The Lie Most Traders Believe

Why You’ll Never Be a Profitable Trader Until You Do This | Edition 16

Dear Traders,

This might be the most honest thing I’ve ever written as a trader.

For the past 4 days, I’ve been in the beautiful city of Denpasar, Bali, finally relaxing after what I’d call half a year of hard work, progress, battles, wins, and losses. But hey, that’s trading, right?

Sometimes you win, sometimes you lose…

And today, while sitting on the beach, my fiancée (soon-to-be wife) was on my left, the water was as blue as the sky, the sun was shining, a soft tune played in the background that matched the vibe perfectly, and in my hand I had Unknown Market Wizards by Jack D. Schwager.

Everything felt perfect, and it truly was, except for one thing…

My mind… or a part of me… felt unsatisfied.

And then, as I often do, I drifted into thought…

I asked myself: Vladislav, what’s wrong with you?

You’re staying at one of the most luxurious resorts in Bali, you’re about to marry the love of your life, you’re healthy, you’re young, you have money, you’ve got everything you dreamed of when you were 16… It’s finally happening.

So why do you feel like this?

Then, in a split second, I understood.

I understood what Jim Carrey really meant.

What makes me feel fulfilled, or “happy” if you will, is when I’m building, when I’m trading, when I help others, when I write here on Substack and connect with other traders.

Don’t get me wrong, I’m not preaching work 24/7 or hustle culture, but relaxing your whole life and a hedonistic lifestyle, where you chase pleasure all the time, is just not for me. This is not who I am.

I don’t get my dopamine from those places, in fact, they usually leave me feeling worse than before.

When I was 16, I thought the path to happiness was having at least a million dollars in the bank and an Audi R8. Now that sounds so superficial… But to be fair, I was a kid consuming way too much MTV and American pop culture. It’s sad when I still see adults thinking the same way.

And to you, young traders or old, I say this: You won’t become profitable until you detach from money, completely.

Yes, I’m not a hypocrite, we do this for money, for a better lifestyle, but that’s not the end goal.

Fall in love with the process, genuinely try to be the best trader you can possibly be. Forget the money for a moment and treat it like a sport.

You’re an athlete, one that has to perform every single day.

Stop giving money so much power and realize that once you’ve secured the basics (a place to sleep, food, electricity, water, internet), you’re ready to begin the process of detaching from money.

If you’re reading this newsletter, you probably already have more than enough. The fact that you even have internet access puts you in the top 50% of the planet.

And all the investors and traders probably tell you to do this, but they don’t tell you how. Here’s what worked for me:

Understand what “enough” means to you. (If you don’t define a number, you’ll keep chasing more.)

Separate your worth as a person from how much money you have.

Invest in freedom, not in status. (Stop trying to impress everyone, man.)

Practice daily gratitude. (When you notice what you already have and how lucky you are compared to others, the desire to “have it all” starts to fade. - Bali helps, just observe..)

Set impact-driven goals, not just money goals.

When your life is driven by purpose, money becomes a tool, not the goal.

Please write to me, do you struggle with this too? Maybe I can help in some way…

Freedom Trade of the week

Since I’m on vacation and technically starting my honeymoon on Monday :)) I won’t be opening any new positions this week, and possibly not next week either, unless an unmissable opportunity shows up.

But if you want to see the positions I still have open, I recommend checking out the previous edition:

This newsletter will be a bit different, as you’ve probably noticed.

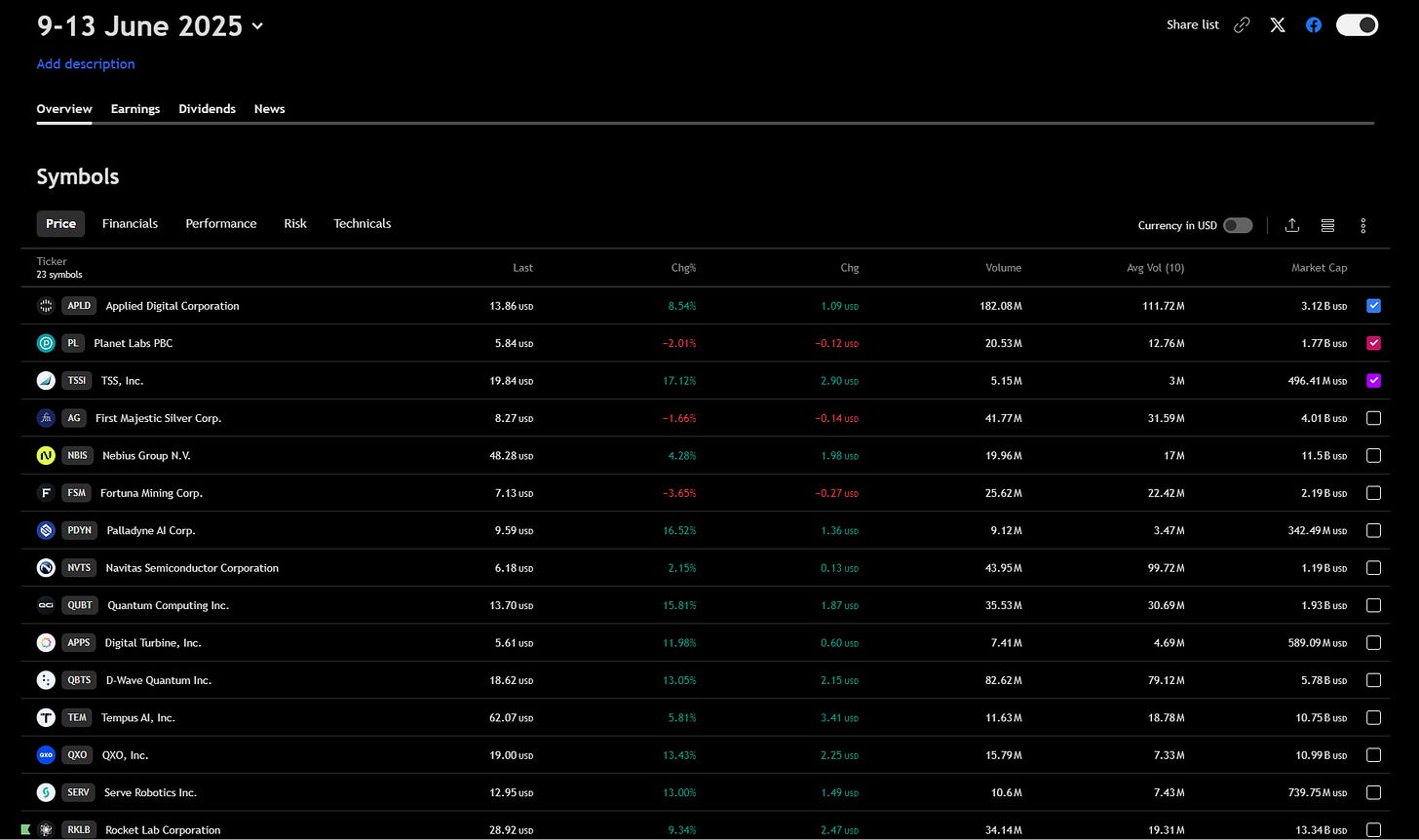

My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Get exclusive market insights, access my free watchlist now!

🔗 Check it out here:

Want more than just a watchlist?

Get weekly stock picks with entry levels, stop-loss, and target prices, so you know exactly what to watch. Gain access to my long-term investing and swing trading strategies, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

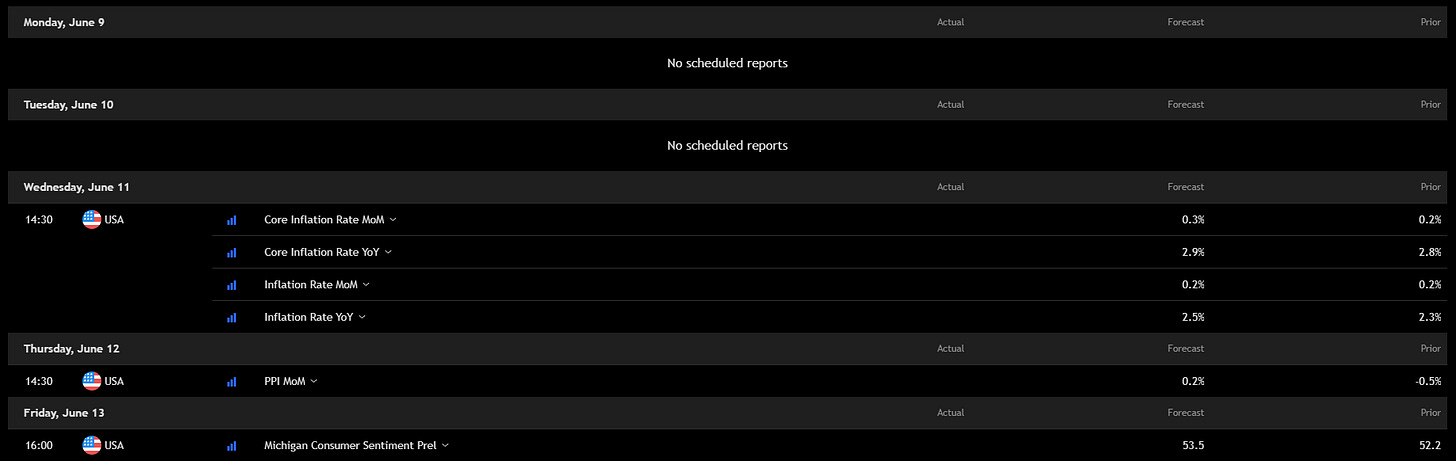

Key economic events to watch next week

Big week ahead.

June 11: CPI + Core CPI, this will either calm markets or light a fire under them.

All eyes on YoY inflation, forecast is ticking higher (2.5% vs 2.3% prior).

June 12: PPI, watch for upstream pressure.

June 13: Consumer Sentiment, if this drops, Fed might flinch.

Earnings to Watch Next Week

Here are the most interesting earnings reports coming up:

A pretty quiet week, but here are a few names that caught my attention.

Tuesday – GameStop:

Retail traders will be watching for any signs of turnaround or meme momentum.

Wednesday – Oracle:

Weak cloud growth could send shockwaves across the tech sector.

Thursday – Adobe:

AI hype vs. real revenue. If Adobe doesn’t deliver upside, expect a reality check for software valuations.

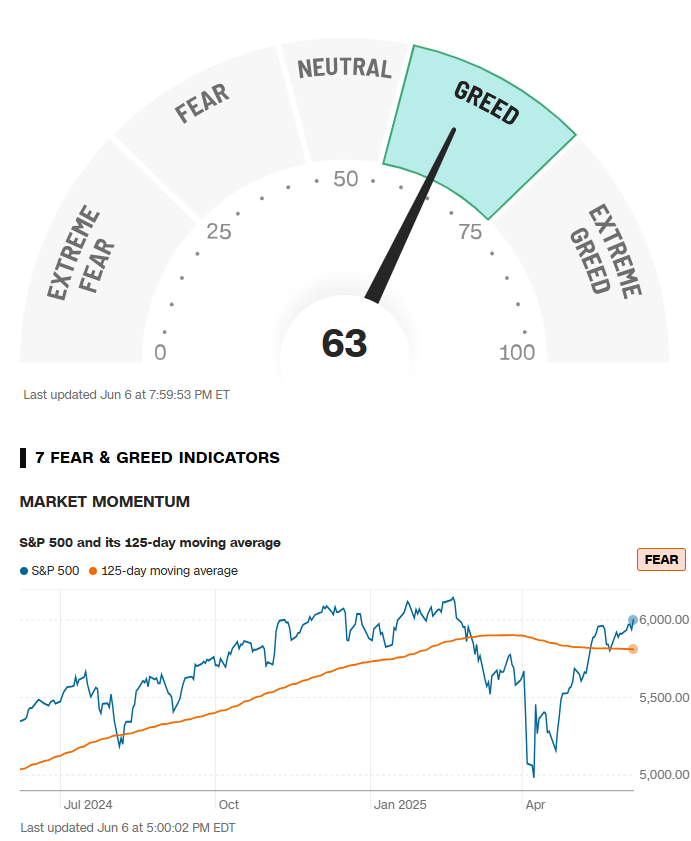

Fear & Greed Index of the week

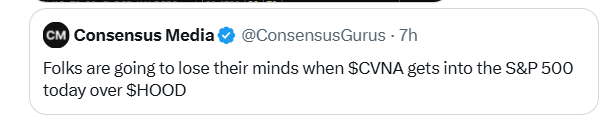

Financial Meme of the week

Credits to @ConsensusGurus on X

Thank you for being with me in this edition, and if you think this newsletter could be helpful for your friends, share it with them so it can reach as many traders as possible.

“One trade closer to freedom.”

Vladislav

Great read! The idea that trading is about perfect setups rather than perfect timing is a game changer. How do you personally manage the tension between waiting for ideal conditions and seizing opportunities in real time? Would love to hear your approach.

Powerful writing