You Missed the 56% Return in 5 Days. Don't Miss This.

An Insane Announcement | Edition 19

Dear Traders,

I want to start with the most important news this week, and it has nothing to do with the Fed or a stock hitting new highs.

It’s about us. About this community.

Effective today, I’m lowering the price of the Freedom Trades paid subscription to just $20 per month....essentially is lower than your weekly coffee budget.

I know. In a greedy world where everyone else is hiking their prices, this move doesn’t make sense on the surface. But I’m not playing their game.

I want to surround myself with people who, like me, are willing to fight for a different future. I'd rather have a smaller, more dedicated group committed to the process than a massive audience of passive followers.

Now, with that on the table, let's get to the markets.

Freedom Trade of the week

An update from last week's post “How to pick the right stocks” , where I said I would take a position in BBAI. Guess what? That’s exactly what I did.

And BBAI had a 56% return in 5 days.

It only proves my point that this method is effective.

BBAI 0.00%↑ is up 56% this week. So if you had listened to me and taken the same position as I did, you would've made a return of at least 27% in 2 days.

This week I'm looking at ticker: U on the NYSE, Unity.

If the price continues to hold this support level around $23.50, where we are seeing a clear increase in buying volume, then I expect a potential move towards the next major resistance zone at approximately $30.

Stop Level: A break and close below $22 would invalidate this idea.

My confidence level with this one is not the same as BBAI. (2 out of 5).

Don’t take a big position on this.

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Get exclusive market insights, access my free watchlist now!

🔗 Check it out here:

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

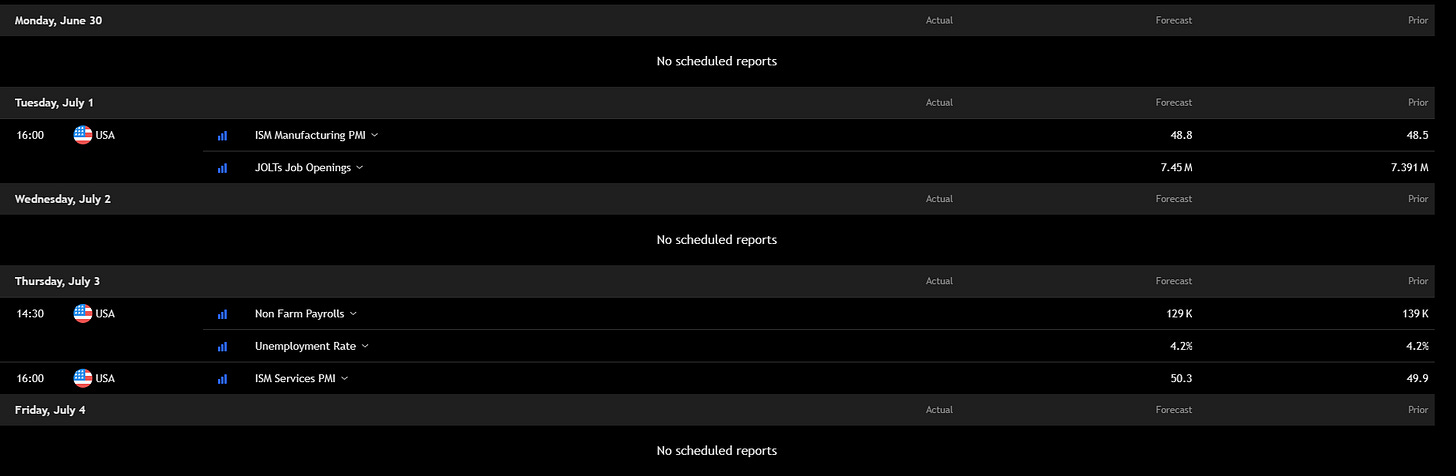

Key economic events to watch next week

All eyes are on Tuesday's JOLTS data and Thursday's Non-Farm Payrolls, packing the week's main events into two days.

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

This week's earnings calendar is looking pretty boring, with no major market-moving companies set to report. This is a perfect opportunity to ignore the low-quality noise and focus on your own system and watchlist.

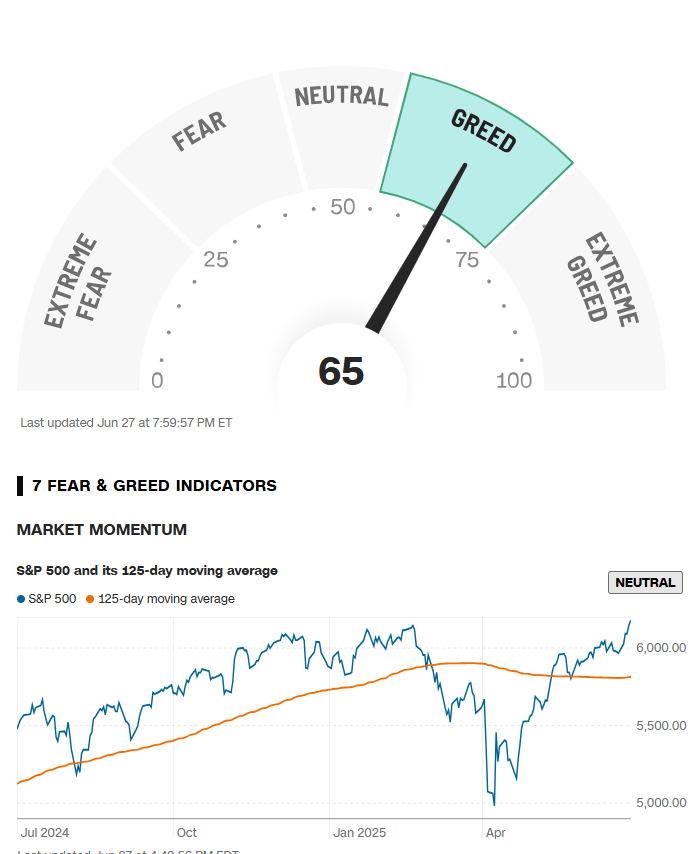

Fear & Greed Index of the week

Financial Meme of the week

Thank you for being with me in this edition, and if you think this newsletter could be helpful for your friends, share it with them so it can reach as many traders as possible.

“One trade closer to freedom.”

Vladislav