Weekly Stock Market Recap (03-07 March 2025)

The objective of this weekly stock market recap is to keep you ahead of the game—Episode 2

Hello Investors,

Every dip feels like an opportunity, but let’s be real… with what cash? Inflation’s still biting, rates are shifting, and the game keeps changing. In this breakdown, we’ll cut through the noise—what happened, what’s next, and how to position yourself smartly.

This week's top market news

Apple plans to invest over $500 billion in U.S. expansion over the next four years, creating 20,000 jobs and opening a new AI-focused factory in Houston by 2026. The company will also double its U.S. Advanced Manufacturing Fund to $10 billion and launch a training academy in Michigan to support future manufacturing talent. While still reliant on East Asia, Apple is increasing its use of U.S.-based suppliers, with mass production of its chips already underway at TSMC’s Arizona facility.

Jobless claims in the U.S. surged to their highest level since December, with 242,000 initial filings in the week ending Feb. 22—up from 220,000 the previous week and exceeding economists’ expectations. Continuing claims, which track ongoing unemployment, declined slightly to 1.86 million, while filings by former federal employees saw a small uptick.

French inflation fell to a four-year low of 0.9% in February, reinforcing expectations that the European Central Bank will cut interest rates again next week. While energy prices drove much of the decline, a broader disinflation trend is emerging across services and other sectors. Inflation remains above target in Germany, but stable price trends in major eurozone economies suggest further easing ahead. However, economic uncertainty lingers, with weak growth and potential U.S.-EU trade tensions threatening Europe’s recovery.

Earnings to Watch - Who’s Making Money?

Here are some interesting earnings reports coming up:

Which earnings report are you watching closely this week? Drop a comment and share your predictions!

My Watchlist for Next Week

Here are the stocks, sectors, or trends I’m watching closely:

Get exclusive market insights—access my free watchlist now!

🔗 Check it out here: TradingView Watchlist

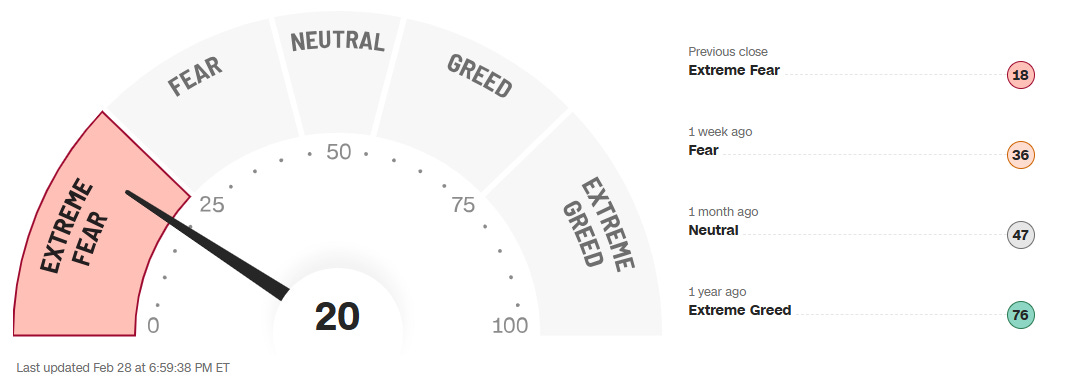

Fear & Greed Index

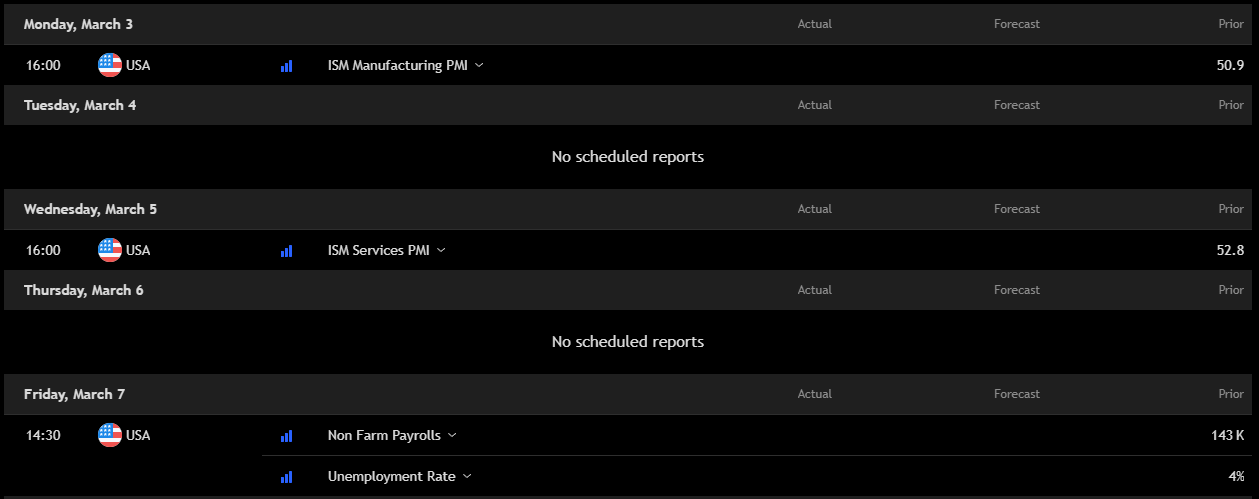

Key Economic Events to Watch Next Week

Next week’s economic calendar is looking like a slow burn until Friday—so don’t fall asleep just yet!

We’ve got ISM Manufacturing PMI on Monday (sitting at 50.9, barely above expansion territory) and ISM Services PMI midweek (holding at 52.8, still showing some economic resilience). But let’s be real—the main event is Friday, with the Non-Farm Payrolls (NFP) and Unemployment Rate. That’s when the market could wake up swinging.

If NFP surprises to the upside, expect rate cut dreams to take a hit. If it disappoints, we might hear the Fed whispering sweet nothings about easing. Either way, buckle up—because boring weeks often end with fireworks.

Meme of the week

Final Thoughts

The market is shifting, and the old playbook doesn’t always work anymore. Staying informed, adaptable, and ahead of trends is what separates winners from the rest. Keep questioning, keep learning, and keep making moves. The game is evolving—are you?