My August trading performance (full transparency)

September could wipe out traders… here’s why | Edition 28

Dear Traders,

August has come to an end, and with it, summer is over too :( (my favorite season).

I’m about to share some very important statistics with you, and on top of that, I’ll be making public some data that other communities wouldn’t be willing to share…not even if you paid them…

But here in the Freedom Trades community, transparency is very important.

It’s the only way a trader like you can assess whether there’s something to learn from me or not… whether you can trust me or not.

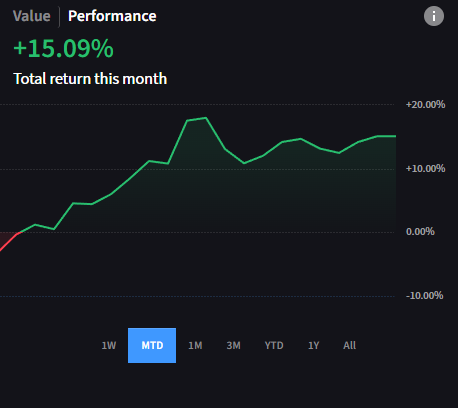

My August Trading Performance

I want to tell you that August has been my best month so far. My portfolio grew by 15% in just this month alone.

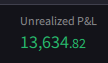

And we still have a few open positions with unrealized profit.

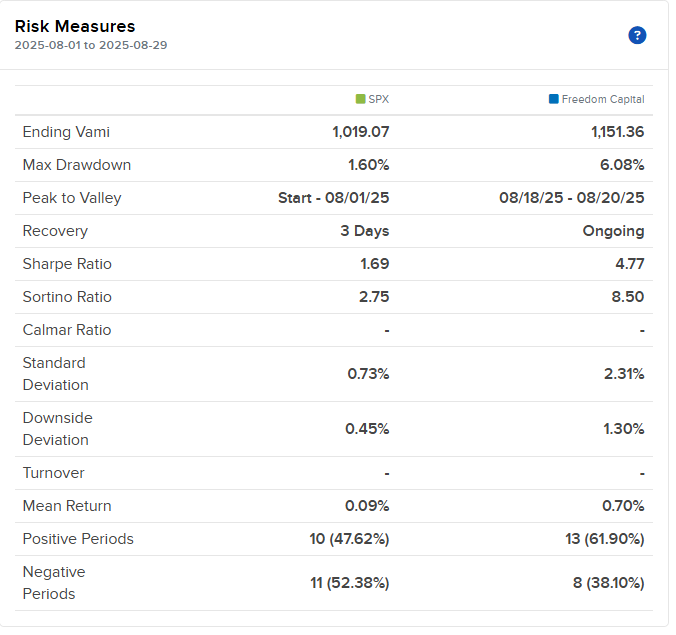

But you know what speaks louder than all of this? My RISK MEASURES!

And one of my subscribers from the paid community actually asked me about this the other day.

So I’ll make them public here and compare them with the SPX (the standard benchmark everyone follows).

If you want access to even more statistics and actually see exactly how much money I have in my trading account right now, check out this post:

But enough about me…I want to hear from you now.

How was August for you?

A few traders from the PRO community showed me some nice profits ( I can’t share, since I don’t have their permission - these were private chats).

If you’re brave, write in the comments what return you had this month.

And if things didn’t go the way you hoped, send me a message, maybe we can turn September into a success!

Speaking of September:

Do you know what happens in September?

The September effect

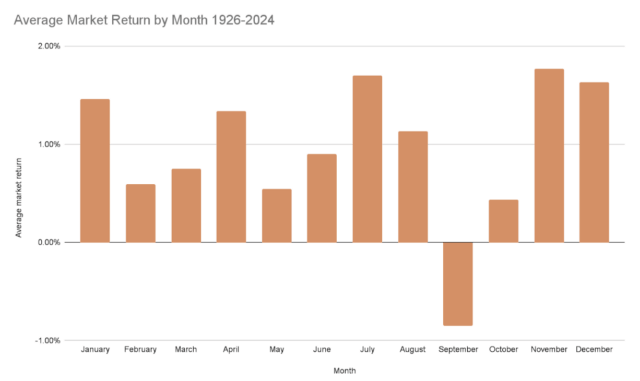

Let’s talk about the September Effect, Wall Street’s favorite superstition.

For almost 100 years, September has had the worst average returns of any month. On paper, stocks drop about 1% more often than not. Why? Nobody really knows. Some blame post-summer profit taking, back-to-school expenses, or even pure psychology: if everyone expects September to be bad, they act like it will be.

But here’s the truth: in the last decade, September hasn’t been consistently negative. In fact, if you had shorted the market every September since 2014, you’d have lost money.

So, is the September Effect real? Kind of. It shows up in long-term data, but it’s not a reliable signal to trade on. Think of it less as a trading edge…and more as market folklore that keeps traders on edge as summer fades.

And the thing is, if we look at the $SPX chart on the monthly timeframe:

We can see the market has already had 4 green months in a row, and it’s also sitting at the top of a channel if you notice.

So naturally, everyone expects a pullback in September.

Which makes me consider that the exact opposite could actually happen…

Nevertheless, we need to be very careful, if September truly turns out to be a losing month, a lot of traders will blow up their accounts!

The euphoria from the past few months, the bull market we’re in, combined with a sharp pullback with high volatility… that’s a recipe for disaster.

But together we’re stronger and better informed, that’s why I encourage you to subscribe to Freedom Trades and start engaging with us.

We really are a solid crew of traders :) Don’t be afraid.

Trade Setup of The Week

Ticker: MARA -0.25%↓

MARA looks good, but it will only move if we see another wave of hype from the crypto market, and right now BTC is in a -13% pullback from its ATH. If we see strength in BTC, MARA could be a better play.

All of August, it has been trading in a $15–16 range, and it looks ready to explode. If that trendline holds, we could see a 32% move and even more if it reaches the next resistance line at $30.

The same goes for MSTR (if you look at the daily timeframe chart)

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my free watchlist here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch. Gain access to my trading strategy, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

Key economic events to watch next week

Busy week for traders:

Tuesday kicks off with ISM Manufacturing PMI, any dip below 50 screams contraction.

Wednesday’s JOLTs will show if the job market is cooling.

Thursday we get ISM Services PMI.

Friday is the main event: Non-Farm Payrolls & Unemployment Rate..the Fed watches these like a hawk.

buckle up, this week’s data will set the tone for September.

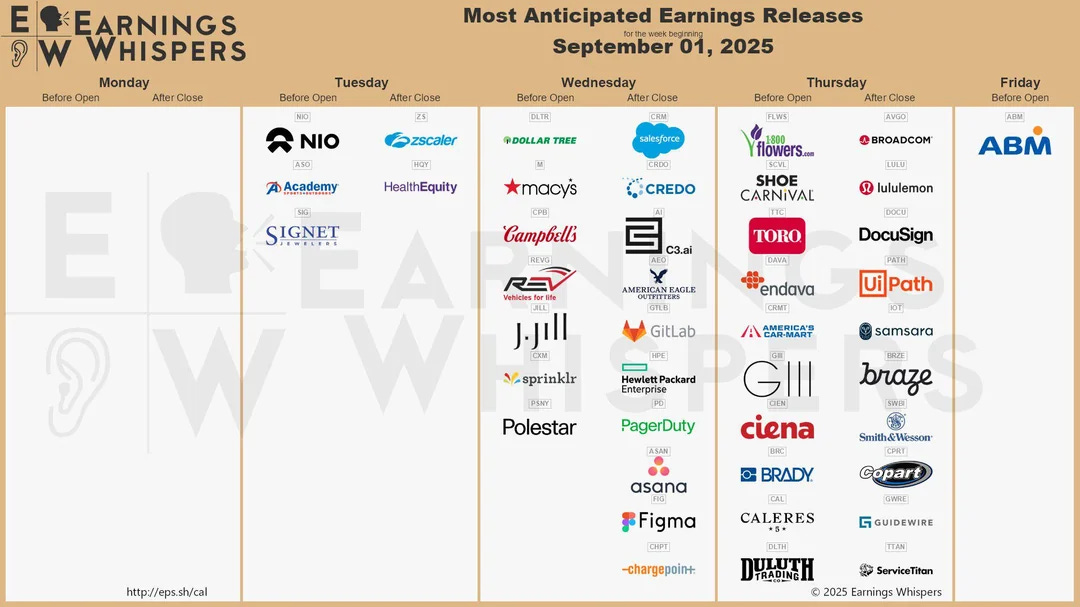

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

Salesforce, Broadcom, and Lululemon are the heavyweights here.

Keep an eye on Dollar Tree and Campbell’s for consumer sentiment signals.

Figma could also be interesting to watch!

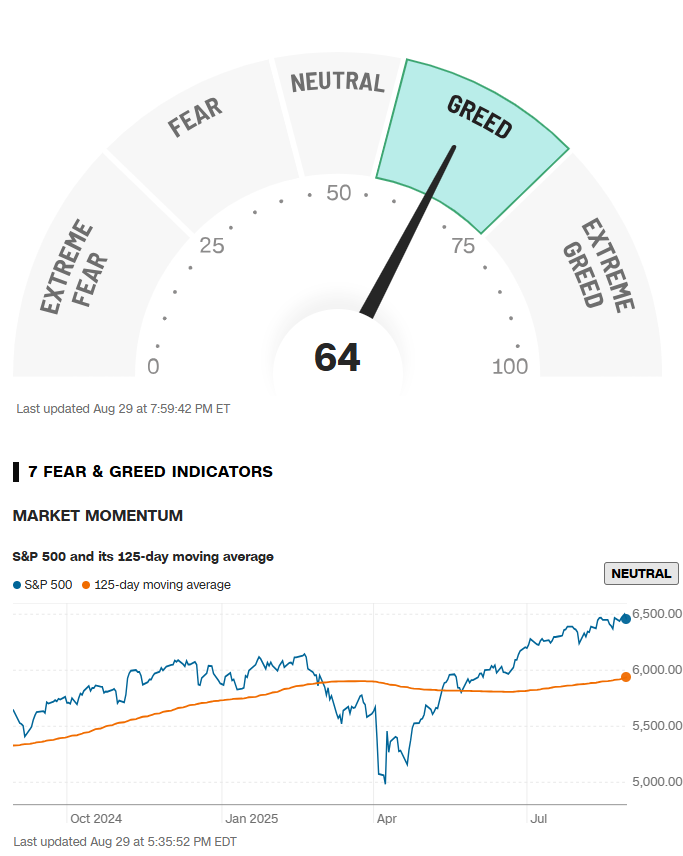

Fear & Greed Index of the week

Financial Meme of the week

Thank you for being with me in this edition. If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible. And here’s the fun part: when you share it, you can unlock special rewards, exclusive insights, premium content, and more.

“One trade closer to freedom.”

Vladislav

I m following MARA as well.

After your post 😍