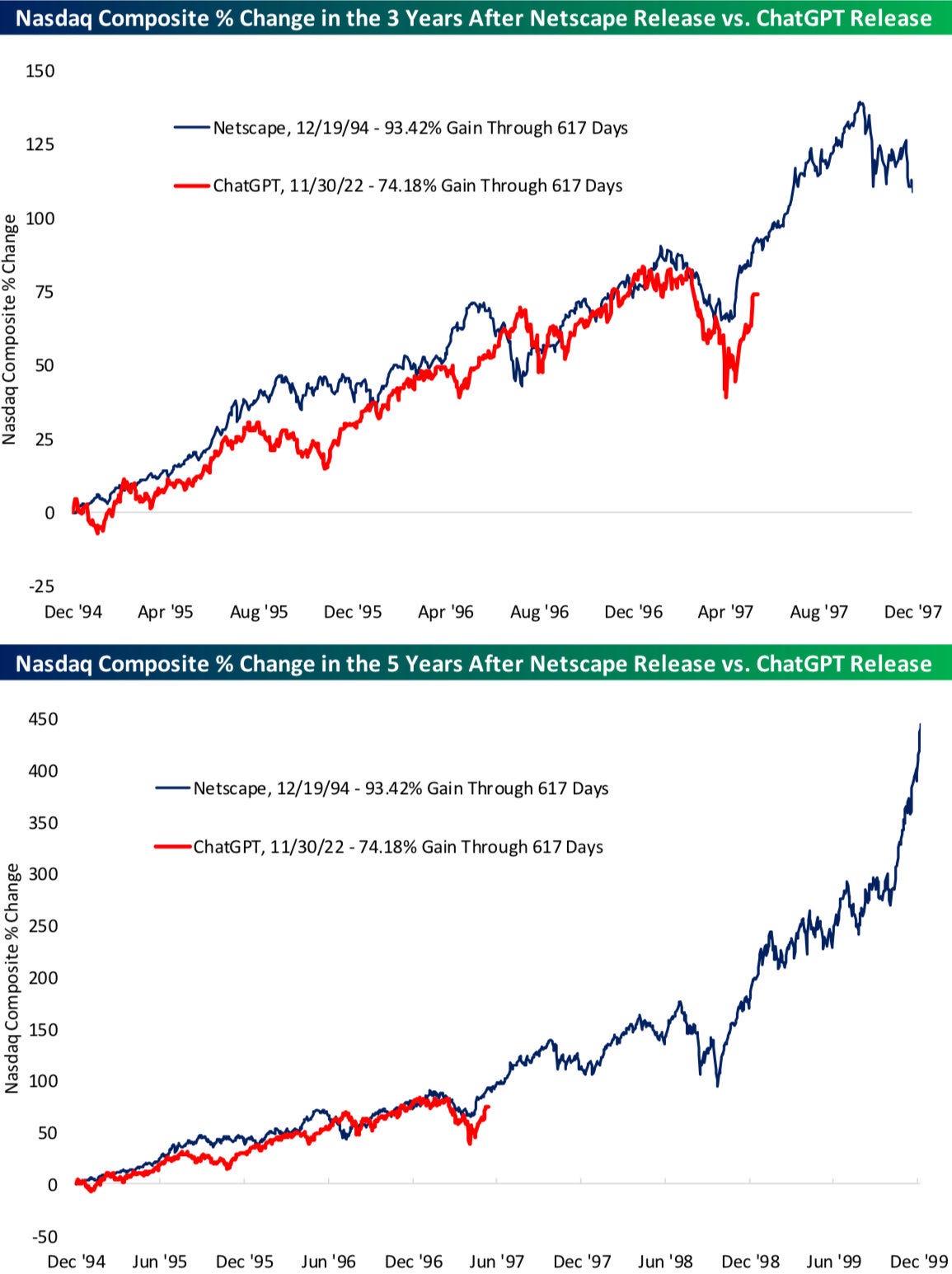

This Chart Says We’re in 1997 Again… You Ready?

Freedom Trades has a new permanent home | Episode 13

Before we start, I want to share something I’m really proud of:

Freedom Trades officially has a permanent home: ft.wtf

Yes… ft.wtf. I picked that domain because let’s be honest, sometimes trading feels exactly like that.

FT stands for Freedom Trades, but on the emotional rollercoaster of this game, it might also mean F%#K Trading, WTF 😂😂

Same content. Same journey. Same mission.

Bookmark it. Share it. Let’s keep building.

Now, here’s an interesting chart I found:

The Nasdaq’s performance after the release of ChatGPT is mirroring the post-Netscape boom almost step for step.

Bulls should hope the trend holds, because if it does, we’re still in 1997 on this analogue. And if you zoom out, you know what came next: a face-melting rally.

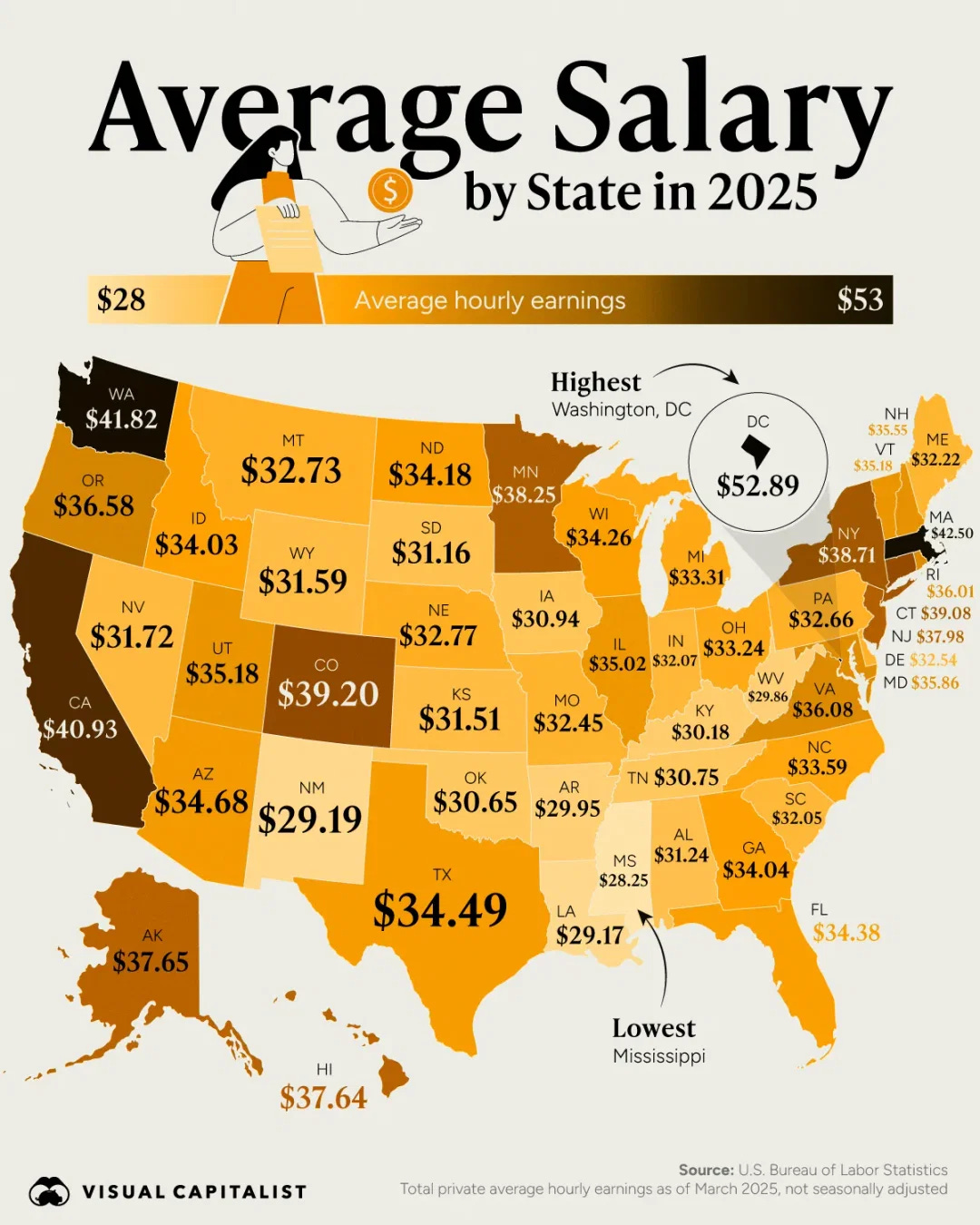

On another note, here is an interesting infographic I discovered today:

This map shows the average salary by state in 2025.

Most people are earning between $28 and $40 per hour… trading their time just to stay afloat.

Meanwhile, as a trader, your hourly rate isn’t capped by geography or a boss, it’s capped only by your skill, risk, and mindset.

You could live in Mississippi earning $28/hr, or you could learn how to trade and make that in minutes…from anywhere…

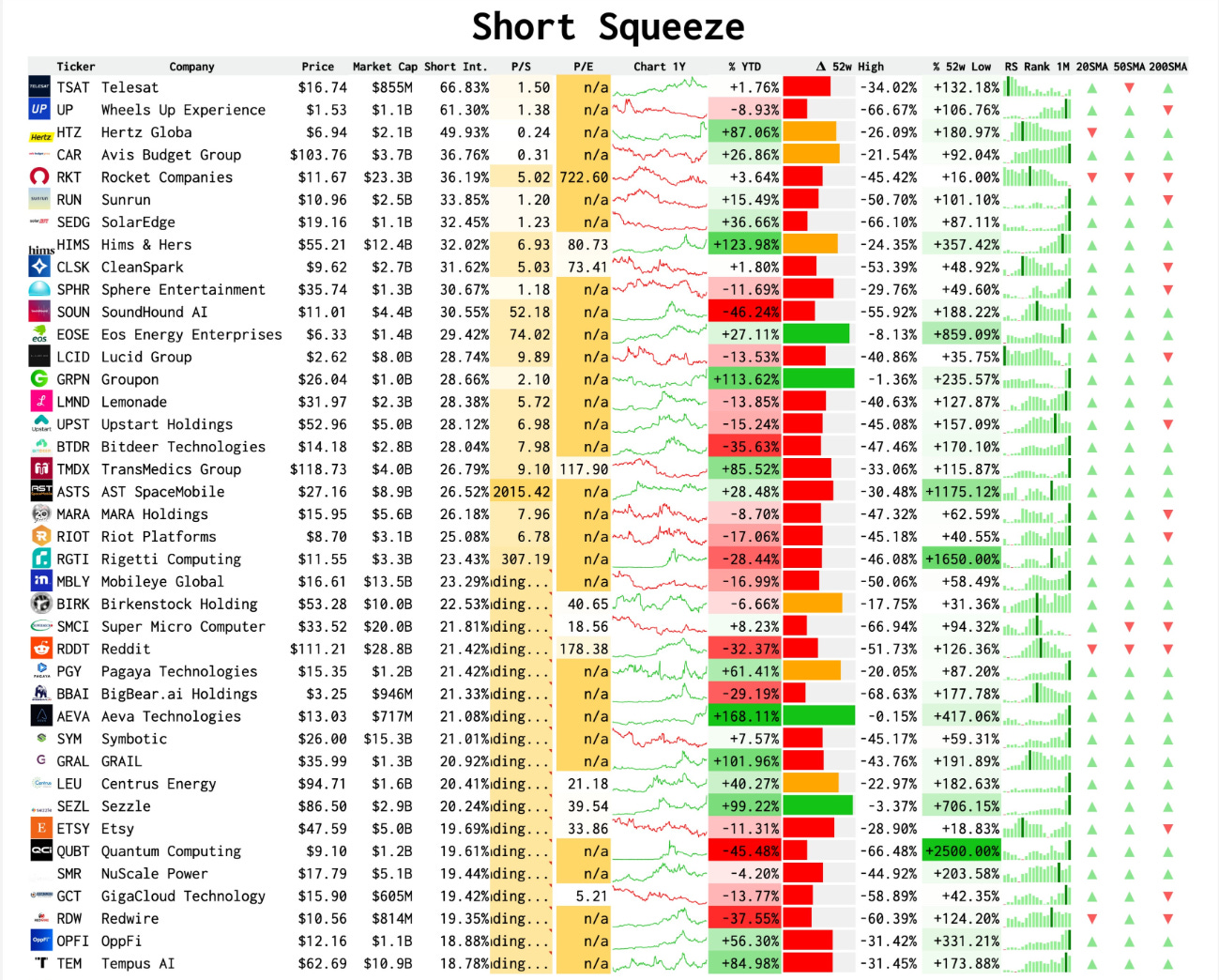

Freedom Trade of the week - Update on the Hertz trade

Still holding the position according to plan. Price is showing strength after consolidating and bouncing off the gap-fill zone. As long as it stays above that 5.50 - $6 area, the setup for a second leg toward the $9 resistance remains valid.

No rush, letting it play out patiently.

Hertz ($HTZ) is showing up strong on the short squeeze radar, nearly 49.93% short interest with +87.06% YTD gains and +180.97% off its 52-week low.

Earning reports are bad, but then again, this is not a fundamental analysis play - it’s a technical / news-driven setup.

Confidence level (1-5): 💸💸💸

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely:

Get exclusive market insights, access my free watchlist now!

🔗 Check it out here: My Watchlist

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

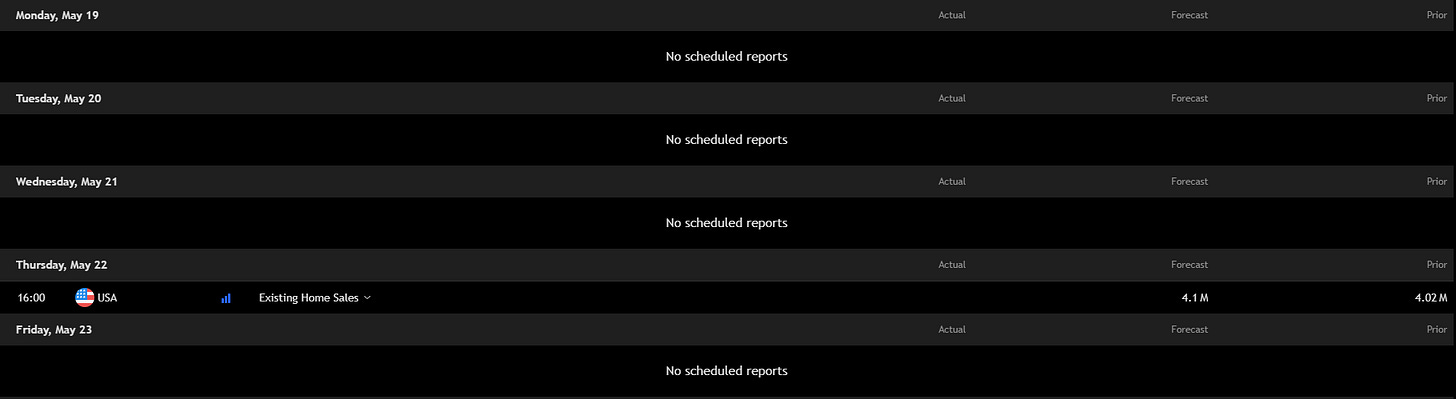

Key economic events to watch next week

Quiet week ahead, only notable release is U.S. Existing Home Sales on Thursday. Price action will likely be choppy unless we get a surprise catalyst.

Earnings to watch

Here are some interesting earnings reports coming up:

Big week for earnings despite the calm economic calendar.

Tuesday: All eyes on Home Depot, consumer spending insights could move markets.

Wednesday: Target, Baidu, Zoom, and Snowflake report.

Thursday: Heavy hitters like Analog Devices, Autodesk, Intuit, Workday, and Ross.

Friday: no interesting names…

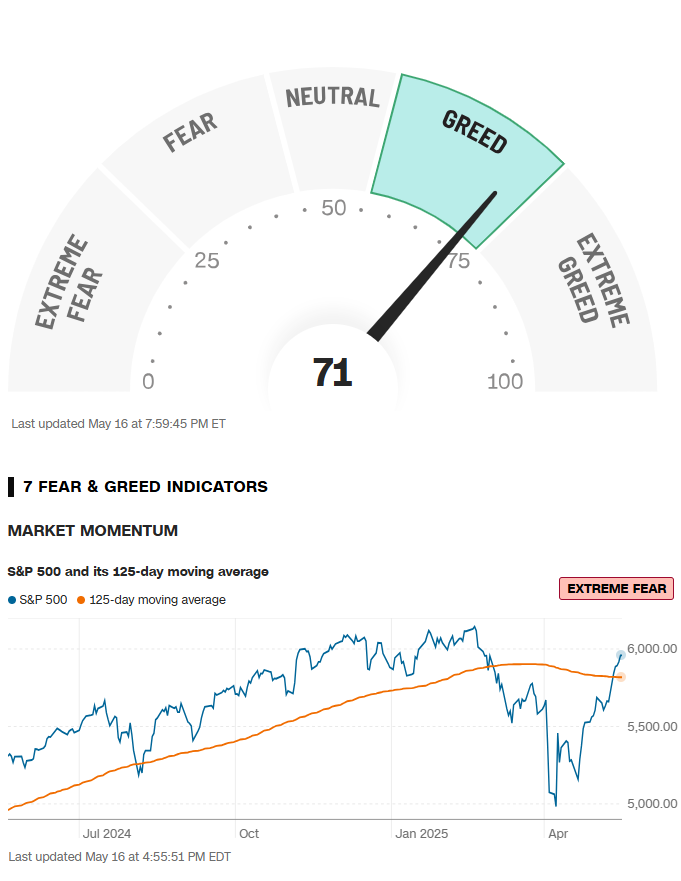

Fear & Greed Index

Meme of the week

Even the gods agree:

One trade closer to freedom.

Vladislav

You put in the work brother, respect.

How do you find out about all of these earnings in real time? Do you watch the news (please say no) read them on the companies website? I know stock holders can call into these reports, but that feels like a lot of time and effort.

Is there an app for that? lol