The highest-probability trade of the year.

Don't miss out on this Long Swing | Episode 14

Trump stirred the markets again, threatening a 25% tariff on Apple unless Tim Cook moves iPhone production to the U.S., and throwing in a 50% tariff threat on the EU for good measure.

Apple’s also under attack from judges, regulators, lawmakers, and even Jony Ive, who’s now building an AI device with OpenAI to make screens obsolete.

Margins are under pressure. Services revenue is facing legal threats.

The question now: Can Apple win in AI the same way it conquered phones by showing up late but better? Investors aren’t so sure. The stock is down 25% from its peak.

Apple closed Friday down 3.03%. AAPL 0.00%↑

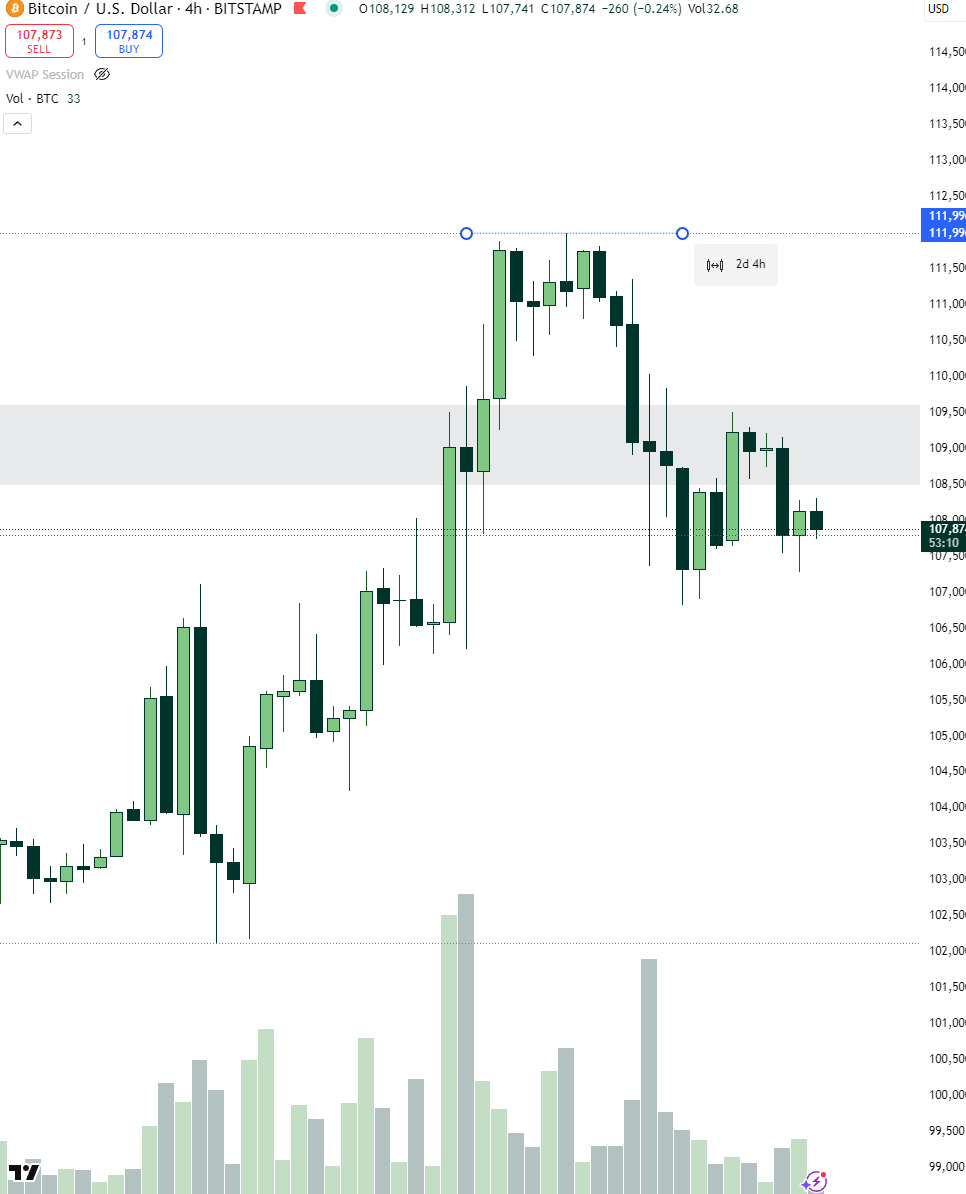

But Bitcoin hit an all-time high of $112,000 on Thursday, once again making it the best-performing asset.

And of course, the dollar slipped to its lowest level since 2023 after Trump’s tariff threats…

Freedom Trade of the week

I'm long on UNH 0.00%↑ United Health Group. The chart shows a textbook setup for a high-probability bounce, despite the brutal news cycle. DOJ investigations, nursing home scandal, CEO resignation, it’s all triggered a deep selloff, but what matters now is the reaction, not the headlines.

When you see that kind of panic selling into prior structural levels, it’s often where smart money starts adding. Price is now retesting that low area, which is exactly where I added to my position.

My plan is simple. First target is the gap fill, around $360–$380. That’s where most trapped longs will sell, and momentum traders will hesitate. I’ll start scaling out there. If the move has legs and macro doesn’t ruin the party, second target sits around $440.

Confidence level (1-5): 💸💸💸💸

PS: I am still long on HTZ 0.00%↑ Hertz.

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Get exclusive market insights, access my free watchlist now!

🔗 Check it out here: My Watchlist

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

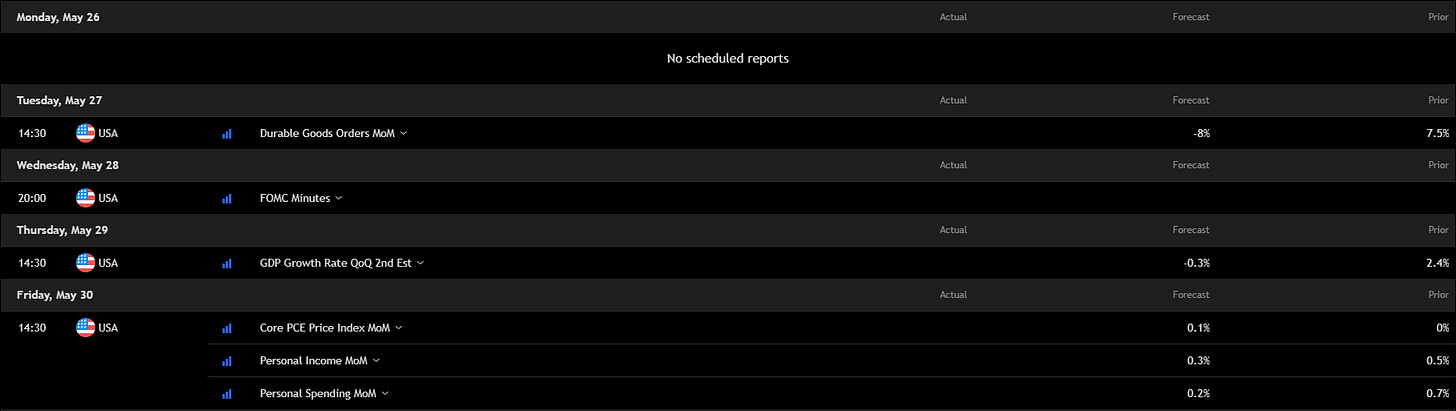

Key economic events to watch next week

Big macro week ahead. Tuesday kicks off with a brutal -8% forecast on Durable Goods, if it lands anywhere near that, recession whispers will get louder. Wednesday’s FOMC Minutes could shake things up if there’s even a hint of hawkishness or rate cut delays.

Thursday’s GDP revision is a reality check, if it confirms a slowdown, risk assets might wobble.

But all eyes are on Friday: Core PCE, income, and spending. That’s the Fed’s favorite inflation gauge, and it’s a triple threat. Soft numbers = fuel for the bulls. Hot print = brace for volatility.

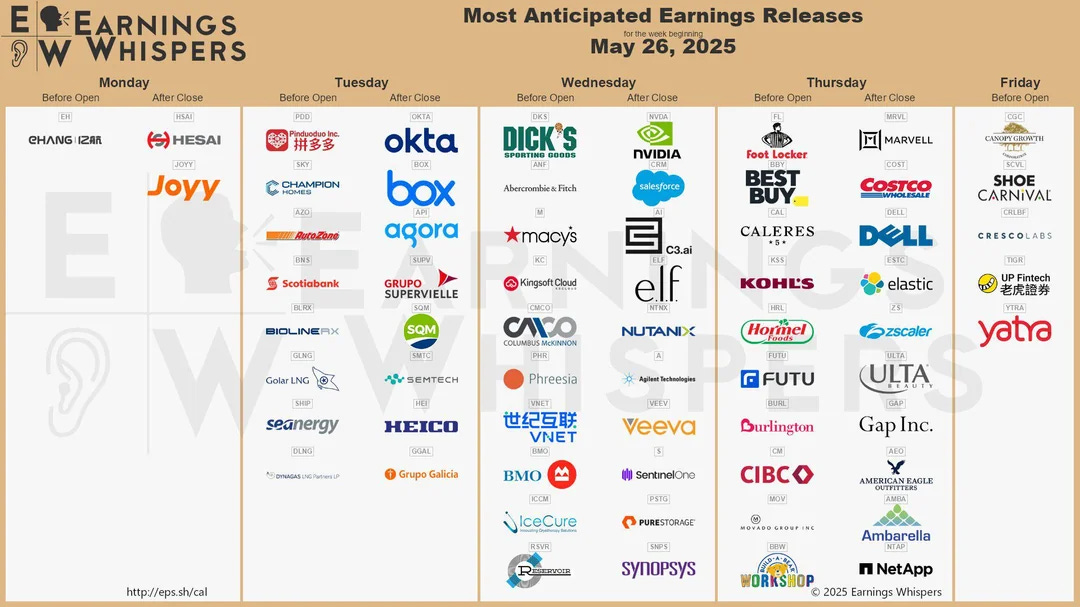

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

Big earnings week.

Nvidia is the headliner, AI hype on the line. A strong beat could ignite tech; a miss could deflate the AI trade.

Pinduoduo, Salesforce, and Dell give us clues on China, enterprise spend, and AI hardware.

Costco, Macy’s, Best Buy, Ulta = consumer pulse check. If they flash weakness, recession fears might resurface.

Eyes on Wednesday and Thursday. High impact.

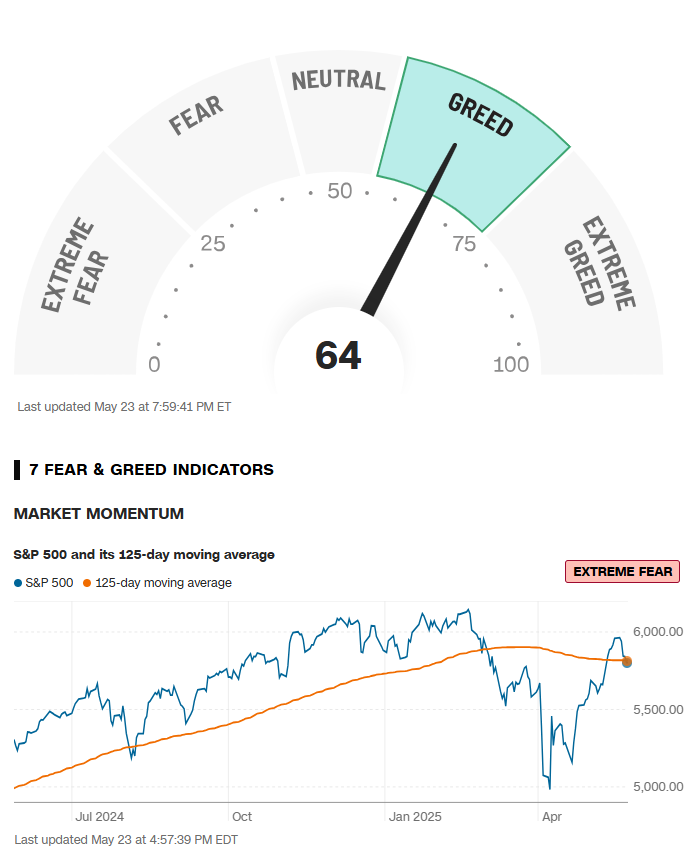

Fear & Greed Index of the week

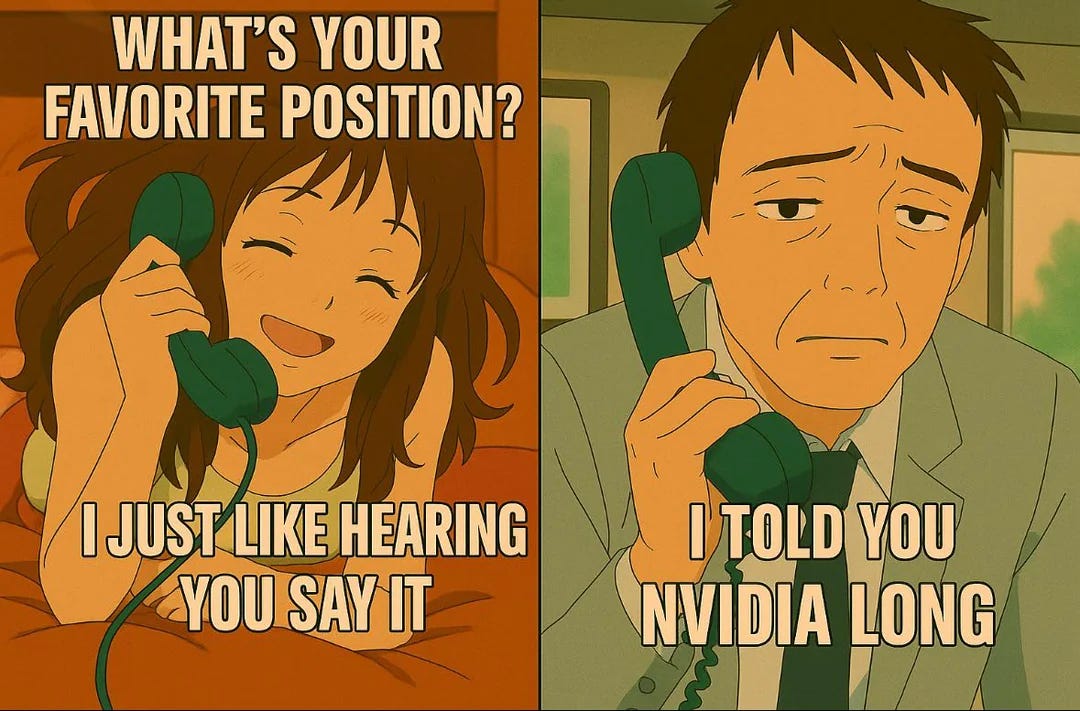

Financial Meme of the week

Remember, markets are closed on Monday for Memorial Day in the US, so it’s a short week, but one that is packed with economic reports and earnings announcements.

“One trade closer to freedom.”

Vladislav