The Reason You Can’t Trust Your Trades (Yet)

How pros build confidence | Edition 23

Hey traders, I'm still on vacation in beautiful Switzerland, and from time to time I check your messages on Substack.

I was chatting with a trader from the community who confessed he doesn’t trust his trades.

After asking him a few questions, I realized he has absolutely no system.

If you're still trading based on vibes, this will hurt.

But it’ll also save you.

You’ve probably been trading for months, maybe even years, and you’re still losing money.

Month after month, you wire your salary in and try to “hit big” with that one lucky trade.

I hate to break it to you, but… it’s never going to happen.

How do I know? Because I was that guy, for years.

Until December 2022, I had a great year, but then December came, the month when we’re supposed to get the Christmas rally, when most traders make their biggest profits, and I lost 5 figures.

In one day. Five figures.

Ouch. It hurts just writing this publicly.

And at that time, it meant a lot. It didn’t just destroy my capital,it wrecked my mental capital (which, trust me, is way more important than how much money you have for trading. You’ll realize that eventually).

It took me a long time to crawl out of that hole, mentally. Something shifted. I stopped trusting my trades. I stopped trusting myself as a trader.

What I haven’t told you until now is this: the trade that caused that loss? It wasn’t even part of my system.

Duh, right? You probably guessed that already.

It was an outlier. A position way too big, right before FOMC...

Let’s call it what it was: a gamble.

It’s been almost two years since that day, and I haven’t taken a trade like that since.

And guess what? My returns have been consistent ever since.

Because that day, I made a decision that changed my entire path as a trader:

I promised myself I would never take a trade outside my system again.

Not one.

Everything comes down to your system.

If your system is profitable, everything else becomes easier, your psychology, your mindset, your risk management.

Even if you’re a discretionary trader with no fixed entry system, you still need something to lean on when everything starts falling apart. At the very least, a system for risk management and exits.

That’s exactly what I’m trying to offer you with this newsletter: CLARITY.

To help you build confidence in yourself as a trader, and build a system that fits you.

At first, you’ll draw inspiration from my system, sure.

But real success comes when your system matches your personality, your risk profile, your way of thinking.

Your strategy has to be an extension of you.

Why? Because it’s way easier to adapt a strategy to fit you…

than to fundamentally change who you are.

That’s why those YouTube strategies don’t work for you.

You can’t be a scalper if your risk profile is that of a swing trader or investor.

That’s who you are at the core. And that won’t change anytime soon.

If what I just said feels like it was written for you, let’s work together.

Maybe I can help.

Freedom Trade of the week

The trade for this week is the ticker DUOL 0.00%↑

Here’s what I’m seeing:

Price is sitting right on the long-term trendline, holding that support zone but still trading below the 200 MA. That’s not ideal for momentum, but it's a spot where bulls could step in.

RSI just came out of oversold territory for the first time since the IPO. That’s not something you see often and usually signals potential for a reversal, if volume shows up.

First target shows about 20% upside, with a secondary target 48% if momentum follows through.

Earnings drop on August 9th, and that could be the real trigger. Could send price flying or wipe out the setup completely. It’s a binary risk.

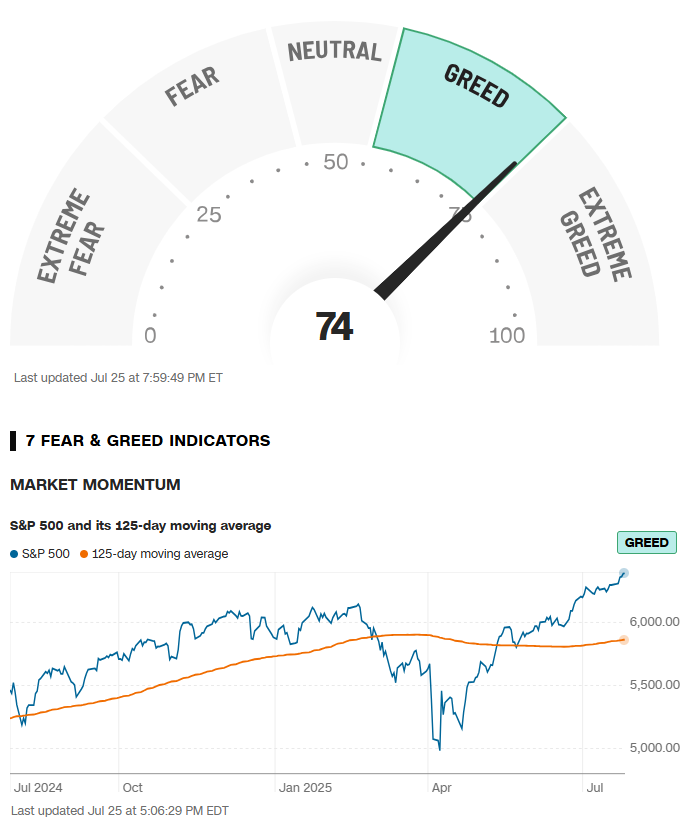

Also, don’t forget, market sentiment is sitting in extreme greed. If the broader market pulls back, this setup can collapse fast.

So trade it, sure, but size accordingly, manage your risk, and don’t get caught blindly long into earnings.

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Get exclusive market insights, access my free watchlist now!

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

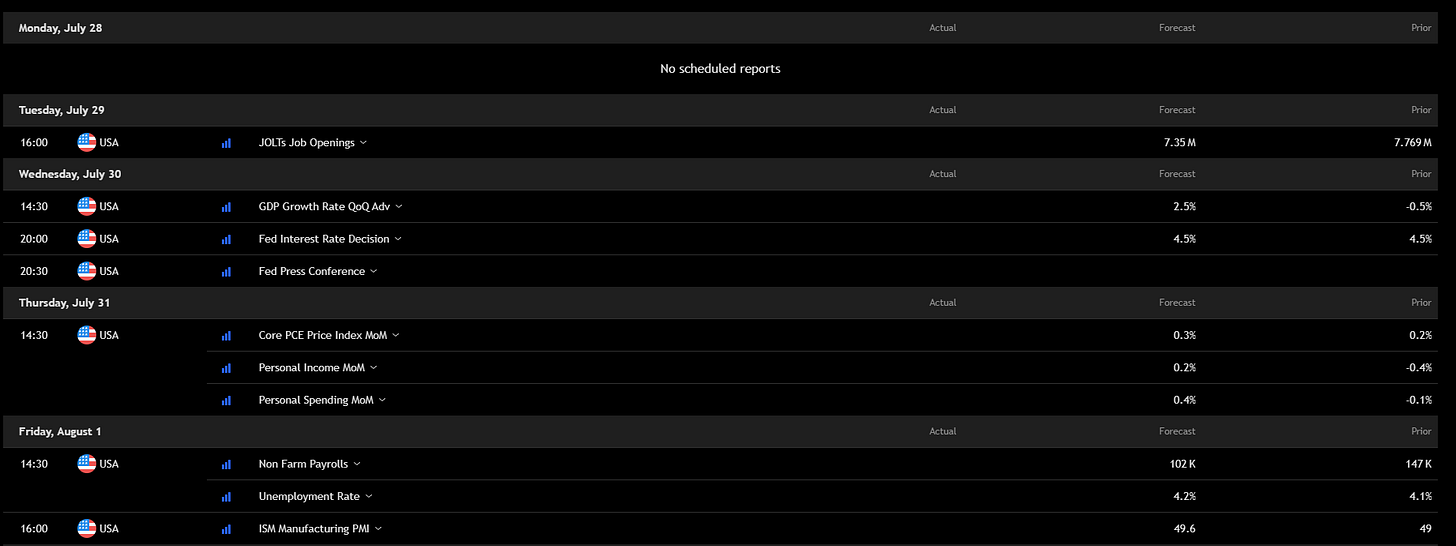

Key economic events to watch next week

Big week ahead, this is not the time to trade blind.

GDP, FOMC, PCE and NFP.

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

This week is earnings madness, Big Tech, Big Banks, Big Oil… all reporting.

Keep an eye on AAPL, AMZN, MSFT, META, RDDT and SOFI.

Fear & Greed Index of the week

Financial Meme of the week

Thank you for being with me in this edition, and if you think this newsletter could be helpful for your friends, share it with them so it can reach as many traders as possible.

“One trade closer to freedom.”

Vladislav