Reddit is the next $100B monster. Here’s why I think it’s a 5x from here.

Reddit is wildly undervalued. Here’s my full investment thesis.

I believe Reddit has the potential to become a company with a market cap of at least $100 billion in the next few years and could easily do a 5x from here.

In this analysis, I’m looking at Reddit (RDDT) from a long-term perspective. I’ll use a simple approach, a Discounted Cash Flow (DCF) to estimate its real value, plus a comparison with similar companies. No fancy Wall Street jargon here, just a breakdown anyone can understand without being a financial analyst.

Look, I’ll say it from the start: Reddit is not Meta. It’s not TikTok. It’s not Snap.

And that’s exactly its superpower.

If you're looking at Reddit through the same lens you use for other social platforms, you're already losing the game. Because Reddit is playing a completely different sport … one built on raw, unfiltered internet culture and obsessive niche communities.

But here’s the problem...

Wall Street hates messy stories. And Reddit? It’s messy as hell.

They went public in March 2024. Opened at ~$50 per share. $9.5B market cap. Today? hovering around $18B.

Most investors look at that and think: "Meh. Next."

But what they’re missing is that Reddit isn't priced for today. It's priced for execution. And that's a bet I'm willing to take.

What Makes Reddit So Different (And So Valuable)

Let’s get real for a second.

Meta owns your social connections. TikTok owns your short-form dopamine hits. But Reddit owns your curiosity.

That sounds fluffy. It's not.

Reddit has over 100 million daily active users. Not casual scrollers. Not bots. But deeply engaged people spending hours inside niche communities. People solving problems. Sharing experiences. Creating memes. Debating politics. Reviewing products. Teaching each other skills.

Reddit's entire model is built around depth….

And that makes their ad inventory infinitely more valuable... if they can figure out how to sell it right.

The Numbers Don't Lie...

Here’s the truth no one wants to admit: Reddit is still early in figuring out how to make money.

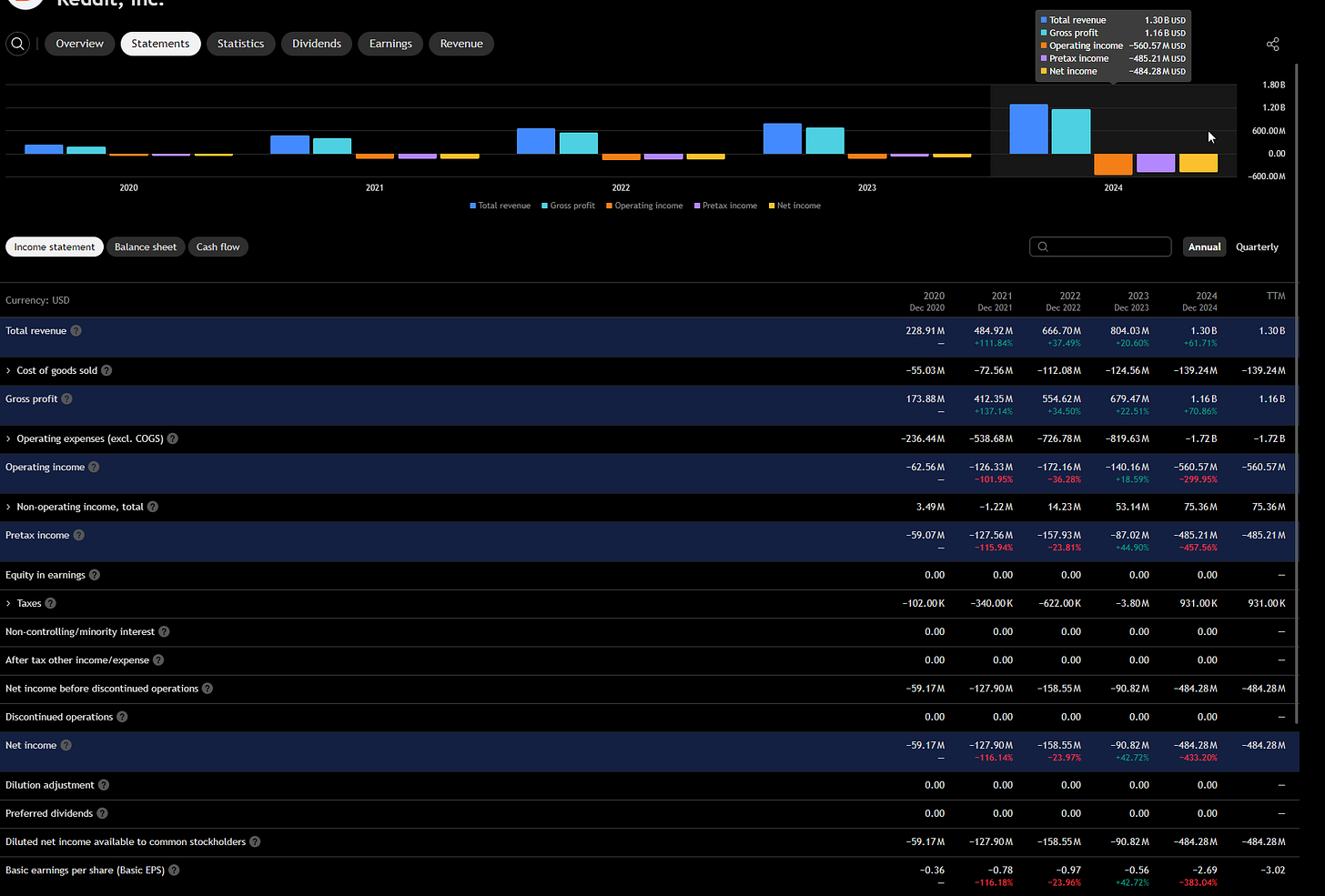

Revenue in 2024 hit $1.3 billion… that’s up big YoY. But they’re burning cash like crazy. Operating margins are sitting at -43%.

That's ugly.

But again, it's also expected.

Reddit is investing in growth:

Hiring talent.

Expanding ad products.

Building AI features.

Improving user experience.

They're doing exactly what you'd want them to do pre-scale.

This was a 9,000-word deep-dive investment report on Reddit (RDDT). I went through every line, every chart, every boring corporate projection, so you don’t have to. What you’re reading here is the simplified version. Just the key things you actually need to know as an investor.

If you enjoy this kind of breakdowns, consider subscribing, it helps me keep doing more of these.

The Path to Profitability is Real

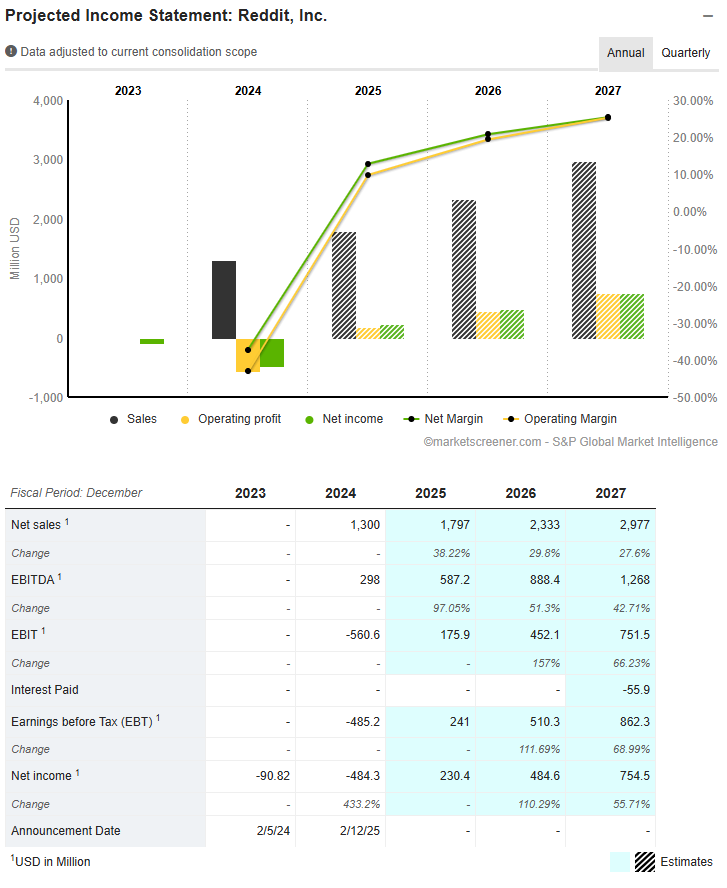

Their own projections show a clear roadmap:

This is not a fantasy scenario. This is very achievable if:

They keep growing DAUs by ~10% per year.

They boost ARPU (Average Revenue Per User) by ~10-15% annually via better ad targeting.

That's textbook social media scaling.

By 2030, Reddit could be pulling $4.5 billion a year in revenue and generating nearly a billion in free cash flow.

That turns today's $18B valuation into a joke.

Why Reddit's Competitive Moat Is Stronger Than It Looks

People love to throw around the "network effect" term.

But Reddit actually has one.

Try replicating 15+ years of archived discussions across millions of subreddits.

Try rebuilding trust within ultra-specific communities like r/WallStreetBets, r/AskDocs, or r/PersonalFinance.

Try creating a culture where people share sensitive stories or DIY tutorials or industry gossip, without the performative bullshit of TikTok or Instagram.

You can't.

Even during the 2023 API drama (when Reddit angered tons of moderators and developers), people tried to move to platforms like Lemmy.

It didn’t stick.

Communities are sticky. And Reddit knows it.

The AI Wildcard: The Gamechanger

This is where I get bullish beyond belief.

Reddit owns a mountain of structured, contextual, human-written data. And in the AI arms race, that's gold.

Look at what happened already:

Google paid Reddit ~$60 million for access to its API data.

Reddit is building "Reddit Answers", an AI-driven feature that could become the best Q&A engine online.

Think about that for a second.

Every LLM (Large Language Model) needs fresh, clean, real-world data. Reddit has it. Billions of posts. Billions of comments. Context-rich. User-validated.

If OpenAI, Google, Microsoft, or Meta want to train their models better, they will have to pay up.

We're talking potential recurring revenue streams from data licensing that could dwarf ad revenue long-term.

This isn't hypothetical. It's already happening.

Risks You Can't Ignore

I'm not here to sell dreams without showing the monsters under the bed.

Reddit still has to prove it can:

Grow users without alienating its core culture.

Monetize without killing the user experience.

Avoid brand safety disasters (ads next to wild content is always a risk).

Stay ahead of fierce competition from TikTok, Discord, and emerging platforms.

Execution risk is very real.

But that’s what makes the reward worth it.

This is not a “safe” stock.

It’s a conviction play.

Catalysts That Could Blow This Stock Wide Open

Let’s talk about the next 1-3 years.

Here’s what could absolutely turbocharge Reddit’s valuation:

AI partnerships with OpenAI, Google, Amazon, or Microsoft.

Launch of Reddit Answers as a killer feature.

Accelerated break-even timeline (ahead of 2027 projections).

Major new ad product rollouts or targeting improvements.

Recovery or growth of digital ad markets industry-wide.

New community-driven events that go viral (like r/place or meme stock waves).

Strategic acquisitions in AI moderation or niche content spaces.

Each of these could add billions to their market cap overnight.

The Buy Case: Why I'm Bullish Long-Term

Let me be clear.

Reddit will not become the next Meta.

This is about becoming the best Reddit. Building an authentic platform…

And that alone could drive this stock from $100 today to $500+ in the next 5 years.

Here’s how I see it playing out:

Base case: Reddit grows revenue to ~$4.5B by 2030, hits ~20-25% margins. Market cap moves to ~$36B. 2x from here.

Bull case: AI monetization hits faster. DAU growth surprises to the upside. Strategic partnerships flood in. Market cap hits $80B+.

Bear case: Execution fails. User growth stagnates. Monetization disappoints. Stock stays flat or drops 30-40%.

That’s the bet.

Disclaimer: I already have a long position with an average price of $60 and I plan to hold it long-term (years, depending on its performance).

Before you go:

I'm here to write what actually helps you, not just what gets clicks.

Vote & let me know, this helps me shape future content.

Most people won’t read a 9,000-word report. You just did it in 5 minutes. If that’s worth something to you, you know what to do, subscribe.

Spicy, excited to read this.