If You’re Burnt Out, This Might Be the Best Trading Advice I Can Give

The 3 Stocks I’m Still Holding | Edition 15

Hello dear traders,

I don’t know how this week was for you, but for me, it was at least hectic.

I juggled work, late flights, exhausting trips, and a very important personal event happening in 9 days.

But even with all that, I still kept my eyes on the market.

It’s true, I didn’t open any new positions.

And that’s exactly what I recommend you do too, traders, when you’re going through a full, stressful period in your life. Staying cash is a position, don’t forget that.

Your time is already packed, you won’t have time to manage another position, and you won’t have the nerves to handle more risk.

So reduce your position size, your trading volume, or better yet, stay away. My biggest drawdowns came from the feeling that I had to make money, that I couldn’t miss out on a trade. So I forced trades I didn’t have time to manage, and they ended up affecting my personal life too.

And that’s exactly what I’ll do… For the next 20 days, you’ll find me in Bali with my future wife (we’re planning to have our wedding ceremony there 😊). I won’t be actively trading, but I’ll keep an eye on the market, I’ll respond to your messages, and maybe I’ll exit a position I’ve been in since November 2022 (yes, I’m talking about BTC). It’s time to slowly start selling and prepare for the next cycle.

It feels weird to share personal stuff with random traders on the internet, but hey, I don’t want this newsletter to turn into a generic one written by ChatGPT.

I’ve been doing this for 15 weeks now, and honestly, I like how this newsletter is evolving, do you?

If yes, how about hitting that subscribe button?

Freedom Trade of the week

As I said above, I haven’t opened any new positions and I don’t plan to next week either, but let’s talk about my current positions.

Especially my top 3 largest ones, the rest aren’t worth mentioning in the free newsletter: UNH 0.00%↑ HTZ 0.00%↑ and BTC.

Let’s start with UNH.

It seems UNH has entered a consolidation zone that could be an accumulation base, if volume confirms.

Now, the most obvious and easiest level for UNH to reach is the previous high, since it's only 8% away, compared to the previous low, which is 17% away. From a probabilistic lens, that makes a retest of the high more likely, though nothing is ever 100%.

I’m patiently waiting to see what happens next week.

HTZ is not moving as expected so far.

After bouncing from my marked buying level, price climbed steadily inside a rising channel, but now breaked the lower boundary. (just FYI - I don’t believe in pattern trading, just like to be aware of them from time to time, especially on the higher time frames, ex: weekly)

I’m still holding my long position, but I’m fully aware this zone needs to hold.

If it breaks, I’ll likely exit.

Target remains the same: that fat zone around $9.

Speaking of pattern trading look at this BTC chart on the 4 hour timeframe:

Since April 4th, BTC has been riding a clean ascending channel, respecting both the upper and lower bounds almost to perfection.

Now we’re seeing some weakness and a clear break below the channel.

Until BTC reclaims the channel or that $107K zone, I expect more chop or downside.

I’m convinced BTC still has room to grow, but I’m very close to selling the position I’ve been holding since 2022.

I’ll start selling gradually, and I expect to be out of my BTC position by the end of summer.

I’ll look to re-enter in the coming years, maybe even below 40 - 50K again… who knows, we’ll see.

I’ll keep you updated either way.

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Get exclusive market insights, access my free watchlist now!

🔗 Check it out here: My Watchlist

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

Key economic events to watch next week

Next week is packed with high-impact U.S. data that could shake the markets, especially with ISM Manufacturing and Services PMI, JOLTs, and the big one: Friday’s NFP + Unemployment Rate.

The Fed is still pretending to be data-driven, so any surprise, especially in job numbers, could shift sentiment fast.

Keep risk tight.

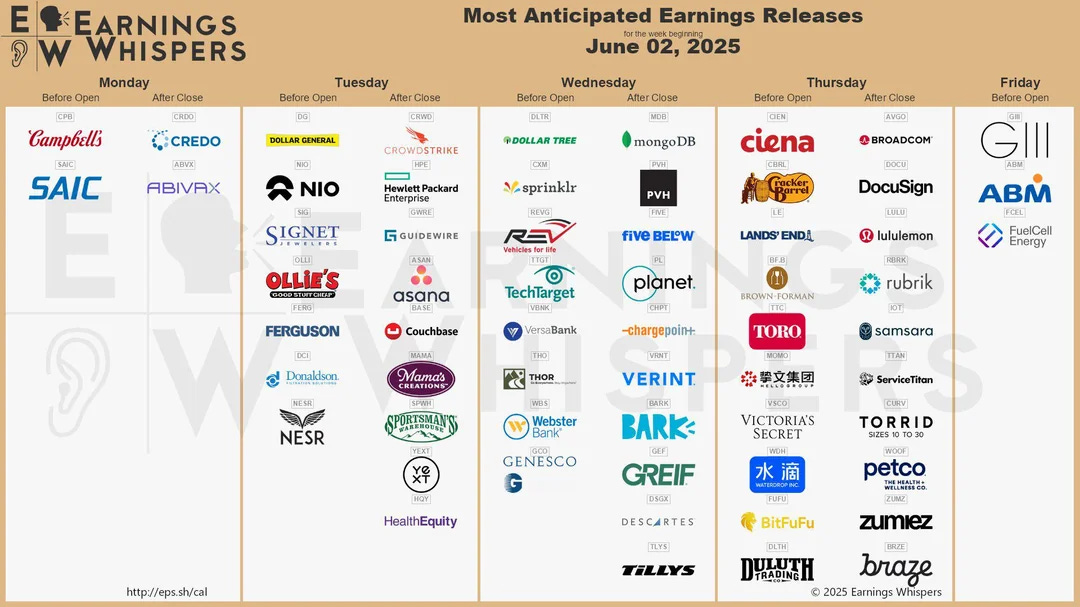

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

Tuesday:

CrowdStrike (CRWD): One of the strongest names in cybersecurity, priced high, so any weakness in guidance could trigger a sharp move.

NIO: China EVs have been struggling..this will be a sentiment check on the whole sector.

Wednesday

MongoDB (MDB): Growth darling with high volatility, watch for margin commentary and AI integration hype.

Thursday

Broadcom (AVGO): Massive semiconductor name tied to AI narrative big implications for SOXX and tech sentiment.

Lululemon (LULU): Luxury retail test if this slips, consumer discretionary may take a hit.

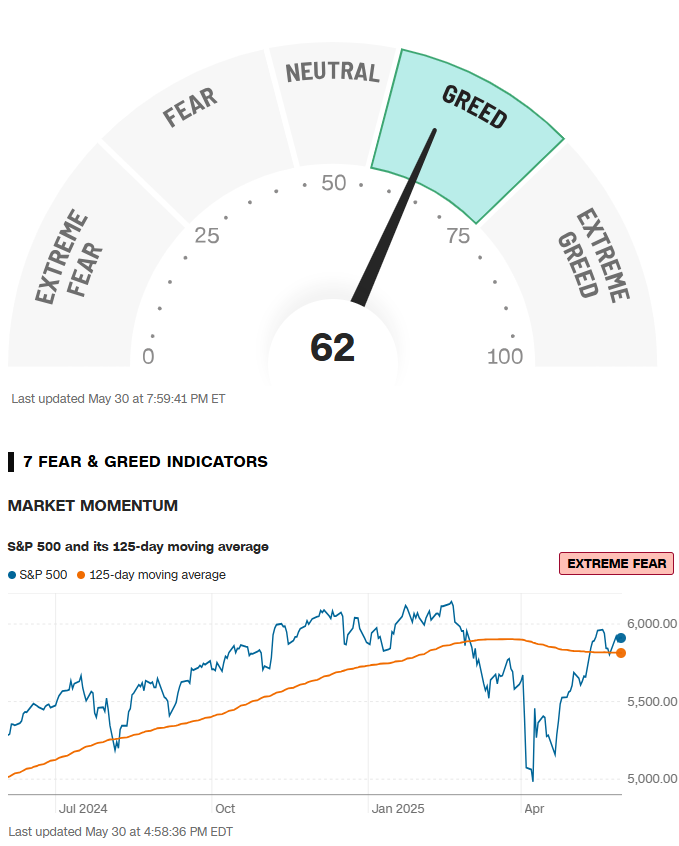

Fear & Greed Index of the week

Financial Meme of the week

credits to @litcapital on X

This was edition 15 of Freedom Trades newsletter.

If you want to access the previous edition, here’s the link:

Thank you for following my trader’s journal, and I’ll see you next time :)

“One trade closer to freedom.”

Vladislav

It does look like a breakout.

That descending red line needs to be lowered a bit on the right side.

To rest on that small rally back there.

Then you will see the breakout above the line.