The new Richest Man in the World

Insane Profits, Market Euphoria & What’s Next | Edition 30

Last week was absolutely insane!

The market is going crazy and hitting all-time highs!

Pretty much all our positions went up, and one of our signals is at +54%!!

I’m talking about… NBIS 0.00%↑

I called out this opportunity just 2 days before it exploded!

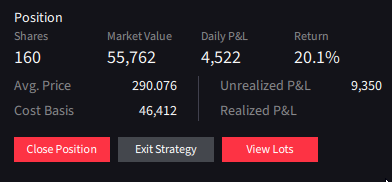

On top of that, I sold one of my massive positions in UNH for a 20% profit.

But it’s not all sunshine and rainbows! We need to stay cautious, because the market is in a stage of euphoria.

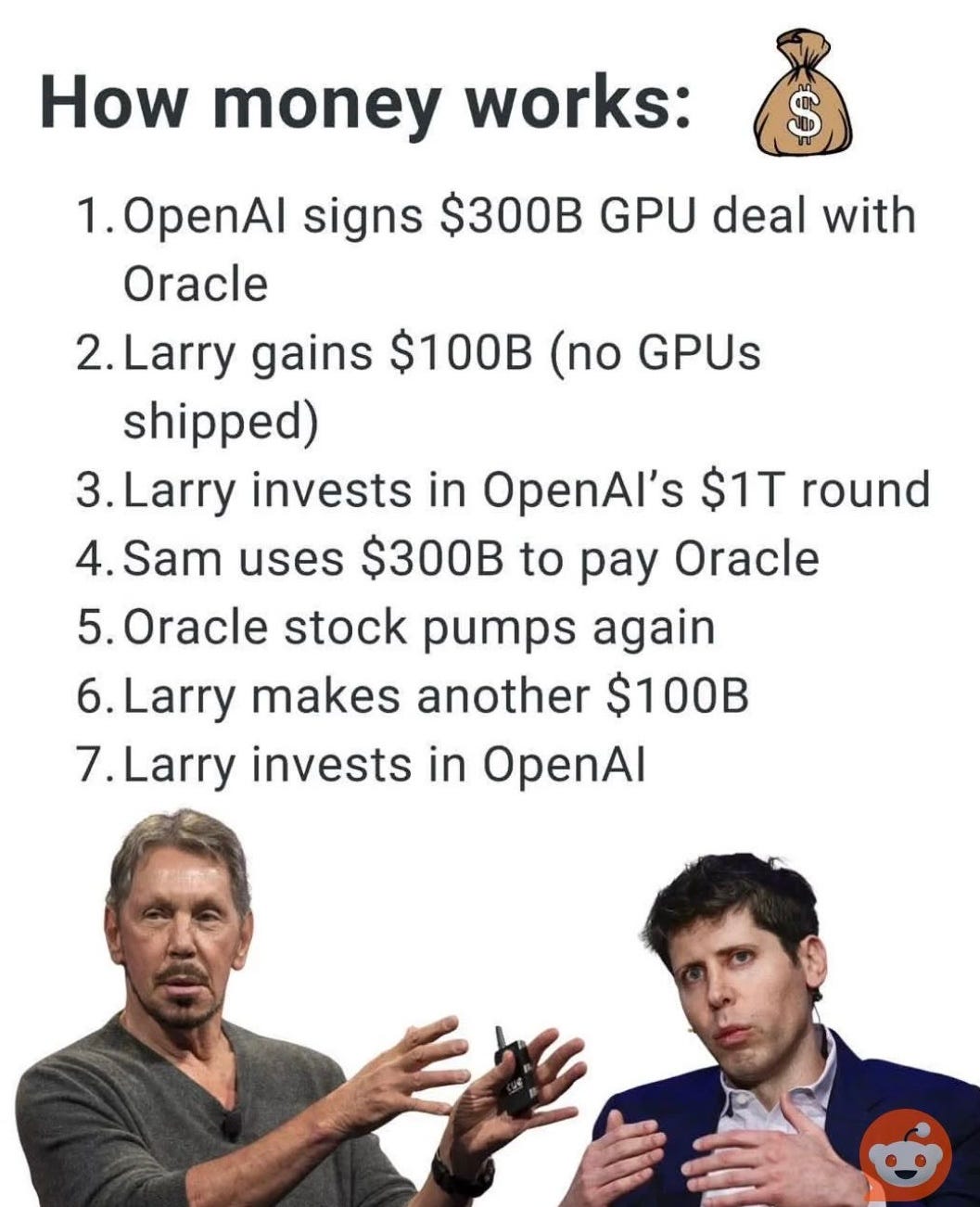

Just look at what happened with Oracle.

+40% in a single day?? $300 billion in market cap added overnight.

So, if you’re wondering why their stock shot up, you probably already guessed it: it’s all about AI.

Basically, demand for their cloud services is booming. They’ve got a massive $455 billion backlog of AI deals already lined up. That’s up 359% from last year, which is just insane.

And it doesn’t stop there. They’re forecasting $18 billion from their cloud business in 2026 alone…a 77% jump.

And as if that wasn’t enough, the Wall Street Journal revealed that Oracle signed a $300 billion deal with OpenAI to provide up to 4.5 gigawatts of data center capacity.

Meanwhile, Larry Ellison officially became the richest man in the world, overtaking Elon Musk.

The biggest single-day jump in the Bloomberg Billionaires Index ever.

Even though I didn’t live through the dot-com crash (I was 5 years old back then), it feels like the same pattern is starting to form hehe.

Maybe some of my older subscribers can confirm or deny this? (send me a message or reply to this)

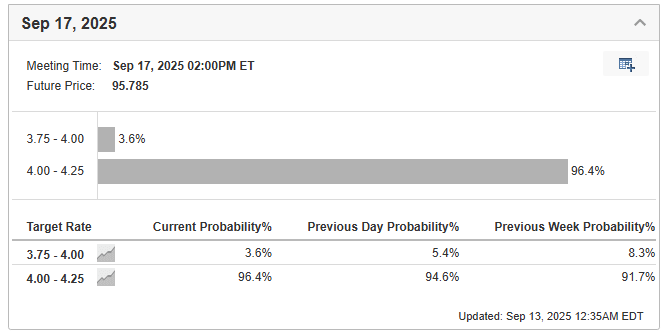

But the big event is on September 17, the next FOMC meeting.

Markets are pricing in a near-certainty of a rate cut, with a 96.4% chance of a quarter-point reduction.

This expectation was bolstered by producer inflation (PPI) data, which unexpectedly fell, strengthening the case for the Fed to act.

Wall Street’s consensus is also shifting, with major banks now forecasting a series of cuts. The common call is for a total of five cuts spread across 2025 and 2026.

I’m super curious to see how markets will react to the event, and maybe we’ll catch up live on the Discord server (invite here) when it happens.

Trade Setup of The Week

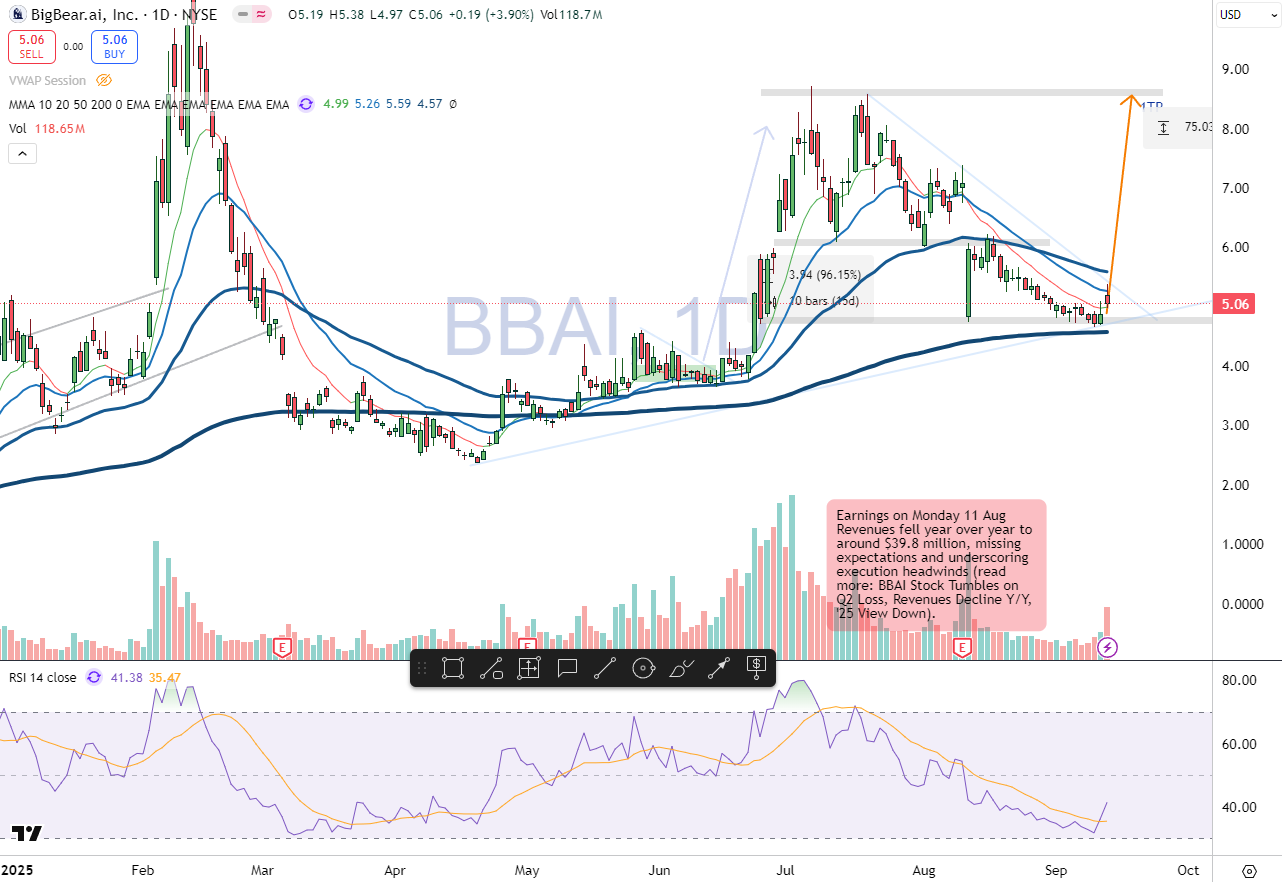

Ticker : BBAI 0.00%↑

BBAI seems to have formed a small support zone around $4.50 – $5 and bounced off the 200 EMA. Volume has also been increasing over the past two days, and RSI is oversold.

But I want to caution you, this is purely a technical setup, with no catalyst behind it, and still in a downtrend since April, failing to break its all-time high. For me, this is a B setup, so don’t allocate a large position to this trade.

For more setups, check out this link for this week’s opportunities:

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my free watchlist here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch. Gain access to my trading strategy, built to maximize returns while managing risk.

Plus, join a community of like-minded individuals who are serious about financial freedom and taking control of their future.

Upgrade now to get the full experience!

Key economic events to watch next week

This week is all about Wednesday, September 17, the Fed meeting.

Rate decision, economic projections, and Powell’s press conference will overshadow everything else.

Retail sales and housing data matter, but let’s be real: the market only cares about what the Fed does and says.

Earnings to Watch Next Week

Next week’s earnings lineup looks pretty weak overall, nothing major…

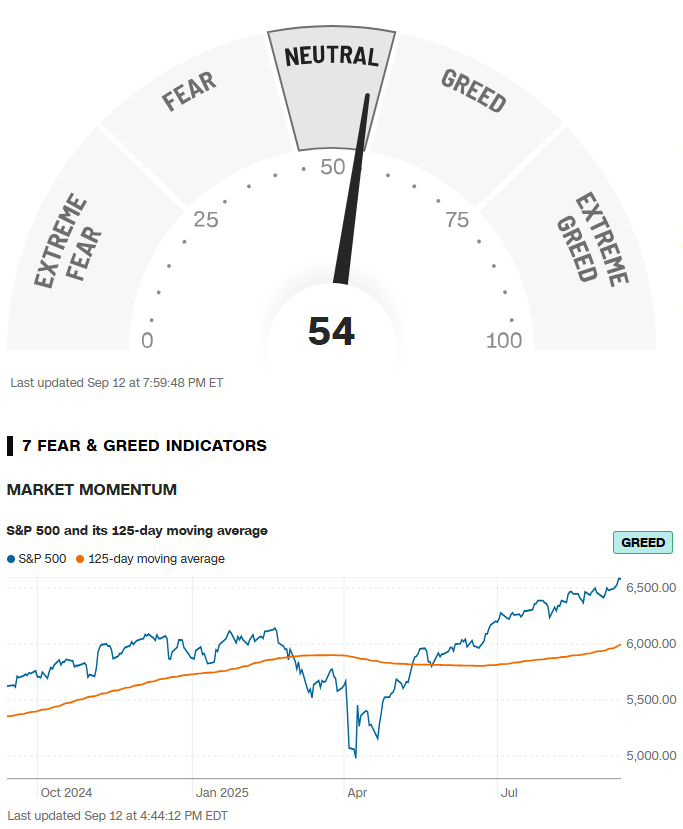

Fear & Greed Index of the week

Financial Meme of the week

Thank you for being with me in this edition. If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible. And here’s the fun part: when you share it, you can unlock special rewards, exclusive insights, premium content, and more.

“One trade closer to freedom.”

Vladislav

I love your

“How Money Works”

Secret Recipe For

Instant Riches

I just have to find that

Magical Company