Understand the Market in 3 Minutes with this

This Report will save you 3 Hours of Market Confusion every week | Edition 40

A few years ago, I had a realization that completely changed how I trade.

Back then, I was doing what 90% of retail traders still do today:

Open the chart… scroll Social Media… check a few headlines… take a trade… hope for the best.

Some weeks I felt like a genius.

Other weeks the market humbled me in 5 minutes.

It wasn’t my strategy.

It wasn’t my entries.

It wasn’t my indicators.

It was the environment.

And I didn’t have a system to understand it.

One day, after getting stopped out on 3 trades in a row, I asked myself the question I should’ve asked much earlier:

“If the entire market is against me, does my strategy even matter today?”

That question was the beginning of everything.

Because the truth is simple:

Your strategy is only as good as the environment you apply it in.

Bull market?

Even B setups work.

Choppy market?

Even AAA+ setups fail.

This is when I understood the #1 rule

Situational Awarness > Setups.

So I started looking at how the overall market is performing before taking any trade.

A few months ago, a PRO member told me: “The High Probability Trades you send every week help me, but to truly trust taking them, I need to understand the current state of the market and the direction it’s heading.”

So I built something I never had before:

A Market Direction Report.

a mechanical, score-based framework that tells me EXACTLY when to be:

Aggressive

Neutral

Defensive

Or completely out of the market

Every successful trader eventually develops these 2 beliefs:

1. “I need to know the playing field before I make a move.”

You wouldn’t enter a war without understanding the terrain.

You wouldn’t play chess without knowing what pieces the opponent has left.

So why enter the market blindly?

A trader with no market direction framework is operating in fog.

2. “My strategy only works inside the right environment.”

Breakout strategies fail in bear markets.

Mean reversion fails in high momentum phases.

Leverage kills you in distribution phases.

The Market Direction Report keeps you aligned with the environment your strategy actually thrives in.

What you actually need

Most traders think the solution is:

more indicators

more screen time

more news

more strategies

But the real breakthrough is none of these.

The real shift is this:

You don’t need more information.

You need a better framework that organizes the information.

A Market Direction Report does exactly that.

The Future you

Imagine waking up knowing exactly:

If this week is a good week for taking swings

If you should size up or size down

If leverage will help you or kill you

If momentum stocks will explode or die

If you are in alignment with the market or fighting it

Imagine being in sync with the trend instead of chasing it.

Imagine avoiding the worst weeks and maximizing the best ones.

That’s what a Market Direction Report gives you.

This is the advantage most retail traders never discover.

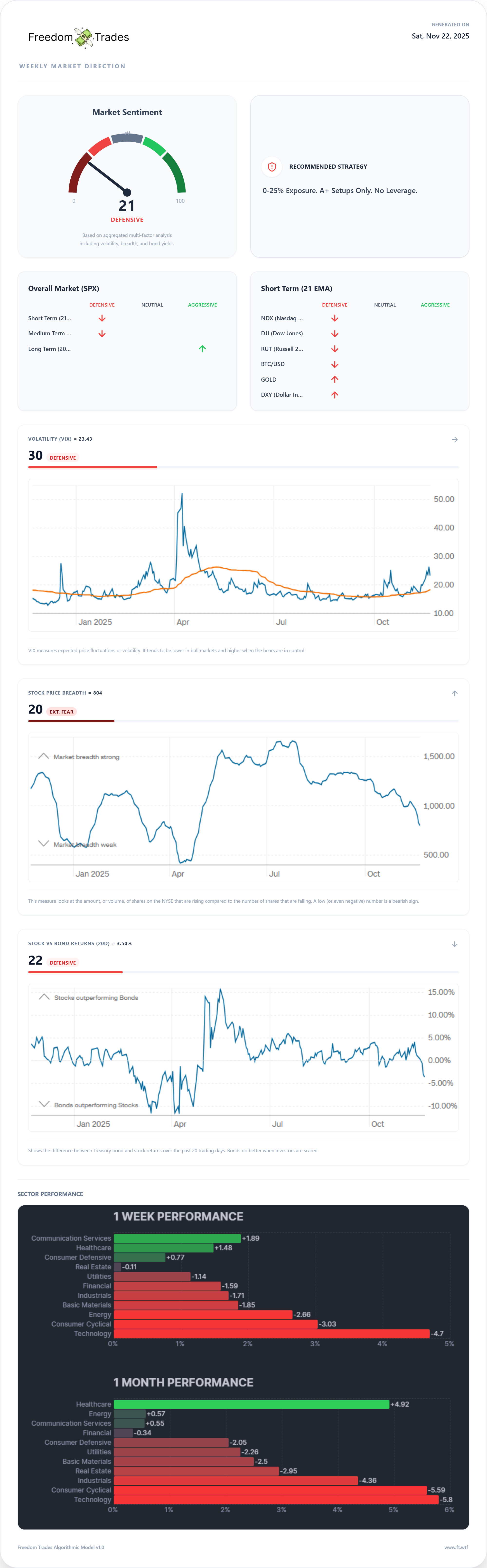

Here’s what the Weekly Market Report looks like.

Now that you understand how this will help you, let me show you the alpha version of the dashboard.

The model is built on 12 indicators that influence the report’s results.

The plan is to give you one clear picture that shows what the market is doing, so you can understand it in less than three minutes.

What used to take you 3 hours now takes only 3 minutes.

As I receive your feedback, this model will continue to evolve.

And if you want this tool to support your trading journey, now is the best moment to join the 135 PRO members.…because the annual plan is currently 70% off.

This offer is available for just 8 more days, and once it’s gone, it’s gone.

Swing Setups of The Week

Copy My Watchlist for next week to Swing Trade

Here are the stocks, sectors, or trends I’m watching closely.

Access my entire watchlist for free here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

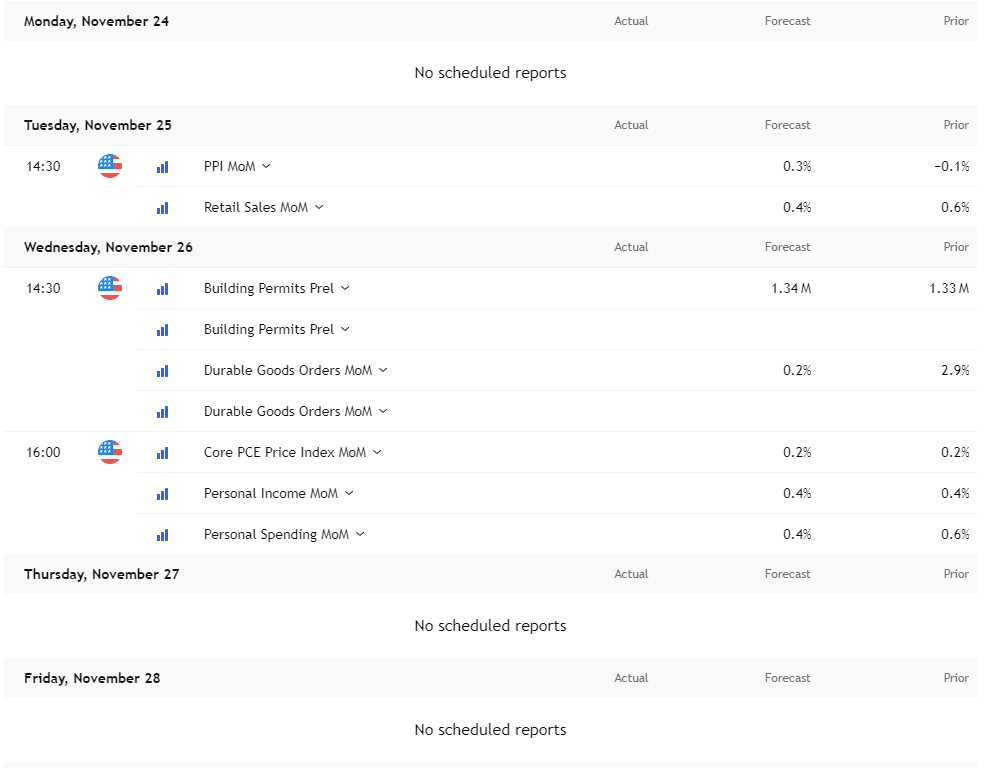

Economic events to watch next week for Swing Trading

We’re going to see some action on Tuesday and Wednesday.

But, remember guys, the U.S. market will be closed on Thursday for Thanksgiving, and Friday will be a half-day.

Liquidity will be low.

Volume will be low.

Price action will be choppy.

Don’t force trades.

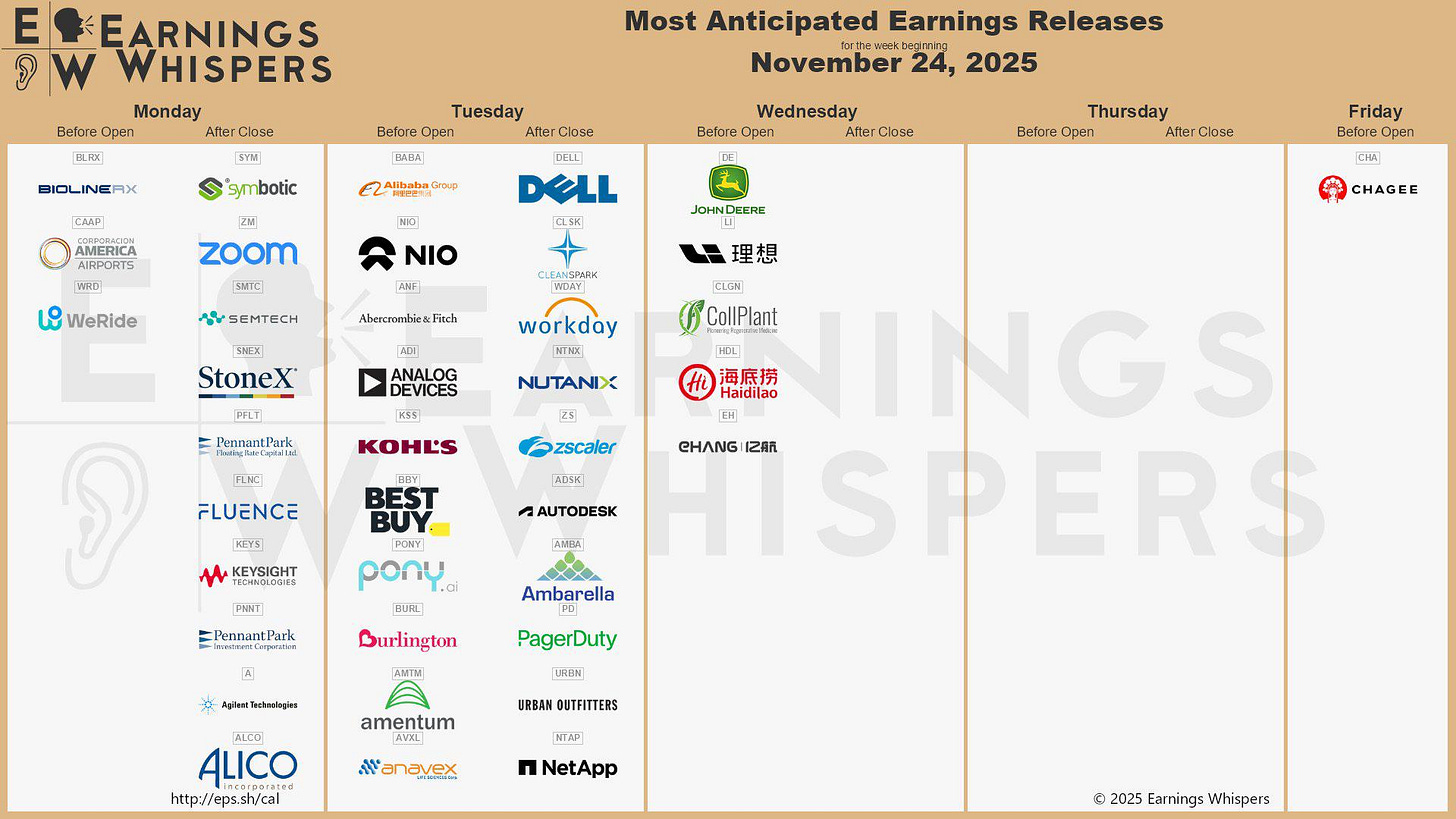

Earnings to Watch Next Week for Swing Trading

This week’s earnings calendar is very light, and that’s exactly what we expect going into Thanksgiving week.

From the list, the only big names worth noting are: BABA and DELL

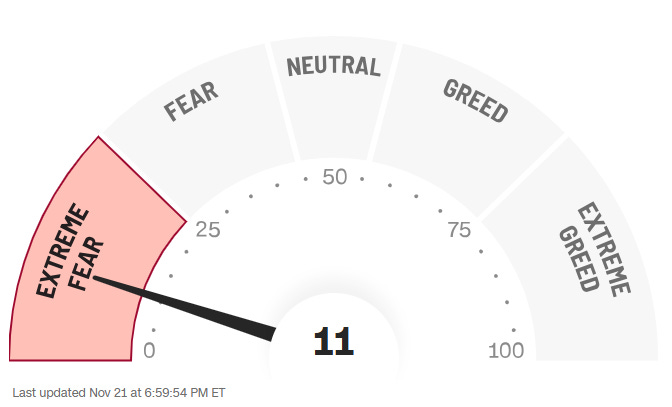

Fear & Greed Index

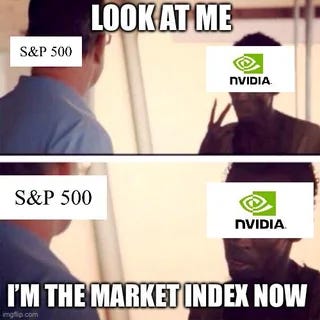

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav

Does this come with your normal subscription or do I need to subscribe to a different tier?