This One Habit Separates Pro Traders from Degens.

The Trap That Keeps Traders Broke (And How I Escaped) | Edition 21

Do you remember what I said last week?

I’m referring to the fact that I took a small short position in case the market dropped because of the tariffs / June 9th date.

Well, that’s exactly what happened.

I was right, sort of... because right after June 8th, the market went up another percent, which would’ve made those contracts expire worthless if I hadn’t closed them.

Which proves my point from the previous newsletter about risk management and how crucial it is.

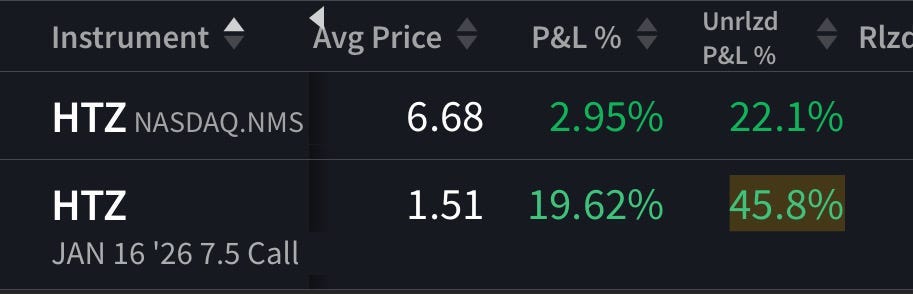

On top of that, I closed those nice positions too.

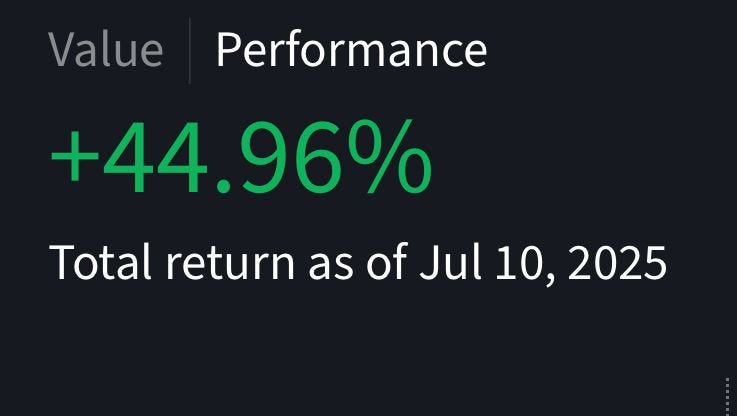

In fact, it’s been going so well this month so far that my account looks like this:

Sometimes it makes me wonder if I should share with you the real dollar value, instead of percentages. ???

No, the answer is no. It would attract the worst kind of traders.

This type of trader judges someone’s performance by how much money they make, not by percentage.

They don’t care if you’re risking 100% of your capital to make 1%, versus someone risking 1% to make 1%.

They don’t even know what RR is.

Thinking in percentages will change your trading game!!!

Here’s why.

Thinking in dollar amounts is a trap.

It makes small wins feel big and big losses feel catastrophic, even when they’re normal in % terms.

It kills your ability to scale, what works on $1,000 blows up on $100,000.

It ties your emotions to money, not performance.

Here is how to fix it

How to Break the Dollar-Think Habit

Reframe wins & losses in your journal.

Next time you log a trade, write:

“+2.5% / -1.2%,” not “+$250 / -$120.”

Train your brain to see percentage impact.

Set risk per trade as a % of capital.

E.g., risk 1% per trade. On $10,000, that’s $100; on $50,000, it’s $500. Same system, different size.

Use % goals, not dollar goals.

Aim for “2-4% monthly growth” instead of “$1,000/month.” It scales automatically and avoids gambling behavior.

If This Feels Hard, Here’s Why

You probably tie your self-worth to money.

You might be thinking short-term.

You haven’t zoomed out to see how real traders grow by percentages, compounding over time.

Why Percentages Win Every Time

Dollar amounts lie to you.

A $1,000 gain sounds great, but on a $100,000 account, it’s just 1%. On a $5,000 account, it’s 20%, way riskier. Percentages reveal the real weight of a win or loss.

They protect you from emotional sabotage.

Big dollar losses feel worse, but percentage-wise, they might be totally normal. If you only judge by cash, you overreact and kill good strategies.

They let you scale like a pro.

Percentages let you apply the same system whether you’re trading $1,000 or $1 million. Dollar-think traps you at your current level.

They build consistency.

If your plan is “make $500 a week,” what happens when you double your account? Percentages help you aim for performance!

Freedom Trade of the week

This week I don’t recommend opening any positions because I’m keeping an eye on BTC, I’ll probably talk more about that in the next newsletter (so stay tuned :)

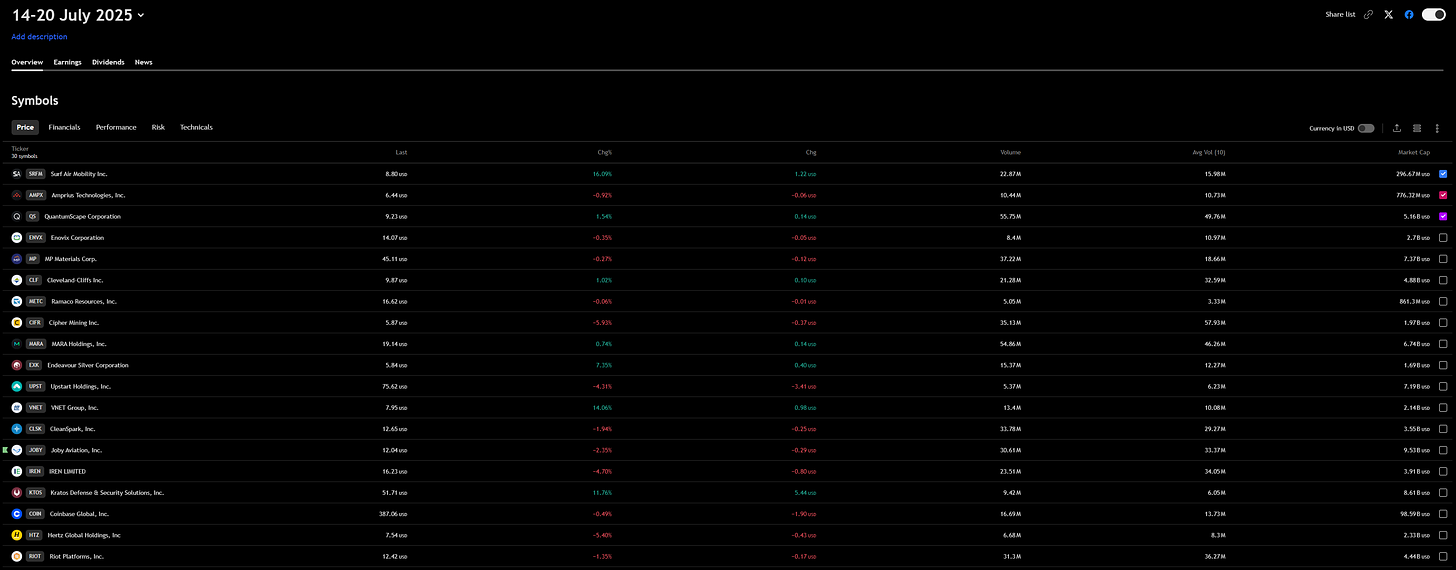

But I am watching a few tickers like VNET 0.00%↑ , SMR 0.00%↑ and many others you can find in the watchlist below.

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Get exclusive market insights, access my free watchlist now!

Check it out here:

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

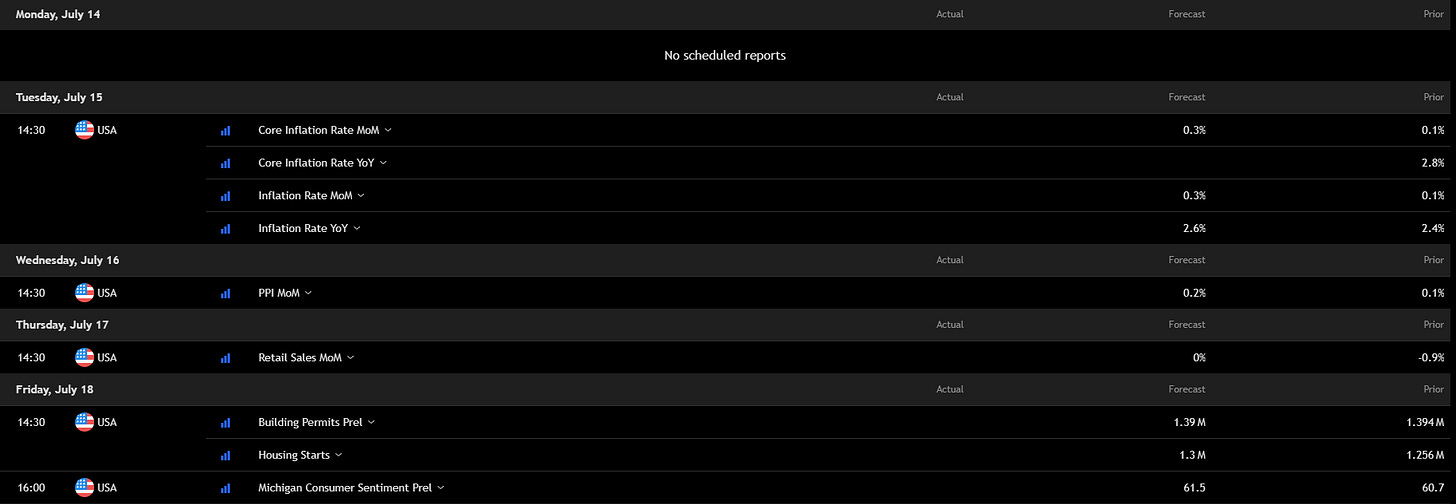

Key economic events to watch next week

Big macro week ahead.

Tuesday’s CPI + core inflation will set the tone, market’s betting on a slight cool-off.

Wednesday’s PPI confirms if input costs are behaving, Thursday’s retail sales checks the consumer pulse, and Friday wraps with housing + Michigan sentiment.

Volatility incoming :)

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

Tuesday: JPMorgan, if the banking giant surprises, the whole financial sector moves.

Wednesday: ASML is the semiconductor king.

Thursday: Netflix is the heavyweight; subscriber growth or slowdown will rock tech sentiment.

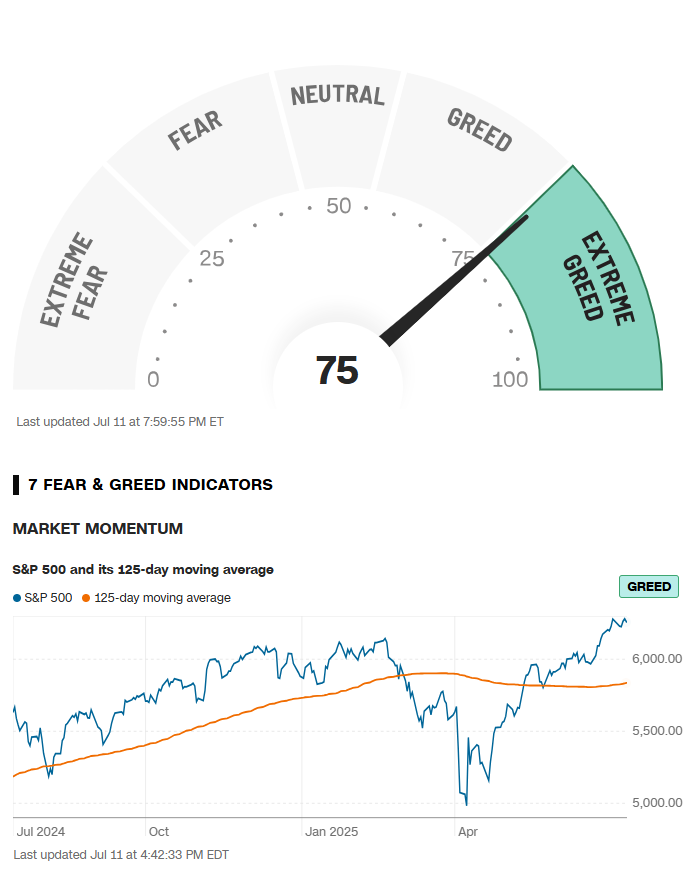

Fear & Greed Index of the week

Financial Meme of the week

Other great reads

Thank you for being with me in this edition, and if you think this newsletter could be helpful for your friends, share it with them so it can reach as many traders as possible.

“One trade closer to freedom.”

Vladislav