Trade Setup, Market Moves & A Hot Earnings Week Ahead

Weekly EDGE - Stock Market (17-23 March 2025) | Episode 5

Dear Investors,

For the first time, I’ve added a trade signal/potential opportunity in today’s newsletter. My goal is simple: I want everyone who subscribed, whether free or paid, to have a real shot at making money. I know what it’s like to start from zero, and honestly, I’m not even focused on making money from this. What matters to me is building a community of like-minded individuals who are serious about this journey.

Also, I threw in some GIFs (let me know if they’re annoying, yeah?).

Alright, let’s dive in.

Because we are going to talk about tariffs, here is a nice GIF explaining how tariffs work:

This Week in the Economy: What You Need to Know

Jobless Claims Drop Again, Layoffs Still Not Surging

Jobless claims dropped slightly last week, 220K vs. 222K the week before. Proving layoffs still aren’t surging despite economic worries. Continuing claims also dipped, meaning fewer people are staying unemployed for long. While hiring has slowed, mass layoffs haven’t hit yet. Federal job cuts are being watched closely, but for now, the labor market is holding steady.

Wholesale Prices Flat in February, But January Inflation Was Worse

Producer prices barely moved last month, but a revision to January’s data showed inflation was hotter than expected 0.6% vs. the previously reported 0.4%. February’s PPI dipped slightly, missing economists' forecasts of a 0.3% rise. Over the past year, wholesale prices are up 3.2%, easing from January’s 3.5%. Now, all eyes are on how this plays into the Fed’s inflation outlook.

Wednesday Economic Data report

Inflation cooled more than expected in February, with both core and headline numbers coming in below forecasts. Core CPI rose just 0.2% MoM (vs. 0.3% expected), and the YoY rate slowed to 3.1%. Headline inflation also undershot at 2.8% YoY. This could ease pressure on the Fed, but inflation is still above target, so rate cuts aren’t a done deal yet.

Key economic events to watch next week

Big week ahead for the markets! Retail sales are down, signaling weaker consumer spending. Housing data drops Tuesday, but the real spotlight is Wednesday’s Fed decision, rates expected to hold at 4.5%, but Powell’s press conference could shake things up. Existing home sales wrap up the week. Buckle up, volatility incoming!

Earnings to watch - Who’s making money?

Here are some interesting earnings reports coming up:

Some of the most interesting and big companies reporting earnings for the week of March 17, 2025, include:

Tuesday:

XPeng (XPEV) – A major Chinese EV manufacturer, often compared to Tesla in China.

Wednesday:

Signet Jewelers (SIG) – One of the largest diamond jewelry retailers.

General Mills (GIS) – A major food company, known for brands like Cheerios, Haagen-Dazs, and Betty Crocker.

Thursday:

Pinduoduo (PDD) – A Chinese e-commerce giant, competing with Alibaba and JD.com.

Micron (MU) – A key player in semiconductor memory and storage.

Nike (NKE) – One of the biggest sportswear and footwear brands globally.

FedEx (FDX) – A logistics and shipping giant, a key indicator of global trade.

Accenture (ACN) – A major global consulting and IT services firm.

Darden Restaurants (DRI) – Owns Olive Garden, LongHorn Steakhouse, and other major restaurant chains.

Jabil (JBL) – A major manufacturing and supply chain solutions company, often linked to Apple’s supply chain.

Friday:

NIO (NIO) – Another leading Chinese EV maker, competing with Tesla and XPeng.

Carnival (CCL) – One of the largest cruise line operators, sensitive to consumer travel trends.

Miniso (MNSO) – A fast-growing Chinese retail chain, focused on affordable lifestyle and home goods.

Which earnings report are you watching closely this week? Send me a message or leave a comment on Substack.

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely:

Get exclusive market insights—access my free watchlist now!

🔗 Check it out here: TradingView Watchlist

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

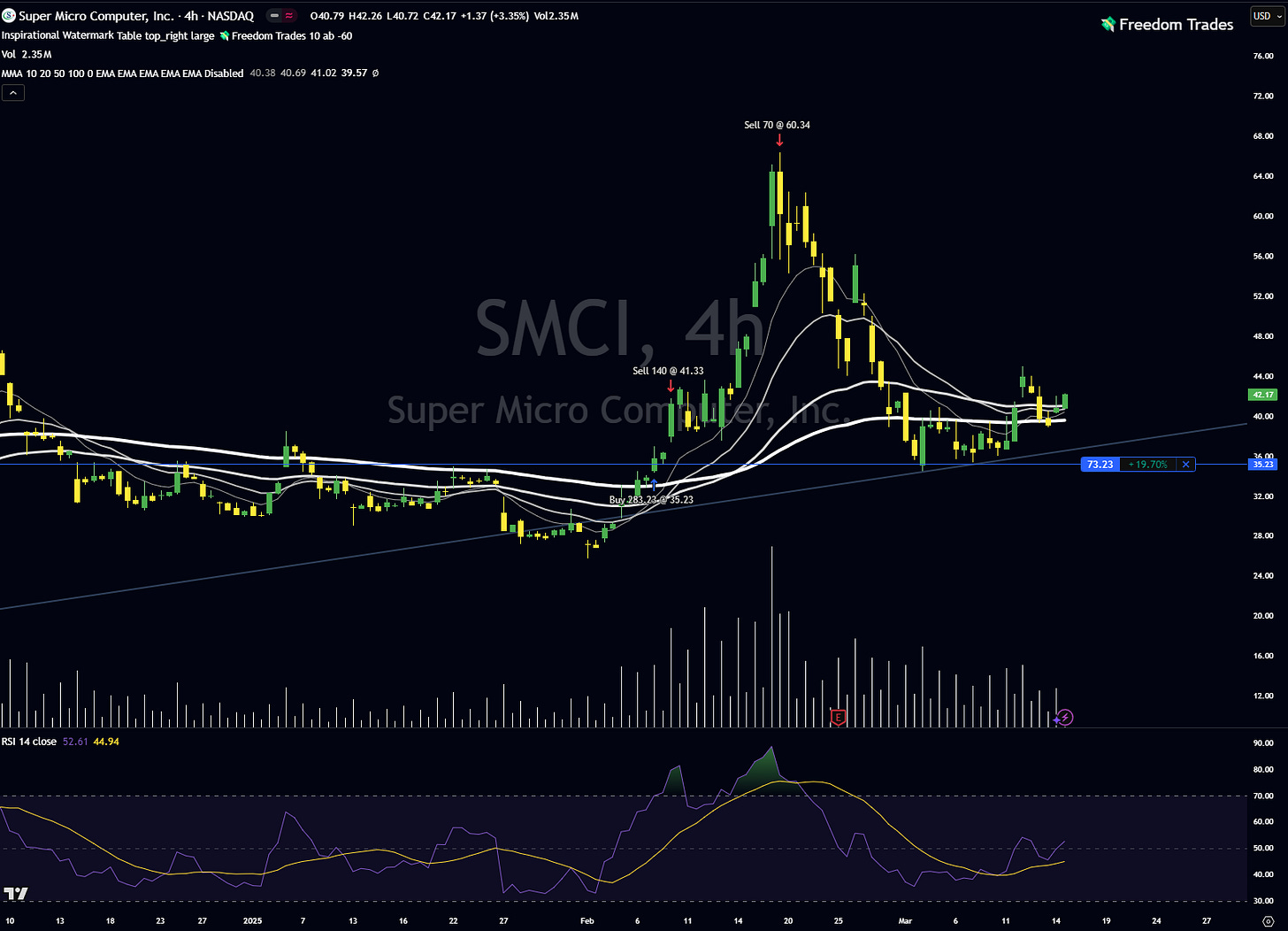

Freedom Trade of the week

Super Micro Computer (SMCI) is showing signs of strength after a healthy pullback. Price is holding above key moving averages, and we’re seeing a potential higher low forming near trendline support. The RSI is curling up, indicating renewed momentum.

✅ Entry: $42.00 - $43.00 (on confirmation of the breakout)

❌ Stop-Loss: $39.50 (below trendline & EMAs) or previous day low for a tighter risk

Volume needs to increase for a stronger move - watch for confirmation.

Confidence Level: 🔥🔥🔥 (Medium)

PS: I am already in a small position.

If you want more setups and trades like this, upgrade your subscription for full access!

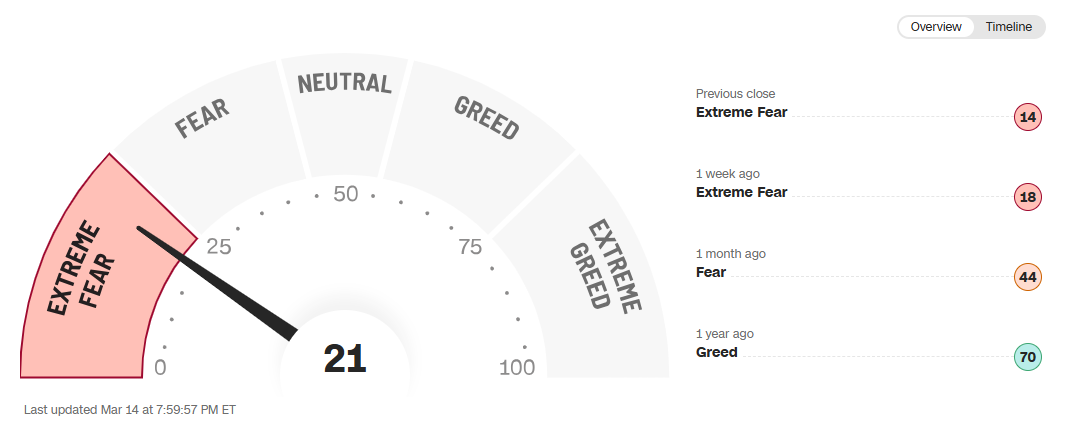

Fear & Greed Index

Meme of the week

Closing Bell

I made some t-shirts with the Freedom Trades logo. For now, they’re just for me, but I’m curious, do they look stupid, or would you actually wear something like this?

Thanks for reading, see you next Sunday with a new Market Edge and fresh opportunities.

Vladislav