Weekly Stock Market Recap (17-23 February 2025)

The objective of this weekly stock market recap is to keep you ahead of the game—Episode 1

Hello Investors,

This is the first edition of the Weekly Stock Market Recap (I don’t promise this will be actually weekly :)) Let’s see how it develops.

The objective of this weekly stock market recap is to keep you ahead of the game—armed with the key market moves, upcoming catalysts, and high-potential opportunities—so you can make informed, strategic decisions instead of gambling or following the herd. By staying plugged into this recap, you’re not just tracking the markets—you’re building the knowledge and mindset to escape the system and take control of your financial future.

If you’re reading this, you’re already ahead of 99% of people still stuck in the system. Let’s break down what happened, what’s coming up, and what plays we’re making next. No fluff. Just straight money moves.

👉 The matrix wants you distracted. We stay informed.

3 Biggest Market Movers This Week

USD/JPY: Yen Falls as Japan’s Inflation Heats Up to 4% — Highest in Two Years

Inflation Concerns Resurface Investors have shifted focus from interest rate volatility to potential inflation resurgence in the latter half of 2025. Factors such as increased wage growth and rising service sector prices are contributing to these concerns.

Geopolitical Tensions and Commodity Prices: The third anniversary of Russia's invasion of Ukraine has heightened geopolitical tensions, leading to a surge in gold prices, which reached a record high of $2,954 per ounce. Analysts suggest it may soon hit $3,000 per ounce

Earnings to Watch - Who’s Making Money?

Here are some interesting earnings reports coming up:

My Watchlist for Next Week

Here are the stocks, sectors, or trends I’m watching closely:

Link to the full Watchlist : https://www.tradingview.com/watchlists/181029777/

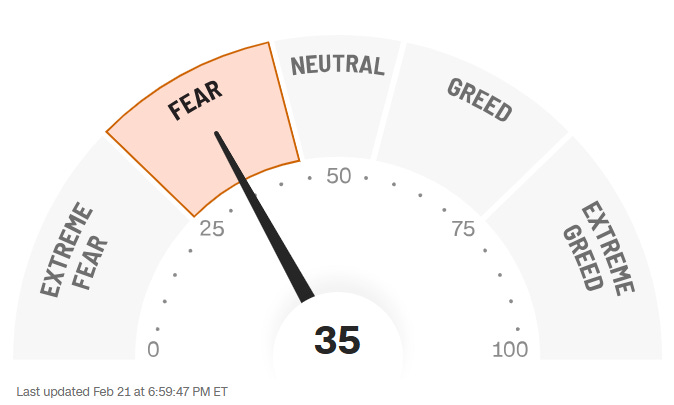

Fear & Greed Index

What’s Coming Next Week? Economic Events to Watch

This economic calendar for the week of February 24 - 28 shows a relatively quiet start, with no scheduled reports until Thursday, February 27. However, the back end of the week brings some key economic data that could impact market sentiment:

Thursday, February 27:

Durable Goods Orders (MoM) rebounded 1.3% after a sharp decline of -2.2% in the previous month. This signals a recovery in business investment and consumer confidence in purchasing long-term goods, which is bullish for the economy.

GDP Growth Rate (QoQ, 2nd Estimate) came in at 2.3%, slightly lower than the previous 3.1%, showing some cooling but still indicating moderate economic expansion.

Friday, February 28:

Core PCE Price Index (MoM) rose 0.3%, slightly above the prior 0.2%, which suggests a gradual rise in inflation—something the Fed watches closely for rate policy decisions.

Personal Income (MoM) held steady at 0.4%, indicating stable wage growth, which is a positive sign for consumer spending.

Personal Spending (MoM) dropped to 0.2% from 0.7%, suggesting some caution from consumers despite rising incomes.

Positive GDP & durable goods orders may support risk assets like stocks.

Inflation creeping up (Core PCE) could keep the Fed alert, but nothing alarming yet.

Slowing consumer spending might hint at cautious sentiment, but steady incomes are a good buffer.

A relatively calm week, but the GDP revision and inflation data are worth watching for any shifts in market sentiment—especially in relation to Fed expectations. Markets will react more to future forecasts than backward-looking data, so pay attention to forward guidance from policymakers and companies.

Meme of the week

Final Thoughts

Every week, you get stronger, sharper, and closer to breaking free from the 9-5 autopilot life. Most people stay asleep. Not us.

What’s YOUR top watch for next week? Drop it in the comments!

Looks like a solid market recap with some useful insights. Always good to stay ahead and be aware of these key moves.