The $10K Trade That Made Me 32% in a Day (And Why I Sold Immediately)

Trade of the Week | Edition 25

Hello traders,

I’m writing this newsletter from the beautiful yacht named YOLO… where I decided to spend four days with some of my colleagues.

As I write this newsletter, I’m reflecting a bit on how much my life has changed over the past five years.

Five years ago (I was 25 at the time), I was at the end of my rope, exhausted both physically and mentally, and a person who had lost six figures in business ventures and five figures in trading…

It was a turning point for me, a moment when I decided that my life wasn't going to end like this.

That I can rebuild, and that at the end of the day, I'm just paper...

In less than three years, I recovered the amount I had lost, and in five years, I’m well on my way to achieving financial freedom for my family.

More than that, I get the opportunity to share all of this with you and meet extraordinary people like you who are on the same path. I truly feel blessed…

Moral of the story: NEVER, EVER, GIVE UP! You got this!

Anyway, I don’t want to sound cheesy, so let’s get started with this newsletter.

This week was one where I played defensively, my largest position was $10,000, relatively small compared to my trading account.

If you’ve been following me, you know that I took a small position in DUOL about three weeks ago.

Well, that position delivered a 32.7% return in a single day after Duolingo raised its third-quarter and full-year guidance, driven by a strong second quarter with 41% revenue growth and earnings of 91 cents per share.

I sold at $451.

I sold immediately at the open because, based on my experience and the price action I saw, it looked like an overreaction to the news Duolingo had announced. For me, a 32% gain in a single day is extraordinary. I don’t want to get greedy, that’s why I sold. I would’ve sold even if it was 20%.

Immediately afterward, there was a massive 22% sell-off, it seems I’m not the only one who took profits.

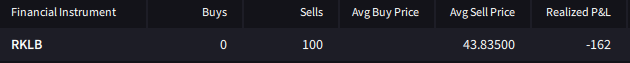

Then there’s RKLB, unfortunately, it was a miss for me. Although the idea was good, the way the price action moved made me sell my position of just 100 shares at a -3.5% loss.

And RGTI with 300 shares, was only a modest win of 5%. It had greater potential, but it closed below the 10 EMA, losing its momentum for a while. Still, I see potential in it, so let’s see how the market reacts on August 12 at earnings.

I might re-enter, but don’t worry, I’ll let the PRO community members know the moment I do.

Speaking of that, a new member joined the PRO Freedom Trades community this week, and that makes me grateful for the chance to meet you and help you in your trading journey.

Yes, I offer weekly stock picks with levels and everything, yes, I share my watchlist and chat updates, and I’ve even shared my full strategy with all the details, but:

The real value of the membership lies in the calls I have with you, in the conversations we share. That’s where you truly learn the ins and outs…

Trade Setup of The Week

Ticker is $NU. If the price manages to maintain the support zone at $12, there is potential to retest the previous high of $14, giving us a reward of approximately 14%. If it manages a breakout, it could go to $15.80, which means a 32% reward.

Keep an eye on the earnings report on August 14. Size accordingly!

If you want more setups for this week, check out this post:

Copy my Watchlist for next week

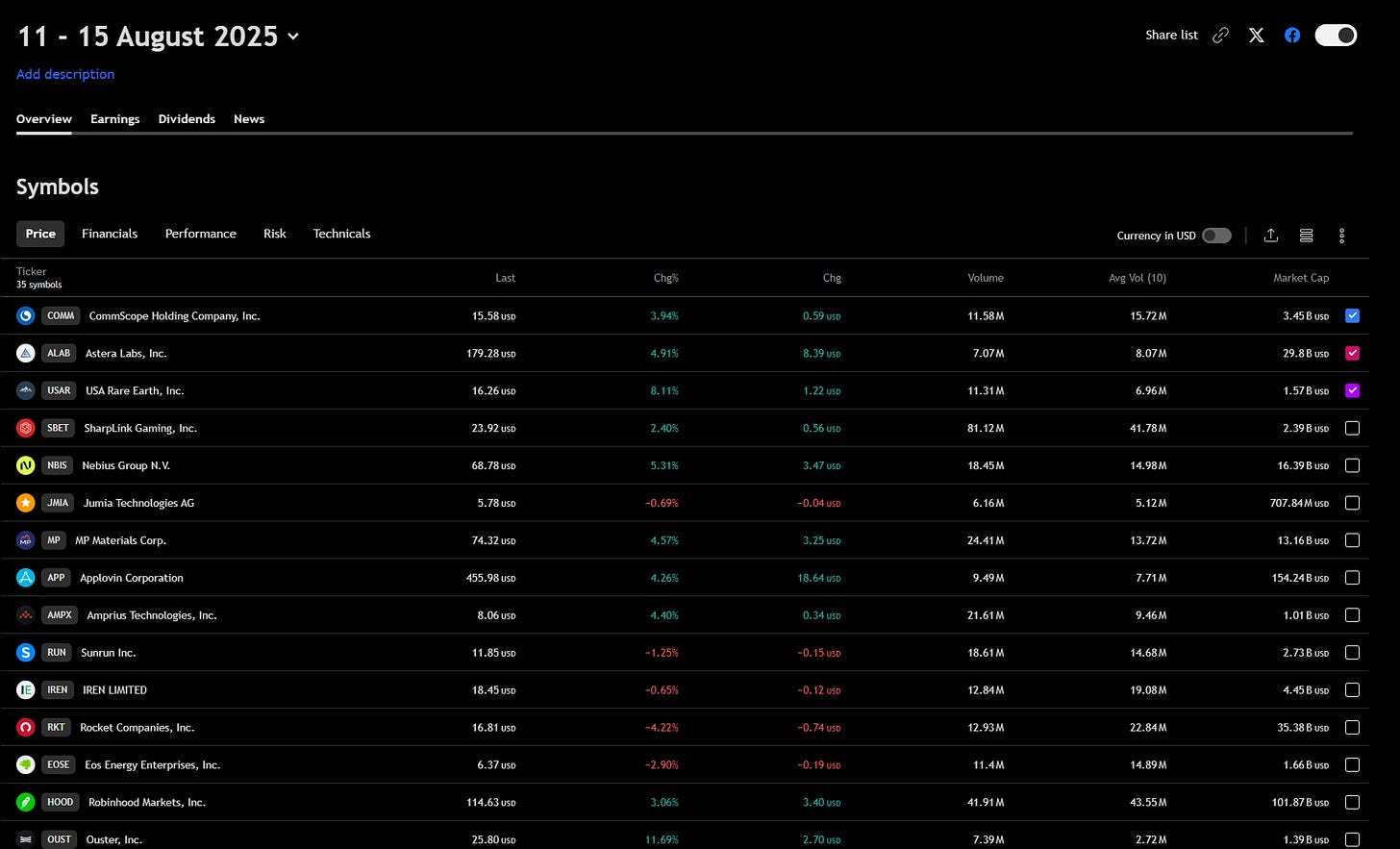

Here are the stocks, sectors, or trends I’m watching closely.

Access my free watchlist here:

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch. Gain access to my trading strategy, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

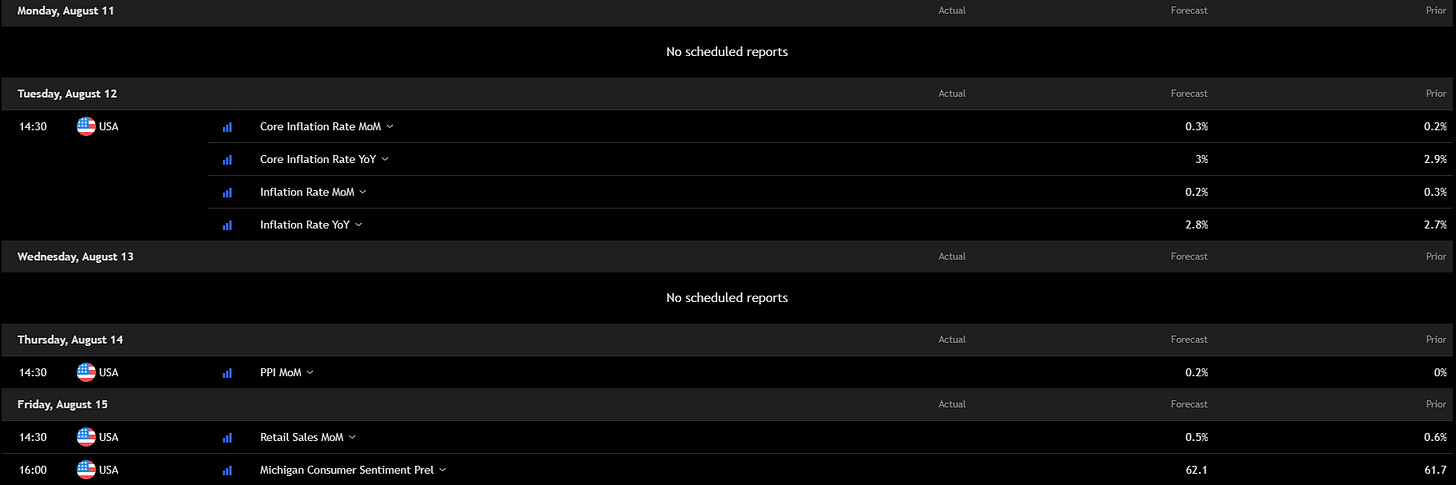

Key economic events to watch next week

Big week, CPI on Tuesday is the main event, with PPI and retail sales to follow. Volatility is almost guaranteed.

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

This week’s earnings calendar is stacked with some heavy hitters and market movers:

Cisco (CSCO) – Big in networking and enterprise IT, often a tech sentiment barometer.

Applied Materials (AMAT) – Key semiconductor equipment player, tied to the AI and chip boom.

JD.com (JD) – One of China’s largest e-commerce giants, closely watched for China consumer trends.

AMC (AMC) – Meme stock legend.

RGTI and NU.

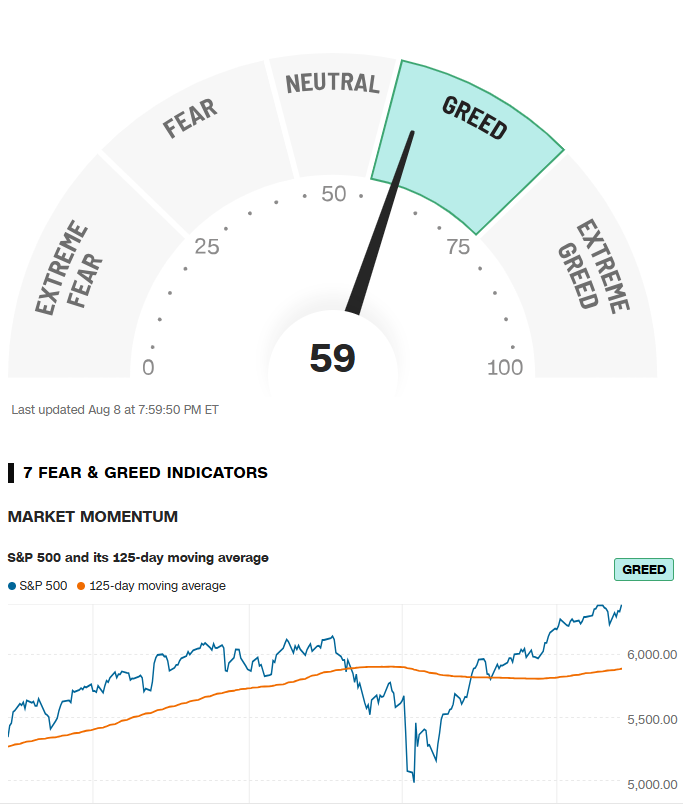

Fear & Greed Index of the week

Financial Meme of the week

Thank you for being with me in this edition, and if you think this newsletter could be helpful for your friends, share it with them so it can reach as many traders as possible.

“One trade closer to freedom.”

Vladislav

Congrats!