This Trading Strategy Made Me 6 Figures

The Swing Trading Strategy That Took Me to Six Figures | Edition 47

Dear Traders,

For a long time, I thought I needed more.

More indicators.

More scans.

More rules.

More time.

Turns out, that was the problem.

The more tools I added, the more confused I became.

And confusion is expensive in trading.

So I did something simple but uncomfortable:

I wrote my entire process down from start to finish.

I wanted to answer one brutal question:

“If someone followed my process step by step, would they know exactly what to do?”

The answer was… not really.

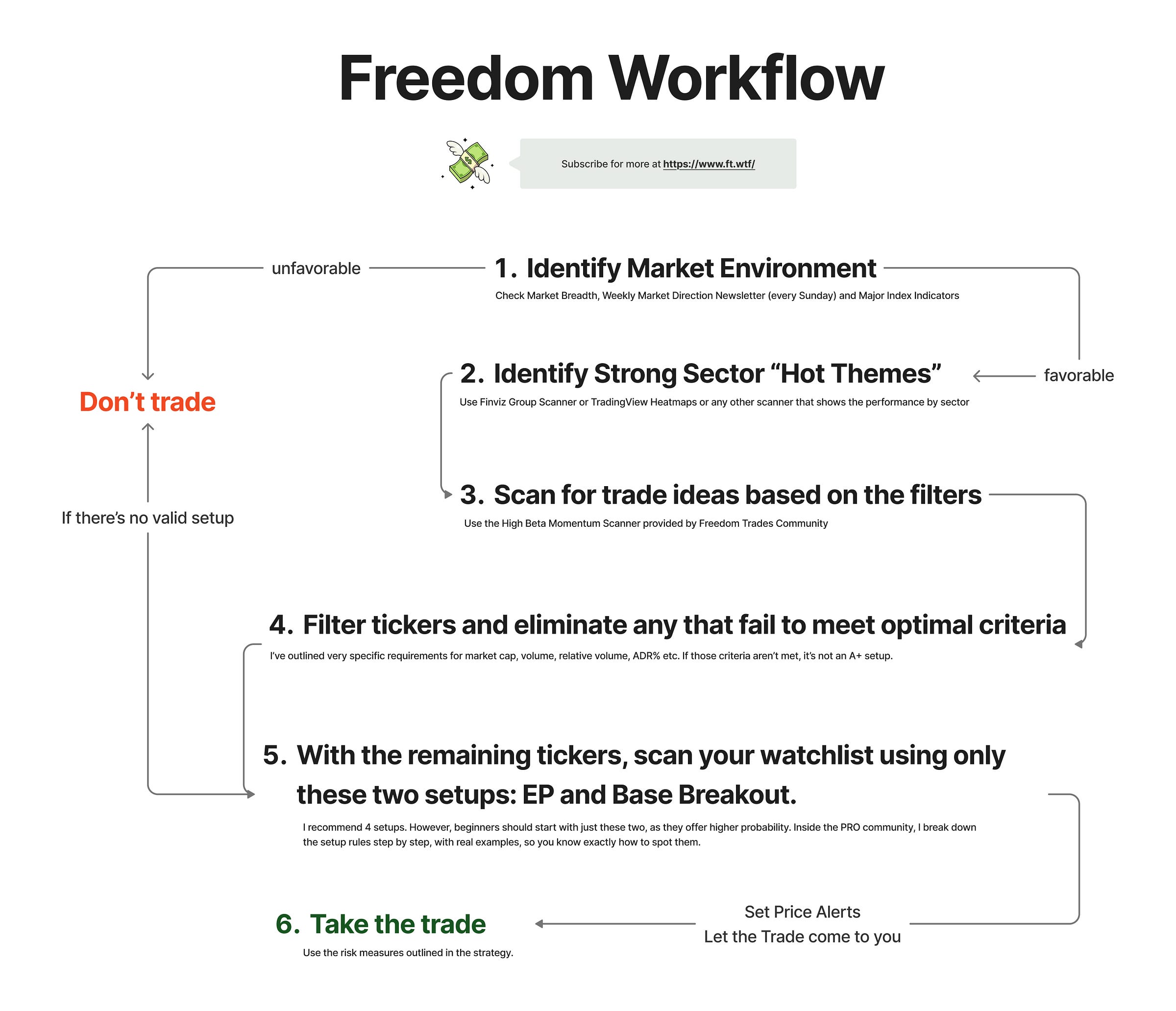

That’s when I built the Freedom Workflow.

It’s a way to remove noise, decisions, and second-guessing.

So I stripped the strategy down to what actually matters.

First, the market environment.

If conditions aren’t right, we don’t force trades. We don’t “get creative.” We don’t trade, we stay cash!

Then sectors.

Because strong stocks usually come from strong themes. This alone removes 70% of garbage ideas.

Then scanning.

But only with clear filters, not endless scrolling and hoping something jumps out.

Then elimination.

If a ticker doesn’t meet the parameters, it’s gone. No debate. No “maybe.”

Then setups.

Just two high-probability ones that do the heavy lifting. (that’s all you need to be profitable)

And only then do we think about execution.

So I updated the strategy and shared everything here:

This workflow is now the backbone of the updated strategy.

And if you follow it step by step, you’ll always know what your next move is.

Freedom Trades Swing Trade Strategy tells you:

when not to trade

what to ignore

what setups to take

how to find high probability trades

and exactly what qualifies as an A+ setup

I built this to remove confusion

No more guessing.

No more overthinking.

No chasing.

That’s how freedom is built.

And this is exactly what I used to achieve those crazy results over the past two years.

If you’re ready to take swing trading seriously, join us:

Trade Setups of The Week

I’m Watching These Stocks Before They Explode

This week’s PRO report breaks down my full momentum stock watchlist, including the setups I’m watching for potential 20–30% moves.

You’ll see my portfolio, my open positions, and the exact stocks I’m targeting.. all based on the same swing trading system.

If you want to trade smarter ,not longer , and get my weekly watchlist with setups, and portfolio breakdowns, this one’s for you.

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my entire watchlist for free here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

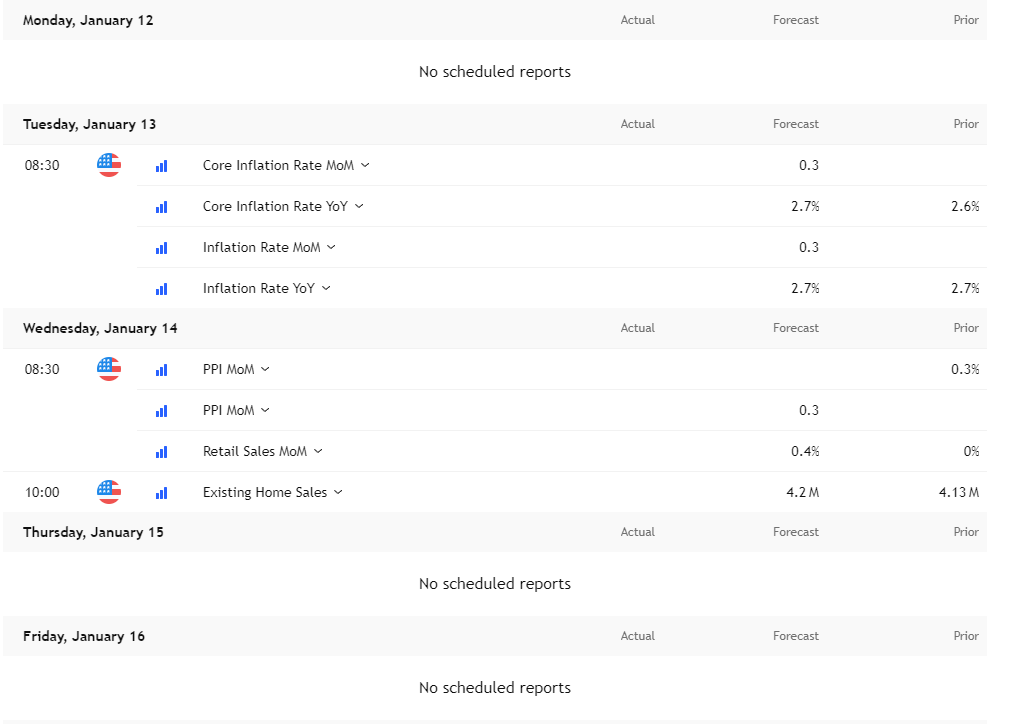

Economic events to watch next week

Tuesday CPI is the main event (0.3% MoM, 2.7% YoY expected). Any upside surprise hits rates and growth.

Wednesday confirms the story with PPI (0.3%), Retail Sales (0.4%), and housing data.

Expect volatility Tuesday–Wednesday, then it likely fades.

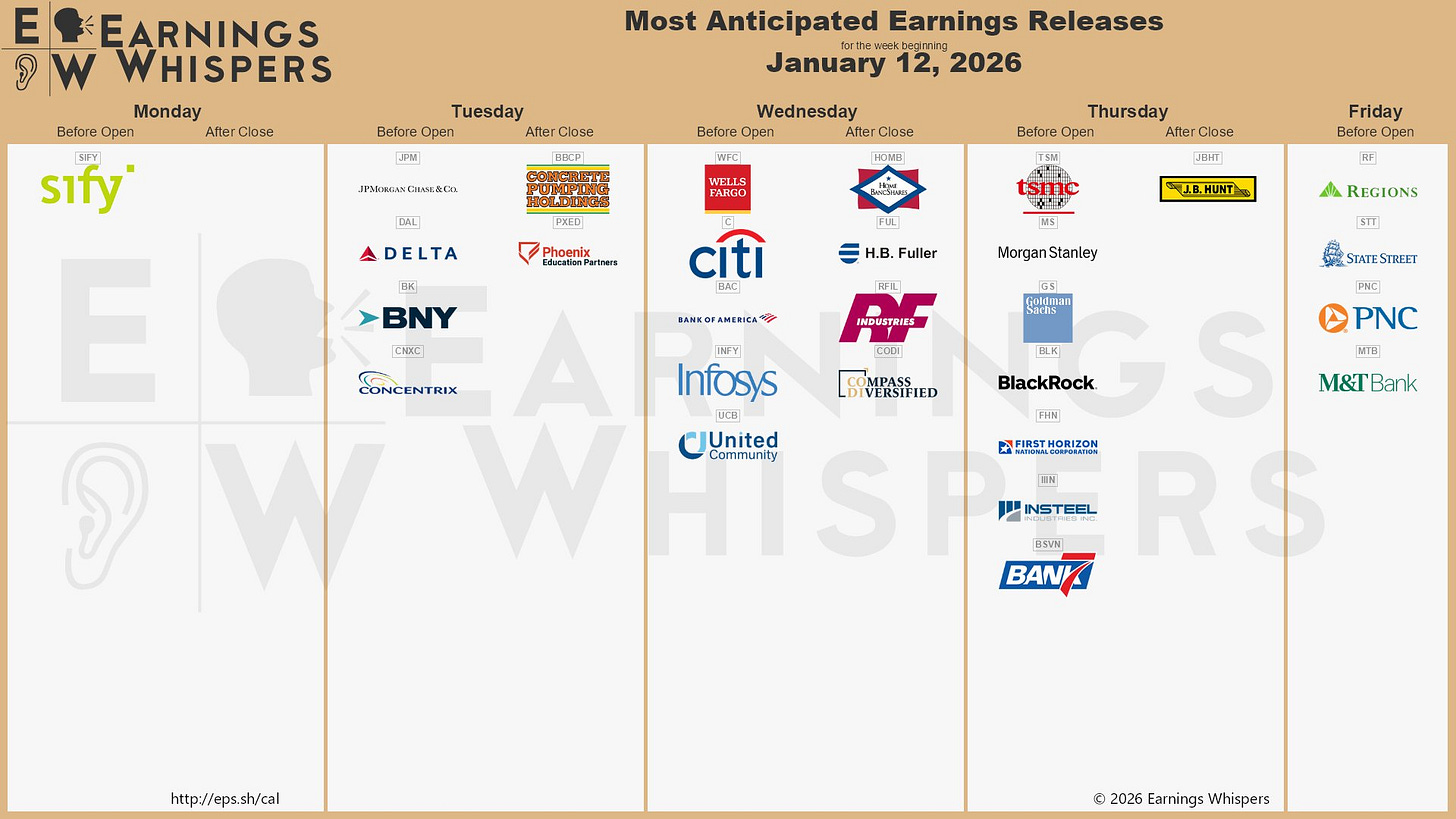

Earnings to Watch Next Week

Earnings are pretty light this week, which usually means fewer random gap moves and cleaner chart behavior.

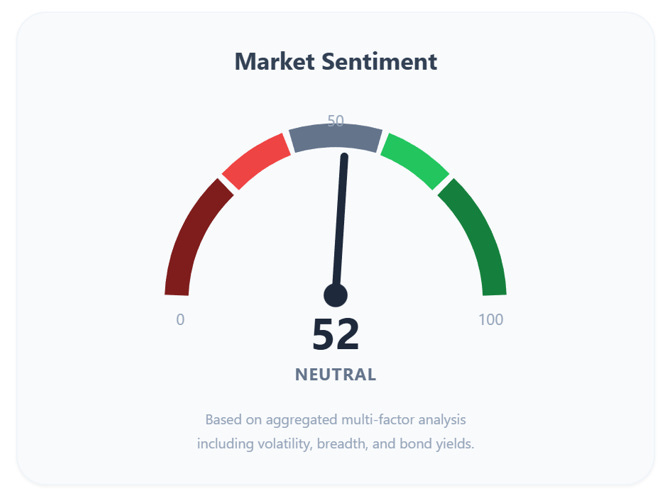

Fear & Greed Index of the week

If you want the full picture with all the signals and context that sits behind this number, consider upgrading so you can see the complete breakdown.

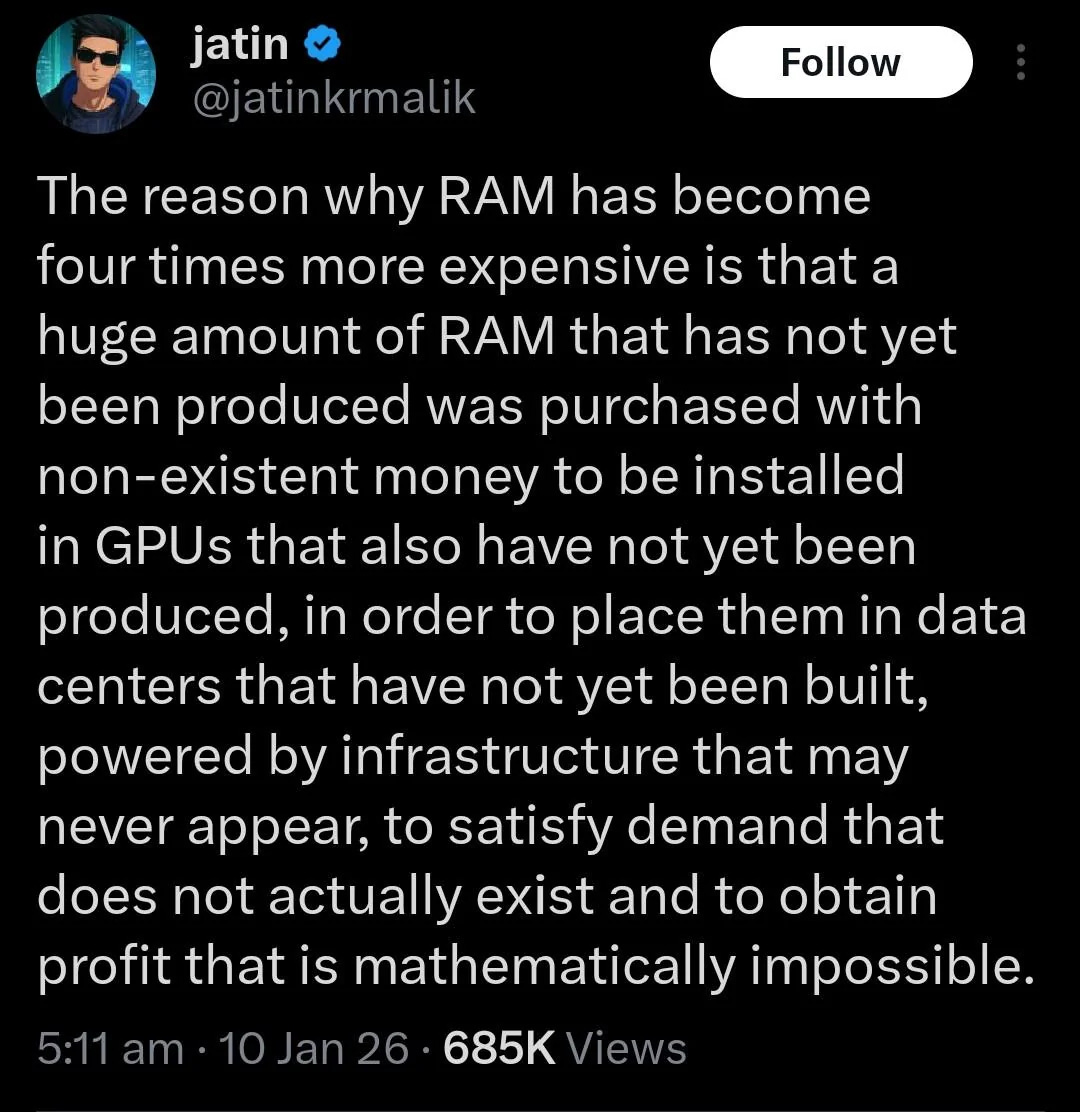

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav