enter a position.

Also, the position in Unity from last week is still open.

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Get exclusive market insights, access my free watchlist now!

🔗 Check it out here:

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

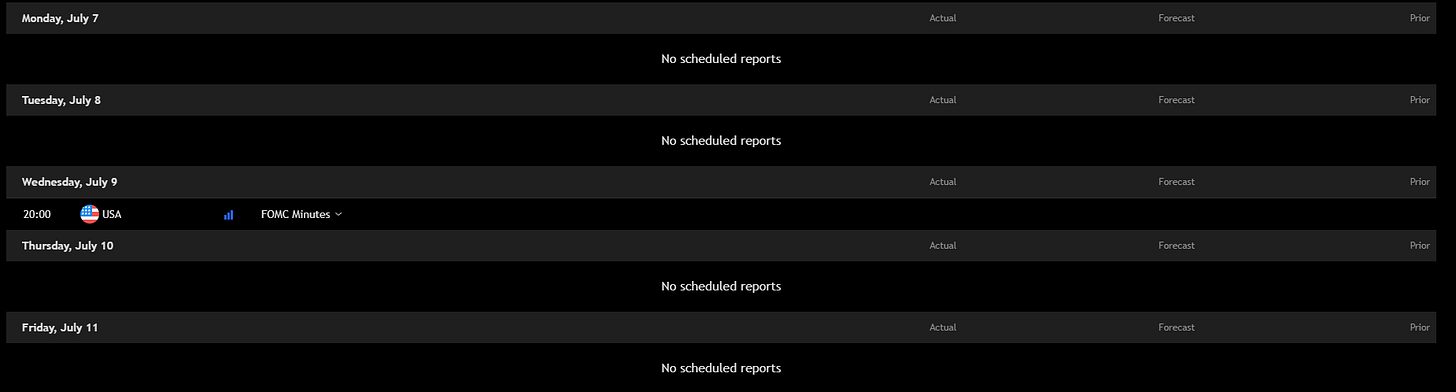

Key economic events to watch next week

Quiet macro week ahead, no major reports until Wednesday’s FOMC minutes. That drop could shake up markets.

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

Watch Thursday closely. Delta, Levi’s, and WD-40 could set the tone for consumer sentiment and travel momentum.

Fear & Greed Index of the week

Financial Meme of the week

Other great reads

Thank you for being with me in this edition, and if you think this newsletter could be helpful for your friends, share it with them so it can reach as many traders as possible.

“One trade closer to freedom.”

Vladislav