The 9-to-5 job is the riskiest investment you’ll ever make. Here is why.

Weekly EDGE (24-30 March 2025) | Episode 6

You ever get that weird feeling deep down, like your job could vanish tomorrow and you’d be screwed?

You’re not crazy. That’s reality. And no one wants to say it out loud, but your so-called “stable” 9-to-5 might be the riskiest investment you’ll ever make.

Think about it. One income stream. One boss. One paycheck every two weeks. All your financial security tied to a single company that could cut you loose the moment they miss a quarterly target. It’s like putting all your money into one stock and praying it doesn’t crash.

And don’t buy the myth of “security.” Just look around. The U.S. unemployment rate just ticked up to 4.1% and that’s with a supposedly strong economy. Layoffs are always just a bad quarter away. Your job exists because you’re profitable for the company, not because anyone cares about your future.

And let’s talk about income. Yeah, you might get a raise every year, but most of the time, it barely keeps up with inflation. The median income is around $60k these days. Cool. But when rent, groceries, and everything else keeps climbing faster than your paycheck, you’re not moving forward. You’re treading water.

Meanwhile, your time is gone. Forty, fifty, sixty hours a week building someone else’s dream while yours sits on the shelf. And for what? A predictable paycheck and the illusion of safety?

I’m not saying quit your job tomorrow and YOLO into options trading. I’m saying: recognize the risk you’re already living with.

Build something of your own. Start small. A side hustle. A freelance gig. Learn how to make your money work for you instead of the other way around. Because when your job is your only source of income, you’re not “secure.” You’re just exposed.

And maybe that’s exactly why you’re here, reading this, inside this community.

Because some part of you already knows: there’s another way. You just need a system that actually works. One that doesn’t sell hype, but teaches you how to think, trade, and invest like someone who’s building freedom, not waiting for permission to have it...

Let’s dive into this week’s Weekly Edge, the watchlist, setups, and market insights to help you take control.

Freedom Trade of the week

FSM just launched nearly 40% off the lows, driven by a wave of speculative buying following major geopolitical news. Price is now pushing into prior resistance with RSI flashing overbought, and we’re seeing signs of momentum fatigue.

This kind of parabolic rally often invites short-term profit-taking and can unwind fast, especially if there's no follow-through.

✅ Entry: $5.95–$6.10 (on weakness or failed breakout setup)

❌ Stop-Loss: $6.35 (above recent high and psychological breakout level)

Risk & Macro Context

This move was news-driven, Trump just signed an executive order using the Defense Production Act to prioritize U.S. mineral producers. The goal? Reduce reliance on China, which currently controls 70% of global rare earths.

Yes, that can ignite a sector-wide rally, but it also brings volatility. If China hits back with export restrictions, the market could spike harder, or reverse even faster.

Don't front-run this short. Wait for confirmation, failed breakout, fading volume, or a clean rejection candle.

This is a high-risk setup. Trade the chart, not the headlines.

Confidence Level: 🔥🔥🔥 (Medium – only with confirmation)

If you want more setups and trades like this, upgrade your subscription for full access!

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely:

Get exclusive market insights—access my free watchlist now!

🔗 Check it out here: TradingView Watchlist

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

This Week in the Economy: What You Need to Know

1.The US Fires Up Its Mining Game

Donald Trump just signed an executive order to boost domestic mining, using the Defense Production Act to prioritize financing and permits for mineral producers. Why? Because China controls 70% of the world's rare earth materials, and any disruption could cripple US industries.

Markets might see a mining stock rally, but expect volatility especially if China tightens exports first. Plus, environmental and regulatory hurdles could slow things down. Meanwhile, China is locking in global supply deals and expanding its refining capacity, keeping control of its supply chain while the US scrambles to catch up.

2.Jobless Claims Tick Up Slightly

US jobless claims rose to 223,000 last week, up from 221,000, while continuing claims hit 1.89 million, signaling a slight increase in unemployment. Economists had expected 225,000 new claims.

Despite concerns about a slowing job market, layoffs remain stable, with initial claims staying between 200,000–250,000 for months. Federal job cuts haven’t significantly impacted data yet, though analysts are watching for effects from canceled government contracts.

For now, hiring remains sluggish, and job seekers face challenges, but no major downturn has appeared.

3.Higher Tariffs Would Raise Inflation, Slow Growth, ECB's Lagarde Says

ECB President Christine Lagarde warned that higher U.S. tariffs on EU imports and potential retaliation would slow eurozone growth and raise inflation. A 25-percentage-point tariff hike could cut growth by 0.3 percentage points, with EU countermeasures deepening the hit to 0.5 points.

She noted inflationary effects would fade, suggesting no ECB rate hikes. With U.S.-EU trade tensions rising, President Trump is set to announce new tariffs on April 2, adding to global economic uncertainty.

Key economic events to watch next week

It’s a quiet start to the week, but major U.S. economic reports are set to drop from Wednesday onward. Durable Goods Orders (Wednesday) are expected to decline -0.7%, a sharp reversal from last month’s 3.1% gain—suggesting weaker business investment.

On Thursday, GDP Growth (Q4 Final) is forecast at 2.3%, down from 3.1%, hinting at slowing economic momentum.

Friday brings critical inflation data, with Core PCE Price Index (the Fed’s preferred inflation gauge) expected at 0.3% MoM, alongside Personal Income (0.4%) and Personal Spending (0.6%), which could shape market sentiment.

Earnings to watch - Who’s making money?

Here are some interesting earnings reports coming up:

Some of the most interesting and big companies reporting earnings for the week of March 24, 2025, include:

Monday: KB Home (KBH)

Homebuilders have been on fire due to the ongoing housing supply crunch and high demand. KB Home’s report will give insight into how mortgage rates and affordability are impacting new home sales. If they guide strong, expect a ripple effect across the housing sector.

Tuesday: GameStop (GME)

The meme stock legend is back. GameStop’s earnings are always a wild card, with retail traders watching closely. The big question: Is the turnaround plan working, or is the company still struggling to stay relevant in a digital gaming world? Expect volatility.

Wednesday: Dollar Tree (DLTR) & Chewy (CHWY)

Dollar Tree is a key player in the consumer staples sector, if they report strong numbers, it signals that budget-conscious shoppers are still spending. Meanwhile, Chewy gives us a pulse on the pet industry, which has been growing but faces cost pressures.

Thursday: Lululemon (LULU) & Braze (BRZE)

Lululemon is one of the hottest brands in retail, and their earnings will show if high-income consumers are still splurging on premium athleisure. On the tech side, Braze (a customer engagement platform) will be worth watching to gauge enterprise spending trends.

Friday: Light on big names

Which earnings report are you watching closely this week? Send me a message or leave a comment on Substack.

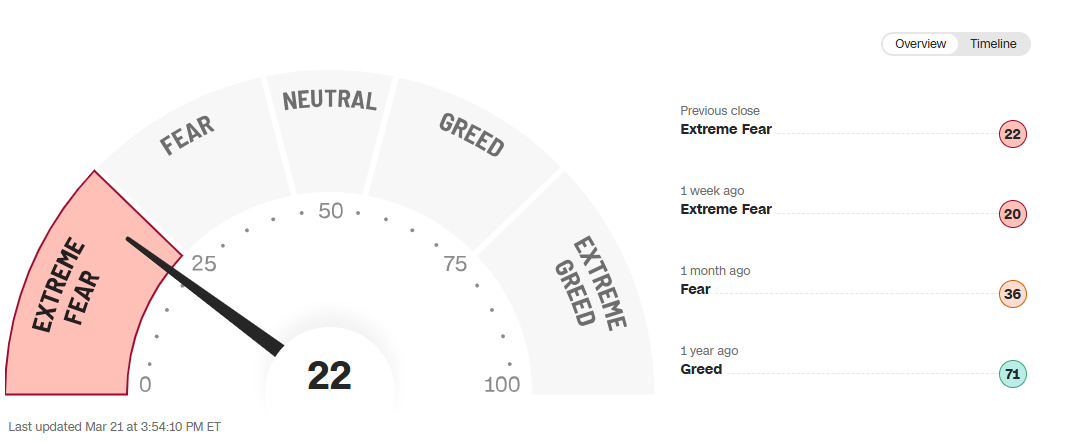

Fear & Greed Index

Meme of the week

Closing Bell

This one delivered exactly what we wanted, textbook pop-fade on weak structure and no real buyers behind the hype.

Entry near the top of the breakdown zone, followed by a fast -24.68% flush in just 4 trading days.

No diamond hands here, just risk-managed execution.

Here is the link to the Trade Idea that was posted on 17 March:

See you next Sunday,

Vladislav

9-5 has benefits, but what you said is true.

Especially ”layoffs are one negative quarter away”.

That hits deep.