Trading while life falls apart

The brutal lesson | Edition 32

Hello Traders,

I can’t believe this is the 32nd letter I’m writing to you.

It’s become one of my favorite parts of the week, when I shut everything off, silence my notifications, put my phone away, and slip into flow.

Today’s letter is different. It’s heavier. More personal.

Because I want to talk about something every trader faces, sooner or later:

How do we trade when life itself feels like it’s falling apart?

We often talk about strategies, setups, and profits. But let’s be honest, none of that matters when you’re carrying a storm inside.

Maybe you’ve had a fight at home.

Maybe someone close to you is sick.

Maybe you’re drowning in financial pressure.

And in those moments, the market looks like an escape.

You tell yourself: “I need to make it back. I need a win here, so I can feel better.”

I’ve been there.

This past week, my wife had surgery. (Some of you already know...thank you so much for your kind words and messages, they meant the world to me.)

It wasn’t easy. Not everything went well. We received more bad news, a new diagnosis that we weren’t prepared for…

Seeing her hooked up to machines, with needles in her arm, is not exactly a relaxing image…it’s an image that shakes you.

You want to be strong, but inside, you’re breaking.

From Monday to Thursday, I was by her side, bringing her whatever she needed, trying to keep her spirits up… while at the same time juggling work, trading, and staying present in this community. Because life doesn’t pause.

And neither does the market. It doesn’t care that you’re exhausted, stressed, or scared.

Don’t get me wrong…I’m not complaining. It’s just life, with its ups and downs.

The market will punish you the second you let emotions take over. And I did.

On top of everything, the market dropped 2% after Jerome Powell’s comments.

I was caught completely off guard.

That’s why I want us to break down my mistake together…so we can learn from it, and be better prepared the next time life and the market collide.

Where I Went Wrong

I was in 2 winning positions.

So let’s start with MARA.

Here are my executions:

On September 2nd, I first entered a position with 630 shares. Later, seeing that it held that level well, I added another 670 shares for a total of 1,300 shares.

So far, so good. After spotting that wick on the 4-hour timeframe on September 18th, I decided to sell 400 shares at $18.935 for a 21% profit.

If you look closely, on Tuesday, September 23rd, a double top formed. It failed to break out above the previous high…and that’s the moment I should have reduced my position.

Even more than that, I was given another chance to sell the next day, Wednesday, September 24th. That wick was a clear signal that I should have exited the position.

I made two mistakes here:

I wasn’t at my computer to check my positions. (Let’s say this one is forgivable, given my situation.)

I didn’t set my stop-loss higher, at least at $17.50. (Here I have no excuse…this was pure negligence.)

Now the question is:

How much did this mistake cost me?

Far too much.

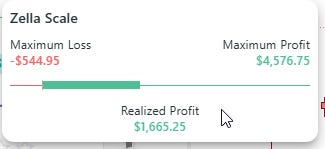

Although the position was profitable, I made $1,665, I could have made up to $4,576. And if I had set that stop-loss, I would have locked in around $3,000.

And if we add the other ticker, SERV///where I made the exact same mistake (and actually lost money there)…

I could have easily made over $4,000 with one simple trick: Trailing Stop Loss.

In short: RISK MANAGEMENT!!

And this is where I urge you again…track all your trades!! I’m begging you.

You can’t improve what you don’t measure.

Every time I talk with you traders, I ask you about a goal you want to achieve with me. And almost every time, we reach the same conclusion: you’re not measuring that goal.

How can we improve something if we don’t have anything measurable?

Are we really going to say we’ve improved, or not, based only on how we feel?

Life is already full of emotions… you don’t need more of them from trading.

This is what I learned this week…even after all these years of trading.

On the days when your personal life is unstable, the best trade you can take is no trade at all.

The second-best trade is making sure your stop-losses are set.

Because the market will still be there tomorrow. But the money you lose when your mind is somewhere else… that doesn’t come back.

If you feel like now is the time to take your trading seriously, join the Freedom Trades community today. Here’s 10% off your first year to start your week strong:

Trade Setup of The Week

Ticker: AMD

AMD is stuck in a range right now. Support sits around $150, resistance around $180. As long as it holds above support, the risk/reward looks solid, about 17% upside if we push back into that resistance zone.

The 200-day is curling up, RSI isn’t screaming overbought or oversold, and volume’s cooling off…classic consolidation. If bulls take control and break that $180 wall, next target is way higher, around $225. But if $150 cracks, we’re back to hunting lower entries.

I’m leaning bullish as long as that support holds.

For more High Probability Trades, check this:

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my free watchlist here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

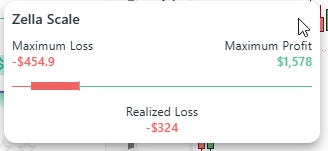

Key economic events to watch next week

JOLTs on Tuesday and ISM Manufacturing Wednesday set the tone, but the real spotlight is Friday with Non-Farm Payrolls, Unemployment Rate, and ISM Services PMI.

Earnings to Watch Next Week

Looks like a pretty quiet earnings week, nothing major or market-moving on the calendar. The big names are missing. (maybe NKE)

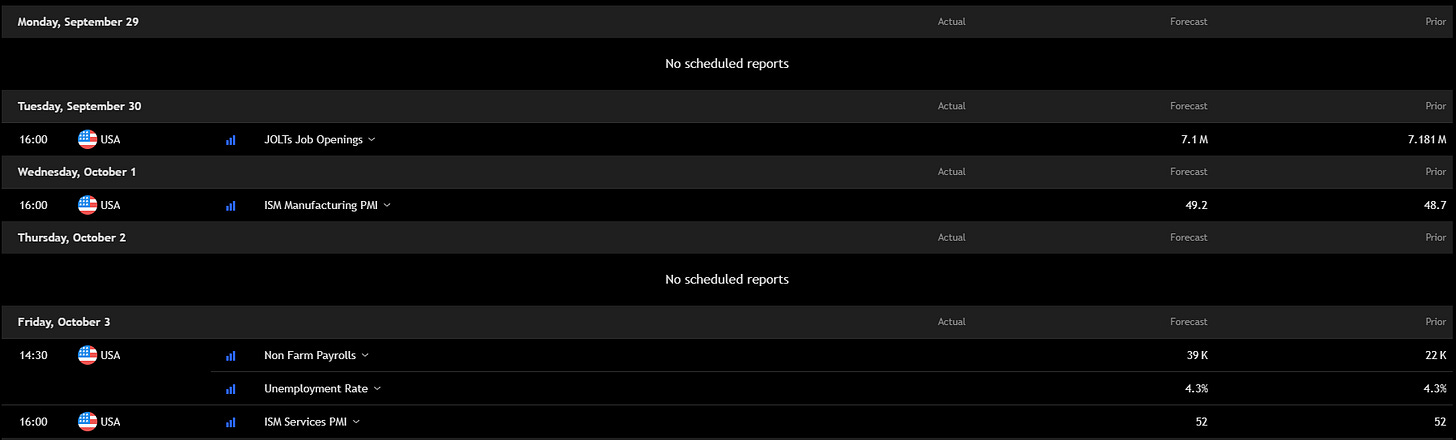

Fear & Greed Index of the week

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav

Some things are more valuable than others.

Obviously the event and later condition of your wife takes place before everything else. Don't you worry on some "risk management" or "trades", those won't matter.

All the best for both of you and come back when situations normalise again :)

Sending you support ❤️