I Tried Every Shortcut in Trading. Here’s the Only Path That Works.

Why 93% of Traders Fail (and How to Join the 7%) | Edition 35

The journey of a trader toward profitability is long… but rewarding.

When I started about ten years ago, I chose the worst possible foundation: day trading crypto.

The only thing worse than that decision? The fact that I actually made money doing it. I turned $700 into roughly $40K.

I thought I was a genius… but it was just one of the biggest bull markets in crypto history, where every altcoin was doing a 10x.

After I burned through the money, about four years later, I said to myself, “I can do it again, it’s easy.”

That’s when I hit the beginner’s wall for the first time.

Nothing worked. I kept blowing up account after account.

For the first time, I felt truly incompetent.

So I quit trading and decided I’d become an entrepreneur.

This time, I had a plan, I was going to fight for freedom.

When things finally started going well, I already had two full-time employees, and then COVID-19 hit.

I lost my contracts. I lost everything.

Six months later, I was bankrupt.

That one hurt. Not only did I feel like a failure inside, my stepfather told me I was one.

I projected that onto myself and even told my girlfriend (now my wife) that she deserved better.

She looked at me and said:

“It’s just an obstacle. I believe in you. Keep fighting.”

That’s all it took.

One person.

No mentors. No inheritance. No money.

Just a fire in my heart … a desire to achieve what generations of my family never could: Financial Freedom.

I rebuilt my plan and moved to the country that could give me the highest purchasing power for the hours I worked.

For almost four years, I did nothing but grow my capital from zero.

I worked 8 to 5 at my job, then 6 to 9 on my dream.

I built my life around that dream. Measured every tiny detail. Optimized everything I could.

I tracked every hour I spent toward that goal. (Yes, literally .. I used Forestapp to do it.)

These are the hours I spent outside my full-time job, working toward my dream.

I kept a journal where I wrote down everything.

I invested 90% of what was left after bills and used 10% to build my swing trading capital.

In the first year, because I was undercapitalized and impatient, I started trading futures.

I blew up over 50 accounts in a matter of months.

Why?

Because my mindset was still the same as when I traded crypto: get rich fast, take huge risks.

I traded NQ on the 1-minute and 500-tick charts. (For those who know, that’s brutal.)

After half a year of failing at futures trading, one evening I came home from work exhausted, furious at myself for not owning my time.

I wasn’t free.

F$%*# THIS!

I sat for hours at my desk, drained.

Then I opened my investment account on my phone. (For context .. I only invest in one ETF: VT.)

It was green. Six months of consistent investing.

Everything I had worked hundreds of hours on, I’d lost money.

But this thing I had barely touched… was making money.

How is that possible?

I did nothing special. Just kept adding money and waited.

Patience.

Could that be what I was missing?

The next day, I made myself a promise:

I’ll take one trade a day, only trade ES contracts, use 1-hour timeframe for exits, and 5-minute for entries.

One month later…

I became a funded trader for a prop firm.

How is that even possible?

The fewer actions I took, the more money I made.

I scaled up to multiple accounts, and as soon as I had around $30K in trading capital, I transitioned fully into swing trading.

(Still, about 80% of my leftover income after bills went straight into long-term investments.)

We’re sold the idea that day trading is the path to Financial Freedom.

That’s completely wrong.

If you start with day trading, you’ll end up financially destroyed.

That’s why the stats are brutal: 40% of traders quit after one month, 80% after two years, and only 7% survive beyond five.

Because the foundation.., the base… was never built.

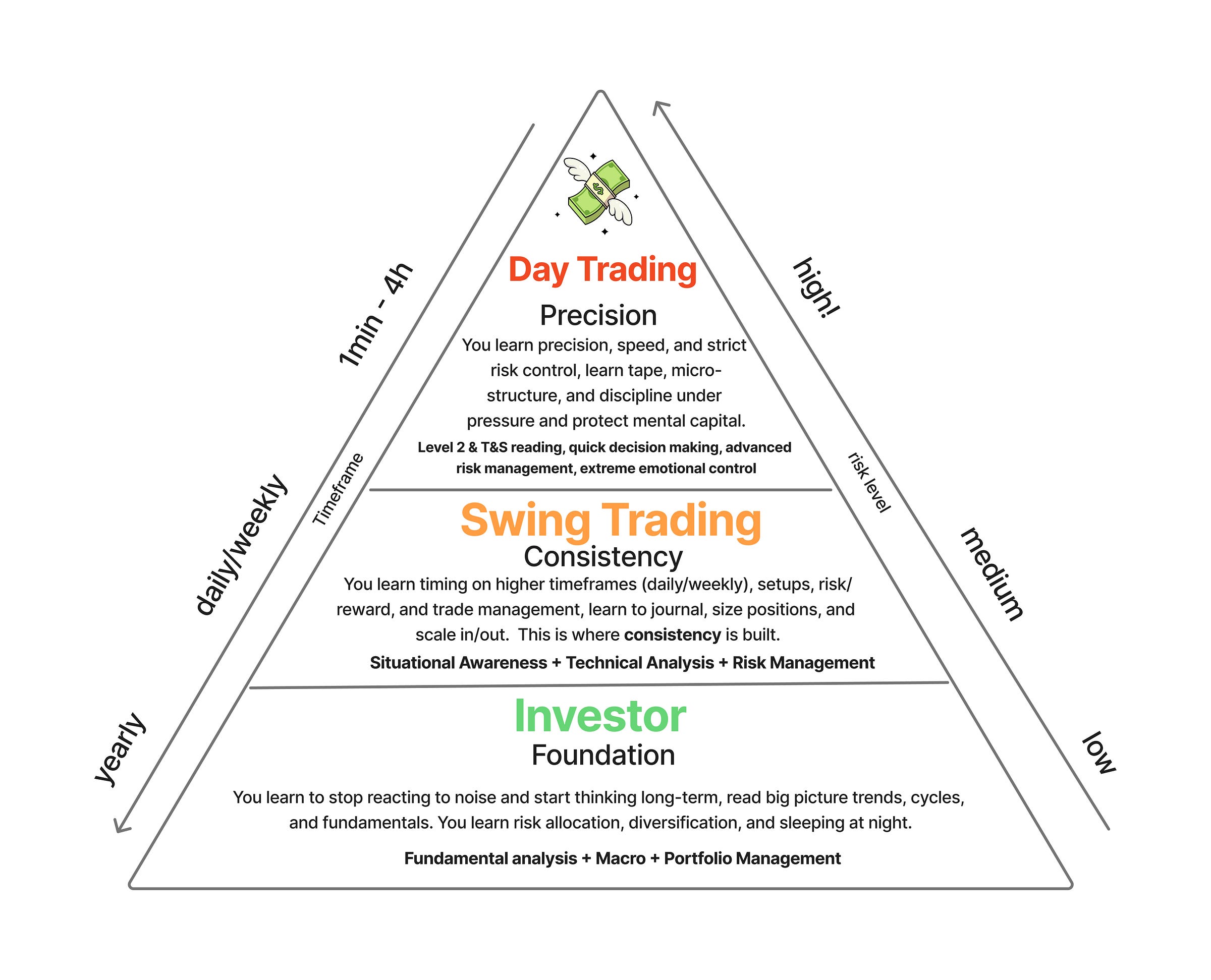

I created this pyramid as a guide to help you understand what your true progression as a trader should look like:

As soon as I understood this process, I started making money.

My win rate improved. My stress levels dropped.

I no longer had to sit in front of the screen all day managing a position.

I could finally focus on my day job, my family, and go out with friends..all while still making money.

Over the last three months, this is roughly what my portfolio has looked like:

Throughout this journey, I realized it’s not about money. It’s not about achievements.

It’s bigger than that.

It’s about the person you become through the process.

It’s about the version of myself from ten years ago, and about the movement, the ideology: freedom.

Excited by these new realizations, I ran into another problem.

I had no one to share this with.

None of my friends were into trading or worked in finance.

So I decided to build Freedom Trades.

Yep… that was the main reason:

To build a global trading community united by one goal: Freedom.

Now we’re over 1,100 traders strong, which is absolutely insane…

I want you to know..you inspire me every single day to create more, to give more, and to dedicate all my time to building something truly great, together.

Join us, where you truly belong.

Trade Setups of The Week

High Probability Trades for Week 42, 2025

This post is available exclusively to PRO members and contains my interpretation of the watchlist along with the trading opportunities I see for the next week.

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my free watchlist here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

Key economic events to watch next week

Technically, we’ve got Existing Home Sales on Thursday and inflation data on Friday, but since the U.S. government is still in shutdown, it’s unclear if those reports will even be released on time.

Earnings to Watch Next Week

Stacked week for earnings, especially midweek.

The spotlight’s on Wednesday and Thursday, with heavyweights like Tesla, IBM, Lam Research, SAP, Intel, Honeywell, and P&G reporting.

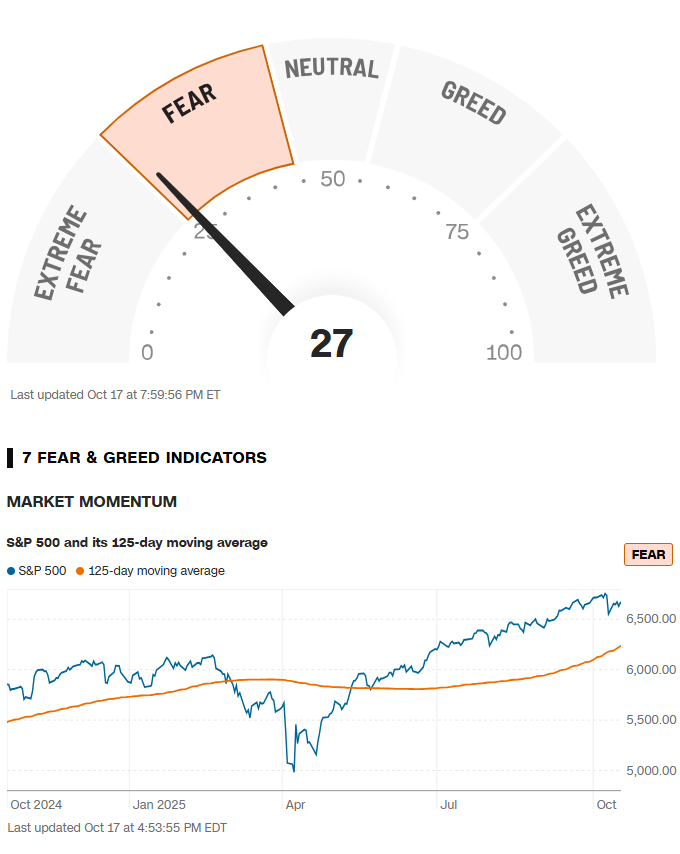

Fear & Greed Index of the week

Markets at all-time high, but we have extreme fear…

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav

Love this story as it’s a familiar path paved with truth. Like your earlier self, I’ve made more by doing nothing but sitting on a single solid decision than chasing endless day trades. I’m transitioning to playing a balance of both. Sounds like you’ve nailed the strategy now.

Emotional Discipline, Position Sizing are the two things a successful trader masters..it cannot be taught..sometimes one has to go through lot of pain..lot of failures..congrats..you seem to be getting closer to your goal