Day Trading Is a Scam! Do This Instead

Trading stocks can be a lot easier | Edition 46

Hello traders,

What I’m about to say will be very controversial.

But it might save you a lot of money, stress, and long-term damage.

I want to bring some light into this industry and show you the truth:

you’re playing this game on hard mode.

Day trading is a scam because 99% of people will lose money.

Just like slot machines.

Can you make money? Yes.

Just like you can win at a casino.

Is it legal? Yes.

But when only 1% win, many call that a scam.

Later, I’ll explain how you can improve your odds and actually make money in a game designed against you.

Why day trading is the worst idea for most people

It’s literally in the name: day trading.

You trade your day to trade.

You sacrifice your entire day staring at charts, trying to catch tiny price moves.

Because it’s day trading, you can’t do it properly while having a job.

Anyone who tries will fail.

The examples you see online are outliers.

They’re the 0.1%.

For most people, it’s impossible to be in front of a screen every morning at 8 a.m.

Day trading is a job.

That’s why it’s called day trading.

You have to show up every day.

It’s not a hobby.

It’s a business.

If you have a full-time job, don’t even think about day trading.

You’re competing with:

professional traders

algorithms

high-frequency traders

firms with massive resources

How exactly are you supposed to beat them in the 30 minutes you squeeze in between work, family, kids, and life?

Day trading is not replicable

Unlike swing trading, day trading must be perfectly aligned with your personality. (i talk more about this here

That’s why 99% of day trading methods sold to you are a scam for you, even if they technically work.

Discretionary day trading cannot be taught.

To make it work, you’d have to change your personality to fit the strategy.

That’s extremely hard.

Swing trading, on the other hand, is replicable.

It’s slower.

More methodical.

More structured.

If you want to become profitable faster, adapt the strategy to your personality, not your personality to the strategy.

Day trading is not for beginners

Starting with day trading is like skipping learning how to walk and jumping straight into flying a plane.

You skipped too many steps.

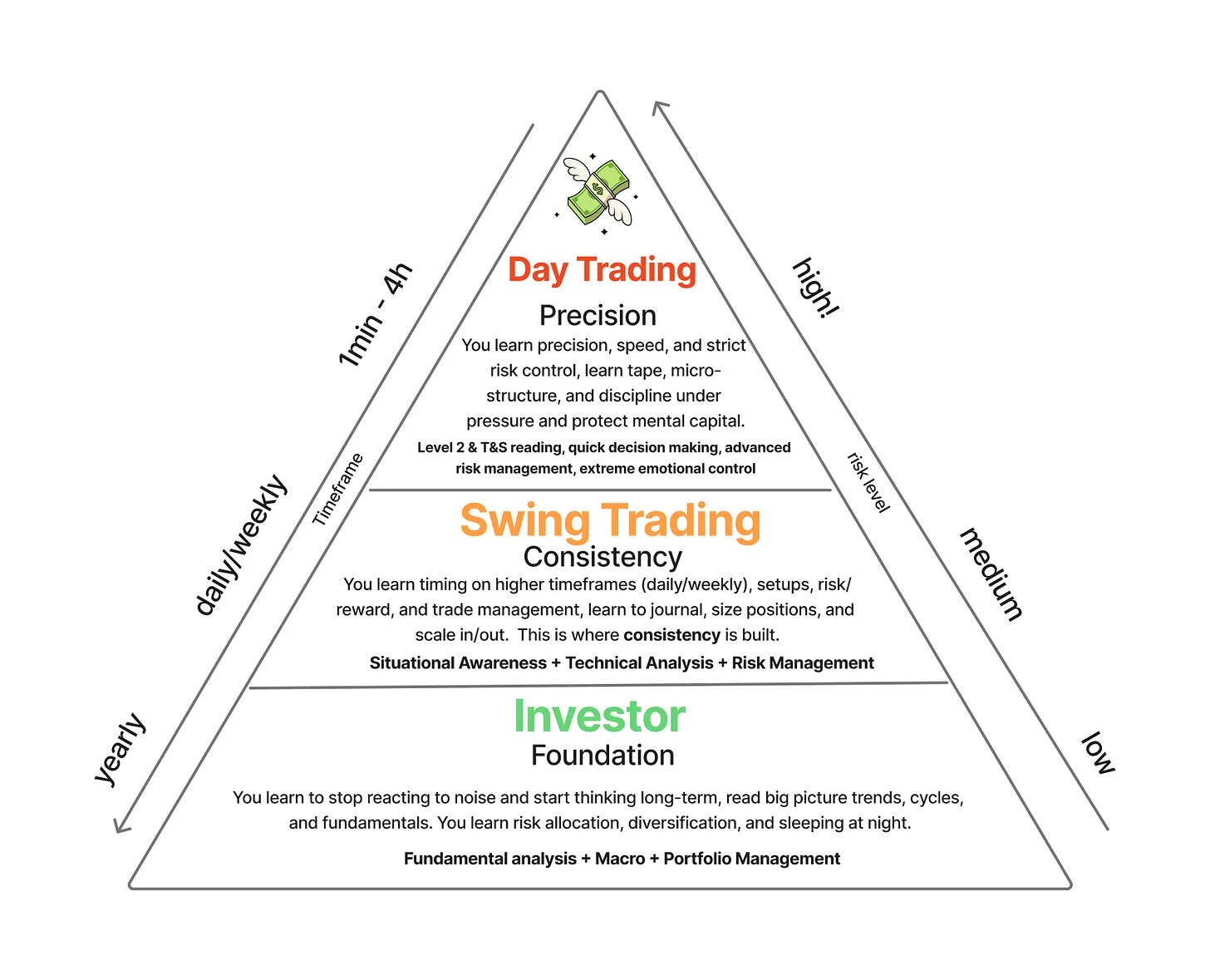

I explained this in detail before and shared a simple progression model:

You start as an investor.

Then you move to swing trading.

Only after that does day trading make sense.

Day trading sits at the top, when you already have experience, discipline, and skill.

No wonder beginners fail.

They’re missing critical foundations.

Worse, they build bad habits that slow their progress even more.

You are undercapitalized

No, you will not reach financial freedom with a $100 account.

You can show me examples.

I can show you millions where it didn’t work.

That’s why I strongly believe you should:

work a 9–5 first

build savings

become an investor

build discipline

Then move to swing trading.

Day trading only makes sense after you have:

Time

Capital

It’s psychologically traumatizing

If you’ve never experienced real volatility, losing 50% of your account in one day , or getting a margin call …. is deeply traumatic.

It can leave scars for life.

It destroys families.

It pushes people into very dark places.

How do I know?

Real freedom: swing trading vs day trading

Day trading is sold as freedom.

In reality, it’s just another stressful job glued to screens.

Swing trading is about:

patience

life outside the charts

That’s real freedom.

If you have a full-time job, swing trading allows you to live your life.

Day trading demands constant presence.

Swing traders:

make fewer trades

pay less in commissions

have time to think

You can plan, analyze, and execute without emotional pressure.

Discipline becomes easier.

Impulse disappears.

The numbers don’t lie

Statistically:

90–95% of day traders lose money in the first 12 months

60–70% of swing traders lose money in the first year

Investors have over a 50% chance of being profitable

That’s why I say: start with what’s easiest.

The game is designed against you.

You’re playing on brutal mode.

So improve your odds.

Start on easy mode.

If you’re ready to take swing trading seriously, join us:

Over 1,700 swing traders are already here.

PS: To be clear, there are very smart day traders on Substack.

I respect them deeply and mention them often.

I have nothing against day trading.

I personally see it as a future step in my own journey.

This post is for beginners, to give them direction, not illusions.

Trade Setups of The Week

Copy My Watchlist for next week

Here are the stocks, sectors, or trends I’m watching closely.

Access my entire watchlist for free here:

My watchlist

Want more than just a watchlist?

Get an understanding of the screener, so you know exactly what to watch.

Gain access to my trading strategy!

Join a community of like-minded individuals who are committed to achieving financial freedom and taking control of their future.

Upgrade now to get the full experience!

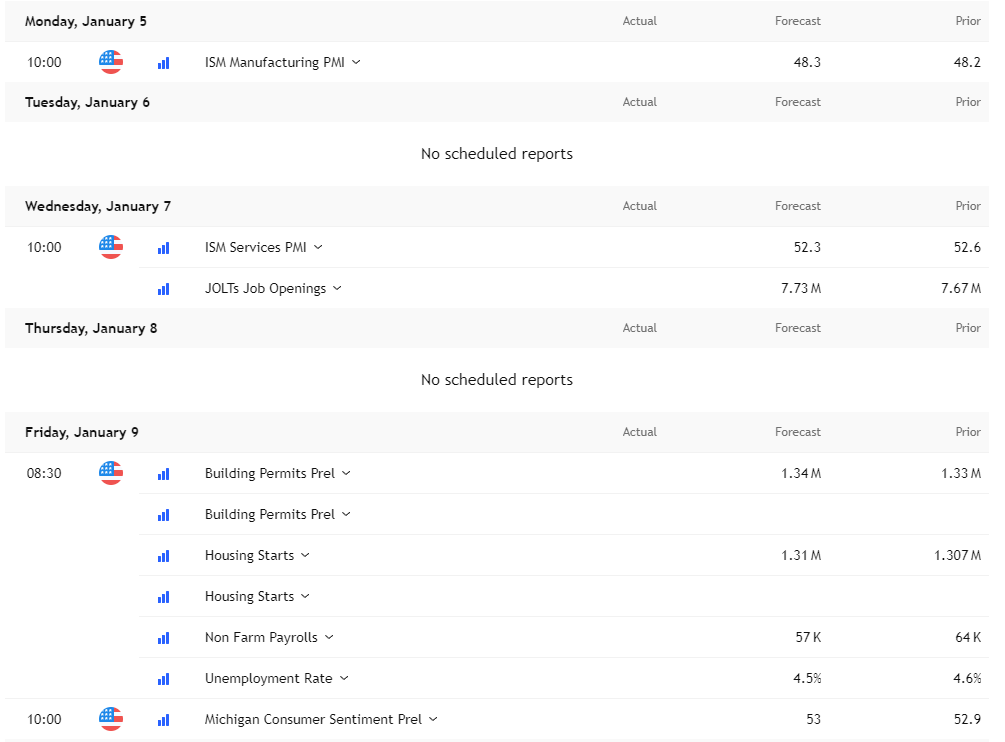

Economic events to watch next week

ISM Services plus JOLTs can shake rates and index direction. Friday is the real landmine with NFP, unemployment, housing data, and sentiment.

Earnings to Watch Next Week

Earnings are pretty light this week, which usually means fewer random gap moves and cleaner chart behavior.

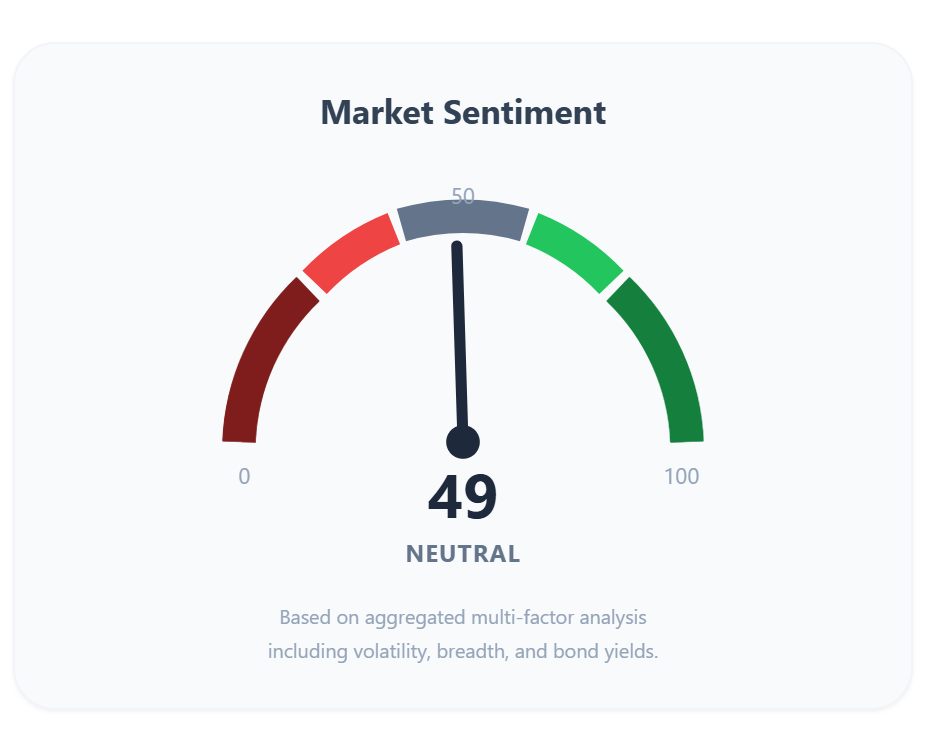

Fear & Greed Index of the week

If you want the full picture with all the signals and context that sits behind this number, consider upgrading so you can see the complete breakdown.

Financial Meme of the week

If you think this newsletter could help your friends, share it with them so it can reach as many traders as possible.

And here’s the fun part: when you share it, you can unlock special rewards + you will look smart in front of your friends :)

“One trade closer to freedom.”

Vladislav

I was a professional trader for hedge funds. We have more resources, money and information than you will ever receive. Chart reading is mandatory and works on four hour charts and dailies bc it will capture everything we did that day. But during the market session, charts aren’t as accurate for you because we are forming the patterns and will change them because we can . We know when and at what price the day traders are more active, since they all behave like a herd, and it only takes one guy to clean them out, on purpose. You watch volume. We know the volume. Is the market maker net short or long and how aggressive is he and at what price can we do trades of different sizes? Which other fund is looking to buy or sell at any price? Who screwed who and is now getting punished? Blah, blah. Thousands of examples of a market small traders should not be in.

Thanks for writing this. Do long term investors become day traders? I always thought it's the other way around once people lose money day trading.